The Trian Group,1 which beneficially owns $3.5 billion of common

stock in The Walt Disney Company (NYSE: DIS), today released a

letter to its fellow Disney shareholders. The full text of the

letter is below and available to view online at:

https://restorethemagic.com/03-18-2024/.

Dear Fellow Walt Disney Company Shareholder:

Disney’s 2024 Annual Meeting will be held on April 3, and it is

time for you to vote to help Restore the Magic at

Disney.

For more than a century, Disney has captivated millions of

people all over the world with unforgettable films and experiences.

Like you, Trian loves Disney and wants to see the Company succeed.

With its iconic franchises, global presence and scale, unparalleled

customer loyalty and enviable commercial flywheel, Disney and its

shareholders should prosper.

But despite its many advantages, Disney has lost its way. Disney

fell from its #1 position at the box office,2 was late to enter the

streaming business3 and doubled down on linear TV at the wrong

time.4 As a result, financial performance has deteriorated, with

earnings per share, free cash flow, operating income and many other

key metrics lower than they were five years ago.5

Consequently, shareholders have suffered. Disney’s stock has

underperformed its media peers and the broader market over most

relevant periods: over the past one, two, three, four and five

years.6

Change Is Needed

To help ensure a better future for this great company, we

believe Disney needs new independent directors who have a

shareholder mindset, deep and relevant experience and a sense of

urgency.

We have nominated two such candidates: Nelson

Peltz and Jay Rasulo, each of whom have

invested their own money in Disney stock and are dedicated to

helping Disney. Nelson was a public company CEO and has served on

the boards of many public companies facing performance, governance

and CEO succession challenges, just like Disney. Jay is the former

Chief Financial Officer of Disney and ran the Company’s parks and

resorts business before that.

Nelson and Jay pledge to work together with the other members of

the Board and Disney’s leadership team to enhance corporate

governance and accountability, accelerate media profitability,

review Disney’s creative engine and clarify the Company’s strategic

focus. We believe Nelson and Jay will be a catalyst for much needed

positive change.

We are seeking to replace two long-serving Disney directors

whose backgrounds and skills are not, in our view, relevant to

Disney’s current challenges or likely to assist in its turnaround:

Michael B.G. Froman and Maria Elena Lagomasino. Mr. Froman is

President of the Council on Foreign Relations (where another Disney

director is on the board) and Ms. Lagomasino helps organize the

affairs of wealthy families. Whatever their strengths and skills in

foreign affairs and wealth management, the cold truth is that

neither of them has helped Disney retain its leadership position in

the media landscape; neither of them has aligned executive pay with

performance;7 and neither of them has facilitated an orderly CEO

transition.8 Instead, under their watch, Disney has fallen – its

fundamental financial performance is worse,9 and its stock has

underperformed.10

Disney can do better. But it needs some fresh

thinking.

We Have Helped Drive Change

At Trian, we have recommended and nominated directors at more

than two dozen companies over the course of our history. Nelson

Peltz has served on 11 public company boards himself and is one of

the most experienced corporate directors in America. Time and

again, Nelson and our other candidates have proven to be productive

and collaborative directors; they have overseen major business

transformations11 and successful leadership transitions12 and have

helped drive growth13 and create value14 for all shareholders.

The simple fact is that Trian suggests candidates for boards in

an effort to help, and our candidates focus their energy entirely

on trying to create value for shareholders. Our fresh perspective

and shareholder mindset, coupled with a genuine dedication to

collegiality and collaboration, and long-term focus are a powerful

combination. Great companies that have lost their way – like Disney

– often thrive after new directors, nominated by Trian, are

appointed.15

Just ask the companies themselves: executives at Mondelēz, Sysco

and Wendy’s, for example, have praised our directors for working

constructively in the boardroom.16 Even CEOs of companies that

initially opposed the appointment of Mr. Peltz – Heinz, DuPont and

Procter & Gamble – later commended him as constructive and

collaborative.17

Accepting Change is Hard

Admittedly, our relationships with companies, and with other

directors, do not always start with such positive feelings.

Sometimes to deflect from performance issues, corporate boards

attempt to sow uncertainty about Trian and our candidates, warning

that we will be “disruptive” or that our candidates will “not add

value.”18

Disney has taken this approach to an extreme. Disney’s Board has

claimed that the election of Nelson and Jay threatens to

“impede,”19 “disrupt”20 and “derail”21 the Company’s supposed

progress. They have disingenuously touted “endorsements” from

“experts”22 who are, in fact, just service providers or advisors to

Disney that have been highly compensated by the Company. Disney has

used inflammatory rhetoric, claiming that our candidates (one of

whom is Disney’s own former CFO) are “oblivious”23 and that our

ideas are “inane.”24

We have been here before.

