Crew Energy Inc. (TSX: CR; OTCQB: CWEGF) ("Crew" or the "Company"),

a growth-oriented natural gas weighted producer operating in the

world-class Montney play in northeast British Columbia (“NE BC”),

is pleased to announce our operating and financial results for the

three and twelve-month periods ended December 31, 2023. Crew’s

audited consolidated Financial Statements and Notes, Management’s

Discussion and Analysis (“MD&A”) and Annual Information Form

are available on Crew’s website and filed on SEDAR+ at

sedarplus.ca.

HIGHLIGHTS

-

30,178 boe per day1 (181 mmcfe per day) average

production in 2023, while Q4/23 production averaged 30,928 boe per

day1 (186 mmcfe per day) and was 15% higher than the preceding

quarter. Crew’s Q4/23 volumes by product averaged:

-

6,268 bbls per day of light crude oil and

condensate, a 55% increase over 4,039 bbls per day

in Q4/22

-

133,270 mmcf per day of natural gas

-

2,448 bbls per day of natural gas

liquids5,6 (“NGLs”)

-

21% reduction in net debt2 to $117.4 million at

year-end 2023 compared to year-end 2022, with an expanded credit

facility totaling $250 million and a net debt2 to trailing last

twelve-month (“LTM”) EBITDA3 ratio of 0.5 times at year-end 2023.

-

In April 2023, Crew completed an early redemption of the $172

million principal amount of our previously outstanding senior

unsecured notes, representing the full remaining balance,

positioning the Company with an improved balance sheet.

-

$246.5 million of AFF2 ($1.52 per fully diluted

share3) generated in 2023, supported by an operating netback4 of

$24.24 per boe. In Q4/23, AFF2 totaled $67.6 million ($0.42 per

fully diluted share).

-

$29.5 million of Free AFF4 generated in 2023,

further enhancing Crew’s long-term sustainability.

-

$119.7 million of net income ($0.74 per fully

diluted share) in 2023, including $39.7 million ($0.24 per fully

diluted share) in Q4/23, was enhanced by Crew’s low cost structure

and risk management program.

-

Low cash costs per boe4 averaged $9.46 in 2023,

compared to $9.53 in 2022, while cash costs per boe4 in Q4/23

averaged $8.76 and were comparable to $8.67 in Q4/22.

-

$216.0 million of net capital expenditures4

supported a safe and successful exploration and development

program, drilling 22 (22.0 net) wells and completing 12 (12.0 net)

wells along with completing condensate stabilization and waste heat

recovery infrastructure projects.

