Extendicare Inc. (“Extendicare” or the “Company”) (TSX: EXE) today

reported results for the three and twelve months ended December 31,

2023. Results are presented in Canadian dollars unless otherwise

noted.

Fourth Quarter 2023 Highlights

- Adjusted EBITDA(1) increased $19.5 million in Q4 to $28.7

million, driven by home health care volume growth and rate

increases; growth in managed services, including full quarter

impact of the Revera and Axium transactions; and funding increases

and improved occupancy in long-term care (“LTC”).

- Home health care growth continued, with Q4 average daily volume

(“ADV”) of 28,158, up 10.2% from Q4 2022 and 2.8% from the prior

quarter.

- LTC occupancy returned to pre-pandemic levels, increasing 330

basis points (“bps”) to 97.8% in Q4 compared to Q4 2022.

- Beds under management through Extendicare Assist grew 64.2% to

9,783 from Q4 2022 driven by the Revera and Axium transactions. SGP

third-party and joint venture serviced beds grew 24.1% to 136,164

over Q4 2022.

- We commenced construction on two new LTC homes in the Ottawa

region in Q4 in partnership with Axium. This brings new LTC homes

under construction to six, representing a total of 1,536 new beds

to replace 1,377 Class C beds, with three of these homes scheduled

to open in 2024.

- We entered into agreements to sell the land and buildings

associated with the Sudbury and Kingston Class C homes, which are

scheduled to close in 2024 when the corresponding redevelopment

projects are opened. Aggregate proceeds are $9.1 million yielding

estimated net proceeds after tax and closing costs of $8.5 million

and a net gain of $7.7 million.

Subsequent to Q4

- We entered into an agreement of

purchase and sale to sell our 256-bed LTC home in Orleans, Ontario

that started construction in Q4 to Axium JV, subject to customary

closing conditions, including receipt of regulatory approvals, with

closing anticipated in Q2 2024.

“Our strong fourth quarter is the result of the strategic

initiatives we have undertaken to reposition Extendicare for growth

and value creation,” said Dr. Michael Guerriere, President and

Chief Executive Officer. “This is the first quarter where we see

the full financial impact of the Revera and Axium transactions. We

also acquired a Revera redevelopment project through our joint

venture with Axium, the first in a pipeline of up to 29 projects

for which we have offer rights. We are also benefiting from cost

management efforts and rate increases, as home care and LTC margins

return closer to historical norms. This, coupled with the robust

growth we delivered in the home care and managed services segments

over the last five quarters, validates the compelling market

opportunity emanating from the growing demand for seniors’

care.”

Strong Execution Across All Operating

Segments

ParaMed reported its fifth sequential quarter of growth in Q4

with ADV of 28,158, a 2.8% increase from Q3 2023 and 10.2% from Q4

2022. ParaMed’s recovery in NOI margin(1) continued in Q4, up 220

bps from the prior year to 8.8%, when adjusted to exclude the

impact of the retroactive funding in Q4 and the impact of unfunded

COVID costs in Q4 2022. Q4 NOI margin was up approximately 20 bps

from Q3 2023 when adjusted for the additional statutory holiday in

Q4. Unadjusted ParaMed NOI margin was 12.6% in Q4.

Extendicare’s LTC occupancy rates have returned to pre-pandemic

levels with overall occupancy at 97.8% in Q4 consistent with Q3

2023. Occupancy improvements, cost moderation and funding rate

increases led to NOI margin improving 310 bps to 8.5% in Q4

compared to Q4 2022.

Managed services benefited from the Revera and Axium

transactions closing in Q3 2023, with revenue and NOI almost double

that of the prior year period. The transactions added 56 homes and

6,990 beds to our Extendicare Assist and SGP group purchasing

services divisions.

Progress on LTC Redevelopment in Ontario

In November 2023, Axium Extendicare LTC II LP (“Axium JV II”)

acquired a new 320-bed LTC redevelopment project in Ottawa from

Revera. Construction commenced in Q4 and the home is anticipated to

open in Q2 2026. Revera is responsible for the development and

construction of the new home, which replaces a 303-bed Revera Class

C home nearby that Extendicare is currently managing. The Company

posted a $5.0 million letter of credit in support of its commitment

to fund its 15% equity share into Axium JV II in connection with

the acquisition.