We know that companies sometimes fear and resist change. But we

also know that turnarounds are not easy and often require objective

thinking and new ideas.

To Disney’s incumbent directors, we say this: we are not here to

upset, interrupt or reverse Disney’s progress, or frustrate the

Board or leadership team. We love Disney; we are a large

investor and we come with the sole purpose of helping the Company

get back to delighting consumers and delivering strong returns for

shareholders. We look forward to the opportunity to do so

together, with you, from inside the boardroom.

Vote for Change

Nelson Peltz and Jay Rasulo have dedicated themselves to helping

build a better future for this iconic company. Like you, we want

Disney to improve the guest experience at its parks and on its

cruises; create unforgettable, industry-leading films and

television content; and deliver sustainable growth and value for

shareholders for generations to come.

We are confident that, given its many advantages, Disney can do

better. But we need your help.

Together, we can elect two new independent directors who will

bring focus, alignment and accountability to the Company’s

boardroom. Together, we can Restore the Magic at

Disney.

To ensure the election of Nelson Peltz and Jay Rasulo,

it is essential that shareholders vote

FOR Nelson Peltz and Jay Rasulo

and WITHHOLD on Michael B.G.

Froman, Maria Elena Lagomasino and all three Blackwells Nominees.

Please use the enclosed BLUE proxy card.

P.S. If you voted already, it is not too late to switch your

vote and support Trian’s Nominees, Nelson Peltz and Jay Rasulo.

Your last vote is the one that counts.

For more information, please visit www.RestoreTheMagic.com.

About Trian Fund Management, L.P.

Founded in 2005, Trian Fund Management, L.P. (“Trian”) is a

multi-billion dollar investment management firm. Trian is a highly

engaged shareowner that combines concentrated public equity

ownership with operational expertise. Leveraging the 40+ years’

operating experience of our Founding Partners, Nelson Peltz and

Peter May, Trian seeks to invest in high quality but undervalued

and underperforming public companies and to work collaboratively

with management teams and boards to help companies execute

operational and strategic initiatives designed to drive long-term

sustainable earnings growth for the benefit of all

stakeholders.

Media Contacts:

Anne A. Tarbell(212) 451-3030atarbell@trianpartners.com

Paul Caminiti / Pamela Greene / Jacqueline ZuhseReevemark(212)

433-4600Trian@reevemark.com

Investor Contacts:

Matthew Peltz(212) 451-3060mpeltz@trianpartners.com

Ryan Bunch(212) 451-3176rbunch@trianpartners.com

Bruce Goldfarb / Pat McHughOkapi Partners LLC(212) 297-0720(877)

629-6357info@okapipartners.com

Edward McCarthy / Richard Grubaugh / Thomas GerminarioD.F. King

& Co., Inc. (212) 229-2634 Disney@dfking.com

Disclaimer

Except as otherwise set forth in this press

release, the views expressed in this press release reflect the

opinions of Trian Fund Management, L.P. and its affiliates

(“Trian”), and are based on publicly available information with

respect to The Walt Disney Company (“Disney” or the “Company”).

Trian recognizes that there may be confidential information in the

possession of the Company that could lead it or others to disagree

with Trian’s conclusions. Trian reserves the right to change any of

its opinions expressed herein at any time as it deems appropriate

and disclaims any obligation to notify the market or any other

party of any such change, except as required by law. Trian

disclaims any obligation to update the information or opinions

contained in this press release, except as required by law. For the

avoidance of doubt, this press release is not affiliated with or

endorsed by Disney.

This press release is provided merely as

information and is not intended to be, nor should it be construed

as, an offer to sell or a solicitation of an offer to buy any

security nor as a recommendation to purchase or sell any security.

Funds, investment vehicles, and accounts managed by Trian currently

beneficially own shares of the Company. These funds, investment

vehicles, and accounts are in the business of trading – buying and

selling – securities and intend to continue trading in the

securities of the Company. You should assume such funds may from

time to time sell all or a portion of their holdings of the Company

in open market transactions or otherwise, buy additional shares (in

open market or privately negotiated transactions or otherwise), or

trade in options, puts, calls, swaps or other derivative

instruments relating to such shares.

Some of the materials in this press release

contain forward-looking statements. All statements contained herein

that are not clearly historical in nature or that necessarily

depend on future events are forward-looking, and the words

“anticipate,” “believe,” “expect,” “potential,” “could,”

“opportunity,” “estimate,” “plan,” “once again,” “achieve,” and

similar expressions are generally intended to identify

forward-looking statements. The projected results and statements

contained herein that are not historical facts are based on current

expectations, speak only as of the date of these materials and

involve risks, uncertainties and other factors that may cause

actual results, performances or achievements to be materially

different from any future results, performances or achievements

expressed or implied by such projected results and statements.