FINANCIAL & OPERATING

HIGHLIGHTS

|

FINANCIAL($ thousands, except per share

amounts) |

Three monthsendedDec. 31,

2023 |

Three monthsendedDec. 31, 2022 |

Year endedDec. 31, 2023 |

Year endedDec. 31, 2022 |

|

Petroleum and natural gas sales |

90,135 |

136,948 |

327,756 |

598,569 |

|

Cash provided by operating activities |

58,721 |

62,570 |

241,373 |

317,337 |

|

Adjusted funds flow2 |

67,643 |

74,994 |

246,508 |

337,345 |

| Per

share3 – basic |

0.44 |

0.49 |

1.60 |

2.21 |

|

– diluted |

0.42 |

0.46 |

1.52 |

2.08 |

|

Net income |

39,733 |

71,383 |

119,694 |

264,359 |

| Per

share – basic |

0.26 |

0.47 |

0.78 |

1.73 |

|

– diluted |

0.24 |

0.44 |

0.74 |

1.63 |

|

Property, plant and equipment expenditures |

53,165 |

60,639 |

217,028 |

176,621 |

|

Net property dispositions4 |

- |

(7) |

(1,016) |

(129,787) |

|

Net capital expenditures4 |

53,165 |

60,632 |

216,012 |

46,834 |

|

Capital Structure($ thousands) |

As at Dec. 31, 2023 |

As at Dec. 31, 2022 |

|

Working capital (deficiency) surplus2 |

(24,873) |

21,844 |

| Other long-term

obligations |

(18,223) |

- |

| Bank loan |

(74,259) |

- |

| Senior

unsecured notes |

- |

(171,298) |

|

Net debt2 |

(117,355) |

(149,454) |

|

Common shares outstanding (thousands) |

156,560 |

154,377 |

|

OPERATIONAL |

Three monthsendedDec. 31,

2023 |

Three monthsendedDec. 31, 2022 |

Year endedDec. 31, 2023 |

Year endedDec. 31, 2022 |

|

Daily production |

|

|

|

|

|

Light crude oil

(bbl/d) |

81 |

84 |

78 |

98 |

|

Condensate

(bbl/d) |

6,187 |

3,955 |

4,548 |

4,546 |

|

Natural gas liquids

(“ngl”)5,6 (bbl/d) |

2,448 |

2,565 |

2,296 |

2,804 |

|

Conventional

natural gas (mcf/d) |

133,270 |

157,732 |

139,535 |

154,971 |

|

Total (boe/d @

6:1) |

30,928 |

32,893 |

30,178 |

33,277 |

| Average

realized3 |

|

|

|

|

|

Light crude oil

price ($/bbl) |

88.90 |

100.10 |

88.09 |

111.56 |

|

Condensate price

($/bbl) |

92.95 |

105.30 |

94.12 |

115.43 |

|

Natural gas liquids

price ($/bbl) |

27.30 |

37.42 |

28.98 |

44.42 |

|

Natural gas price

($/mcf) |

2.48 |

6.14 |

2.84 |

6.32 |

|

Commodity price

($/boe) |

31.68 |

45.25 |

29.76 |

49.28 |

|

|

Three monthsendedDec. 31,

2023 |

Three monthsendedDec. 31, 2022 |

Year endedDec. 31, 2023 |

Year endedDec. 31, 2022 |

|

Netback ($/boe) |

|

|

|

|

|

Petroleum and

natural gas sales |

31.68 |

45.25 |

29.76 |

49.28 |

|

Royalties |

(2.27) |

(6.09) |

(2.74) |

(4.90) |

|

Realized gain

(loss) on derivative financial instruments |

3.13 |

(5.72) |

4.84 |

(7.07) |

|

Net operating

costs4 |

(3.55) |

(3.47) |

(4.17) |

(3.65) |

|

Net transportation

costs4 |

(3.39) |

(3.05) |

(3.45) |

(3.23) |

|

Operating

netback4 |

25.60 |

26.92 |

24.24 |

30.43 |

|

General and

administrative (“G&A”) |

(1.15) |

(1.17) |

(1.13) |

(0.98) |

|

Interest expense on

debt4 |

(0.67) |

(0.98) |

(0.71) |

(1.67) |

|

Adjusted funds

flow2 |

23.78 |

24.77 |

22.40 |

27.78 |

| |

| 1 See table in the

Advisories for production breakdown by product type as defined in

NI 51-101. |

| 2 Capital management

measure that does not have any standardized meaning as prescribed

by International Financial Reporting Standards, and therefore, may

not be comparable with the calculations of similar measures for

other entities. See “Advisories - Non-IFRS and Other Financial

Measures” contained within this press release. |

| 3 Supplementary

financial measure that does not have any standardized meaning as

prescribed by International Financial Reporting Standards, and

therefore, may not be comparable with the calculations of similar

measures for other entities. See “Advisories - Non-IFRS and Other

Financial Measures” contained within this press release. |

| 4 Non-IFRS financial

measure or ratio that does not have any standardized meaning as

prescribed by International Financial Reporting Standards, and

therefore, may not be comparable with calculations of similar

measures or ratios for other entities. See “Advisories - Non-IFRS

and Other Financial Measures” contained within this press release

and in our most recently filed MD&A, available on SEDAR+ at

sedarplus.ca. |

| 5 Throughout this

news release, NGLs comprise all natural gas liquids as defined in

National Instrument 51-101, Standards of Disclosure for Oil and Gas

Activities (“NI 51-101”), other than condensate, which is disclosed

separately, and natural gas means conventional natural gas by NI

51-101 product type. |

| 6 Excludes condensate

volumes which have been reported separately. |

| 7 See “Advisories –

Type Curves / Wells”. |

| 8 The actual results

of operations of Crew and the resulting financial results will

likely vary from the estimates and material underlying assumptions

set forth in this guidance by the Company and such variation may be

material. The guidance and material underlying assumptions

have been prepared on a reasonable basis, reflecting management's

best estimates and judgments. |

| |

BALANCING FINANCIAL STRENGTH WITH

LONG-TERM GROWTH

Crew intends to maintain our track record of

successfully managing through periods of commodity weakness with a

strong financial position through prudent capital allocation and a

focus on long-term value creation. This includes strategically

directing development investment in a manner that maintains

flexibility, prioritizes higher value products and positions the

Company for future success through expansion of infrastructure

while reducing costs and significantly reducing emissions. This

strategy was successfully demonstrated in 2023 when Crew materially

increased our condensate production to offset the impact of a

weaker natural gas market while reducing net debt. Continuing this

strategy of balancing capital discipline with growth, the Company

remains committed to our longer-range plans, supported by strategic

infrastructure investments that include the expansion of our gas

processing capabilities while reducing operating costs and

maintaining a strong balance sheet.

In addition to having flexibility in the

selection of commodity type and geologic zone to optimize value

creation, the Company also has a strategic advantage

geographically. Crew’s sizeable and contiguous land base is

proximal to the Coastal Gas Link Pipeline, accesses multiple

Canadian and US sales hubs, and stands to benefit from the

potential for coastal liquids egress via the CN Rail line.

Additionally, with the country’s first liquified natural gas

(“LNG”) export terminal anticipated to start-up in 2025, we are

positioned to capitalize on what is anticipated to be an improved

natural gas supply and demand landscape to further solidify our

strategic advantage.

Crew takes pride in initiatives that can both

reduce our environmental footprint while also maximizing economic

benefit, including our recently announced electrification projects

and use of spoolable pipelines. The electrification of the West

Septimus gas plant is expected to reduce emissions from the

facility by approximately 82% and operating costs by over 10%. Crew

gratefully acknowledges assistance from the Province of British

Columbia’s CleanBC Industry Fund for their part in supporting this

project.

OPERATIONS UPDATE

NE BC Montney (Greater

Septimus)

- Crew drilled seven

(7.0 net) Montney wells during Q4/23.

- Over the first 60

days on production (“IP60”), four (4.0 net) ultra-condensate rich

(“UCR”) natural gas wells which were completed on the 1-24 pad in

Q4/23 have produced average raw wellhead rates of 2,973 mcf per day

of natural gas and 874 bbls per day of condensate. Crew achieved

our target by averaging over 7,000 bbls per day of condensate and

light crude oil production in November 2023 and averaged 6,268 bbls

per day in Q4/23.

- During Q1/24, Crew

plans to complete five (5.0 net) Montney UCR wells, equip and

tie-in 11 (11.0 net) Montney UCR wells and drill six (6.0 net)

Montney wells.

Groundbirch

-

The original three (3.0 net) wells on the 4-17 pad have completed

lateral lengths averaging 3,000 meters and have produced an average

of over 4 bcf of natural gas over the first 720 days, exceeding

Sproule’s year-end 2023 proved plus probable (“2P”) undeveloped

Groundbirch type curve (the “Sproule Type Curve”) by approximately

33% to date.

