Applied UV, Inc. Announces Closing of $2.76 Million Registered Direct and Private Placement

01 Abril 2024 - 12:31PM

via NewMediaWire -- Applied UV, Inc. (NASDAQ: AUVI) (the

“Company”), a leader in smart building technology solutions, today

announced the closing of its previously announced registered direct

offering and concurrent private placement with institutional

investors. The Company issued shares of common stock of the Company

(“Common Stock”) and pre-funded warrants (“Pre-Funded Warrants”) in

a registered direct offering. In a concurrent private placement,

the Company also issued common warrants (“Common Warrants”) to the

same investors. Aggregate gross proceeds to the Company from both

transactions were approximately $2.76 million. The transactions

closed on April 1, 2024. The transactions were priced at the

market under Nasdaq rules.

The transactions consisted of (i) the public

sale of an aggregate of 1,726,875 shares of Common Stock (or

Pre-Funded Warrants in lieu thereof) and (ii) the private placement

of Common Warrants to purchase up to 518,065 shares of Common Stock

at an initial exercise price of $16.00 per share. The public

offering price per share of Common Stock is $1.60 (or $1.5999 for

each Pre-Funded Warrant, which is equal to the public offering

price per share of Common Stock to be sold in the offering minus an

exercise price of $0.0001 per Pre-Funded Warrant). The Pre-Funded

Warrants will be immediately exercisable and may be exercised at

any time until exercised in full. The Common Warrants are

exercisable immediately subject to registration and expire 5 years

after the initial issuance date. The Company expects to use the net

proceeds from the offering to help fund recent large orders within

the Smart Building Technologies division from customers including:

Siemens, Sherwin Williams and Arco Murray and other general

corporate purposes.

Aegis Capital Corp. acted as the exclusive

placement agent for the offerings. Sichenzia Ross Ference Carmel

LLP acted as counsel to the Company for the offerings. Kaufman

& Canoles, P.C. acted as counsel to the Placement Agent for the

offerings.

The registered direct offering was being made

pursuant to an effective shelf registration statement on Form S-3

(No. 333-266015) previously filed with the U.S. Securities and

Exchange Commission (SEC) and declared effective by the SEC on July

12, 2022. A final prospectus supplement and accompanying prospectus

describing the terms of the proposed offering has been filed with

the SEC and will be available on the SEC’s website located at

www.sec.gov. Electronic copies of the final prospectus supplement

and the accompanying prospectus may be obtained, when available, by

contacting Aegis Capital Corp., Attention: Syndicate Department,

1345 Avenue of the Americas, 27th floor, New York, NY 10105, by

email at syndicate@aegiscap.com, or by telephone at +1 (212)

813-1010.

The offer and sale of the securities in the

private placement were made in a transaction not involving a public

offering and have not been registered under the Securities Act of

1933, as amended (the “Securities Act”), or applicable state

securities laws. Accordingly, the securities may not be reoffered

or resold in the United States except pursuant to an effective

registration statement or an applicable exemption from the

registration requirements of the Securities Act and such applicable

state securities laws. The securities were offered only to

accredited investors. Pursuant to a registration rights agreement

with the investors, the Company has agreed to file one or more

registration statements with the SEC covering the resale of the

Common Stock and the Shares issuable upon exercise of the

pre-funded warrants and warrants.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Applied UV, Inc.

Applied UV Inc. is dedicated to developing and

acquiring smart building technologies for healthcare, hospitality,

commercial and municipal markets. With SteriLumen, MunnWorks, LED

Supply Co., and PURO, the company has a diverse portfolio that

addresses various needs in the market. Applied UV Inc. is committed

to innovation and excellence in providing solutions for a healthier

and smarter world. More details about Applied UV, Inc., and its

subsidiaries can be found at https://applieduvinc.com

Forward-Looking Statements

The foregoing material may contain

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, each as amended. Forward-looking statements

include all statements that do not relate solely to historical or

current facts, including without limitation statements regarding

the Company’s product development and business prospects, and can

be identified by the use of words such as “may,” “will,” “expect,”

“project,” “estimate,” “anticipate,” “plan,” “believe,”

“potential,” “should,” “continue” or the negative versions of those

words or other comparable words. Forward-looking statements are not

guarantees of future actions or performance. These forward-looking

statements are based on information currently available to the

Company and its current plans or expectations and are subject to a

number of risks and uncertainties that could significantly affect

current plans. Should one or more of these risks or uncertainties

materialize, or the underlying assumptions prove incorrect, actual

results may differ significantly from those anticipated, believed,

estimated, expected, intended, or planned. Although the Company

believes that the expectations reflected in the forward-looking

statements are reasonable, the Company cannot guarantee future

results, performance, or achievements. Except as required by

applicable law, including the security laws of the United States,

the Company does not intend to update any of the forward-looking

statements to conform these statements to actual results.

For Additional Company Information: Applied UV, Inc. Max Munn

Applied UV Founder, CEO & Director

Max.munn@applieduvinc.com

Investor Relations Contact: TraDigital IR Kevin McGrath

+1-646-418-7002 kevin@tradigitalir.com

Applied UV (NASDAQ:AUVI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

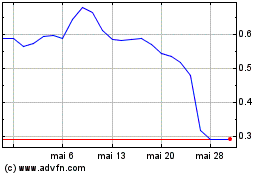

Applied UV (NASDAQ:AUVI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024