Vaxxinity, Inc. (Nasdaq: VAXX), a U.S. company pioneering the

development of a new class of immunotherapeutic vaccines, today

reported financial results for the fourth quarter and full year

ended December 31, 2023, and provided a corporate update.

“2024 will prove to be a critical year for Vaxxinity as we

refocus our efforts on our neurodegeneration programs and move

closer to obtaining our company’s first approval,” said Mei Mei Hu,

CEO of Vaxxinity. “Just this month, we presented exploratory

biomarker data from our Phase 1 trial of UB-312 in Parkinson’s

patients: a first of its kind demonstrating target engagement of

toxic alpha-synuclein in the CNS and a potential correlation with

clinical efficacy. This represents a major step for our platform in

neurodegeneration where the safe engagement of aberrant protein

targets in the CNS remains critical, and new hope for the

Parkinson’s community. We also seek to advance UB-311, our anti-Aβ

Alzheimer’s candidate, as we resume dialogue with regulatory

authorities and partners. Finally, we’re looking forward to the

readout from the Phase 1 trial of VXX-401, our vaccine candidate

for hypercholesterolemia, as well as the potential marketing

authorization of UB-612, our heterologous booster vaccine candidate

for COVID-19.”

2023 and Recent Clinical Pipeline

Developments

UB-312 in Parkinson’s disease (PD) and other

synucleinopathies

- UB-312 targets toxic forms of

aggregated α-synuclein (aSyn).

- Two exploratory CSF biomarkers show

promise as measures of disease progression:

- aggregated aSyn, as measured by an

aSyn Seed Amplification Assay developed in collaboration with Mayo

Clinic, UTHealth Houston, and Amprion, with funding from The

Michael J. Fox Foundation.

- phosphorylated aSyn

(pS129-aSyn).

- PD patients with UB-312-induced

antibodies in CSF had significantly less aSyn aggregation (p =

0.0183) and pS129-aSyn (p = 0.0351) as compared to placebo.

- PD patients with UB-312-induced

antibodies in CSF showed significant improvement in the clinical

MDS-UPDRS II activities of daily living scale as compared to

placebo (p = 0.0062).

- Anti-aSyn antibody titer levels in

CSF correlate with reduction in aggregated aSyn, which correlated

with improvement in MDS-UPDRS II.

- In March 2024, JC Dodart, Chief

Scientific Officer, presented these exploratory analyses at AD/PD

2024 in Lisbon, Portugal.

VXX-401 in hypercholesterolemia

- VXX-401 targets proprotein

convertase subtilisin/kexin type 9 (PCSK9) to reduce LDL

cholesterol.

- All six cohorts of the Phase 1 trial

of VXX-401 are fully enrolled.

- In February 2024, results from

multiple preclinical studies of VXX-401 in non-human primates,

demonstrating robust, sustained reduction in LDL-C, were published

in the Journal of Lipid Research.

- The company anticipates topline

Phase 1 data by mid-2024.

UB-612 COVID-19 booster

- UB-612 employs a “multitope”

approach to neutralizing the ancestral SARS-CoV-2 virus and its

variants.

- In November 2023, Vaxxinity

presented data from its head-to-head Phase 3 trial of UB-612 at

Vaccines Summit in Boston, MA, and published a peer-reviewed

article about UB-612 in Vaccine reporting antibody response against

SARS-CoV-2 in cynomolgus macaques.

2023 and Recent Corporate Updates

- Academic Collaborations

& State of Florida Grant. In January 2024 Vaxxinity

announced a collaboration with the University of Central Florida to

conduct research funded by the state of Florida to further the

development of our active immunotherapies against myostatin and

activin A to prevent and mitigate muscle and bone wasting,

well-known health challenges related to long-term spaceflight.

These targets share biological mechanisms implicated in obesity,

diabetes, and highly prevalent age-related diseases. In the same

month, Vaxxinity announced a collaboration with the University of

Florida’s Center for Translational Research in Neurodegenerative

Disease (CTRND) to support our development of vaccines for

neurodegenerative diseases.

Fourth Quarter and Year End 2023 Financial

Results

As of December 31, 2023, Vaxxinity had $30.4

million of highly liquid assets, including $4.9 million of cash and

cash equivalents and $25.5 million of short-term investments,

compared to $86.8 million as of December 31, 2022.

