Oak Valley Bancorp (NASDAQ: OVLY) (the “Company”), the bank holding

company for Oak Valley Community Bank and their Eastern Sierra

Community Bank division, recently reported unaudited consolidated

financial results for the first quarter of 2024. For the three

months ended March 31, 2024, consolidated net income was

$5,727,000, or $0.69 per diluted share (EPS). This compared to

consolidated net income of $5,865,000, or $0.71 EPS, for the prior

quarter and $9,225,000, or $1.12 EPS, for the same period a year

ago. The net income decrease compared to prior periods was

primarily the result of an increase in deposit interest expense.

Average cost of funds increased to 68 bps as of March 31, 2024,

compared to 55 bps for the prior quarter and 10 bps for the first

quarter of 2023. This was partially offset by loan growth of $22.9

million over the prior quarter.

Net interest income for the three months ended

March 31, 2024 was $17,241,000, compared to $17,914,000 in the

prior quarter, and $19,543,000 in the same period a year ago. The

decrease from the prior periods is attributable to the increased

cost of funds, offset by loan growth, as described above. The

decrease in net interest income was also influenced by lower

deposits as our liquidity position allowed us to strategically

tolerate some rate-sensitive deposit migration, which substantially

mitigated our cost of funds increases relative to peer.

Net interest margin for the three months ended

March 31, 2024 was 4.09%, compared to 4.15% for the prior quarter

and 4.39% for the same period last year. The interest margin

contraction compared to prior periods was due to previously noted

deposit rate pressure on cost of funds.

“We are pleased with our overall financial

position. While our deposit costs have increased, our average cost

of funds remains manageable, as our service-focused banking model

continues to strengthen our core-deposit base,” stated Rick

McCarty, President and Chief Operating Officer.

Non-interest income was $1,519,000 for the

quarter ended March 31, 2024, compared to $1,755,000 for the prior

quarter and $1,655,000 for the same period last year. The decreases

compared to prior periods was primarily due to changes in the

market value of an equity security, and a reduction in overdraft

and non-sufficient fund fees charged to customers resulting from

regulatory changes in the industry.

Non-interest expense totaled $11,529,000 for the

quarter ended March 31, 2024, compared to $10,760,000 in the

previous quarter and $9,757,000 in the same quarter a year ago. The

increase in non-interest expense compared to prior periods

corresponds primarily to staffing expense and general operating

costs related to servicing the growing business portfolios.

Total assets were $1.81 billion at March 31,

2024, a decrease of $36.7 million and $134.9 million from December

31, 2023 and March 31, 2023, respectively. Gross loans were $1.04

billion at March 31, 2024, an increase of $22.9 million and $112.7

million over December 31, 2023 and March 31, 2023, respectively.

The Company’s total deposits were $1.61 billion at March 31, 2024,

a decrease of $38.1 million and $156.8 million from December 31,

2023 and March 31, 2023, respectively. The deposit decrease during

the first quarter was mainly related to normal seasonal activity.

The deposit decrease compared to the same period a year ago was due

to the aforementioned migration of rate-sensitive deposits,

including those transferred to our Oak Valley Investments channel.

Our liquidity position remains strong, as evidenced by $169.7

million in cash and cash equivalents balances at March 31,

2024.

“We have started 2024 with a solid performance.

Our team’s steadfast focus on targeted prospecting, regardless of

economic conditions, has led to a strong first quarter in loan

production and a robust loan pipeline,” stated Chris Courtney,

CEO.

Non-performing assets (“NPA”) remained at zero

as of March 31, 2024, as they were as of December 31, 2023, and

March 31, 2023. The allowance for credit losses (“ACL”) as a

percentage of gross loans was 1.05% at March 31, 2024, compared to

1.07% at December 31, 2023 and 1.01% at March 31, 2023. Given

industry concerns of credit risk specific to commercial real

estate, management has performed a thorough analysis of this

segment as part of the CECL credit risk model’s ACL computation,

concluding that the credit loss reserves relative to gross loans

remains at acceptable levels, and credit quality remains stable. As

a result, the Company did not record a provision for credit losses

during the first quarter.

