KCA Confirms Commitment to Xali Gold’s El Oro Tailings Project

24 Outubro 2024 - 8:00AM

Xali Gold Corp. (TSXV:XGC) ("Xali Gold” or the ”Company”) is

pleased to advise that Kappes, Cassiday and Associates (“KCA”)

continues to meet the terms of the Purchase Agreement (the

“Agreement”) on the Mexican Mine Tailings Reprocessing Project at

El Oro (the “El Oro Tailings Project”) in Mexico with a recent

payment of US$100,000.

“We are very pleased with the progress that KCA

has made to date on the El Oro Tailings Project and that they are

committed to getting the reprocessing project into production,”

states Joanne Freeze, President and CEO of Xali Gold. “KCA’s recent

payment reinforces the Company’s strategy to minimize dilution by

raising funds through partnerships in our Mexican projects.”

KCA has the right to process and sell all gold

and silver recovered from the Tailings in return for a gross

royalty of 3 to 4% to Xali Gold as well as an 8% Net Profits

Interest to the municipality of El Oro. KCA expects to be in

production within 12 to 18 months and prior to that will be

obligated to make minimum royalty payments of US$50,000 to Xali

Gold every six months. Please refer to News Releases dated April

15, 2024 and May 16, 2024 for complete details on the terms of the

Agreement.

The tailings are estimated to contain 1.27

million tonnes at a grade of 2.94 grams per tonne (“gpt”) gold and

75.12 gpt silver (3.85 gpt gold equivalent) containing 119,900

ounces (“oz”) of gold and 3,061,200 oz of silver as per an Inferred

Mineral Resource Estimate National Instrument 43-101 Resource Study

in 2014*. KCA’s work to date indicates a minimum recovery of 75% of

the contained gold and silver.

*Note: Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability. All

figures have been rounded to reflect the accuracy of the estimate.

For more information see “National Instrument 43-101 Technical

Report on the Inferred Mineral Resource Estimate of the Mexico Mine

Tailings” prepared by Nadia Caira, P.Geo. and Allan Reeves, P.Geo.,

dated August 25, 2014 with an effective date of July 8, 2014

available at www.sedar.com.

About Xali Gold

Xali Gold has gold and silver projects in Peru

and Mexico. The Company’s flagship project, El Oro, is a district

scale historic producer of gold and silver. While the Company’s

main goal at El Oro is to make a new discovery, similar to the ore

bodies mined historically, the Company has entered into two

agreements to bring in cash flow. Two third-parties now have the

rights to produce gold and silver from El Oro. KCA has the right to

reprocess tailings which contain 1.27 million tonnes at a grade of

2.94 gpt gold and 75.12 gpt silver (3.85 gpt gold equivalent)

containing 119,900 oz of gold and 3,061,200 oz of silver*.

Remedioambiente S.A. de C.V. has the right to recover gold and

silver from mineralized veins and backfill left behind in historic

workings. Xali Gold is to receive various payments related to net

smelter returns agreements with these two parties.

Future exploration in Mexico will be focused on

the El Oro property which covers 20 veins with past production and

more than 57 veins in total, from which approximately 6.4M ozs of

gold and 74M ozs of silver were reported to have been produced from

just two of these veins (Ref. Mexico Geological Service Bulletin

Nr. 37, Mining of the El Oro and Tlalpujahua Districts. 1920, T.

Flores). Modern understanding of epithermal vein systems indicates

that several of the El Oro district’s veins hold excellent

discovery potential, particularly below and adjacent to the

historic workings of the San Rafael Vein, which was mined to an

average depth of only 200m.

With renewed interest in gold and silver

exploration in South America, Xali Gold recently resumed

exploration in Peru by optioning the Majo Project, located within a

proven high sulphidation epithermal belt. The Company still

maintains other properties in Peru including the Tres Marias

Property, which is under option to Barrick Gold.

Xali Gold is dedicated to being a responsible

community partner.

Joanne C. Freeze, P.Geo., President and CEO is

the Qualified Person as defined by National Instrument 43-101 for

the projects discussed above. Ms. Freeze has reviewed and approved

the contents of this release. Neither the TSX Venture Exchange nor

its Regulation Services Provider accepts responsibility for the

adequacy or accuracy of this release.

On behalf of the Board of Xali Gold

Corp.

“Joanne Freeze” P.Geo.President, CEO and

Director

For further information please contact:Joanne

Freeze, President & CEOTel: + 1 604-512-3359

info@xaligold.com

Forward-looking InformationThis news release may

contain forward-looking information (as such term is defined under

Canadian securities laws) including but not limited to historical

production records and resource estimates. While such

forward-looking information is expressed by Xali Gold in good faith

and believed by Xali Gold to have a reasonable basis, they may

address future events and conditions and are therefore subject to

inherent risks and uncertainties including those set out in Xali

Gold’s MD&A. Factors that cause the actual results to differ

materially from those in forward-looking information include,

without limitation, gold prices, results of exploration and

development activities, regulatory changes, defects in title,

availability of materials and equipment, timeliness of government

approvals, potential environmental issues, availability of capital

and financing and general economic, market or business conditions.

Xali Gold expressly disclaims any intention or obligation to update

or revise any forward-looking information, whether as a result of

new information, future events or otherwise, except in accordance

with applicable securities laws.

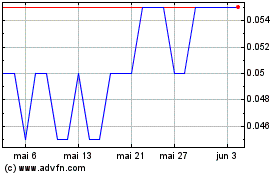

Xali Gold (TSXV:XGC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

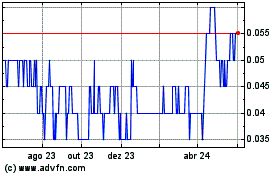

Xali Gold (TSXV:XGC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025