Comparison of three months ended December 31,

2023 to three months ended December 31, 2022

Research and development expenses were $8.2

million and $13.1 million for the three months ended December 31,

2023 and 2022, respectively.

The $4.9 million decrease in research and

development expenses was primarily due to decreases in

program-related costs of $0.6 million for our UB-313 migraine

program, $0.4 million for our VXX-401 hypercholesterolemia program,

and $0.4 million for our UB-312 Parkinsons program, as well

decreases in personnel and consulting costs totaling $2.1

million.

General and administrative expenses were $3.4

million and $7.7 million for the three months ended December 31,

2023, and 2022, respectively.

The $4.3 million decrease was primarily due to a

decrease in personnel costs of $1.7 million, consulting and

professional services totaling $0.9 million, and travel expenses of

$0.5 million.

Net loss for the three months ended December 31, 2023, was $11.4

million or $0.09 per share compared to $20.5 million or $0.16 per

share for the three months ended December 31, 2022.

Comparison of the year ended December 31, 2023

to the year ended December 31, 2022

Research and development expenses were $35.9

million and $47.6 million for the years ended December 31, 2023 and

2022, respectively.

The $11.7 million decrease in research and

development expenses was primarily due to decreases in

program-related costs of $4.3 million for our UB-612 Covid-19

program and $1.0 million for our UB-312 Parkinson’s Disease

program, as well decreases in personnel costs of $4.2 million and

consulting costs of $1.8 million.

General and administrative expenses were $22.4

million and $28.4 million for the years ended December 31, 2023,

and 2022, respectively.

The $6.0 million decrease was primarily due to a

decrease in personnel costs of $2.0 million, D&O insurance

premiums of $1.8 million, and consulting and professional services

costs of $1.2 million.

Net loss for the year ended December 31, 2023, was $56.9 million

or $0.45 per share compared to $75.2 million or $0.60 per share for

the year ended December 31, 2022.

|

VAXXINITY, INC. |

|

|

Statement of Operations |

|

|

(In thousands, except number of shares and per share

amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Years Ended |

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

8,220 |

|

|

|

13,018 |

|

|

|

35,899 |

|

|

|

47,627 |

|

|

|

General and administrative |

|

3,430 |

|

|

|

7,806 |

|

|

|

22,386 |

|

|

|

28,352 |

|

|

|

Total operating expenses |

|

11,650 |

|

|

|

20,824 |

|

|

|

58,285 |

|

|

|

75,979 |

|

|

|

Loss from operations |

|

(11,650 |

) |

|

|

(20,824 |

) |

|

|

(58,285 |

) |

|

|

(75,979 |

) |

|

|

Other (income) expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other expense |

|

182 |

|

|

|

250 |

|

|

|

696 |

|

|

|

514 |

|

|

|

Interest and other income |

|

(433 |

) |

|

|

(634 |

) |

|

|

(2,090 |

) |

|

|

(1,259 |

) |

|

|

(Gain) loss on foreign currency transactions, net |

|

(7 |

) |

|

|

16 |

|

|

|

43 |

|

|

|

(12 |

) |

|

|

Other (income) |

|

(258 |

) |

|

|

(368 |

) |

|

|

(1,351 |

) |

|

|

(757 |

) |

|

|

Net loss |

$ |

(11,392 |

) |

|

$ |

(20,456 |

) |

|

$ |

(56,934 |

) |

|

$ |

(75,222 |

) |

|

|

Net loss per share, basic and diluted |

$ |

(0.09 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.45 |

) |

|

$ |

(0.60 |

) |

|

|

Weighted average common shares outstanding, basic and diluted |

|

126,736,784 |

|

|

|

126,056,241 |

|

|

|

126,508,917 |

|

|

|

125,939,050 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VAXXINITY, INC. |