-

The second phase of development at Crew’s 4-17 pad has completed

lateral lengths averaging 2,650 meters, featuring a three-zone

development with five (5.0 net) wells that have continued to exceed

the Sproule Type Curve when normalized to 3,000 meters, with

estimated average raw gas Expected Ultimate Recovery (EUR) of 12

BCF per well7.

Other NE BC Montney

- The

Company has six (6.0 net) drilled Extended Reach Horizontal wells

on the 15-28 pad at Tower, targeting light crude oil and featuring

lateral lengths of over 4,000 meters. Of these wells, four (4.0

net) Upper Montney “B’ wells and two (2.0 net) Upper Montney “C”

wells are planned for completion in Q3/24.

RISK MANAGEMENT PROFILE

To secure a base level of AFF2 to fund planned

capital projects, Crew continues to utilize hedging to limit

exposure to fluctuations in commodity prices and foreign exchange

rates, while allowing for participation in spot commodity

prices.

As of March 7, our 2024 and 2025 hedging profile

includes:

2024

-

2,500 GJ per day of natural gas at C$2.76 per GJ or C$3.37 per mcf

using Crew’s heat factor;

-

2,000 bbls per day of condensate at an average price of C$104.04

per bbl for 1st half 2024;

-

1,750 bbls per day of condensate at an average price of C$104.01

per bbl for 2nd half 2024;

-

1,000 bbls per day of WTI at C$106.09 per bbl for Q1 2024;

-

500 bbls per day of WTI at C$112.00 per bbl for Q2 2024; and

-

250 bbls per day of WTI at C$110.50 per bbl for 2nd half 2024.

2025

-

10,000 GJ per day of AECO natural gas utilizing a costless collar

at $2.75 by $3.25 per GJ.

SUSTAINABILITY AND ESG

INITIATIVES

Crew’s environment, social and governance

(“ESG”) program remained a key focus in 2023, as we continued to

invest in innovations designed to complement our operational and

financial growth. We are proud to share highlights from Crew’s ESG

performance in 2023:

-

Realized over 1.568-million-person hours of work without a single

recordable injury to the end of 2023, marking a new corporate

record. We are extremely proud of our Crew team for demonstrating

this unprecedented level of dedication to the safety and protection

of our team.

-

Crew continued to strive for top-tier emissions intensity through

the successful implementation of waste heat recovery at our

Septimus gas plant, and the use of spoolable produced water

transfer, with over 217,000 m3 transferred during 2023, removing

over 173,000 kilometers of truck traffic and preventing

approximately 531 tonnes of CO2e emissions.

-

Directed a total of $7.9 million to abandonment and reclamation

activities in 2023, reducing Crew’s idle well count by 16%.

-

Invested 188 volunteer hours in 2023 as part of our “Crew Cares”

initiative and made financial contributions into community support

initiatives and not-for-profit organizations, largely geared

towards fostering the health, well-being and resilience of our

local communities and their economies.

-

Published our second digital ESG report in September 2023, which

outlined our achievements and progress in achieving targets and

commitments, along with issuing a standalone report on the Task

Force on Climate-Related Financial Disclosure (TCFD) and completing

re-verification under the Equitable Origin EO100 standard for

responsible energy development.

OUTLOOK

-

Full Year 2024 Guidance Reaffirmed – The Company’s

currently planned 2024 capital program, as previously outlined in

our February 8, 2024 press release, is designed to:

- Allocate $165 to

$185 million of net capital expenditures4, including:

- $105 to $115 million

to drilling 6.0 net wells and completing 11.0 net wells, with 10.0

net wells remaining drilled and uncompleted at year-end 2024.

- $60 to $70 million

to infrastructure spending, including:

- $50 to $55 million

to electrification at West Septimus.

- $10 to $15 million

to front-end engineering and design (“FEED”) and site preparation

at the future Groundbirch plant.

-

Maintain forecasted average 2024 production of 29,000 to 31,000 boe

per day1.

-

Increase condensate production by 15%.

-

Reduce natural gas production by 5%.

-

Maintain a strong financial position.

-

Net Debt to LTM EBITDA3 forecast at <1.0x.

-

Electrify the West Septimus Plant.

-

Increase capacity by 20 mmcf per day to total 140 mmcf per day in

2025.

-

Reduce operating costs by more than 10%.

-

Reduce CO2 emissions by approximately 82%, and potentially generate

carbon credits under BC’s Output-Based Pricing System.

-

Position the Company to thrive and grow in an improved natural gas

price environment.

|

|

2024 Guidance and

Assumptions8 |

|

Net capital expenditures4 ($Millions) |

165–185 |

|

Annual average production1 (boe/d) |

29,000–31,000 |

|

Natural gas weighting |

73-75% |

|

Royalties |

8–10% |

|

Net operating costs4 ($ per boe) |

$4.50–$5.00 |

|

Net transportation costs4 ($ per boe) |

$3.50–$4.00 |

|

G&A ($ per boe) |

$1.00–$1.20 |

|

Effective interest rate on long-term debt |

8.0–10.0% |

|

* No change to guidance previously released on February 8,

2024 |

|

|

|

|

-

Active Q1 Capital Program – Our previously

announced Q1/24 net capital expenditure4 forecast remains unchanged

and is designed to:

-

Allocate $75 to $85 million of net capital expenditures4.

-

Drill six (6.0 net) wells, complete five (5.0 net) wells and equip

and tie-in 11 (11.0 net) Montney wells in Q1/24.

-

Result in forecast average Q1/24 production of 29,000 to 31,000 boe

per day1, which includes the impact of an anticipated 2,100 boe per

day of production that is currently shut-in for offsetting

completion and construction operations.

