Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) ("Liberty Gold" or the

"Company") is pleased to announce the results of a Preliminary

Feasibility Study (“PFS” or the “Study”) prepared in accordance

with National Instrument 43-101 – Standards of Disclosure for

Mineral Projects (“NI 43-101”) at its flagship Black Pine Oxide

Gold Project (“Black Pine” or the “Project”) in southern Idaho,

USA. The Study supports a technically straight-forward, low capital

intensity, open-pit, run-of-mine (“ROM”) (no ore crushing,

screening or agglomeration) heap-leach operation processing oxide

gold ore, with attractive economic returns.

This news release should be read in combination with the Study

presentation slide deck available at this

link: https://libertygold.ca/images/news/2024/October/BlackPineProjectPFSDeck.pdf

The Study assumes a base-case gold price of

$2,000/ounce (“oz”) and all figures in this news release are stated

in United States dollars (“$” or “US$”) unless otherwise noted.

Table 1 below presents a summary of the key metrics for the Black

Pine PFS.

Cal Everett, CEO and Director of Liberty

Gold commented: “This PFS highlights the strong economic

potential at Black Pine, representing our vision for a low-risk,

sustainable and long-lived gold mining operation in Idaho. It

demonstrates the Project’s ability to exploit higher grades early

in the mine life, allowing for solid cash flows over the first five

years, with a production profile that reduces the payback period

and maximizes the initial return for our investors. The PFS mine

plan produces more than 2 million ounces of gold over a projected

mine life of 17 years, creating a solid pathway towards mine

permitting, project advancement and a future construction

decision.”

“We believe there is significant upside for

project optimization and resource growth going into a full

feasibility study. Growth will be driven by new resource discovery

from multiple target areas, upgrade of inferred mineral resources

into the measured and inferred mineral resource categories and

assessment of gold production potential from the reclaimed heap

leach pad. Work in many of these areas is already beginning to

yield encouraging results. We look forward to keeping the market

apprised of our progress.”

Table 1: Key Black Pine Project Metrics

|

Project Economics |

Base Case |

Spot Price |

|

Gold Price |

$2,000/oz |

$2,600/oz |

| Pre-tax Net Present Value

(“NPV”) (5%) |

$658 million |

$1,575

million |

| Pre-tax Internal Rate of

Return (“IRR”) |

35% |

67% |

| Operating Pre-Tax Cash

Flow |

$1,042

million |

$2,352 million |

| After-Tax NPV (5%) |

$552 million |

$1,296 million |

| After-Tax IRR |

32% |

62% |

| After-Tax Cash Flow |

$873 million |

$1,921 million |

| After-Tax Payback Period |

3.3 years |

1.5 years |

|

Production Profile |

| Mine Life |

17 years |

|

| Ore to Leach Pad |

50,000 tonnes per day |

|

| Total Tonnes of Ore Mined and

Processed |

299 million tonnes |

|

| Head Grade (years 1-5) |

0.45 grams per tonne ("g/t") |

|

| Head Grade (Life-of-Mine

“LOM”) |

0.32 g/t |

|

| Strip Ratio (Waste:Ore) |

1.3:1 |

|

| Average Gold Recovery |

70.4% |

|

| Total Gold Ounces

Recovered |

2,191 koz1 |

|

| Average Annual Gold Production

(Yr 1-5) |

183 koz |

|

| Peak Annual Gold

Production |

231 koz |

|

| Average Annual Gold Production

(LOM) |

135 koz |

|

|

Unit Operating Costs |

| LOM Operating Cost |

$9.10/tonne

processed |

|

| LOM Total Cash Cost2 |

$1,249/oz |

|

| LOM AISC2 |

$1,380/oz |

|

|

Total Capital Costs |

| Initial Capital2 |

$327 million |

|

| LOM Sustaining Capital |

$219 million |

|

| LOM Total Capital |

$546 million |

|

| Closure Costs |

$54 million |

|

| 1 “koz” refers to

thousand ounces 2Refer to “Non-GAAP Measures and Other Financial

Information” below |

| |

Conference Call and Webcast

Liberty Gold will be hosting a conference call and webcast to

discuss the results of the PFS:

| Webcast |

| Date: |

Thursday, October 10th |

| Time: |

11:00 am Eastern Time (8:00 am Pacific Time) |

| Please register for the webcast here:

https://edge.media-server.com/mmc/p/ve6u4vr3 |

| |

| Conference Call |

| Toll-free in U.S. and Canada: |

+1.888.596.4144 |

| International callers: |

+1.646.968.2525 |

| Conference ID: |

5058354 |

| |

|

The conference call will be archived for later

playback until October 17, 2024, and can be accessed by dialing

Toll-free in U.S. and Canada: +1.800.770.2030 or Toll:

+1.609.800.9909 using the Playback ID 5058354#.