|

Selected Balance Sheet Data |

|

(in Thousands) |

| |

|

|

|

|

|

|

|

| |

December 31, |

|

December 31, |

| |

2023 |

|

2022 |

|

Cash and cash equivalents |

$ |

4,931 |

|

|

$ |

33,475 |

|

|

Short term investments |

|

25,464 |

|

|

|

53,352 |

|

|

Total assets |

|

44,311 |

|

|

|

106,399 |

|

|

Total liabilities |

|

30,902 |

|

|

|

44,222 |

|

|

Total stockholder's equity |

|

13,409 |

|

|

|

62,177 |

|

|

|

|

|

|

|

|

|

|

About Vaxxinity

Vaxxinity, Inc. is a purpose-driven biotechnology company

committed to democratizing healthcare across the globe. The company

is pioneering a new class of synthetic, peptide-based active

immunotherapy medicines aimed at disrupting the existing treatment

paradigm for chronic disease, increasingly dominated by monoclonal

antibodies, which suffer from prohibitive costs and cumbersome

administration. The company’s proprietary technology platform has

enabled the innovation of novel pipeline candidates designed to

bring the efficiency of vaccines to the treatment of chronic

diseases, including Alzheimer’s, Parkinson’s, migraine, and

hypercholesterolemia. The technology is also implemented as part of

a COVID-19 vaccine program. Vaxxinity has optimized its pipeline to

achieve a potentially historic, global impact on human health.

For more information about Vaxxinity, Inc., visit

http://www.vaxxinity.com and follow us on social media

@vaxxinity.

Forward-looking Statements

This press release includes forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. The use of certain words, including "believe," "may,"

"continue," "advancing," "will" and similar expressions, are

intended to identify forward-looking statements. Forward-looking

statements include statements, other than statements of historical

fact, regarding, among other things: the plans for, or progress,

scope, initiation, duration, enrollment, results or timing for

availability of results of, development of any of Vaxxinity’s

product candidates or programs; the target indication(s) for

development or approval, the size, design, population, location,

conduct, cost, objective, enrollment, duration or endpoints of any

clinical trial, or the timing for initiation or completion of or

availability or reporting of results from any clinical trial; the

potential future regulatory authorization or approval and

commercialization of Vaxxinity’s product candidates; the potential

benefits or competitive position of any Vaxxinity product candidate

or program or the commercial opportunity in any target indication;

and Vaxxinity’s plans, expectations or future operations, financial

position, revenues, costs or expenses. These forward-looking

statements involve substantial risks and uncertainties, including

statements that are based on the current expectations and

assumptions of Vaxxinity’s management about the development of a

new class of immunotherapeutic vaccines and the innovation and

efficacy of Vaxxinity’s product candidates. Various important

factors could cause actual results or events to differ materially

from those that may be expressed or implied by our forward-looking

statements, including, but not limited to: whether UB-311, UB-312,

UB-313, VXX-401, UB-612 or any other current or future product

candidate of Vaxxinity will be approved or authorized by any

regulatory agency for the indications that Vaxxinity targets; any

potential negative impacts of the COVID-19 pandemic, including on

manufacturing, supply, conduct or initiation of clinical trials, or

other aspects of Vaxxinity’s business; Vaxxinity’s product

candidates may not be successful or clinical development may take

longer and be more costly than anticipated; product candidates that

appeared promising in earlier research and clinical trials may not

demonstrate safety or efficacy in larger-scale or later clinical

trials or in clinical trials for other indications; the timing for

initiation or completion of, or for availability of data from,

clinical trials for UB-311, UB-312, UB-313, VXX-401 or UB-612, and

the outcomes of such trials; Vaxxinity’s reliance on collaborative

partners and other third parties for development of its product

candidates; Vaxxinity’s ability to obtain coverage, pricing or

reimbursement for any approved products and acceptance from

patients and physicians for any approved indications; delays or

other challenges in the recruitment of patients for, or the conduct

of, Vaxxinity’s clinical trials; challenges associated with supply

and manufacturing activities; and Vaxxinity’s accounting policies.

These and other important factors to be considered in connection

with forward-looking statements are described in the "Risk Factors"

section of Vaxxinity’s Annual Report on Form 10-K filed with the

U.S. Securities and Exchange Commission on March 27, 2024. The

forward-looking statements are made as of this date and Vaxxinity

does not undertake any obligation to update any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

Investor ContactMark

Joinnidesir@vaxxinity.com

Press Contact

Ali Nagy / McKenna Miller

anagy@kcsa.com / mmiller@kcsa.com

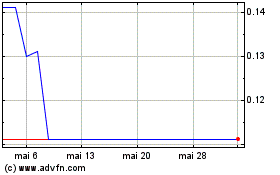

Vaxxinity (NASDAQ:VAXX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Vaxxinity (NASDAQ:VAXX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024