Extendicare also commenced construction of a new 256-bed LTC

home in Orleans, Ontario, which is anticipated to open in Q2 2026

and will replace a 240-bed Extendicare Class C home nearby. In

March 2024, the Company entered into an agreement of purchase and

sale to sell the home to Axium JV, with Extendicare retaining a 15%

managed interest. Closing of the transaction is anticipated in Q2

2024, subject to customary closing conditions, including receipt of

regulatory approvals.

Together with the four projects already under construction,

these six projects will replace 1,377 Class C LTC beds with 1,536

new beds in Ontario. In addition to the Company’s remaining 15

projects to replace 2,211 Class C beds with 3,032 new beds across

Ontario, the Company has the option to purchase all future Revera

LTC redevelopment projects undertaken in connection with Revera’s

other 29 Class C LTC homes currently being managed by the

Company.

Extendicare continues to advance the balance of its

redevelopment portfolio to be ready to participate in future

capital funding programs. We are hopeful we can begin up to four

new construction projects in 2024, pending a funding

announcement.

Q4 2023 Financial Highlights (all comparisons

with Q4 2022)

- Revenue increased 12.8% or $39.8 million to $350.2 million,

driven primarily by LTC flow-through funding increases and improved

occupancy; home health care ADV growth, rate increases and the

impact of $5.4 million in retroactive funding; and growth in

managed services; partially offset by prior period LTC funding of

$2.2 million and COVID-19 funding of $15.3 million recognized in Q4

2022.

- NOI(1) increased 97.3% or $21.1 million to $42.8 million;

excluding unfunded COVID-19 costs of $8.5 million and out-of-period

LTC funding and other adjustments of $2.5 million in Q4 2022 and

$5.4 million of out-of-period funding recognized in home health

care in Q4 2023, NOI improved by $9.7 million, reflecting revenue

growth partially offset by higher operating costs across all

segments.

- Adjusted EBITDA(1) increased $19.5 million to $28.7 million,

reflecting the improvements in NOI noted above, partially offset by

higher administrative costs of $1.6 million.

- Other expense of $2.7 million was down $6.0 million, reflecting

a decline in strategic transformation costs in connection with the

Revera and Axium transactions and the impact of an impairment

charge in Q4 2022.

- Earnings from continuing operations increased $16.3 million to

$8.6 million, driven by the after-tax improvement in Adjusted

EBITDA and decline in other expense, partially offset by higher

depreciation, amortization and net finance costs.

- AFFO(1) was $19.1 million ($0.23 per basic share) compared with

$1.9 million ($0.02 per basic share in Q4 2022), reflecting the

after-tax improvement in earnings and lower maintenance capex.

Year Ended 2023 Financial Highlights (all

comparisons with year ended 2022)

- Revenue increased 6.8% or $83.4 million to $1,305.0 million,

driven primarily by LTC flow-through funding increases, improved

occupancy, growth in home health care volume of 8.4%, rate

increases and growth from managed services, partially offset by

lower COVID-19 funding of $80.8 million.

- NOI(1) improved 39.2% or $42.5 million to $151.0 million;

excluding the impact of a higher recovery of COVID-19 costs of

$12.9 million, net of out-of-period LTC funding and other

adjustments of $2.3 million, NOI improved by $31.9 million,

reflecting revenue growth, partially offset by higher operating

costs across all segments.

- Adjusted EBITDA(1) increased 65.7% or $37.7 million to $95.2

million, reflecting the improvements in NOI noted above, partially

offset by higher administrative costs of $4.8 million.

- Other expense of $2.7 million was down $11.3 million; the

favourable year-over-year change related to the gain on sale of

assets to Axium JV of $9.1 million and impact of an impairment

charge recognized in 2022, partially offset by an increase in

strategic transformation costs.

- Earnings from continuing operations increased $38.5 million to

$34.0 million, driven by the after-tax impact improvement in

Adjusted EBITDA, lower net finance costs, and the decline in other

expense.

- AFFO(1) of $61.2 million ($0.72 per basic share) was up from

$26.1 million ($0.29 per basic share), reflecting the after-tax

improvement in earnings and the impact of the normal course issuer

bid (“NCIB”) activity. Excluding the impact to AFFO of the net

higher recovery of COVID-19 costs, prior period LTC funding and

workers compensation rebates, AFFO per basic share increased $0.33

to $0.56 from $0.23 in the prior year.