Our long-range strategic plan is designed to

generate optimal value from our expansive Montney land base, which

is advantageously positioned to capitalize on the anticipated

improvement in the natural gas supply and demand landscape

following the commissioning of LNG Canada in 2025. With its

strategic location, target zones optionality, commodity diversity,

multiple egress options and most importantly, large inventory of

over 2,500 drilling locations, our land base serves as a

cornerstone for Crew’s long-term success.

We remain committed to the pursuit of

operational excellence and financial resilience to deliver

long-term shareholder value while upholding our commitment to

safety and environmental responsibility. Thank you to all

stakeholders for their ongoing support of Crew while we continue to

unlock value from our robust inventory of Montney well

locations.

ABOUT CREW

Crew is a growth-oriented natural gas and

liquids producer, committed to pursuing sustainable per share

growth through a balanced mix of financially and socially

responsible exploration and development. The Company’s operations

are exclusively located in northeast British Columbia and feature a

vast Montney resource with a large contiguous land base in the

Greater Septimus and Groundbirch areas in British Columbia,

offering significant development potential over the long-term. Crew

has access to diversified markets with operated infrastructure and

access to multiple pipeline egress options. The Company’s common

shares are listed for trading on the Toronto Stock Exchange (“TSX”)

under the symbol “CR” and on the OTCQB in the US under ticker

“CWEGF”.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

| Dale Shwed, President and CEOJohn

Leach, Executive Vice President and CFO |

Phone: (403) 266-2088Email:

investor@crewenergy.com |

| |

|

ADVISORIES

Forward-Looking Information and

Statements

This news release contains certain

forward–looking information and statements within the meaning of

applicable securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "may", "will", "project",

"should", "believe", "plans", "intends" "forecast" "targets",

"goals" and similar expressions are intended to identify

forward-looking information or statements. In particular, but

without limiting the foregoing, this news release contains

forward-looking information and statements pertaining to the

following: the ability to execute on its near and longer range

strategic plan (the "Strategic Plan") and underlying strategy,

associated plans, goals and targets, all as more particularly

outlined and described in this press release; our 2024 annual

capital budget range (the "2024 Budget"), associated drilling,

completion and infrastructure plans, the anticipated timing

thereof, and all associated strategies, initiatives, goals and

targets, along with all forecasts, guidance and underlying

assumptions and sensitivities related to the 2024 Budget as

outlined in the "Outlook" section in this press release; production

estimates and targets under the 2024 Budget and balance of the

longer range plan including infrastructure plans and anticipated

benefits associated therewith as outlined in this press release

including, without limitation, the planned expansion and

electrification of the West Septimus gas plant and anticipated

associated metrics estimates, economic and other benefits thereof,

expectations in regards to the extent of provincial and federal

government grants, credits and financial incentives related

thereto, the planned construction of the Groundbirch Plant and

anticipated benefits thereof, anticipated timing and assumed

receipt of all regulatory approvals required in connection with our

infrastructure plans and our ability to secure financing for these

plans as may be required, from time to time, and the potential

costs associated therewith; commodity price expectations and

assumptions; Crew's commodity risk management programs and future

hedging plans; marketing and transportation and processing plans

and requirements; the potential for coastal liquids egress via the

CN rail line; estimates of processing capacity and requirements;

anticipated reductions in GHG emissions and decommissioning

obligations; future liquidity and financial capacity and ability to

finance our Strategic Plan; potential hedging opportunities and

plans related thereto; future results from operations and targeted

operating and leverage metrics; world supply and demand projections

and long-term impact on pricing; future development, exploration,

acquisition, disposition and infrastructures activities (including

our capital investment model and associated drilling and completion

plans, associated receipt of all required regulatory permits for

our Strategic Plan, development timing and cost estimates); the

potential to serve a Canadian LNG market including the anticipated

start-up of LNG Canada in 2025 and the anticipated benefits thereof

to the Corporation both strategically and economically; the number

of estimated potential identified drilling locations outlined in

this press release; the potential of our Groundbirch area to be a

core area of future development and the anticipated commerciality

of up to four potential prospective zones to be drilled; the

successful implementation of our ESG initiatives, and significant

emissions intensity improvements going forward; the amount and

timing of capital projects; and anticipated improvement in our

long-term sustainability and the expected positive attributes

discussed herein attributable to our Strategic Plan.

The internal projections, expectations, or

beliefs underlying our Board approved 2024 Budget and associated

guidance, as well as management's strategy, and associated plans,

goals and targets in respect of the balance of its strategic plan,

are subject to change in light of, without limitation, the

continuing impact of the Russia/Ukraine conflict, war in the Middle

East and any related actions taken by businesses and governments,

ongoing results, prevailing economic circumstances, volatile

commodity prices, resulting changes in our underlying assumptions,

goals and targets provided herein and changes in industry

conditions and regulations. Crew's financial outlook and guidance

provides shareholders with relevant information on management's

expectations for results of operations, excluding any potential

acquisitions or dispositions, for such time periods based upon the

key assumptions outlined herein. Readers are cautioned that events

or circumstances and updates to underlying assumptions could cause

capital plans and associated results to differ materially from

those predicted and Crew's guidance for 2024, and more particularly

its internal model, goals and targets for 2025 and beyond which are

not based upon Board approved budget(s) at this time, may not be

appropriate for other purposes. Accordingly, undue reliance should

not be placed on same.

In addition, forward-looking statements or

information are based on a number of material factors, expectations

or assumptions of Crew which have been used to develop such

statements and information, but which may prove to be incorrect.