Assumptions relating to the foregoing involve judgments with

respect to, among other things, future economic competitive and

market conditions and future business decisions, all of which are

difficult or impossible to predict accurately and many of which are

beyond the control of Trian.

The estimates, projections and potential impact

of the opportunities identified by Trian herein are based on

assumptions that Trian believes to be reasonable as of the date of

this press release, but there can be no assurance or guarantee (i)

that any of the proposed actions set forth in this press release

will be completed, (ii) that the actual results or performance of

the Company will not differ, and such differences may be material,

or (iii) that any of the assumptions provided in this press release

are accurate.

Trian has neither sought nor obtained the

consent from any third party to use any statements or information

contained herein that have been obtained or derived from statements

made or published by such third parties, nor has it paid for any

such statements. Any such statements or information should not be

viewed as indicating the support of such third parties for the

views expressed herein. Trian does not endorse third-party

estimates or research which are used herein solely for illustrative

purposes.

Important Information

Trian Fund Management, L.P., together with

Nelson Peltz, Peter W. May, Josh Frank, Matthew Peltz, Isaac

Perlmutter, James A. Rasulo, Trian Fund Management GP, LLC, Trian

Partners, L.P., Trian Partners Parallel Fund I, L.P., Trian

Partners Master Fund, L.P., Trian Partners Co-Investment

Opportunities Fund, Ltd., Trian Partners Fund (Sub)-G, L.P., Trian

Partners Strategic Investment Fund-N, L.P., Trian Partners

Strategic Fund-G II, L.P., Trian Partners Strategic Fund-K, L.P.,

The Laura & Isaac Perlmutter Foundation Inc., Object Trading

Corp., Isaac Perlmutter T.A., and Zib Inc. (collectively, the

“Participants”) filed a definitive proxy statement and accompanying

form of blue proxy card (as supplemented and amended on February

12, 2024, the “Definitive Proxy Statement”) with the Securities and

Exchange Commission (the “SEC”) on February 1, 2024 to be used in

connection with the 2024 annual meeting of shareholders of the

Company.

THE PARTICIPANTS STRONGLY ADVISE ALL

SHAREHOLDERS OF THE COMPANY TO READ THE DEFINITIVE PROXY STATEMENT

AND OTHER PROXY MATERIALS BECAUSE THEY CONTAIN IMPORTANT

INFORMATION. SUCH PROXY MATERIALS ARE AVAILABLE AT NO CHARGE ON THE

SEC’S WEBSITE AT HTTP://WWW.SEC.GOV AND TRIAN’S WEBSITE,

HTTPS://RESTORETHEMAGIC.COM. THE DEFINITIVE PROXY STATEMENT AND

ACCOMPANYING PROXY CARD WILL BE FURNISHED TO SOME OR ALL OF THE

COMPANY’S SHAREHOLDERS. SHAREHOLDERS MAY ALSO DIRECT A REQUEST TO

EITHER OF TRIAN’S PROXY SOLICITORS, OKAPI PARTNERS LLC, 1212 AVENUE

OF THE AMERICAS, NEW YORK, NY 10036 (SHAREHOLDERS CAN E-MAIL

INFO@OKAPIPARTNERS.COM OR CALL TOLL-FREE: (877) 629-6357), OR D.F.

KING & CO., INC., 48 WALL STREET, NEW YORK, NY 10005

(SHAREHOLDERS CAN E-MAIL DISNEY@DFKING.COM OR CALL TOLL-FREE: (800)

207-3158).

Information about the Participants and a

description of their direct or indirect interests by security

holdings or otherwise can be found in the Definitive Proxy

Statement.

_______________1 Please refer to the definitive proxy statement,

filed with the United States Securities and Exchange Commission by

Trian Fund Management L.P. and certain of its affiliates and

other persons (the “Definitive Proxy Statement”) for information

regarding the members of the “Trian Group.” Nelson Peltz

beneficially owns Disney shares worth approximately $3.5 billion

and Jay Rasulo owns Disney shares worth approximately $800,000, in

each case as further detailed in the Definitive Proxy Statement.

Note that ownership position values are based on Disney’s share

price at the close of business on March 15, 2024.2 Trian

presentation, filed with the Securities and Exchange Commission on

03/04/24 (“Trian’s White Paper”) at page 106.3 Id. at page 30.4 Id.

at pages 58-60.5 Id. at page 9.6 FactSet. Note: Disney performance

measures total shareholder return (“TSR”) through 03/15/24 defined

as the total return an investor would have received if they

purchased one share of stock on the first day of the measured

period, inclusive of share price appreciation and dividends paid.

