Press Release Orange: Good start to the year, strong momentum on

“Lead the Future”

Press releaseParis, 24 April

2024

Financial results at 31 March 2024

Good start to the year, strong momentum

on “Lead the Future”

- Creation of MASORANGE, new leader in

Spain

- Acceleration of revenue and EBITDAaL

growth in the first quarter

- Confirmation of 2024 targets

|

In millions of euros |

|

1Q 2024 |

1Q 2023comparablebasis |

1Q 2023historicalbasis |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

9,850 |

9,649 |

9,517 |

2.1 % |

3.5 % |

|

EBITDAaL |

|

2,406 |

2,351 |

2,306 |

2.3 % |

4.3 % |

|

eCAPEX (excluding licenses) |

|

1,550 |

1,512 |

1,493 |

2.5 % |

3.8 % |

|

o/w Continuing operations |

|

1,384 |

1,343 |

1,323 |

3.1 % |

4.6 % |

|

o/w Discontinued operations |

|

166 |

169 |

169 |

(2.1)% |

(2.1)% |

|

EBITDAaL - eCAPEX of continuing operations |

|

1,022 |

1,008 |

982 |

1.4 % |

4.0 % |

MASORANGE, the 50:50 joint venture combining the

Spanish operations of Orange and MASMOVIL1 was created on

26 March 2024. The Group’s Spanish operations are deemed to be

discontinued under IFRS 5 until closing and will subsequently

be consolidated using the equity method in the Group’s financial

statements. Historical data has been restated.

Commenting on these results, Christel Heydemann,

Orange’s Chief Executive Officer, said:“Orange has made a very good

start to the year, marked by the completion of the deal with

MASMOVIL to create MASORANGE, creating the leading operator in

Spain in terms of customer numbers. This is a major step forward in

the execution of the “Lead the Future” plan and for the Group’s

development in Europe. In the first quarter, Group revenues and

EBITDAaL accelerated, rising 2.1% and 2.3% respectively, in line

with this year’s objectives as set out in our strategic plan. In

France, revenue growth was driven by retail services, underpinned

by a value-oriented strategy that delivered increases across all

ARPOs. In the B2B market, Orange Business revenues were stable

while those of IT and Integration services, Orange Cyberdefense in

particular, grew. Orange Business continues to execute its

transformation plan with several important milestones achieved this

quarter, notably the implementation of the cost reduction plan.

Driven by its robust growth drivers, the Africa & Middle East

region maintained its strong momentum with double-digit revenue

growth for the fourth consecutive quarter.I would like to thank all

our colleagues for their dedication and trust. Orange continues to

evolve to be efficient across all its activities and be among the

sector’s global leaders.”

Orange group revenues rose 2.1%

compared with the first quarter of 20232 (+201 million euros)

thanks to growth in retail services (+3.2% or +232 million

euros) and a smaller decline in wholesale services (-4.1% or

-62 million euros), mainly related to higher unbundling rates

in France.

- Africa

& Middle East is the main contributor to this growth,

with revenues rising strongly (+11.1% or +185 million euros)

lead by a robust performance in voice and double-digit increases in

its four growth engines (+15.7% in mobile data, +20.6% in fixed

broadband, +23.5% at Orange Money and +14.1% in B2B across all

activities), and this despite the devaluation of the Egyptian

pound.

- Revenues in

France increased 0.8% (+35 million euros)

thanks to the growth in retail services excluding PSTN3 (+3.0%), in

line with the “Lead the Future” target of growth between 2.0% and

4.0%, and to a smaller decline in wholesale (-4.2%) due to the

higher unbundling rate applied from 1 January 2024.

-

Europe declined (-2.0% or -35 million euros)

due to a reduction in low-margin activities, offset partially by

the continued growth of retail services excluding IT and

Integration services (+0.9%).

- The slight decrease

in Orange Business revenues (-0.3% or

-6 million euros) was due to the decline in fixed voice

revenues (-8.7% or -72 million euros), which was almost offset

by accelerated growth in IT and Integration services revenues

(+7.5% or +65 million euros), notably driven by Orange

Cyberdefense (+15.3% or +39 million euros).

