Xali Gold Signs New Agreement for Sale of the El Oro Tailings Project

15 Abril 2024 - 8:00AM

Xali Gold Corp. (TSXV:XGC) ("Xali Gold” or the “Company”) is

pleased to announce that the Company has signed a Letter of Intent

to enter a Purchase Agreement (the “LOI Agreement”) with Kappes,

Cassiday & Associates (“KCA”) on the Mexican Mine Tailings

Reprocessing Project at El Oro (the “El Oro Tailings Project”) in

Mexico. The Letter of Intent is a legally binding agreement.

“We are excited to be able to move ahead with

our El Oro Tailings Project,” says Joanne Freeze, President and CEO

of Xali Gold. “With KCA’s experience in Mexico, and their

proprietary recovery process, we anticipate a fairly rapid

development timeline. KCA’s recovery process is expected to achieve

higher gold and silver recoveries and require less permitting than

the previous process proposed by Sun River Gold. As such, we

estimate that this new agreement on the Tailings should allow us

both to pay outstanding mineral rights fees on the El Oro Project

as well as fund exploration at El Oro. El Oro is a district scale

gold project encompassing a well-known prolific high-grade gold

dominant gold-silver epithermal vein system in Mexico. The project

covers 20 veins with past production and more than 57 veins in

total, from which approximately 6.4 million ounces of gold and 74

million ounces of silver were reported to have been produced from

just two of these veins. The previous agreement with Sun River Gold

has been terminated as they were in default of their obligations

under that agreement and were given sufficient notice of their

default.”

In order to earn 100% interest in the El Oro

Tailings Project, subject to royalty payments outlined below, KCA

has agreed to:

- Pay Xali Gold US$25,000 upon

signing;

- Pay Xali Gold an additional

US$25,000 three months after signing the LOI Agreement;

- Pay Xali Gold US$100,000 six months

after signing the LOI Agreement.

Terms of the Royalty Payments are as

follows:

- Once production begins, KCA will

pay Xali Gold a gross royalty equal to 4% of the sales income

("NSR") received from the gold and silver produced from the El Oro

Tailings Project, less any royalties due and payable to others (the

Municipality of El Oro), but in no case less than a 3% gross

royalty.

- KCA has the right at any time to

buy a 1% royalty from Xali Gold for US$1,000,000, which would lower

the NSR from 4% to 3% of the sales income received from the gold

and silver produced from the Project, less any royalties due and

payable to others including the Municipality of El Oro, but in no

case less than a 2% royalty.

- KCA will make minimum royalty

payments of US$50,000 every six months commencing six months from

signing the LOI agreement, until a total royalty payment of

US$1,000,000 has been paid to Xali Gold, but royalty payments on

production will continue past that point.

- KCA will also be obligated to pay

the Municipality of El Oro an 8% Net Profits Interest (“NPI”) on

production from the Tailings or renegotiate this with the

Municipality.

- Xali Gold has the right to receive

the first US$1.5M from the Municipality’s 8% NPI.

The Mexico Mine Tailings at El Oro contain an

Inferred Resource* of 1,267,400 Tonnes grading 2.94 gold grams per

tonne (“g/t”), 75.12 silver g/t containing 119,900 ounces of gold

and 3,061,200 ounces of silver.

*Note: Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability. All

figures have been rounded to reflect the accuracy of the estimate.

For more information, please see below.

About KCA

Since 1972, KCA has provided process

metallurgical services to the international mining industry.

KCA specializes in all aspects of heap leaching, cyanide

processing, laboratory testing, project feasibility studies,

engineering design, construction and operations management.

KCA has worked in Mexico for many years and maintains an office in

Chihuahua to serve its Mexican consulting clients. KCA was

responsible for the construction management of several major

projects in Mexico including Ocampo, Pinos Altos, and most recently

the recovery plant of Orla’s Camino Rojo project. While the

El Oro Tailings Project will be KCA’s first entrepreneurial mining

venture in Mexico, KCA owns a gold mining project in the

neighboring country of Guatemala and looks forward to making a

success of the El Oro Tailings Project.

About Xali Gold

Xali Gold has gold and silver exploration

projects in Peru and Mexico. El Oro is our main focus in Mexico.

Modern understanding of epithermal vein systems indicates that

several of the El Oro district’s veins hold excellent discovery

potential, particularly below and adjacent to the historic workings

of the San Rafael Vein, which was mined to an average depth of only

200m.