Business Updates

The following is a summary of Extendicare’s revenue, NOI(1) and

NOI margins(1) by business segment for the three and twelve months

ended December 31, 2023 and 2022.

|

(unaudited) |

Three months ended December 31 |

|

|

Twelve months ended December 31 |

|

| (millions of dollars |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

unless otherwise noted) |

Revenue |

NOI |

Margin |

|

|

Revenue |

NOI |

Margin |

|

|

Revenue |

NOI |

Margin |

|

|

Revenue |

NOI |

Margin |

|

|

Long-term care |

206.4 |

17.6 |

8.5 |

% |

|

193.4 |

10.5 |

5.4 |

% |

|

788.1 |

81.8 |

10.4 |

% |

|

767.1 |

68.5 |

8.9 |

% |

| Home health care |

127.2 |

16.1 |

12.6 |

% |

|

108.4 |

6.4 |

5.9 |

% |

|

469.1 |

44.2 |

9.4 |

% |

|

421.6 |

22.5 |

5.3 |

% |

| Managed

services |

16.5 |

9.1 |

55.1 |

% |

|

8.6 |

4.8 |

56.0 |

% |

|

47.8 |

25.1 |

52.5 |

% |

|

32.8 |

17.5 |

53.3 |

% |

|

|

350.2 |

42.8 |

12.2 |

% |

|

310.4 |

21.7 |

7.0 |

% |

|

1,305.0 |

151.0 |

11.6 |

% |

|

1,221.6 |

108.5 |

8.9 |

% |

|

Note: Totals may not sum due to rounding. |

| |

Long-term Care

The average occupancy of our LTC homes has recovered, improving

to 97.8% in Q4 2023, up 330 bps from 94.5% in Q4 2022 and unchanged

from 97.8% in Q3 2023.

In 2023, preferred occupancy continued to recover yielding $1.1

million of additional revenue over 2022. While there is still a gap

to pre-pandemic levels, the improvement demonstrates the importance

of optionality within our service offering and strong demand.

NOI and NOI margin in Q4 2023 were $17.6 million and 8.5%,

respectively, up from $10.5 million and 5.4% in Q4 2022, reflecting

improved alignment of costs with funding, lower staffing agency use

and increased occupancy.

Home Health Care

Home health care ADV of 28,158 in Q4 2023 was up 10.2% from Q4

2022 and 2.8% from Q3 2023.

Revenue was $127.2 million in Q4 2023, up 17.3% from Q4 2022,

driven by growth in ADV and rate increases, including $5.4 million

of out-of-period funding, partially offset by reduced COVID-19

funding of $0.9 million.

NOI and NOI margin were $16.1 million and 12.6%, respectively in

Q4 2023, up from $6.4 million and 5.9% in Q4 2022. Excluding the

impact of $5.4 million of out-of-period funding recognized in Q4

2023 and unfunded COVID-19 costs of $0.8 million in Q4 2022, NOI

improved by $3.5 million to $10.7 million with an NOI margin of

8.8% from $7.1 million and 6.6% in Q4 2022, respectively,

reflecting higher volumes and rates, partially offset by higher

wages and benefits.

Managed Services

Following the closing of the Revera and Axium transactions,

Extendicare Assist had management contracts with 72 homes

comprising 9,783 beds at the end of Q4 2023, up from 50 homes and

5,959 beds at the end of Q4 2022. It also provides a further 50

homes with consulting and other services. The number of third-party

beds served by SGP increased to approximately 136,200 at the end of

Q4 2023, up 24.1% from Q4 2022 and 5.6% from Q3 2023.

Revenue increased by $8.0 million or 92.5% to $16.5 million from

Q4 2022, largely due to the addition of managed homes as a result

of the Revera and Axium transactions and new SGP clients, partially

offset by Extendicare Assist clients that reduced their scope of

services. NOI increased by $4.3 million to $9.1 million with an NOI

margin of 55.1% in the quarter compared to 56.0% in Q4 2022.

Financial Position

Extendicare has strong liquidity with cash and cash equivalents

on hand of $75.2 million and access to a further $70.9 million in

undrawn demand credit facilities as at December 31, 2023.

Furthermore, proceeds are expected to be realized in 2024 from the

pending sales of the Orleans, Ontario 256-bed LTC redevelopment

project to Axium JV and the Sudbury and Kingston Class C LTC land

and buildings.