- In terms of

commercial performance, the Group maintained its

leadership position in convergence, with 9.1 million

convergent customers (+1.9%), as well as its

commercial momentum in mobile contracts and very high-speed fixed

broadband accesses. Mobile services had

242.6 million accesses worldwide (+7.0%) including

90.7 million contracts (+12.3%). Fixed

services had 39.2 million accesses worldwide (-3.2%)

of which 13.3 million were very high-speed broadband accesses,

an area that continued to show strong growth (+14.4%). Fixed

narrowband accesses continued their decline (-13.2%).

The Group’s EBITDAaL was

2,406 million euros for the period ended 31 March 2024,

an increase of 2.3% in line with the objective of slight growth in

2024. The EBITDAaL from telecom activities was to

2,440 million euros (+2.3%).

eCAPEX amounted to

1,384 million euros in the first quarter of 2024, excluding

166 million euros of CAPEX for Spain booked in the first

quarter in the Group’s financial statements. eCAPEX rose 3.1% and

eCAPEX for telecom activities as a percentage of revenues was

14.0%, reflecting the objective to maintain discipline in 2024. The

number of households connectable to FTTH reached 56.2 million

excluding Spain (+12.2%), and the FTTH customer base was

12.2 million (+15.4%).

The Group can therefore confirm its

financial targets for

20244:

- Low single-digit

growth in EBITDAaL

- Discipline on

eCAPEX

- Organic cash

flow of at least 3.3 billion euros from telecom

activities

- Net

debt/EBITDAaL ratio of telecom activities unchanged at about 2x in

the medium term

- Proposal to

increase the 2024 dividend payable in 2025 to 0.75 euros per share,

including an interim dividend of 0.30 euros in December 2024.

Changes in the asset

portfolio

Impact of the creation of MASORANGE, the

joint venture between Orange and MASMOVIL in Spain

The Group’s operations in Spain are deemed to be

discontinued under IFRS 5 “Non-current Assets Held for Sale

and Discontinued Operations” for the period from 1 January to

26 March 2024, and the historical data was restated in the

same way.

As a result:

− the consolidated

income statement presents continuing and discontinued operations

separately. Orange’s net income and expenses in Spain are presented

until 26 March 2024 in net income from discontinued

operations, and the data published for previous years has been

restated accordingly. Applied retroactively, the constituent parts

of the newly published net income from continuing operations no

longer include Orange’s net income and expenses in Spain, and the

procedures for eliminating internal operating flows have been

reviewed;

− the previously

published consolidated statement of financial position and

consolidated cash flow statement remain unchanged and include

Orange’s assets/liabilities and cash flows in Spain.

Since 26 March 2024, the investment in the

joint venture has been consolidated using the equity method in the

Group’s Consolidated Financial Statements.

________________________________________________________________________________

The Board of Directors of Orange SA met on

23 April 2024 and reviewed the consolidated financial results

at 31 March 2024.

More detailed information on the Group’s

financial results and performance indicators is available on the

Orange website www.orange.com/en/consolidated-results.

Review by operating

segment

France

|

In millions of euros |

|

1Q 2024 |

1Q 2023comparablebasis |

1Q 2023historicalbasis |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

4,339 |

4,304 |

4,307 |

0.8 % |

0.7 % |

|

Retail services (B2C+B2B) |

|

2,795 |

2,748 |

2,751 |

1.7 % |

1.6 % |

|

Convergence |

|

1,287 |

1,234 |

1,238 |

4.3 % |

4.0 % |

|

Mobile-only |

|

585 |

583 |

582 |

0.3 % |

0.4 % |

|

Fixed-only |

|

922 |

931 |

931 |

(0.9)% |

(0.9)% |

|

Wholesale |

|

1,055 |

1,100 |

1,100 |

(4.2)% |

(4.2)% |

|

Equipment sales |

|

324 |

311 |

307 |

4.1 % |

5.6 % |

|

Other revenues |

|

166 |

144 |

149 |

15.0 % |

11.2 % |

Good performance of retail

services

With quarterly revenues of

4,339 million euros, France recorded growth of 0.8% year on

year (+35 million euros). Growth in retail services (+1.7% or

+47 million euros), equipment sales (+4.1% or +13 million

euros) and other revenues (+15.0% or +22 million euros) offset

the expected decline in wholesale services (-4.2% or

-46 million euros), which was mitigated this quarter by the

higher unbundling rates applied from 1 January 2024.