“Media Peers” represents the simple average of “Media Industry

Peers” as defined in Disney’s 2024 Definitive Proxy Statement and

consists of Alphabet, Amazon, Apple, Comcast, Meta, Netflix,

Paramount, and Warner Bros. Discovery; “Broader Market” represents

the S&P 500 which we highlight here only as a widely recognized

index, however, for various reasons the performance of the index

and that of the securities mentioned above may not be comparable.

One cannot invest directly in an index.7 Since Ms. Lagomasino

became Chair of Disney’s Compensation Committee, Disney’s

say-on-pay votes have averaged just 73%, which ranks in the bottom

10% of all S&P 500 companies and Disney’s say-on-pay approval

percentages have been below the S&P 500 median every year.

Say-on-pay has also been below the average of all of the S&P

500 companies since 2018, which is Mr. Froman’s tenure on the

Board.8 Trian’s White Paper at page 64.9 Trian’s White Paper at

page 9.10 FactSet. Disney’s stock has underperformed Media Peers

and the Broader Market over one, three and five years. See supra n.

6.11 At The Procter & Gamble Company (“P&G”), a household

products company where Mr. Peltz served on the Board from 2018

until 2022, he helped P&G develop and oversee a “Four-Year

Overhaul” that resulted in P&G “making several dramatic changes

to help improve performance” and “streamlin[ing] its operations

from 10 business units to six, improv[ing] its earnings growth,

clear[ing] out bureaucracy and increas[ing] accountability.”

(Source: Article titled “Peltz to Depart P&G Board, Capping

Nearly Four-Year Overhaul,” published August 5, 2021 by

Bloomberg.)12 Nelson Peltz has assisted six different boards with

executing on successful succession plans since 2016: Unilever

(2023), Janus Henderson (2022), P&G (2021), Sysco (2020),

Mondelēz (2017) and Wendy’s (2016 and 2024).13 At Mondelēz

International, an international snack company, during Mr. Peltz’s

tenure on the board of directors from 2014 to 2018, the company

improved its cash flow generation through margin improvement and

development of working capital efficiencies. (Source: SEC filings.

In 2014, operating income margins were 11.7% and improved to 16.7%

in 2018. Cash flow from operations were $3.56 billion in 2014 and

improved to $3.95 billion in 2018.)14 At Trian portfolio companies

where Nelson Peltz has served on the board, those companies have

delivered an average annualized TSR of 17%, from the first day

Trian invested through 12/31/23 (or through a company’s sale date

related to an acquisition), outperforming the S&P 500 by more

than 500 bps and representing a 1600 bps improvement from the

five-year period prior to Trian’s involvement. This TSR information

does not represent, and should not be construed as describing, the

performance of any funds, investment vehicles or accounts managed

by Trian. Past TSR performance is not indicative of future TSR

performance. Although Trian believes that the changes or

improvements for certain companies identified herein were

attributable in significant part to the cumulative effects of the

implementation of operational and strategic initiatives during the

period of Nelson and Trian’s active involvement, there is no

objective method to confirm what portion of such growth was

attributable to Nelson and Trian’s efforts and what may have been

attributable to other factors.15 Id.16 See the “Third Party

Perspectives” page of the Trian Group’s website,

www.RestoreTheMagic.com, for a list of quotes from select former

directors and executives with whom Trian’s partners have served on

a public company board.17 Id.18 P&G Letter to Shareholders,

08/01/17.19 Disney Letter to Shareholders, 02/12/24.20 Disney

Letter to Shareholders, 02/26/24.21 Disney Letter to Shareholders,

02/12/24.22 See the “Expert Analysis” page of Disney’s campaign

website, which includes supportive quotes from Jamie Dimon, the CEO

of JPMorgan Chase, and Mason Morfit, the CEO of ValueAct Capital.

According to the Financial Times, JPMorgan Chase has received more

than $150 million in fees from Disney since 2014. See also

Blackwells Capital Investor Presentation, 03/11/24 (estimating that

ValueAct has earned more than $90 million in fees from managing

assets for Disney’s pension funds).23 Disney presentation filed

with the SEC on 03/11/24 at page 42.24 Id. at page 4.

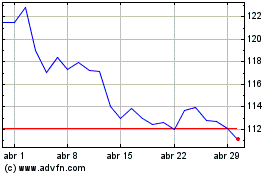

Walt Disney (NYSE:DIS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Walt Disney (NYSE:DIS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024