Xali Gold is dedicated to being a responsible

Community partner.

Mexican Mines Tailings Inferred Resource

Estimate*

|

Classification |

Tonnes |

Gold (g/t) |

Silver (g/t) |

Ounces Gold |

Ounces Silver |

|

Inferred |

1,267,400 |

2.94 |

75.12 |

119,900 |

3,061,200 |

*Note: Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability.

The estimate reflects the results of the auger

and channel sampling program completed in May 2014 (see News

Release 036 June 26, 2014) as compared with extensive historic

assessments including drill testing and metallurgical test work.

The 2014 verification sampling program of the 1990 historic results

was completed through systematic sampling of the upper 3.0 metres

of the tailings with a hand auger and vertically channel sampling

the lower 5 to 10 metres of the tailings dump. In 1990, Luismin

drilled 297.7 metres in 22 holes and in 1951, the Cooperativa de

Las Dos Estrellas drilled 2162.7 metres in 184 holes. The mineral

resources reported have been estimated using criteria consistent

with the Canadian Institute of Mining and Metallurgy (“CIM”)

Definition Standards (2014) and in conformity with the CIM

“Estimation of Mineral Resources and Mineral Reserves Best

Practice” (2003) guidelines. The contained metal figures shown are

in-situ. No assurance can be given that the estimated quantities

will be produced. All figures have been rounded to reflect accuracy

and to comply with securities regulatory requirements. Some

summations may not agree due to rounding. This reported Mineral

Resource has an effective date of July 8th, 2014.

The Mexico Mine Tailings mineral resource was

constrained on the west and north by an offset of 30m from an

existing highway and is reported at a cut-off grade of 2.5 g/t gold

equivalent (“AuEq”). Gold and silver recoveries used were 50% and

50% respectively. Metal prices used were 12-month rolling averages

for: gold US$1,304.92/oz and silver US$20.67/oz. Mining and

processing costs and G&A used were $7.00, $27.00 and $11.00 US

per tonne respectively.

For more information see “National Instrument

43-101 Technical Report on the Inferred Mineral Resource Estimate

of the Mexico Mine Tailings” prepared by Nadia Caira, P.Geo. and

Allan Reeves, P.Geo., dated August 25, 2014 with an effective date

of July 8, 2014 available at www.sedar.com

Joanne C. Freeze, P.Geo., President and CEO is a

Qualified Person as defined by National Instrument 43-101 for the

projects discussed above. Ms. Freeze has reviewed and approved the

contents of this release.

Neither the TSX Venture Exchange nor its

Regulation Services Provider accepts responsibility for the

adequacy or accuracy of this release.Forward-looking

InformationThis news release may contain forward-looking

information (as such term is defined under Canadian securities

laws) including but not limited to the mineral resource estimate

for the Mexico Mine Tailings and information regarding references

to historical resource estimates, the potential for discovery on

the El Oro Properties and other statements that are not historical

facts, and the ability to pay mineral rights fees and fund

exploration. While such forward-looking information is expressed by

Xali Gold in good faith and believed by Xali Gold to have a

reasonable basis, they address future events and conditions and are

therefore subject to inherent risks and uncertainties including

those set out in Xali Gold’s MD&A. Factors that cause the

actual results to differ materially from those in forward-looking

information include, without limitation, gold prices, results of

exploration and development activities, regulatory changes, defects

in title, availability of materials and equipment, timeliness of

government approvals, potential environmental issues, availability

of capital and financing and general economic, market or business

conditions. Xali Gold expressly disclaims any intention or

obligation to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

except in accordance with applicable securities laws.

On behalf of the Board of Xali Gold

Corp.

“Joanne Freeze” P.Geo.President, CEO and

Director

For further information please contact:Joanne

Freeze, President & CEOTel: + 1 (604)

689-1957info@xaligold.com

NR 128

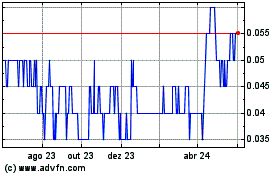

Xali Gold (TSXV:XGC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

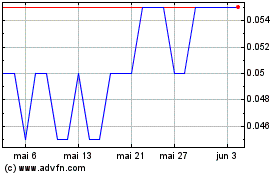

Xali Gold (TSXV:XGC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024