The growth in retail services, excluding fixed-only

narrowband services (PSTN) of 3.0% (+77 million euros), is

fully in line with the “Lead the Future” growth target of between

2% and 4%. It is testament to the successful execution of France’s

value strategy as illustrated by the year-on-year increase in the

average Mobile and Fixed Broadband ARPOs, as well as in the

convergent ARPO which reached 74.8 euros.

From a commercial standpoint, Mobile net additions

for the first quarter amounted to +9,0005 (an improvement compared

to the first quarter of 2023) and the churn rate remained moderate

at 12.7%. The general market slowdown seen since the beginning of

last year continued to affect Fixed broadband net additions in the

first quarter (-43,000), while Fiber retained its very good

momentum (+247,000). There are now 38.2 million households

connectable to Orange Fiber.

Based on these good first-quarter results, France

confirms its ambition to grow non-PSTN retail services by between

2% and 4%, thanks to the balance achieved by its volume/value

equation and the stability of its 2024 EBITDAaL.

Europe (excluding Spain)

|

In millions of euros |

|

1Q 2024 |

1Q 2023comparablebasis |

1Q 2023historicalbasis |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

1,727 |

1,762 |

1,577 |

(2.0)% |

9.5 % |

|

Retail services (B2C+B2B) |

|

1,233 |

1,232 |

1,074 |

0.0 % |

14.8 % |

|

Convergence |

|

347 |

324 |

255 |

7.0 % |

35.9 % |

|

Mobile-only |

|

536 |

538 |

523 |

(0.4)% |

2.5 % |

|

Fixed-only |

|

248 |

259 |

191 |

(4.2)% |

30.3 % |

|

IT & Integration services |

|

102 |

111 |

106 |

(8.4)% |

(3.5)% |

|

Wholesale |

|

198 |

218 |

208 |

(9.4)% |

(4.9)% |

|

Equipment sales |

|

257 |

262 |

249 |

(1.8)% |

3.4 % |

|

Other revenues |

|

39 |

49 |

45 |

(20.5)% |

(13.8)% |

Good commercial performance focused on the

value strategy

Revenues for Europe decreased 2.0%

(-35 million euros), in the first quarter due to a reduction

in low-margin activities. Wholesale services fell (-9.4% or

-20 million euros) due to the regulatory decrease in call

termination rates, which had no effect on EBITDAaL, alongside

declines in equipment sales (-1.8% or -5 million euros)

and revenues from IT and Integration services (-8.4% or

-9 million euros).

Retail services growth of +0,9% excluding IT and

Integration services, was driven by the strategy to balance volume

and value, with strong momentum from convergent services (+7.0% or

+23 million euros).

The good performance of Convergence benefitted from

price increases and growth in the Fixed broadband customer base,

with nearly 3.5 million FTTH and cable customers, up 10.3%

year on year. The 1.4-point decline in Mobile churn and 3.6-point

decline in Fixed broadband churn, as well as net additions of

+70,000 in Mobile and +72,000 in Fiber, reflect good commercial

momentum.

The Group continued its consolidation in Europe

with the complete integration of VOO in Belgium and the merger

underway in Romania.

The Group is confident that Europe can achieve

slight growth in EBITDAaL in 2024, in line with its objectives.

Africa & Middle East

|

In millions of euros |

|

1Q 2024 |

1Q 2023comparablebasis |

1Q 2023historicalbasis |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

1,849 |

1,664 |

1,699 |

11.1 % |

8.8 % |

|

Retail services (B2C+B2B) |

|

1,662 |

1,482 |

1,509 |

12.2 % |

10.2 % |

|

Mobile-only |

|

1,414 |

1,273 |

1,297 |

11.1 % |

9.0 % |

|

Fixed-only |

|

232 |

199 |

202 |

16.4 % |

14.5 % |

|

IT & Integration services |

|

16 |

9 |

9 |

80.9 % |

79.1 % |

|

Wholesale |

|

153 |

151 |

158 |

1.3 % |

(3.4)% |

|

Equipment sales |

|

24 |

22 |

23 |

6.6 % |

3.3 % |

|

Other revenues |

|

9 |

9 |

9 |

10.0 % |

2.6 % |

Maintaining a very strong

performance

Africa & Middle East revenues

grew strongly (+185 million euros), with double-digit growth

(+11.1%) for the fourth consecutive quarter. Nine countries out of

16 recorded double-digit growth.

