Communication at the request of the FSMA on the transactions with

Qliniq

Communication at the request of the FSMA

on the transactions with Qliniq

-

Revision of 2022 and half-year of 2023 (HY 2023) financial

statements following a correction of a non-cash error in the

accounting treatment of the transactions with Qliniq announced on

20 January 2023

-

HY-088 and HY-038 considered as a non-monetary exchange under IAS

38.45 in 2023

-

No impact on the cash flow and cash position

Liège, Belgium – 14 March 2023 – 07:00AM

CET – Regulated Information – Inside

informaition - Hyloris Pharmaceuticals SA (Euronext Brussels:

HYL), a specialty biopharma company committed to

addressing unmet medical needs through reinventing existing

medications, today announces it has issued a restatement of fiscal

year 2022 and half year 2023 results. Following discussions with

the Belgian Financial Services and Markets Authority (FSMA) and

Hyloris‘ statutory auditor, the Board of Directors has revised the

financial statements due to the correction of a non-cash accounting

error regarding the divestment of HY-038 and acquisition of

HY-088.

Clarification on the press release of 20

January 2023 on the transactions with Qliniq

On 20 January 2023 Hyloris announced that the

global rights of the ongoing development of HY-088 was licensed-in

from a Dutch company, Qliniq, who maintained the rights to

commercialize the product candidate in its home country, and a

selected number of Middle Eastern and developing countries. In the

same press release, Hyloris announced that it had divested HY-038

to the same company, Qliniq, for a price of EUR 1 million.

As detailed in the 2022 Annual Report, HY-038

falls under the category of high-barrier generics and thus lies

beyond Hyloris’ core portfolio of assets. Limited development

activities had occurred for HY-038 since the IPO and the product

was no longer under development at the time of the closing of the

transaction with Qliniq. Hyloris encountered challenges in

identifying a suitable Contract Manufacturing Organization (CMO)

capable of producing HY-038 at a desired cost. The transaction

price of € 1 million was received on 16 February 2023.

HY-088 is a ready-to-administer oral liquid

formulation designed for addressing hypophosphatemia. Presently,

physicians utilize compounded products for treating this condition,

which have not undergone regulatory evaluation regarding their

safety, effectiveness, and quality. At the time of the transaction,

QliniQ held no exclusive rights to develop the oral liquid

formulation and had not initiated any significant development

activities on HY-088.

It is expected that Hyloris will submit HY-088

for registration in the course of 2025. The transaction price of

€1.2 million (including €200 thousand designated as prepaid

expenses), was paid by Hyloris on 13 February 2023.

QliniQ is a Dutch company which develops and

in-licenses drugs and medical supplies in various therapeutic

domains and commercializes these in the Netherlands. QliniQ

nurtures cooperation and long-lasting business relationships with

international companies as part of its successful market approach.

At December 31, 2022, Qliniq had a balance sheet total of € 0.8

million, a cash balance of € 0.2 million and 2 FTE’s. Qliniq’s

shareholders have previously successfully developed several

pharmaceutical companies.

Accounting treatment of the transactions

with Qliniq

Hyloris initially recognized (a) €1 million in

revenue in 2022 from the divestment of HY-038, and (b) € 1 million

in R&D expenses and € 0,2 million in intangible assets in H1

2023 for the purchase of HY-088. A reassessment determined that

both transactions qualify as a non-monetary exchange because

negotiations and valuations occurred simultaneously. Due to the

development stage of the products exchanged, the fair value of

neither the asset received, nor the asset given up can be reliably

determined. As a result of this reassessment, the restated

financials for 2022 will reverse the €1 million revenue from the

divestment of HY-038. This adjustment will also affect the

half-year 2023 financial statements, resulting in a reversal of €1

million in R&D expenses for HY-088. These expenses are offset

against the €1 million received by Hyloris for HY-038.

The following tables summarize the impact of the

restatement on the consolidated financial statements.

