Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) ("Liberty Gold" or the

“Company”), is pleased to announce its financial and operating

results for the fiscal year ended December 31, 2023. All amounts

are presented in United States dollars unless otherwise stated.

2023 AND RECENT HIGHLIGHTS

- On September 15,

2023, closed a non-brokered private placement raising proceeds of

$5.7 million, anchored by a $5.0 million strategic investment by

Wheaton Precious Metals Corp.

(“Wheaton”)1.

- On September 5,

2023, published second annual Environmental, Social and Governance

report: Developing Gold Deposits in a Responsible and Sustainable

Manner2.

- On November 8,

2023, announced the appointment of Cal Everett as Chief Executive

Officer and Jon Gilligan as President, effective November 10,

20233.

At the Black Pine project (“Black Pine”),

- On February 15,

2024, announced an update to the independent mineral resource that

was originally published on February 7 20234 (the “Updated

Resource”). The new Updated Resource5 is reported using a $1,800

USD constraining resource pit at a cut-off grade (“COG”) of 0.20

grams per tonne (“g/t”) gold (“Au”) and consists of:

- An indicated

resource of 3,206,000 ounces (“oz”) of oxide gold at an average

grade of 0.49 g/t Au and totalling 203.8 million tonnes (“Mt”);

and

- An inferred

resource of 325,000 oz of oxide gold at an average grade of 0.42

g/t Au and totalling 24.1 Mt.A high-grade subset of the Updated

Resource contained within the 0.2 g/t Au resource pit, applying a

COG of 0.5 g/t Au and consists of:

- Indicated resources

of 1,765,000 oz Au at an average grade of 1.01 g/t Au and totalling

54.2 Mt; and

- Inferred resources

of 143,000 oz Au at an average grade of 0.91 g/t Au and totalling

4.9 Mt.

- On September 11,

2023, announced the purchase of the existing 0.5% Net Smelter

Royalty (“NSR”) at Black Pine from a private company, and the

sale of a new 0.5% NSR to an affiliate of Wheaton, including an

option to repurchase 50% of the royalty for US$3.6 million at any

point in time up to the earlier of commercial production at Black

Pine, or January 1, 2030, which would reduce the NSR to

0.25%1.

- On September 6,

2023, announced the submission of a Mining Pre-Plan of Operations

to US Federal Agencies, and the selection of M3 Engineering &

Technology as lead engineer for the pre-feasibility study6.

- Completed 2023 RC exploration

drilling program as of December 31, 2023, for a total of 27,461

meters drilled. The drill program targeted resource upgrade and

expansion over several areas of the deposit, as well as some

reconnaissance drilling in new areas along the eastern and southern

margins of Rangefront and the northern margin of Back Range.

- On July 24, 2023, announced a new

discovery area “Rangefront South” located approximately two

kilometres to the south of the main Rangefront Zone, with two

reportable intercepts of oxide gold: 0.37 g/t Au over 9.1 m, and

0.31 g/t Au over 7.6 m in drill hole LBP9317.

- Reported weighted average 86.9%

gold extraction8 from 24 Phase 4A metallurgical column leach tests

on Rangefront Zone oxide gold mineralization, showing that the

Rangefront Zone comprises the most leach-amenable oxide material at

Black Pine.

SELECTED FINANCIAL DATA

The following selected financial data is derived

from our Annual Financial Statements and related notes thereto (the

“Annual Financial Statements”) for the year ended December 31,

2023, as prepared in accordance with IFRS Accounting Standards as

issued by the International Accounting Standards Board.

A copy of the Annual Financial Statements is

available on the Company’s website at www.libertygold.ca or on

SEDAR+ at www.sedarplus.ca.

The information in the tables below is presented

in $’000s, except ‘per share’ data:

|

|

Year ended December 31, |

|

|

|

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

Attributable to shareholders: |

|

|

|

|

|

Loss for the period |

|

$ |

(20,191 |

) |

$ |

(21,101 |

) |

$ |

(29,743 |

) |

|

Loss and comprehensive loss for the period |

|

$ |

(19,815 |

) |

$ |

(23,483 |

) |

$ |

(29,589 |

) |

|

Basic and diluted loss per share |

|

$ |

(0.06 |

) |

$ |

(0.07 |

) |

$ |

(0.11 |

) |

|

|

As at December 31, |

|

|

2023 |

|

2022 |

|

2021 |

|

Cash and short-term investments |

$ |

9,082 |

$ |

19,813 |

$ |

17,255 |

|

Working capital |

$ |

7,648 |

$ |

17,668 |

$ |

13,691 |

|

Total assets |

$ |

35,337 |

$ |

47,954 |

$ |

53,329 |

|

Current liabilities |

$ |

1,750 |

$ |

2,543 |

$ |

9,885 |

|

Non-current liabilities |

$ |

3,180 |

$ |

2,812 |

$ |

3,116 |

|

Shareholders’ equity |

$ |

27,636 |

$ |

38,949 |

$ |

32,800 |

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and

developing open pit oxide deposits in the Great Basin of the United

States, home to large-scale gold projects that are ideal for

open-pit mining. This region is one of the most prolific

gold-producing regions in the world and stretches across Nevada and

into Idaho and Utah. We know the Great Basin and are driven to

discover and advance big gold deposits that can be mined profitably

in open-pit scenarios.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations Phone:

604-632-4677 or Toll Free 1-877-632-4677 info@libertygold.ca

Peter Shabestari, P.Geo., Vice-President

Exploration, Liberty Gold, is the Company's designated Qualified

Person for this news release within the meaning of National

Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI

43-101") and has reviewed and validated that the information

contained in the release is accurate.