Normal Course Issuer Bid

During 2023, the Company purchased for cancellation 1,749,131

Common Shares, at a cost of $11.1 million, or $6.34 per share.

Purchases included 1,121,631 Common Shares under the current NCIB,

which allows for the purchase for cancellation of up to 7,273,707

Common Shares until June 29, 2024.

Since June 2022, the Company has purchased 6,760,311 Common

Shares at a cost of $46.1 million. Decisions regarding the quantity

and timing of purchases of Common Shares are based on market

conditions, share price and the outlook for capital needs.

Select Financial Information

The following is a summary of the Company’s consolidated

financial information for the three and twelve months ended

December 31, 2023 and 2022.

|

(unaudited) |

Three months ended December

31 |

|

|

Twelve months ended December

31 |

|

|

(thousands of dollars unless otherwise noted) |

2023 |

|

2022 |

|

|

2023 |

|

2022 |

|

|

Revenue |

350,181 |

|

310,393 |

|

|

1,304,957 |

|

1,221,577 |

|

|

Operating expenses |

307,403 |

|

288,707 |

|

|

1,153,935 |

|

1,113,048 |

|

|

NOI(1) |

42,778 |

|

21,686 |

|

|

151,022 |

|

108,529 |

|

|

NOI margin(1) |

12.2 |

% |

7.0 |

% |

|

11.6 |

% |

8.9 |

% |

|

Administrative costs |

14,115 |

|

12,526 |

|

|

55,835 |

|

51,075 |

|

|

Adjusted EBITDA(1) |

28,663 |

|

9,160 |

|

|

95,187 |

|

57,454 |

|

|

Adjusted EBITDA margin(1) |

8.2 |

% |

3.0 |

% |

|

7.3 |

% |

4.7 |

% |

|

Other expense |

2,714 |

|

8,751 |

|

|

2,686 |

|

13,953 |

|

| Share

of (profit) loss from investment in joint ventures |

578 |

|

− |

|

|

(20 |

) |

− |

|

|

Earnings (loss) from continuing operations |

8,620 |

|

(7,704 |

) |

|

33,982 |

|

(4,511 |

) |

|

per basic and diluted share ($) |

0.10 |

|

(0.09 |

) |

|

0.40 |

|

(0.05 |

) |

|

Loss from operating activities of discontinued operations |

− |

|

(306 |

) |

|

− |

|

(172 |

) |

| Gain on sale of discontinued

operations, net of tax |

− |

|

6,317 |

|

|

− |

|

74,237 |

|

|

Net earnings (loss) |

8,620 |

|

(1,693 |

) |

|

30,013 |

|

69,554 |

|

|

per basic and diluted share ($) |

0.10 |

|

(0.02 |

) |

|

0.40 |

|

0.78 |

|

|

per diluted share ($) |

0.10 |

|

(0.02 |

) |

|

0.40 |

|

0.76 |

|

|

AFFO(1) |

19,050 |

|

1,889 |

|

|

61,216 |

|

26,143 |

|

|

per basic share ($) |

0.23 |

|

0.02 |

|

|

0.72 |

|

0.29 |

|

|

per diluted share ($) |

0.21 |

|

0.02 |

|

|

0.68 |

|

0.29 |

|

|

Maintenance capex |

4,988 |

|

6,630 |

|

|

14,658 |

|

14,982 |

|

|

Cash dividends declared per share |

0.12 |

|

0.12 |

|

|

0.48 |

|

0.48 |

|

|

Payout ratio(1) |

52 |

% |

544 |

% |

|

66 |

% |

162 |

% |

|

Weighted average number of shares (000’s) |

|

|

|

|

|

| Basic |

84,297 |

|

86,678 |

|

|

84,986 |

|

89,009 |

|

|

Diluted |

95,507 |

|

97,604 |

|

|

96,219 |

|

100,015 |

|

Extendicare’s disclosure documents, including its Management’s

Discussion and Analysis (“MD&A”), may be found on SEDAR+ at

www.sedarplus.ca under the Company’s issuer profile and on the

Company’s website at www.extendicare.com under the

“Investors/Financial Reports” section.