Oak Valley Bancorp operates Oak Valley Community

Bank & their Eastern Sierra Community Bank division, through

which it offers a variety of loan and deposit products to

individuals and small businesses. They currently operate through 18

conveniently located branches: Oakdale, Turlock, Stockton,

Patterson, Ripon, Escalon, Manteca, Tracy, Sacramento, Roseville,

two branches in Sonora, three branches in Modesto, and three

branches in their Eastern Sierra division, which includes

Bridgeport, Mammoth Lakes, and Bishop.

For more information, call 1-866-844-7500 or

visit www.ovcb.com.

This press release includes forward-looking

statements about the corporation for which the corporation claims

the protection of safe harbor provisions contained in the Private

Securities Litigation Reform Act of 1995.

Forward-looking statements are based on

management's knowledge and belief as of today and include

information concerning the corporation's possible or assumed future

financial condition, and its results of operations and business.

Forward-looking statements are subject to risks and uncertainties.

A number of important factors could cause actual results to differ

materially from those in the forward-looking statements. Those

factors include fluctuations in interest rates, government policies

and regulations (including monetary and fiscal policies),

legislation, economic conditions, including increased energy costs

in California, credit quality of borrowers, operational factors and

competition in the geographic and business areas in which the

company conducts its operations. All forward-looking statements

included in this press release are based on information available

at the time of the release, and the Company assumes no obligation

to update any forward-looking statement.