Project Economics Sensitivity Analysis

A sensitivity analysis was carried out on the

after-tax financial metrics from the PFS base case to illustrate

the Project’s sensitivity to commodity prices, initial capital and

operating costs. Results are illustrated in Tables 2 and 3 (all

figures in US dollar millions unless otherwise indicated).

Table 2: After-tax NPV (5%), IRR and Payback Sensitivity

to Gold Price

|

Gold Price ($/oz) |

$1,700 |

$1,850 |

$2,000 |

$2,150 |

$2,300 |

$2,450 |

$2,600 |

| After-Tax NPV (5%) ($M) |

$174 |

$362 |

$552 |

$739 |

$924 |

$1,110 |

$1,296 |

| After-Tax IRR (%) |

15% |

24% |

32% |

40% |

47% |

55% |

62% |

| Payback (years) |

4.3 |

3.8 |

3.3 |

2.4 |

1.8 |

1.7 |

1.5 |

| |

|

|

|

|

|

|

|

Table 3: After-Tax NPV (5%) and IRR sensitivity to

Changes in Project Parameters & Gold Price

|

|

|

Gold Price/oz |

|

After-tax NPV (5%) in $M |

Change |

$1,850 |

$2,000 |

$2,300 |

$2,600 |

| Total

Capital Costs |

15% |

$323 |

$512 |

$884 |

$1,256 |

|

0% |

$362 |

$552 |

$924 |

$1,296 |

|

-15% |

$403 |

$593 |

$965 |

$1,336 |

| Operating

Costs |

15% |

$131 |

$323 |

$701 |

$1,072 |

|

0% |

$362 |

$552 |

$924 |

$1,296 |

|

-15% |

$591 |

$776 |

$1,148 |

$1,516 |

|

|

|

Gold Price/oz |

|

After-Tax IRR (%) |

Change |

$1,850 |

$2,000 |

$2,300 |

$2,600 |

| Total

Capital Costs |

15% |

20% |

27% |

41% |

54% |

|

0% |

24% |

32% |

47% |

62% |

|

-15% |

29% |

38% |

56% |

73% |

| Operating

Costs |

15% |

13% |

22% |

39% |

54% |

|

0% |

24% |

32% |

47% |

62% |

|

-15% |

33% |

41% |

56% |

70% |

|

|

|

|

|

|

|

PFS Overview

The PFS incorporates geological, assay,

hydrological, metallurgical, geotechnical, environmental and

cultural information collected by Liberty Gold and its consultants

and contractors, as well as extensive historic information captured

from the previous mining operation on site.

Project Description

Black Pine hosts a large, Carlin-style,

sedimentary-hosted oxide gold system, located in southeastern

Cassia County, southern Idaho, USA, a 2-hour drive north from Salt

Lake City, Utah. The currently identified surface footprint of the

gold mineralization extends over an approximate 18 square kilometre

(“km2”) target area contained within Liberty Gold’s 69.3 km2

project area of which 40.6 km2 are permitted for exploration

activities including drilling. (see press releases dated June 11,

2024 and September 25, 2024).

Black Pine is a past-producing open-pit, ROM

heap leach mine, active from 1991 to 1997 when Pegasus Gold

produced 435,000 oz of gold and 189,000 oz of silver from five open

pits. Road access to the site is well established with the I-84

highway running directly adjacent to the project area and existing

power at the mine gate. The location is sparsely populated,

semi-arid, with no surface water exposed in the project area and no

threatened or endangered species.

The production from the Project is subject to a

0.5% net smelter royalty (with a 50% buyback right to the Company,

which has been assumed to be exercised in the economic

analysis).

For a 3D video of a run through of the site

layout, click on this link: https://youtu.be/ScIQ4cF_QwE

Mining

The PFS utilizes open pit mining with mine

planning based on economic pit shells generated by mine planning

software. Ore feed to the leach pad is planned at 50,000 tonnes per

day or 18.3 million tonnes per year for the estimated 17-year life

of mine. There will be a 9-month pre-production period to provide

access to higher grade ore horizons for early years processing.