March Dividend Declared

The Board of Directors of Extendicare today declared a cash

dividend of $0.04 per share for the month of March 2024, which is

payable on April 15, 2024, to shareholders of record at the close

of business on March 29, 2024. This dividend is designated as an

“eligible dividend” within the meaning of the Income Tax Act

(Canada).

Conference Call and Webcast

On March 8, 2024, at 11:30 a.m. (ET), Extendicare will hold a

conference call to discuss its 2023 fourth quarter results. The

call will be webcast live and archived online at

www.extendicare.com under the “Investors/Events &

Presentations” section. Alternatively, the call-in number is

1-800-319-4610 or 416-915-3239. A replay of the call will be

available approximately two hours after completion of the live call

until midnight on March 22, 2024. To access the rebroadcast, dial

1-800-319-6413 followed by the passcode 0669#.

About Extendicare

Extendicare is a leading provider of care and services for

seniors across Canada, operating under the Extendicare, ParaMed,

Extendicare Assist, and SGP Purchasing Partner Network brands. We

are committed to delivering quality care throughout the health

continuum to meet the needs of a growing seniors’ population. We

operate a network of 125 long-term care homes (53 owned/72 under

management contracts), deliver 10 million hours of home health care

services annually, and provide group purchasing services to third

parties representing approximately 136,200 beds across Canada.

Extendicare proudly employs approximately 22,000 qualified, highly

trained and dedicated team members who are passionate about

providing high-quality care and services to help people live

better.

Non-GAAP Measures

Certain measures used in this press release, such as “net

operating income”, “NOI”, “NOI margin”, “Adjusted EBITDA”,

“Adjusted EBITDA margin”, “AFFO”, and “payout ratio”, including any

related per share amounts, are not measures recognized under GAAP

and do not have standardized meanings prescribed by GAAP. These

measures may differ from similar computations as reported by other

issuers and, accordingly, may not be comparable to similarly titled

measures as reported by such issuers. These measures are not

intended to replace earnings (loss) from continuing operations, net

earnings (loss), cash flow, or other measures of financial

performance and liquidity reported in accordance with GAAP. Such

items are presented in this document because management believes

that they are relevant measures of Extendicare’s operating

performance and ability to pay cash dividends.

Management uses these measures to exclude the impact of certain

items, because it believes doing so provides investors a more

effective analysis of underlying operating and financial

performance and improves comparability of underlying financial

performance between periods. The exclusion of certain items does

not imply that they are non-recurring or not useful to

investors.

Detailed descriptions of these measures can be found in

Extendicare’s Q4 2023 MD&A (refer to “Non-GAAP Measures”),

which is available on SEDAR+ at www.sedarplus.ca and on

Extendicare’s website at www.extendicare.com.

The reconciliations for certain non-GAAP measures included in

this press release are outlined as follows:

The following table provides a reconciliation of AFFO, which

includes discontinued operations, to “net cash from operating

activities”, which the Company believes is the most comparable GAAP

measure to AFFO.

|

(unaudited) |

Three months ended December

31 |

|

|

Twelve months ended December

31 |

|

|

(thousands of dollars) |

2023 |

|

2022 |

|

|

2023 |

|

2022 |

|

|

Net cash from operating activities |

19,040 |

|

32,271 |

|

|

23,284 |

|

98,869 |

|

| Add

(Deduct): |

|

|

|

|

|

| Net change in operating assets

and liabilities, including interest, and taxes |

3,283 |

|

(26,758 |

) |

|

43,218 |

|

(65,534 |

) |

| Other expense |

2,714 |

|

3,809 |

|

|

11,806 |

|

9,011 |

|

| Current income tax on items

excluded from AFFO |

(720 |

) |

(1,020 |

) |

|

(2,729 |

) |

(2,391 |

) |

| Depreciation for office

leases |

(711 |

) |

(778 |

) |

|

(3,099 |

) |

(2,959 |

) |

| Depreciation for FFEC

(maintenance capex) |

(3,611 |

) |

(2,137 |

) |

|

(11,556 |

) |

(8,974 |

) |

| Additional maintenance

capex |

(1,059 |

) |

(4,493 |

) |

|

(2,584 |

) |

(6,008 |

) |

| Principal portion of

government capital funding |

503 |

|

995 |

|

|

2,540 |

|

4,129 |

|

|

Adjustments for joint ventures |

(389 |

) |

− |

|

|

336 |

|

− |

|

|

AFFO |

19,050 |

|

1,889 |

|

|

61,216 |

|

26,143 |

|

| |

|

|

|

|

|

|

|

|

|

The following table provides a reconciliation of “earnings

(loss) from continuing operations before income taxes” to Adjusted

EBITDA and “net operating income”, which excludes discontinued

operations.