This performance stems from the rapid growth of

retail services (+12.2%), thanks to good results in voice with a

favorable impact from both volume and value, and continued

double-digit increases in the four growth engines, namely Mobile

data (+15.7%), Fixed broadband (+20.6%), Orange Money (+23.5%) and

B2B across all activities (+14.1%).

The anticipated devaluation of the Egyptian pound

had a limited impact on Africa & Middle East revenues, which

grew 8.8% on a historical basis.

The mobile customer base reached

153.1 million, a year-on-year increase of 6.4%, with

accelerated growth in the 4G customer base (+23.7%) and a 5.4%

increase in average Mobile ARPO.

Orange Bank Africa, consolidated since 1 January

2024 in this segment, has 1.4 million customers.

The Group is confident of continued EBITDAaL growth

in the region in 2024.

Orange Business

|

In millions of euros |

|

1Q 2024 |

1Q 2023comparablebasis |

1Q 2023historicalbasis |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

1,939 |

1,945 |

1,951 |

(0.3)% |

(0.6)% |

|

Fixed-only |

|

752 |

824 |

828 |

(8.7)% |

(9.2)% |

|

Voice |

|

200 |

232 |

233 |

(13.9)% |

(14.3)% |

|

Data |

|

552 |

591 |

595 |

(6.6)% |

(7.2)% |

|

IT & Integration services |

|

937 |

871 |

872 |

7.5 % |

7.4 % |

|

Mobile |

|

251 |

251 |

251 |

(0.1)% |

(0.1)% |

|

Mobile-only |

|

176 |

168 |

168 |

4.8 % |

4.8 % |

|

Wholesale |

|

10 |

10 |

10 |

(2.0)% |

(2.0)% |

|

Equipment sales |

|

65 |

73 |

73 |

(11.0)% |

(11.0)% |

Further progress in the recovery

plan

Revenues for the Orange Business segment were

1,939 million euros in the first quarter of 2024, down

slightly (-0.3% or -6 million euros).

Growth in IT and Integration services (+7.5% or

+65 million euros) was driven by double-digit growth in Orange

Cyberdefense (+15.3%) and the performance of Digital services

(+5.1%). This growth is higher than that of the first quarter of

2023 but did not fully offset the structural decline in legacy

fixed voice and data activities (-8.7% or -72 million

euros).

Gartner ranked Orange Business as the best global

long-distance network service provider based on its ability to

execute.

Orange Business has also innovated by offering a

Circular Mobility service to reduce the carbon footprint of mobile

phone fleets and by introducing new indicators to its Flux Vision

population flow observation tool, allowing customers to measure the

carbon footprint generated by the movements of goods and people.

Two new generative AI solutions were also launched at the Orange

Business Summit. These illustrate Orange Business’s positioning as

a provider of sustainable, differentiated and reliable

solutions.

Orange Business achieved important milestones in

its recovery plan this quarter, key steps toward halving the

decrease in EBITDAaL this year before an expected return to growth

in 2025:

- a simpler product portfolio, with the

number of marketed products and services more than halved;

- implementation of

the cost-reduction program.

TOTEM

|

In millions of euros |

|

1Q 2024 |

1Q 2023comparablebasis |

1Q 2023historicalbasis |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

174 |

174 |

174 |

0.1 % |

0.1 % |

|

Wholesale |

|

174 |

174 |

174 |

0.1 % |

0.1 % |

|

Other revenues |

|

- |

- |

- |

- |

- |

Revenues of the TOTEM TowerCo were stable at

174 million euros (+0.1%). The growth in hosting revenues, up

2.6% to 146 million euros, was offset by the decline in

revenues from low-margin activities such as tower location planning

and work, and the resale of energy, for which prices have fallen.

The contributory share of hosting revenues increased 4.6% (+11.6%

excluding MASORANGE). There were 27,272 sites at the end of March

2024, with a tenancy ratio of 1.41 co-tenants per site, an increase

in line with the target to reach 1.5 co-tenants per site in

2026.