There are significant opportunities to improve mid-life production

through resource growth and conversion ahead of the feasibility

study. Lower-grade ores are stockpiled throughout the mine life and

re-handled on to the heap to optimize gold production.

Total material movement averages 47 million

tonnes per year over life of mine, with a peak at 55 million tonnes

per year. Ore is sourced from two large multi-phase open pits,

together with six smaller ‘satellite’ open pits. The strip ratio is

favourably low at 1.3:1 (waste:ore), resulting from the extensive

envelope of lower-grade oxide gold mineralization surrounding the

higher-grade horizons and permeating through the mass of carbonate

host rock units.

The open pit mining at Black Pine is designed as

a conventional, owner-operated surface mining operation, where the

owner is responsible for planning and executing direct mining and

all mine fleet maintenance, equipment mobilization, supervision,

labor, geology and grade control. Blasting would be performed as a

contract service. The PFS mine plan proposes a blended mine fleet

of 400 tonne-class hydraulic excavators, 100 tonne-class hydraulic

excavators, 11.5 cubic metre bucket front end loaders, 136 tonne

off-highway haul trucks and 64 tonne off-highway haul trucks.

Metallurgy

Six phases of metallurgical testing have been

completed on Black Pine oxide ores, using bulk samples and

predominantly, large diameter PQ core. A total of six bulk samples

and 174 variability composites have been tested at Kappes, Cassiday

& Associates in Reno, Nevada and included extensive

geo-metallurgical characterization, comminution testing, bottle

roll and column leach testing and environmental characterization of

head samples and column residues. The oxide ores respond very well

to cyanide leaching with typically >80% of the leachable gold

extracted in the first 10 days of laboratory column leaching.

Modeling of column test data support ROM leaching as the preferred

processing method, with a primary leach cycle of 90 days.

Commercial scale ROM gold and silver

grade-recovery models have been developed for the geo-metallurgical

oxide ore types, defined by gold cyanide solubility, location and

lithology. The limited amount of mineralized carbonaceous material

present at Black Pine has been extensively modelled and has been

treated as waste rock.

Processing

Gold will be recovered using run-of-mine (no

crushing, screening or agglomeration) heap leaching with material

placed by mine haul truck stacking onto a single heap leach pad

sited at the eastern extent of the Project. The pad is designed in

four phases to contain up to 315 million dry tonnes of leachable

material, with operational segregation of the oxide ore types in

isolated cells on the leach pad to prevent comingling.

ROM-sized ore will be stacked in 10 metre (“m”)

vertical lifts to a maximum heap height of 100 m. Lime will be

added prior to truck dumping on the pad, ore will be ripped and

subsequently leached with dilute cyanide solution using

conventional irrigation. Leach solution will flow by gravity

through the heap and be conveyed to the process solution tank. No

surface ponds other than an emergency event pond are included in

the PFS design.

Leached gold will be recovered from solution

using a 3-train, activated carbon adsorption circuit. The gold (and

any silver) will then be stripped from carbon using a desorption

process followed by electrowinning to produce a precipitate sludge,

which is refined on site in a furnace to produce final doré

bars.

Process water is drawn from five existing,

active water wells, located within 5 kilometres from the processing

facility. Power is grid supply over an existing 25 kV line to the

mine gate.

Cost Estimates

Capital and operating costs were estimated by M3

Engineering for the processing and general and administration

components of the PFS costs estimate; all mining costs were

estimated by AGP Mining.

The capital costs estimate presented in Table 4,

is considered to have overall accuracy of -20% / +25%.

Table 4: Black Pine PFS Capital Cost

Breakdown

|

Capital Costs |

Initial |

Sustaining |

Total |

|

US$ Million |

US$ Million |

US$ Million |

| Pre-stripping and Stockpile

(1) |

$89.3 |

$0.0 |

$89.3 |

| Mine (2) |

$31.4 |

$55.9 |

$87.3 |

| Process |

$161.4 |

$121.3 |

$282.6 |

| Contingency |

$35.3 |

$31.4 |

$66.7 |

| Owners Cost |

$9.2 |

$10.6 |

$19.8 |

| Total Capital Costs(3) |

$326.6 |

$219.2 |

$545.8 |

1. 13 million tonnes of ore stockpiled during pre-stripping2.

Includes down payment for lease financing of mine equipment3.