Although Crew believes that the expectations reflected in such

forward-looking statements or information are reasonable, undue

reliance should not be placed on forward-looking statements because

Crew can give no assurance that such expectations will prove to be

correct. In addition to other factors and assumptions which may be

identified herein, assumptions have been made regarding, among

other things: that Crew will continue to conduct its operations in

a manner consistent with past operations; results from drilling and

development activities consistent with past operations; the quality

of the reservoirs in which Crew operates and continued performance

from existing wells; the continued and timely development of

infrastructure in areas of new production; the accuracy of the

estimates of Crew's reserve volumes; certain commodity price and

other cost assumptions; continued availability of debt and equity

financing and cash flow to fund Crew's current and future plans and

expenditures; the impact of increasing competition; the general

stability of the economic and political environment in which Crew

operates; that future business, regulatory and industry conditions

will be within the parameters expected by Crew; the general

continuance of current industry conditions; the timely receipt of

any required regulatory approvals; the ability of Crew to obtain

qualified staff, equipment and services in a timely and cost

efficient manner; drilling results; the ability of the operator of

the projects in which Crew has an interest in to operate the field

in a safe, efficient and effective manner; the ability of Crew to

obtain financing on acceptable terms; field production rates and

decline rates; the ability to replace and expand oil and natural

gas reserves through acquisition, development and exploration; the

timing and cost of pipeline, storage and facility construction and

expansion and the ability of Crew to secure adequate product

transportation; future commodity prices; currency, exchange and

interest rates; regulatory framework regarding royalties, taxes,

environmental and indigenous matters in the jurisdictions in which

Crew operates; that regulatory authorities in British Columbia will

continue granting approvals for oil and gas activities on time

frames, and on terms and conditions, consistent with past

practices; and the ability of Crew to successfully market its oil

and natural gas products.

The forward-looking information and statements

included in this news release are not guarantees of future

performance and should not be unduly relied upon. Such information

and statements, including the assumptions made in respect thereof,

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to defer materially from

those anticipated in such forward-looking information or statements

including, without limitation: the continuing and uncertain impact

of the Russia/Ukraine conflict and war in the Middle East; changes

in commodity prices; changes in the demand for or supply of Crew's

products, the early stage of development of some of the evaluated

areas and zones and the potential for variation in the quality of

the Montney formation; interruptions, unanticipated operating

results or production declines; changes in tax or environmental

laws, royalty rates; climate change regulations, or other

regulatory matters; changes in development plans of Crew or by

third party operators of Crew's properties, increased debt levels

or debt service requirements; inaccurate estimation of Crew's oil

and gas reserve volumes and identified drilling inventory; limited,

unfavourable or a lack of access to capital markets; increased

costs; a lack of adequate insurance coverage; the impact of

competitors; and certain other risks detailed from time-to-time in

Crew's public disclosure documents (including, without limitation,

those risks identified in this news release and Crew's MD&A and

Annual Information Form).

This press release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about Crew's prospective capital

expenditures and all associated guidance, all of which are subject

to the same assumptions, risk factors, limitations, and

qualifications as set forth in the above paragraphs. The actual

results of operations of Crew and the resulting financial results

will likely vary from the amounts set forth in this press release

and such variation may be material. Crew and its management believe

that the FOFI has been prepared on a reasonable basis, reflecting

management's best estimates and judgments. However, because this

information is subjective and subject to numerous risks, it should

not be relied on as necessarily indicative of future results.

Except as required by applicable securities laws, Crew undertakes

no obligation to update such FOFI. FOFI contained in this press

release was made as of the date of this press release and was

provided for the purpose of providing further information about

Crew's anticipated future business operations. Readers are

cautioned that the FOFI contained in this press release should not

be used for purposes other than for which it is disclosed

herein.

The forward-looking information and statements

contained in this news release speak only as of the date of this

news release, and Crew does not assume any obligation to publicly

update or revise any of the included forward-looking statements or

information, whether as a result of new information, future events

or otherwise, except as may be required by applicable securities

laws.

Risk Factors to the Company's Strategic

Plan

Risk factors that could materially impact

successful execution and actual results of the Company’s strategic

plan include:

- volatility of

petroleum and natural gas prices and inherent difficulty in the

accuracy of predictions related thereto;

- changes in Federal

and Provincial regulations;

- execution of

construction timelines from BC Hydro to support the electrification

of the West Septimus and Groundbirch plants;

- receipt of

high-value regulatory permits required to launch development under

the strategic plan;

- the Company's

ability to secure financing for the Groundbirch plant; and

- Those additional

risk factors set forth in the Company's most recently filed

MD&A and Annual Information Form on SEDAR+.

Information Regarding Disclosure on Oil

and Gas Operational Information

All amounts in this news release are stated in

Canadian dollars unless otherwise specified. This press release

contains metrics commonly used in the oil and natural gas industry.

Each of these metrics are determined by Crew as specifically set

forth in this news release. These terms do not have standardized

meanings or standardized methods of calculation and therefore may

not be comparable to similar measures presented by other companies,

and therefore should not be used to make such comparisons. Such

metrics have been included to provide readers with additional

information to evaluate the Company’s performance however, such

metrics are not reliable indicators of future performance and

therefore should not be unduly relied upon for investment or other

purposes. See “Non-IFRS and Other Financial Measures” below for

additional disclosures.

Drilling Locations

This press release discloses internally

identified "potential drilling locations" which are comprised of:

(i) proved locations; (ii) probable locations; and (iii) unbooked

locations. Proved locations and probable locations are derived from

the Company's independent reserve evaluator's report effective

December 31, 2023 (the "Sproule Report") and account for drilling

inventory that have associated proved and/or probable reserves

assigned by Sproule. Unbooked locations are internally identified

potential drilling opportunities based on the Company's prospective

acreage and an assumption as to the number of wells that can be

drilled per section based on industry practice and internal review.

Unbooked locations do not have reserves or resources attributed to

them and are not estimates of drilling locations which have been

evaluated by a qualified reserves evaluator performed in accordance

with the COGE Handbook. There is no certainty that the Company will

drill any of these potential drilling opportunities and if drilled

there is no certainty that such locations will result in additional

oil and gas reserves, resources or production. The drilling

locations on which we actually drill wells will ultimately depend

upon the availability of capital, regulatory approvals, seasonal

restrictions, oil and natural gas prices, costs, actual drilling

results, additional reservoir information that is obtained and

other factors.