|

|

|

Oak Valley Bancorp |

|

Financial Highlights (unaudited) |

| |

|

|

|

|

|

|

|

($ in thousands, except per share) |

1st Quarter |

4th Quarter |

3rd Quarter |

2nd Quarter |

1st Quarter |

|

Selected Quarterly Operating Data: |

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

Net interest income |

$ |

17,241 |

|

$ |

17,914 |

|

$ |

18,938 |

|

$ |

19,407 |

|

$ |

19,543 |

|

| |

Provision for (reversal of) credit losses |

|

– |

|

|

1,130 |

|

|

300 |

|

|

– |

|

|

(460 |

) |

| |

Non-interest income |

|

1,519 |

|

|

1,755 |

|

|

1,566 |

|

|

1,655 |

|

|

1,655 |

|

| |

Non-interest expense |

|

11,529 |

|

|

10,760 |

|

|

10,578 |

|

|

10,062 |

|

|

9,757 |

|

| |

Net income before income taxes |

|

7,231 |

|

|

7,779 |

|

|

9,626 |

|

|

11,000 |

|

|

11,901 |

|

| |

Provision for income taxes |

|

1,504 |

|

|

1,914 |

|

|

2,272 |

|

|

2,596 |

|

|

2,676 |

|

| |

Net income |

$ |

5,727 |

|

$ |

5,865 |

|

$ |

7,354 |

|

$ |

8,404 |

|

$ |

9,225 |

|

| |

|

|

|

|

|

|

| |

Earnings per common share – basic |

$ |

0.70 |

|

$ |

0.72 |

|

$ |

0.90 |

|

$ |

1.03 |

|

$ |

1.13 |

|

| |

Earnings per common share – diluted |

$ |

0.69 |

|

$ |

0.71 |

|

$ |

0.89 |

|

$ |

1.02 |

|

$ |

1.12 |

|

| |

Dividends paid per common share |

$ |

0.225 |

|

$ |

– |

|

$ |

0.160 |

|

$ |

– |

|

$ |

0.160 |

|

| |

Return on average common equity |

|

13.86 |

% |

|

16.44 |

% |

|

19.85 |

% |

|

23.48 |

% |

|

28.36 |

% |

| |

Return on average assets |

|

1.26 |

% |

|

1.27 |

% |

|

1.57 |

% |

|

1.79 |

% |

|

1.93 |

% |

| |

Net interest margin (1) |

|

4.09 |

% |

|

4.15 |

% |

|

4.34 |

% |

|

4.45 |

% |

|

4.39 |

% |

| |

Efficiency ratio (2) |

|

59.61 |

% |

|

53.08 |

% |

|

49.89 |

% |

|

46.31 |

% |

|

46.31 |

% |

| |

|

|

|

|

|

|

|

Capital – Period End |

|

|

|

|

|

| |

Book value per common share |

$ |

19.97 |

|

$ |

20.03 |

|

$ |

16.29 |

|

$ |

17.76 |

|

$ |

17.08 |

|

| |

|

|

|

|

|

|

|

Credit Quality – Period End |

|

|

|

|

|

| |

Nonperforming assets/ total assets |

|

0.00 |

% |

|

0.00 |

% |

|

0.00 |

% |

|

0.00 |

% |

|

0.00 |

% |

| |

Credit loss reserve/ gross loans |

|

1.05 |

% |

|

1.07 |

% |

|

1.00 |

% |

|

0.99 |

% |

|

1.01 |

% |

|

|

|

|

|

|

|

|

|

Period End Balance Sheet |

|

|

|

|

|

|

($ in thousands) |

|

|

|

|

|

| |

Total assets |

$ |

1,805,739 |

|

$ |

1,842,422 |

|

$ |

1,835,402 |

|

$ |

1,861,713 |

|

$ |

1,940,674 |

|

| |

Gross loans |

|

1,039,509 |

|

|

1,016,579 |

|

|

971,243 |

|

|

950,488 |

|

|

926,820 |

|

| |

Nonperforming assets |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

| |

Allowance for credit losses |

|

10,922 |

|

|

10,896 |

|

|

9,738 |

|

|

9,411 |

|

|

9,383 |

|

| |

Deposits |

|

1,612,400 |

|

|

1,650,534 |

|

|

1,666,548 |

|

|

1,682,378 |

|

|

1,769,176 |

|

| |

Common equity |

|

166,916 |

|

|

166,092 |

|

|

135,095 |

|

|

147,122 |

|

|

141,470 |

|

| |

|

|

|

|

|

|

|

Non-Financial Data |

|

|

|

|

|

| |

Full-time equivalent staff |

|

219 |

|

|

222 |

|

|

225 |

|

|

213 |

|

|

206 |

|

| |

Number of banking offices |

|

18 |

|

|

18 |

|

|

18 |

|

|

18 |

|

|

18 |

|

| |

|

|

|

|

|

|

|

Common Shares outstanding |

|

|

|

|

|

| |

Period end |

|

8,359,556 |

|

|

8,293,168 |

|

|

8,293,468 |

|

|

8,281,661 |

|

|

8,281,661 |

|

| |

Period average – basic |

|

8,209,617 |

|

|

8,200,177 |

|

|

8,197,083 |

|

|

8,195,270 |

|

|

8,182,737 |

|

| |

Period average – diluted |

|

8,244,648 |

|

|

8,236,897 |

|

|

8,232,338 |

|

|

8,227,218 |

|

|

8,226,991 |

|

| |

|

|

|

|

|

|

|

Market Ratios |

|

|

|

|

|

| |

Stock Price |

$ |

24.78 |

|

$ |

29.95 |

|

$ |

25.08 |

|

$ |

25.19 |

|

$ |

23.66 |

|

| |

Price/Earnings |

|

8.86 |

|

|

10.55 |

|

|

7.05 |

|

|

6.12 |

|

|

5.17 |

|

| |

Price/Book |

|

1.24 |

|

|

1.50 |

|

|

1.54 |

|

|

1.42 |

|

|

1.39 |

|

| |

|

|

|

|

|

|

| (1) |

Ratio computed on

a fully tax equivalent basis using a marginal federal tax rate of

21%. |

| (2) |

Ratio computed on

a fully tax equivalent basis using a marginal federal tax rate of

21%. |

| |

A marginal

federal/state combined tax rate of 29.56%, was used for applicable

revenue. |

|

Contact: |

Chris Courtney/Rick McCarty |

| Phone: |

(209) 848-2265 |

| |

www.ovcb.com |

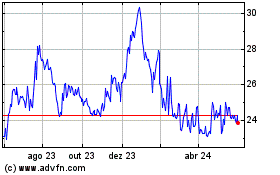

Oak Valley Bancorp (NASDAQ:OVLY)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

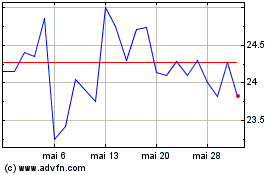

Oak Valley Bancorp (NASDAQ:OVLY)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025