Excludes reclamation and closure costs estimated at $54 million

A summary of the operating costs estimate for

Black Pine is presented in Table 5. Operating costs are based on

ownership and owner’s direction of all mine and processing

equipment and facilities. Reclamation and closure costs estimated

from first principles at $54 million and validated with a Nevada

Standardized Reclamation Cost Estimator model, are additional to

sustaining capital costs illustrated in Table 4 and are included in

the Project economic evaluation.

The mining costs are based on quotes for mining

equipment and estimated owners’ costs. The PFS base case assumes

the mine fleet is leased with the mine operating cost carrying the

annual lease payment. Processing costs were estimated by M3

Engineering and NewFields, based on first principles, assuming the

owner employs and directs all operations and maintenance for all

site facilities. Labor costs were estimated using Idaho labor rates

and specific staffing requirements. Unit consumption of materials,

consumables, power and water were estimated from first

principles.

Table 5: Black Pine Operating Cost Estimate

|

Operating Costs |

LOM |

Unit Costs |

|

US$ Million |

US$/tonne ore |

| Mining(1) |

$1,943 |

$6.49 |

| Process Plant |

$538 |

$1.80 |

| G&A |

$220 |

$0.73 |

| Refining |

$22 |

$0.07 |

| Total Operating Cost |

$2,724 |

$9.10 |

1. Assumes lease financing of mine equipment

Operating costs have an effective date of June

1, 2024, and are presented with no added contingency.

Sustainability

At Liberty Gold, sustainability is integral to

our operations and decision-making, ensuring long-term value for

stakeholders. Since 2021, we have published annual sustainability

reports, reinforcing our commitment to transparency and

accountability. At Black Pine, we engage regularly with

stakeholders through updates, tours, and local events. We are

deeply committed to preserving biodiversity, supporting sage grouse

habitat restoration and funding a four-year mule deer migration

study with Idaho Fish and Game. Sustainability initiatives included

in the Black Pine PFS include renewable energy supply through local

utility, no net increase in water draw, habitat mitigation, and

waste rock backfill. We propose to explore mine fleet

electrification and other key sustainable initiatives during

feasibility to minimize our carbon and project footprint.

Further Opportunities

Optimization of the Black Pine Project will be

evaluated ahead of and during feasibility. This includes:

- Potential to

significantly increase the size and confidence of the resource at

Black Pine. Approximately 60% of the project area has not yet been

drill-tested:

- The infill

drilling and step-out drilling at Rangefront, M-Zone and Discovery,

if successful, could expand the mineral resource and convert

inferred mineral resource into the measured and indicated mineral

resource categories.

- Evaluation of

the historic heap to determine the nature and extent of residual

gold in the heap and its amenability to further processing.

- New discovery

from a currently on-going drill exploration program on seven

high-priority targets across the project area.

- The resulting

feasibility mine plan would likely change based on continued

exploration success and resource expansion.

- Mine planning

and design focusing on cut-off grade optimization, stockpiling

strategy, bulk-material movement options (e.g. conveyors) for ore

to the heap, haul road layout optimization and the potential to

expand leaching capacity to 24 million tonnes per year.

- Use of electric

and potentially autonomous mining equipment in the open pits

(shovels, drills & haul trucks).

- Further define

the options for renewable energy, such as solar, to supply site

requirements, particularly important for future electrification

options.

Next Steps

- A Mine Plan of

Operations is currently being drafted and is planned for submission

to US federal and cooperating agencies in the fourth quarter of

2024 to commence formal mine permitting under the National

Environmental Policy Act (“NEPA”).

- Advance all baseline studies

required to support the mine permit applications.

- Technical work

to further advance and de-risk the project towards feasibility

level will continue into 2025 and the Company intends to conduct a

feasibility study to provide the basis for a construction decision.

Key areas of work include:

- Resource upgrade

and growth,

- Evaluate

historic heap potential as a future ore supply,

- Refine

geo-metallurgical models and complete metallurgical testing

required,

- Completion of

additional studies on groundwater sources & quality,

geotechnical data collection and design for the heap, pit slopes

and rock waste facilities, and

- Feasibility

level rock geochemical characterisation for environmental

studies.

- An NI 43-101

compliant technical report on the Black Pine PFS will be available

on SEDAR within 45 days of this release (the “Technical Report”),

including all qualifications, assumptions and exclusions that

relate to this PFS. The Technical Report is intended to be read as

a whole and sections should not be read or relied upon out of

context.