The following table provides a detailed

breakdown of the identified gross potential drilling locations

presented herein:

|

|

Total Drilling Locations |

Proved Locations |

Probable Locations |

Unbooked Locations |

|

Montney Total Drilling Locations |

2,537 |

132 |

106 |

2,299 |

| Groundbirch Locations |

1,717 |

37 |

66 |

1,614 |

| West Septimus Locations |

483 |

59 |

28 |

396 |

| Septimus Locations |

191 |

36 |

9 |

146 |

| Tower

Locations |

146 |

- |

3 |

143 |

| |

|

|

|

|

Test Results and Initial Production

Rates

A pressure transient analysis or well-test

interpretation has not been carried out and thus certain of the

test results provided herein should be considered to be preliminary

until such analysis or interpretation has been completed. Test

results and initial production (“IP”) rates disclosed herein,

particularly those short in duration, may not necessarily be

indicative of long-term performance or of ultimate recovery.

Type Curves/Wells

The Groundbirch type curves referenced herein

reflect the average per well proved plus probable undeveloped raw

gas assignments (EUR) for Crew's area of operations, as derived

from the Company's year-end independent reserve evaluations

prepared by Sproule in accordance with the definitions and

standards contained in the COGE Handbook. Unless otherwise stated,

the type wells are based upon all Crew producing wells in the area

as well as non-Crew wells determined by the independent evaluator

to be analogous for purposes of the reserve assignments.

There is no guarantee that Crew will achieve the estimated or

similar results derived therefrom and therefore undue reliance

should not be placed on them. Such information has been prepared by

Management, where noted, for purposes of making capital investment

decisions and for internal budget preparation only.

BOE and Mcfe Conversions

Measurements expressed in barrel of oil

equivalents, BOEs or Mcfe may be misleading, particularly if used

in isolation. A BOE conversion ratio of 6 mcf: 1 bbl and an Mcfe

conversion ratio of 1 bbl:6 Mcf are based on an energy equivalency

conversion method primarily applicable at the burner tip and do not

represent a value equivalency at the wellhead. Given that the value

ratio based on the current price of crude oil as compared to

natural gas is significantly different than the energy equivalency

of 6:1, utilizing the 6:1 conversion ratio may be misleading as an

indication of value.

Non-IFRS and Other Financial

Measures

Throughout this press release and other

materials disclosed by the Company, Crew uses certain measures to

analyze financial performance, financial position and cash flow.

These non-IFRS and other specified financial measures do not have

any standardized meaning prescribed under IFRS and therefore may

not be comparable to similar measures presented by other entities.

The non-IFRS and other specified financial measures should not be

considered alternatives to, or more meaningful than, financial

measures that are determined in accordance with IFRS as indicators

of Crew’s performance. Management believes that the presentation of

these non-IFRS and other specified financial measures provides

useful information to shareholders and investors in understanding

and evaluating the Company’s ongoing operating performance, and the

measures provide increased transparency and the ability to better

analyze Crew’s business performance against prior periods on a

comparable basis.

Capital Management Measures

a) Funds from

Operations and Adjusted Funds Flow (“AFF”)

Funds from operations represents cash provided

by operating activities before changes in operating non-cash

working capital, accretion of deferred financing costs and

transaction costs on property dispositions. Adjusted funds flow

represents funds from operations before decommissioning obligations

settled (recovered). The Company considers these metrics as key

measures that demonstrate the ability of the Company’s continuing

operations to generate the cash flow necessary to maintain

production at current levels and fund future growth through capital

investment and to service and repay debt. Management believes that

such measures provide an insightful assessment of the Company's

operations on a continuing basis by eliminating certain non-cash

charges, actual settlements of decommissioning obligations and

transaction costs on property dispositions, the timing of which is

discretionary. Funds from operations and adjusted funds flow should

not be considered as an alternative to or more meaningful than cash

provided by operating activities as determined in accordance with

IFRS as an indicator of the Company’s performance. Crew’s

determination of funds from operations and adjusted funds flow may

not be comparable to that reported by other companies. Crew also

presents adjusted funds flow per share whereby per share amounts

are calculated using weighted average shares outstanding consistent

with the calculation of income per share. The applicable

reconciliation to the most directly comparable measure, cash

provided by operating activities, is contained under “free adjusted

funds flow” below.

b) Net Debt and

Working Capital Surplus (Deficiency)

Crew closely monitors its capital structure with

a goal of maintaining a strong balance sheet to fund the future

growth of the Company. The Company monitors net debt as part of its

capital structure. The Company uses net debt (bank debt plus

working capital deficiency or surplus, excluding the current

portion of the fair value of financial instruments) as an

alternative measure of outstanding debt. Management considers net

debt and working capital deficiency (surplus) an important measure

to assist in assessing the liquidity of the Company.