|

(unaudited) |

Three months ended December

31 |

|

|

Twelve months ended December

31 |

|

|

(thousands of dollars) |

2023 |

|

2022 |

|

|

2023 |

|

2022 |

|

|

Earnings (loss) from continuing operations

before income taxes |

12,264 |

|

(10,364 |

) |

|

44,803 |

|

(4,496 |

) |

| Add

(Deduct): |

|

|

|

|

|

|

|

| Depreciation and

amortization |

8,678 |

|

7,692 |

|

|

32,225 |

|

31,559 |

|

| Net finance costs |

4,429 |

|

3,081 |

|

|

15,493 |

|

16,438 |

|

| Other expense |

2,714 |

|

8,751 |

|

|

2,686 |

|

13,953 |

|

| Share

of (profit) loss from investment in joint ventures |

578 |

|

− |

|

|

(20 |

) |

− |

|

|

Adjusted EBITDA |

28,663 |

|

9,160 |

|

|

95,187 |

|

57,454 |

|

|

Administrative costs |

14,115 |

|

12,526 |

|

|

55,835 |

|

51,075 |

|

|

Net operating income |

42,778 |

|

21,686 |

|

|

151,022 |

|

108,529 |

|

| |

|

|

|

|

|

|

|

|

|

Forward-looking Statements

This press release contains forward-looking statements

concerning anticipated future events, results, circumstances,

economic performance or expectations with respect to Extendicare

and its subsidiaries, including, without limitation, statements

regarding its business operations, business strategy, growth

strategy, results of operations and financial condition, including

anticipated timelines and costs in respect of development projects;

statements relating to the agreements entered into with Revera,

Axium and its affiliates, Axium JV and/or Axium JV II in respect of

the acquisition, disposition, ownership, operation and

redevelopment of LTC homes in Ontario and Manitoba; and statements

in respect of the impact of COVID-19 on the Company’s operating

costs, staffing, procurement, occupancy levels and volumes in its

home health care business. Forward-looking statements can often be

identified by the expressions “anticipate”, “believe”, “estimate”,

“expect”, “intend”, “objective”, “plan”, “project”, “will”, “may”,

“should” or other similar expressions or the negative thereof.

These forward-looking statements reflect the Company’s current

expectations regarding future results, performance or achievements

and are based upon information currently available to the Company

and on assumptions that the Company believes are reasonable. The

Company assumes no obligation to update or revise any

forward-looking statement, except as required by applicable

securities laws. These statements are not guarantees of future

performance and involve known and unknown risks, uncertainties and

other factors that may cause actual results, performance or

achievements of the Company to differ materially from those

expressed or implied in the statements. For further information on

the risks, uncertainties and assumptions that could cause

Extendicare’s actual results to differ from current expectations,

refer to “Risks and Uncertainties” and “Forward-looking Statements”

in Extendicare’s Q4 2023 MD&A filed by Extendicare with the

securities regulatory authorities, available at www.sedarplus.ca

and on Extendicare’s website at www.extendicare.com. Given these

risks and uncertainties, readers are cautioned not to place undue

reliance on Extendicare’s forward-looking statements.

Extendicare contact:David Bacon, Senior Vice

President and Chief Financial OfficerT: (905) 470-4000E:

david.bacon@extendicare.comwww.extendicare.com

|

Endnote |

|

(1) |

|

See the “Non-GAAP Measures” section of this press release and the

Company’s Q4 2023 MD&A, which includes the reconciliation of

such non-GAAP measures to the most directly comparable GAAP

measures. |

|

|

|

|

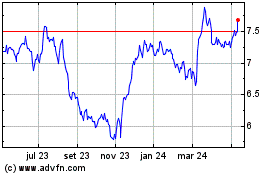

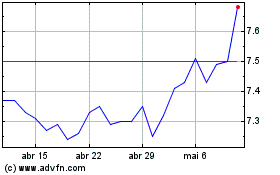

Extendicare (TSX:EXE)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Extendicare (TSX:EXE)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024