Black Pine Mineral Reserve Estimate

Mineral Reserves have been estimated for a

conventional, multiple pit, open pit mining operation utilizing

surface waste rock storage facilities, pits backfill, extensive ore

stockpiling and direct haul to a single ROM heap leach facility.

Pit slope angles were defined by geotechnical evaluation supported

by hydrological analysis.

Table 6: Black Pine Mineral Reserve

Estimate

|

Reserve Class |

Million tonnes |

g/t Au |

(000) oz Au |

| Probable |

299.4 |

0.32 |

3,110 |

|

Total |

299.4 |

0.32 |

3,110 |

|

|

|

|

|

Notes:

- The Mineral Reserve estimate was prepared by AGP Mining

Consultants Inc., Toronto, Canada (“AGP”) and has an effective date

of June 1, 2024. The Qualified Person responsible as defined under

NI 43-101 for the Mineral Reserve estimate is Todd Carstensen

RM-SME, Principal Mine Engineer and independent of Liberty

Gold.

- Mineral Reserves reported are

consistent with the CIM Definition Standards for Mineral Resources

and Mineral Reserves (2014).

- Mineral Reserves are converted from

Mineral Resources through the process of pit optimization, pit

design, production scheduling, stockpiling and cut-off grade

optimization.

- Mineral Reserves are reported to a

cut-off grade of 0.10 g/t gold and are based on a gold price of

US$1,650/oz.

- Metallurgical recovery of gold is

based on a variable gold leach recovery model derived from

extensive metallurgical studies. All mineralized carbonaceous

materials have been treated as waste.

- Mine dilution was estimated based

on a 1.0 m skin applied to ore to waste contacts.

- Units are metric tonnes, metric

grams & troy ounces; “Au” = gold.

- The estimate of mineral reserves

may be materially affected by geology, environment, permitting,

legal, title, taxation, sociopolitical, marketing, or other

relevant issues.

Black Pine Mineral Resource Estimate

The Study has updated the Black Pine Mineral Resource estimate.

Key changes relative to the previous Mineral Resource estimate (see

press release dated February 15, 2024) are:

- Updated metallurgical recovery model

for gold,

- Change in resource cut-off

grade,

- Increase in constraining pit shell

value ($2,000/oz gold price), and

- Revision to low-grade (<0.2 g/t)

block resource classification.

Table 7: Black Pine Mineral Resource

Estimate

|

Resource Class |

Million tonnes |

g/t Au |

(000) oz Au |

| Indicated |

402.6 |

0.32 |

4,163 |

| Inferred |

97.7 |

0.23 |

712 |

| |

|

|

|

Notes:

- The Mineral Resource estimate was

prepared by SLR Consulting (Canada) Ltd., Toronto, Canada (“SLR”)

and has an effective date of June 1, 2024. The Qualified Person

responsible as defined under NI 43-101 for the Mineral Resource is

Valerie Wilson, M.Sc., P.Geo., Principal Resource Geologist, a

fulltime employee of SLR and independent of Liberty

Gold.

- Mineral Resources reported are

consistent with the CIM Definition Standards for Mineral Resources

and Mineral Reserves (2014).

- Mineral Resources are reported

within conceptual open pits estimated at a gold cut-off grade of

0.10 g/t, using the PFS pit slope parameters, a long-term gold

price of US$2,000 per ounce and the PFS variable gold leach

recovery model derived from extensive metallurgical studies. All

carbonaceous material and gold mineralized material falling outside

the conceptual open pits is considered waste rock and is excluded

from resource classification.

- Bulk density is variable by rock

type.

- Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability.

- Mineral Resources are reported

inclusive of Mineral Reserves.

- Rounding as required by reporting

guidelines may result in apparent discrepancies between tonnes,

grades, and contained gold content.

- Units are metric tonnes, metric

grams & troy ounces; “Au” = gold.

- The estimate of Mineral Resources

may be materially affected by geology, environment, permitting,

legal, title, taxation, sociopolitical, marketing, or other

relevant issues.

- Totals may not match due to

rounding.