Non-IFRS Financial Measures and

Ratios

a) Net Property

Acquisitions (Dispositions)

Net property acquisitions (dispositions) equals

property acquisitions less property dispositions and transaction

costs on property dispositions. Crew uses net property acquisitions

(dispositions) to measure its total capital investment compared to

the Company’s annual capital budgeted expenditures. The most

directly comparable IFRS measures to net property acquisitions

(dispositions) are property acquisitions and property

dispositions.

|

($ thousands) |

Three monthsended

December 31, 2023 |

Three monthsended September 30, 2023 |

Three monthsended December 31, 2022 |

Year ended December 31, 2023 |

Year ended December 31, 2022 |

|

Property acquisitions |

- |

- |

- |

- |

- |

|

Property dispositions |

- |

(20) |

(7) |

(1,016) |

(129,990) |

|

Transaction costs on property dispositions |

- |

- |

- |

- |

203 |

|

Net property dispositions |

- |

(20) |

(7) |

(1,016) |

(129,787) |

|

|

|

|

|

|

|

b) Net Capital Expenditures

Net capital expenditures equals exploration and

development expenditures less net property acquisitions

(dispositions). Crew uses net capital expenditures to measure its

total capital investment compared to the Company’s annual capital

budgeted expenditures. The most directly comparable IFRS measure to

net capital expenditures is property, plant and equipment

expenditures.

|

($ thousands) |

Three monthsended

December 31, 2023 |

Three months endedSeptember 30, 2023 |

Three months endedDecember 31, 2022 |

Year ended December 31, 2023 |

Year ended December 31, 2022 |

|

Total property, plant and equipment expenditures |

53,165 |

104,045 |

60,639 |

217,028 |

176,621 |

| Net property dispositions |

- |

(20) |

(7) |

(1,016) |

(129,787) |

|

Net capital expenditures |

53,165 |

104,025 |

60,632 |

216,012 |

46,834 |

|

|

|

|

|

|

|

c) EBITDA

EBITDA is calculated as consolidated net income

(loss) before interest and financing expenses, income taxes,

depletion, depreciation and amortization, adjusted for certain

non-cash, extraordinary and non-recurring items primarily relating

to unrealized gains and losses on financial instruments and

impairment losses. The Company considers this metric as key

measures that demonstrate the ability of the Company’s continuing

operations to generate the cash flow necessary to maintain

production at current levels and fund future growth through capital

investment and to service and repay debt. The most directly

comparable IFRS measure to EBITDA is cash provided by operating

activities.

|

($ thousands) |

Three monthsended

December 31, 2023 |

Three months endedSeptember 30, 2023 |

Three months endedDecember 31, 2022 |

Year ended December 31, 2023 |

Year ended December 31, 2022 |

|

Adjusted funds flow |

67,643 |

45,313 |

74,994 |

246,508 |

337,345 |

|

Financing expenses on debt |

1,915 |

1,120 |

2,971 |

7,853 |

20,270 |

|

EBITDA |

69,558 |

46,433 |

77,965 |

254,361 |

357,615 |

|

|

|

|

|

|

|

d) Free Adjusted Funds

Flow

Free adjusted funds flow represents adjusted

funds flow less capital expenditures, excluding acquisitions and

dispositions. The Company considers this metric a key measure that

demonstrates the ability of the Company’s continuing operations to

fund future growth through capital investment and to service and

repay debt. The most directly comparable IFRS measure to free

adjusted funds flow is cash provided by operating activities.

|

($ thousands) |

Three monthsended

December 31, 2023 |

Three monthsended September 30, 2023 |

Three monthsended December 31, 2022 |

Year ended December 31, 2023 |

Year ended December 31, 2022 |

|

|

|

|

|

|

|

| Cash provided by operating

activities |

58,721 |

46,056 |

62,570 |

241,373 |

317,337 |

| Change in operating non-cash

working capital |

6,350 |

(1,238) |

7,565 |

(2,522) |

8,331 |

| Accretion of deferred

financing costs |

- |

- |

(149) |

(199) |

(854) |

| Transaction costs on property

dispositions |

- |

- |

- |

- |

203 |

|

Funds from operations |

65,071 |

44,818 |

69,986 |

238,652 |

325,017 |

|

Decommissioning obligations settled excluding government

grants |

2,572 |

495 |

5,008 |

7,856 |

12,328 |

|

Adjusted funds flow |

67,643 |

45,313 |

74,994 |

246,508 |

337,345 |

| Less:

property, plant and equipment expenditures |

53,165 |

104,045 |

60,639 |

217,028 |

176,621 |

|

Free adjusted funds flow |

14,478 |

(58,732) |

14,355 |

29,480 |

160,724 |

|

|

|

|

|

|

|

e) Net Operating

Costs

Net operating costs equals operating costs net

of processing revenue. Management views net operating costs as an

important measure to evaluate its operational performance. The most

directly comparable IFRS measure for net operating costs is

operating costs.

|

($ thousands, except per boe) |

Three monthsended

December 31, 2023 |

Three monthsended September 30, 2023 |

Three monthsended December 31, 2022 |

Year ended December 31, 2023 |

Year ended December 31, 2022 |

|

|

|

|

|

|

|

| Operating costs |

10,722 |

12,372 |

11,115 |

48,364 |

47,759 |

|

Processing revenue |

(622) |

(557) |

(616) |

(2,425) |

(3,441) |

|

Net operating costs |

10,100 |

11,815 |

10,499 |

45,939 |

44,318 |

| Per

boe |

3.55 |

4.79 |

3.47 |

4.17 |

3.65 |

| |

|

|

|

|

|

f) Net Operating Costs

per boe

Net operating costs per boe equals net operating

costs divided by production. Management views net operating costs

per boe as an important measure to evaluate its operational

performance. The calculation of Crew’s net operating costs per boe

can be seen in the non-IFRS measure entitled “Net Operating Costs”

above.

g) Net Transportation

Costs

Net transportation costs equals transportation

costs net of transportation revenue. Management views net

transportation costs as an important measure to evaluate its

operational performance. The most directly comparable IFRS measure

for net transportation costs is transportation costs. The

calculation of Crew’s net transportation costs can be seen in the

section entitled “Net Transportation Costs” of this MD&A.