This news release contains “forward-looking

information” and “forward-looking statements” within the meaning of

applicable securities laws, including statements or information

concerning, future financial or operating performance of Liberty

Gold and its business, operations, properties and condition;

planned de-risking activities at Liberty Gold’s mineral properties;

the potential quantity, recoverability and/or grade of minerals;

the potential size of a mineralized zone or potential expansion of

mineralization; proposed exploration and development of Liberty

Gold’s exploration property interests; the results of mineral

resource estimates and timing of pre-feasibility studies; and the

Company’s anticipated expenditures.

Forward-looking information is often, but not

always, identified by the use of words such as "seek",

"anticipate", "plan", "continue", "planned", "expect", "project",

"predict", "potential", "targeting", "intends", "believe",

"potential", and similar expressions, or describes a "goal", or

variation of such words and phrases or state that certain actions,

events or results "may", "should", "could", "would", "might" or

"will" be taken, occur or be achieved. Forward-looking information

is not a guarantee of future performance and is based upon a number

of estimates and assumptions of management at the date the

statements are made including, among others, assumptions about

future prices of gold, and other metal prices, currency exchange

rates and interest rates, favourable operating conditions,

political stability, obtaining governmental approvals and financing

on time, obtaining renewals for existing licenses and permits and

obtaining required licenses and permits, labour stability,

stability in market conditions, availability of equipment, timing

or results of the publication of any mineral resources,

pre-feasibility study, the availability of drill rigs, successful

resolution of disputes and anticipated costs and expenditures. Many

assumptions are based on factors and events that are not within the

control of Liberty Gold and there is no assurance they will prove

to be correct.

Such forward-looking information, involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to

the interpretation of results and/or the reliance on technical

information provided by third parties as related to the Company’s

mineral property interests; changes in project parameters as plans

continue to be refined; current economic conditions; future prices

of commodities; possible variations in grade or recovery rates; the

costs and timing of the development of new deposits; failure of

equipment or processes to operate as anticipated; the failure of

contracted parties to perform; the timing and success of

exploration activities generally; the timing or results of the

publication of any mineral resources , pre-feasibility studies;

delays in permitting; possible claims against the Company; labour

disputes and other risks of the mining industry; delays in

obtaining governmental approvals, financing or in the completion of

exploration as well as those factors discussed in the Annual

Information Form of the Company dated March 28, 2024, in the

section entitled "Risk Factors", under Liberty Gold’s SEDAR+

profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements.

Liberty Gold disclaims any intention or obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise unless required by law.

Note to United States Investors Concerning

Estimates of Measured, Indicated and Inferred Resources

The information in this MD&A, including any

information incorporated by reference, and disclosure documents of

Liberty Gold that are filed with Canadian securities regulatory

authorities concerning mineral properties have been prepared in

accordance with the requirements of securities laws in effect in

Canada, which differ from the requirements of United States

securities laws.

Without limiting the foregoing, these documents

use the terms “measured resources”, “indicated resources”,

“inferred resources” and “probable mineral reserves”. These terms

are Canadian mining terms as defined in, and required to be

disclosed in accordance with, NI 43-101, which references the

guidelines set out in the Canadian Institute of Mining, Metallurgy

and Petroleum (the “CIM”) – CIM Definition Standards on Mineral

Resources and Reserves (“CIM Definition Standards”), adopted by the

CIM Council, as amended. However, these standards differ

significantly from the mineral property disclosure requirements of

the United States Securities and Exchange Commission (the “SEC”) in

Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under

the United States Securities Act of 1934, as amended. The Company

does not file reports with the SEC and is not required to provide

disclosure on its mineral properties under the SEC Modernization

Rules and will continue to provide disclosure under NI 43-101 and

the CIM Definition Standards.

1 See press releases dated September 11, and September 18, 20232

See press release dated September 5, 20233 See press release dated

November 8, 20234 See press releases dated February 7, 2023 and

March 21, 2023 and “Technical Report on the Updated Mineral

Resource Estimate at the Black Pine Gold Project, Cassia and Oneida

Counties, Idaho, USA”, effective January 21, 2023, and signed March

10, 2023, prepared by Ryan Rodney, C.P.G of SLR Consulting (Canada)

Ltd; Gary L. Simmons of GL Simmons Consulting LLC of Larkspur,

Colorado, both independent Qualified Persons under National

Instrument 43-101; and Moira Smith Ph.D., P.Geo., of Liberty Gold

Corp;5 See press release dated February 15, 20246 See press release

dated September 6, 20237 See press release dated July 24, 20238

Weighted average gold extraction is obtained using the following

equation: (composite head grade (grams/tonnes) multiplied by

extraction (%) for all head grades)/sum of all head grades. Using

arithmetic averages tends to over-represent low grade composites

and under-represent high grade composites. The arithmetic

extraction average of the 24 column tests is 76%.

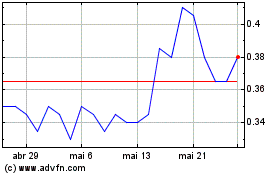

Liberty Gold (TSX:LGD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Liberty Gold (TSX:LGD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024