Consolidated statement of financial position

|

Per 31 December 2022(in € thousands) |

Impact of Restatement |

|

As previously reported |

Adjustment |

As restated |

|

Current assets |

50.801 |

-1.000 |

49.801 |

|

Trade and other receivables |

5.127 |

-1.000 |

4.127 |

|

Total assets |

61.864 |

-1.000 |

60.864 |

|

|

|

|

|

|

Equity |

55.045 |

-1.000 |

54.045 |

|

Result of the period |

(10.770) |

-1.000 |

(11.770) |

|

Total equity and liabilities |

61.864 |

-1.000 |

60.864 |

Consolidated statement of profit or loss and

other comprehensive income

|

For the year ended 31 December 2022(in €

thousands) |

Impact of Restatement |

|

As previously reported |

Adjustment |

As restated |

|

Revenues |

2.951 |

-1.000 |

1.951 |

|

Gross profit |

2.857 |

-1.000 |

1.857 |

|

Operating profit/(loss) (EBIT) |

(10.638) |

-1.000 |

(11.638) |

|

Profit (loss) before taxes |

(10.766) |

-1.000 |

(11.766) |

|

PROFIT (LOSS) FOR THE PERIOD |

(10.770) |

-1.000 |

(11.770) |

|

TOTAL COMPREHENSIVE INCOME FOR THE PERIOD |

(10.770) |

-1.000 |

(11.770) |

|

For the year ended 31 December 2022(in €)

|

Impact of Restatement |

|

As previously reported |

Adjustment |

As restated |

|

Basic/diluted earnings/(loss) per share |

(0.380) |

(0.035) |

(0.435) |

Consolidated statement of cash flows

Even though there was an actual cash inflow of € 1 million from

the divestment of HY-038 and a cash outflow of € 1.2 million

resulting from the in-licensing of HY-088, the transactions are

presented in the net consolidated cash flow statement for the year

ended per December 31, 2023 (i.e., € 200k prepaid expenses), as

this most faithfully presents the substance of the transactions.

There is no impact on the consolidated statement of cash flows for

the year ended on December 31, 2022, as there is no cash

impact.

About Hyloris Pharmaceuticals SA

Hyloris is a specialty biopharma company focused

on innovating, reinventing, and optimizing existing medications to

address important healthcare needs and deliver relevant

improvements for patients, healthcare professionals and payors.

The Company’s development strategy primarily

focuses on leveraging established regulatory pathways, such as the

FDA’s 505(b)2 pathway in the U.S or equivalent regulatory

frameworks in other regions which are specifically designed for

pharmaceuticals for which safety and efficacy of the molecule have

already been established. This approach can reduce the clinical

burden required for market entry, and significantly shorten the

development timelines, leading to reduced costs and risks.

Hyloris has built a broad, patented portfolio of

18 reformulated and repurposed value-added medicines that have the

potential to offer significant advantages over existing

alternatives. Two products are currently in early phases of

commercialization in collaboration with commercial partners:

Sotalol IV for the treatment of atrial fibrillation, and Maxigesic®

IV, a non-opioid post-operative pain treatment. In addition to its

core strategic focus, the Company has 1 approved high barrier

generic product launched in the U.S. and 2 high barrier generic

products in development.

Hyloris is based in Liège, Belgium. For more

information, visit www.hyloris.com and follow-us

on LinkedIn.

For more information, contact Hyloris

Pharmaceuticals:Stijn Van Rompay,

CEOstijn.vanrompay@hyloris.com+32 (0)4 346 02 07Jean-Luc

Vandebroek, CFOjean-luc.vandebroek@hyloris.com+32 (0)478 27 68

42Jessica McHarguejessica.mchargue@hyloris.com+1 919 451 4740

Disclaimer and forward-looking statements

Hyloris means “high yield, lower risk”, which

relates to the 505(b)(2) regulatory pathway for product approval on

which the Company focuses, but in no way relates or applies to an

investment in the Shares.

Certain statements in this press release are

“forward-looking statements.” These forward-looking statements can

be identified using forward-looking terminology, including the

words "believes", "estimates," "anticipates", "expects", "intends",

"may", "will", "plans", "continue", "ongoing", "potential",

"predict", "project", "target", "seek" or "should", and include

statements the Company makes concerning the intended results of its

strategy. These statements relate to future events or the Company’s

future financial performance and involve known and unknown risks,

uncertainties, and other factors, many of which are beyond the

Company’s control, that may cause the actual results, levels of

activity, performance or achievements of the Company or its

industry to be materially different from those expressed or implied

by any forward-looking statements. The Company undertakes no

obligation to publicly update or revise forward-looking statements,

except as may be required by

law.

- 20240314 Restatement of FY22 ENG

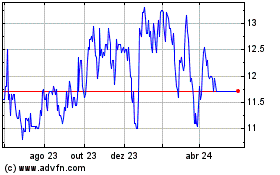

Hyloris Pharmaceuticals (EU:HYL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Hyloris Pharmaceuticals (EU:HYL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025