|

($ thousands, except per boe) |

Three monthsended

December 31, 2023 |

Three monthsended September 30, 2023 |

Three monthsended December 31, 2022 |

Year ended December 31, 2023 |

Year ended December 31, 2022 |

|

|

|

|

|

|

|

| Transportation costs |

11,842 |

11,053 |

10,701 |

45,150 |

45,120 |

|

Transportation revenue |

(2,185) |

(1,827) |

(1,485) |

(7,108) |

(5,892) |

|

Net transportation costs |

9,657 |

9,226 |

9,216 |

38,042 |

39,228 |

| Per

boe |

3.39 |

3.74 |

3.05 |

3.45 |

3.23 |

| |

|

|

|

|

|

h) Net Transportation

Costs per boe

Net transportation costs per boe equals net

transportation costs divided by production. Management views net

transportation costs per boe as an important measure to evaluate

its operational performance.

i) Operating Netback

per boe

Operating netback per boe equals petroleum and

natural gas sales including realized gains and losses on commodity

related derivative financial instruments, marketing income, less

royalties, net operating costs and transportation costs calculated

on a boe basis. Management considers operating netback per boe an

important measure to evaluate its operational performance as it

demonstrates its field level profitability relative to current

commodity prices.

j) Cash costs per

boe

Cash costs per boe is comprised of net

operating, transportation, general and administrative and interest

expense on debt calculated on a boe basis. Management views cash

costs per boe as an important measure to evaluate its operational

performance.

|

($/boe) |

Three monthsended

December 31, 2023 |

Three monthsended September 30, 2023 |

Three monthsended December 31, 2022 |

Year ended December 31, 2023 |

Year ended December 31, 2022 |

|

|

|

|

|

|

|

| Net operating costs |

3.55 |

4.79 |

3.47 |

4.17 |

3.65 |

| Net transportation costs |

3.39 |

3.74 |

3.05 |

3.45 |

3.23 |

| General and administrative

expenses |

1.15 |

1.14 |

1.17 |

1.13 |

0.98 |

|

Interest expense on debt |

0.67 |

0.45 |

0.98 |

0.71 |

1.67 |

|

Cash costs |

8.76 |

10.12 |

8.67 |

9.46 |

9.53 |

|

|

|

|

|

|

|

k) Interest expense on

debt per boe

Interest expense on debt per boe is comprised of

the sum of interest on bank loan and other, interest on senior

notes and accretion of deferred financing charges, divided by

production. Management views interest expense on debt per boe as an

important measure to evaluate its cost of debt financing.

|

($ thousands, except per boe) |

Three months ended December 31,

2023 |

Three months ended September 30, 2023 |

Three months ended December 31, 2022 |

Year ended December 31, 2023 |

Year ended December 31, 2022 |

|

|

|

|

|

|

|

| Interest on bank loan and

other |

1,915 |

1,120 |

4 |

4,070 |

2,321 |

| Interest on senior notes |

- |

- |

2,818 |

3,584 |

17,095 |

|

Accretion of deferred financing charges |

- |

- |

149 |

199 |

854 |

|

Financing expenses on debt |

1,915 |

1,120 |

2,971 |

7,853 |

20,270 |

| Production (boe/d) |

30,928 |

26,834 |

32,893 |

30,178 |

33,277 |

|

Interest expense on debt per boe |

0.67 |

0.45 |

0.98 |

0.71 |

1.67 |

| |

|

|

|

|

|

Supplementary Financial

Measures

"Adjusted funds flow per basic

share" is comprised of adjusted funds flow divided by the

basic weighted average common shares.

"Adjusted funds flow per diluted

share" is comprised of adjusted funds flow divided by the

diluted weighted average common shares.

"Adjusted funds flow per boe"

is comprised of adjusted funds flow divided by total

production.

"Average realized commodity

price" is comprised of commodity sales from production, as

determined in accordance with IFRS, divided by the Company's

production. Average prices are before deduction of net

transportation costs and do not include gains and losses on

financial instruments.

“Average realized light crude oil

price” is comprised of light crude oil commodity sales

from production, as determined in accordance with IFRS, divided by

the Company’s light crude oil production. Average prices are before

deduction of net transportation costs and do not include gains and

losses on financial instruments.

"Average realized ngl price" is

comprised of ngl commodity sales from production, as determined in

accordance with IFRS, divided by the Company's ngl production.

Average prices are before deduction of net transportation costs and

do not include gains and losses on financial instruments.

“Average realized condensate

price” is comprised of condensate commodity sales from

production, as determined in accordance with IFRS, divided by the

Company’s condensate production. Average prices are before

deduction of net transportation costs and do not include gains and

losses on financial instruments.

"Average realized natural gas

price" is comprised of natural gas commodity sales from

production, as determined in accordance with IFRS, divided by the

Company's natural gas production. Average prices are before

deduction of net transportation costs and do not include gains and

losses on financial instruments.

"Net debt to last twelve months (“LTM”)

EBITDA" is calculated as net debt at a point in time

divided by EBITDA earned from that point back for the trailing

twelve months.

Supplemental Information Regarding

Product Types

References to gas or natural gas and NGLs in

this press release refer to conventional natural gas and natural

gas liquids product types, respectively, as defined in National

Instrument 51-101, Standards of Disclosure for Oil and Gas

Activities ("NI 51-101"), except where specifically noted

otherwise.

The following is intended to provide the product

type composition for each of the production figures provided

herein, where not already disclosed within tables above:

| |

Light & Medium Crude Oil |

Condensate |

Natural Gas Liquids1 |

Conventional Natural Gas |

Total(boe/d) |

|

Q1 2024 Average |

0% |

16% |

8% |

76% |

29,000–31,000 |

|

2024 Annual Average |

3% |

15% |

8% |

74% |

29,000–31,000 |

|

Notes:1) Excludes condensate volumes which have been reported

separately. |

| |

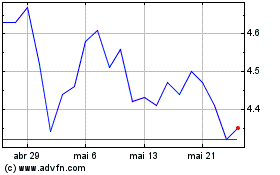

Crew Energy (TSX:CR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Crew Energy (TSX:CR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025