Table 8: Black Pine Mineral Resource Cut-off Grade

Sensitivity

|

Cut-off (g/t Au) |

Classification |

Million tonnes |

g/t Au |

(000) oz Au |

|

0.10 g/t |

Indicated |

402.6 |

0.32 |

4,163 |

|

Inferred |

97.7 |

0.23 |

712 |

|

0.17 g/t |

Indicated |

250.0 |

0.43 |

3,449 |

|

Inferred |

40.9 |

0.34 |

445 |

|

0.20 g/t |

Indicated |

197.8 |

0.49 |

3,119 |

|

Inferred |

28.0 |

0.39 |

353 |

|

0.50 g/t |

Indicated |

39.7 |

1.09 |

1,388 |

|

Inferred |

3.0 |

0.91 |

89 |

*Please refer to notes accompanying Table 7,

above. The reporting Mineral Resource estimate is shown in bold

font. Tonnes, grade and ounces are expressed within a series of

nested pit shells generated at $2,000/ounce gold whereby only the

material above each cut-off grade is processed.

Qualified Persons

This announcement has been reviewed and approved

for release by Pete Shabestari, Vice President of Exploration at

Liberty Gold and the Company's designated Qualified Person within

the meaning of NI 43-101. Mr. Shabestari has verified the data

disclosed including sampling, analytical, and test data underlying

the drill results, using a variety of techniques including

comparison against independently sourced assay certificates, site

visit investigations, and digital based verification tests, and he

consents to the inclusion in this release of said data in the form

and context in which it appears.

The PFS was prepared by a team of independent

industry experts. The independent Qualified Persons for the “NI

43-101 Technical Report and Pre-feasibility Study for the Black

Pine Project, Idaho, USA”, which will be filed within 45 days of

the date of this press release, and which will be available on

SEDAR+ (www.sedarplus.ca) and on Liberty Gold’s website, are as

follows:

Table 9: Qualified Persons

|

Category |

Name |

Company |

|

Mineral Resource Estimate |

Valerie Wilson, P.Geo. |

SLR Consulting Ltd. |

| Mineral

Reserve Estimate |

Todd

Carstensen, RM-SME |

AGP

Mining Consultants Inc. |

|

Metallurgy |

Gary

Simmons, MMSA |

GL

Simmons Consulting, LLC. |

| Heap

Design & Closure |

Nicholas T. Rocco, Ph.D., P.E. |

NewFields Companies LLC. |

| Mineral

Processing & Financial Evaluation |

Benjamin Bermudez, P.E. |

M3

Engineering & Technology Corp. |

|

Infrastructure & Study Lead Engineer |

Matthew

Sletten, P.E. |

M3

Engineering & Technology Corp. |

|

Hydrology |

John

Rupp, P.E. |

Piteau

Associates Ltd. |

|

Geotechnical Engineering |

Daniel

Yang, P.Eng., P.E. |

Knight

Piésold Ltd. |

|

Environmental Permitting & Compliance |

Richard

DeLong, M.Sc. |

Westland Engineering & Environmental Services Inc. |

| |

|

|

Independent Third-Party Review

The heap design from NewFields was subject to

independent third-party review by Tierra Group International Ltd.

The financial model from M3 Engineering was subject independent

third-party review by Hive Advisory Inc. All material

recommendations arising have been incorporated into the Study.

Non-GAAP Measures and Other Financial

Measures

Alternative performance measures are furnished

to provide additional information. These non-GAAP performance

measures are included in this news release because these statistics

are key performance measures that management uses to monitor

performance, to assess how the Company is performing, to plan and

to assess the overall effectiveness and efficiency of mining

operations. These performance measures including Initial Capital

Costs, Total Cash Costs, and All-In Sustaining Costs, do not have a

standard meaning within International Financial Reporting Standards

(“IFRS”) and, therefore, amounts presented may not be comparable to

similar data presented by other mining companies. Each of these

measures used are intended to provide additional information to the

user and should not be considered in isolation or as a substitute

for measures prepared in accordance with IFRS.

The non-IFRS financial measures used in this

news release and common to the gold mining industry are defined

below.

Initial Capital Costs

Initial Capital Cost is defined as capital

required to develop, construct and to bring the Project to

commercial production.

Total Cash Costs and Total Cash Costs per Gold

Ounce

Total Cash Costs are reflective of the cost of

production. Total Cash Costs reported in the PFS include mining

costs, processing, on-site general & administrative costs,

treatment & refining costs, and royalties. Total Cash Costs per

Ounce is calculated as Total Cash Costs divided by total LOM

payable gold ounces.

