World Financial Split Corp. Announces Year End Results

27 Março 2024 - 5:01PM

(TSX: WFS; WFS.PR.A) World Financial Split Corp.

(the “Fund”) announces results of operations for the year ended

December 31, 2023. Increase in net assets from operations

attributable to holders of Class A shares amounted to $0.29 million

or $0.33 per Class A share. As at December 31, 2023,

net assets attributable to holders of Class A shares were $1.30

million or $1.51 per Class A share. Cash distributions to Preferred

Shareholders totaling $0.47 million or $0.53 per Preferred share

were paid during the year.

The Fund is a mutual fund corporation which

invests in a portfolio that includes common equity securities

selected from the ten largest financial services or real estate

companies by market capitalization in each of Canada, the United

States and the Rest of the World (the “Portfolio Universe”). The

issuers of securities in the Portfolio, other than Canadian

issuers, must have a minimum credit rating of “A” from Standard

& Poor’s Rating Services or a comparable rating from an

equivalent rating agency.

In addition, up to 25% of the Net Asset Value of

the Fund may be invested in common equity securities of financial

services or real estate companies not included in the Portfolio

Universe as long as such companies have a market capitalization at

the time of investment of at least US$10 billion and for

non-Canadian issuers, a minimum credit rating of “A-” from Standard

& Poors Rating Services or a comparable rating from an

equivalent rating agency.

The Fund employs an active covered call strategy

to enhance the income generated by the Portfolio and to reduce

volatility.

The Fund’s investment portfolio is managed by

its investment manager, Mulvihill Capital Management Inc. The

Fund’s Preferred and Class A shares are listed on Toronto Stock

Exchange under the symbols WFS.PR.A and

WFS respectively.

|

Selected Financial Information: ($ Millions) |

|

|

|

Statement of Financial Position as at December

31st |

|

2023 |

|

|

Assets |

$ |

10.01 |

|

|

Liabilities (including Redeemable Preferred Shares) |

|

(8.71 |

) |

| Net

Assets Attributable to Holders of Class A Shares |

$ |

1.30 |

|

|

Statement of Comprehensive Income for the year ended

December 31st |

|

|

| Income

(including Net Gain on Investments) |

$ |

1.16 |

|

|

Expenses |

|

(0.40 |

) |

| Operating

Profit |

|

0.76 |

|

| Preferred

Share Distributions |

|

(0.47 |

) |

| Increase

in Net Assets Attributable to Holders of Class A Shares |

$ |

0.29 |

|

|

|

|

|

For further information, please contact Investor Relations at

416.681.3966, toll free at 1.800.725.7172, email at

info@mulvihill.com or visit www.mulvihill.com.

|

John Germain, Senior Vice-President & CFO |

Mulvihill Capital Management Inc.121 King Street

WestSuite 2600Toronto, Ontario, M5H 3T9416.681.3966;

1.800.725.7172www.mulvihill.com |

Commissions, trailing commissions, management

fees and expenses all may be associated with investment funds.

Please read the prospectus before investing. Investment funds are

not guaranteed, their values change frequently and past performance

may not be repeated.

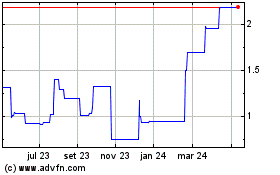

World Financial Split (TSX:WFS)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

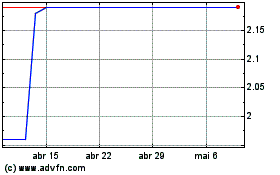

World Financial Split (TSX:WFS)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025