All-in Sustaining Costs (“AISC”) and AISC per

Gold Ounce

AISC is reflective of all of the expenditures

that are required to produce an ounce of gold from operations. AISC

reported in the PFS includes Total Cash Costs, sustaining capital,

closure costs and Idaho Mine License Tax. AISC per ounce is

calculated as AISC divided by total LOM payable gold ounces.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and

developing open pit oxide deposits in the Great Basin of the United

States, home to large-scale gold projects that are ideal for

open-pit mining. This region is one of the most prolific

gold-producing regions in the world and stretches across Nevada and

into Idaho and Utah. We know the Great Basin and are driven to

discover and advance big gold deposits that can be mined profitably

in open-pit scenarios.

For more information, visit www.libertygold.ca or

contact:

Susie Bell, Manager, Investor RelationsPhone:

604-632-4677 or Toll Free

1-877-632-4677info@libertygold.ca

All statements in this press release, other

than statements of historical fact, are "forward-looking

information" with respect to Liberty Gold within the meaning of

applicable securities laws, including statements that address

potential quantity and/or grade of minerals, potential size and

expansion of a mineralized zone, proposed timing of exploration and

development plans, expected capital costs at Black Pine, expected

gold and silver recoveries from the Black Pine mineralized

material, potential additions to the resource through additional

drill testing, potential upgrade of inferred mineral resources to

measured and indicated mineral resources, the potential for silver

resources at Black Pine and intentions to pursue a silver resource

study and beliefs regarding gold resources being contained within a

larger property area. Forward-looking information is often, but not

always, identified by the use of words such as "seek",

"anticipate", "plan", "continue", "planned", "expect", "project",

"predict", "potential", "targeting", "intends", "believe",

"potential", and similar expressions, or describes a "goal", or

variation of such words and phrases or state that certain actions,

events or results "may", "should", "could", "would", "might" or

"will" be taken, occur or be achieved. Forward-looking information

is not a guarantee of future performance and is based upon a number

of estimates and assumptions of management at the date the

statements are made including, among others, assumptions about

future prices of gold, and other metal prices, currency exchange

rates and interest rates, favourable operating conditions,

political stability, obtaining governmental approvals and financing

on time, obtaining renewals for existing licenses and permits and

obtaining required licenses and permits, labour stability,

stability in market conditions, availability of equipment, accuracy

of any mineral resources and mineral reserves, the availability of

drill rigs, the accuracy of the PFS, successful resolution of

disputes and anticipated costs and expenditures. Many assumptions

are based on factors and events that are not within the

control of Liberty Gold and there is no assurance they will prove

to be correct.

Such forward-looking information, involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to

the interpretation of results and/or the reliance on technical

information provided by third parties as related to the Company’s

mineral property interests; changes in project parameters as plans

continue to be refined; current economic conditions; future prices

of commodities; possible variations in grade or recovery rates; the

costs and timing of the development of new deposits; failure of

equipment or processes to operate as anticipated; the failure of

contracted parties to perform; the timing and success of

exploration activities generally; delays in permitting; possible

claims against the Company; labour disputes and other risks of the

mining industry; delays in obtaining governmental approvals,

financing or in the completion of exploration as well as those

factors discussed in the Annual Information Form of the Company

dated March 28, 2024 in the section entitled "Risk Factors", under

Liberty Gold’s SEDAR+ profile at www.sedarplus.ca.

The Mineral Resource estimates referenced in

this press release use the terms "Indicated Mineral Resources" and

"Inferred Mineral Resources." While these terms are defined in and

required by Canadian regulations (under NI 43-101), these terms are

not recognized by the U.S. Securities and Exchange Commission

("SEC"). "Inferred Mineral Resources" have a great amount of

uncertainty as to their existence, and great uncertainty as to

their economic and legal feasibility. The SEC normally only permits

issuers to report mineralization that does not constitute SEC

Industry Guide 7 compliant "reserves" as in-place tonnage and grade

without reference to unit measures. U.S. investors are cautioned

not to assume that any part or all of mineral deposits in these

categories will ever be converted into reserves. Liberty Gold is

not an SEC registered company.

Although Liberty Gold has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements.

Liberty Gold disclaims any intention or obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise unless required by law.

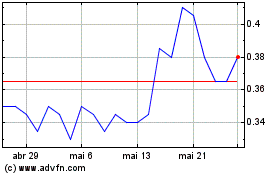

Liberty Gold (TSX:LGD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Liberty Gold (TSX:LGD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025