TOTEM has begun to roll out the latest-generation

mobile networks for the Grand Paris Express “Line 15 South” metro

line to extend 5G coverage to the whole of this future line. The

full connectivity of this metro line was incorporated from the

design stage of this large-scale industrial project.

International Carriers & Shared

Services

|

In millions of euros |

|

1Q 2024 |

1Q 2023comparablebasis |

1Q 2023historicalbasis |

changecomparablebasis |

changehistoricalbasis |

|

Revenues |

|

334 |

339 |

354 |

(1.4)% |

(5.5)% |

|

Wholesale |

|

204 |

227 |

227 |

(10.2)% |

(10.2)% |

|

Other revenues |

|

130 |

112 |

127 |

16.3 % |

2.9 % |

Wholesale services revenues decreased 10.2% in the

first quarter (-23 million euros). The accelerated decline in

voice revenues (in volume and price) was partially offset by the

increase in roaming services and Data activities.

The increase in other revenues of 16.3%

(+18 million euros) reflects the good performance of both

Orange Marine’s submarine cable laying and maintenance activities,

and Sofrecom’s services.

Mobile Financial Services

The plan to discontinue Orange Bank’s activities in

Europe has begun:

- in France, Orange Bank has started

referring customer accounts to Hello Bank! and BNP Paribas;

- in Spain, Orange Bank has initiated

the sale of its loan portfolio to Banco Cetelem.

Calendar of upcoming events

22 May

2024 -

Annual Shareholders Meeting

24 July

2024 -

Publication of First-Half 2024 financial results

Contacts

|

press: Frédéric Texierfred.texier@orange.comTom

Wrighttom.wright@orange.com Caroline

Celliercaroline.cellier@orange.com |

financial communication: (analysts and investors)Constance

Gestconstance.gest@orange.com Louise

Racinelouise.racine@orange.comHong Hai

Vuonghonghai.vuong@orange.comLouis

Celierlouis.celier@orange.com |

Disclaimer

This press release contains forward-looking

statements about Orange’s financial situation, results of

operations and strategy. Although we believe these statements are

based on reasonable assumptions, they are subject to numerous risks

and uncertainties, including matters not yet known to us or not

currently considered material by us, and there can be no assurance

that anticipated events will occur or that the objectives set out

will actually be achieved. More detailed information on the

potential risks that could affect our financial results is included

in the Universal Registration Document filed on 28 March 2024

with the French Financial Markets Authority (AMF) and in the annual

report (Form 20-F) filed on 29 March 2024 with the U.S. Securities

and Exchange Commission. Forward-looking statements speak only as

of the date they are made. Other than as required by law, Orange

does not undertake any obligation to update them in light of new

information or future developments.

Appendix 1: financial key

indicators

Quarterly data

|

In millions of euros |

|

1Q 2024 |

1Q 2023comparablebasis |

1Q 2023historicalbasis |

variationcomparablebasis |

changehistoricalbasis |

|

Revenues |

|

9,850 |

9,649 |

9,517 |

2.1 % |

3.5 % |

|

France |

|

4,339 |

4,304 |

4,307 |

0.8 % |

0.7 % |

|

Europe |

|

1,727 |

1,762 |

1,577 |

(2.0)% |

9.5 % |

|

Africa & Middle East |

|

1,849 |

1,664 |

1,699 |

11.1 % |

8.8 % |

|

Orange Business |

|

1,939 |

1,945 |

1,951 |

(0.3)% |

(0.6)% |

|

Totem |

|

174 |

174 |

174 |

0.1 % |

0.1 % |

|

International Carriers & Shared Services |

|

334 |

339 |

354 |

(1.4)% |

(5.5)% |

|

Intra-Group eliminations |

|

(512) |

(539) |

(545) |

|

|

|

EBITDAaL (1) |

|

2,406 |

2,351 |

2,306 |

2.3 % |

4.3 % |

|

o/w Telecom activities |

|

2,440 |

2,385 |

2,341 |

2.3 % |

4.2 % |

|

As % of revenues |

|

24.8 % |

24.7 % |

24.6 % |

0.1 pt |

0.2 pt |

|

o/w Mobile Financial Services |

|

(34) |

(34) |

(35) |

(0.3)% |

2.5 % |

|

eCAPEX |

|

1,550 |

1,512 |

1,493 |

2.5 % |

3.8 % |

|

o/w Continuing operations |

|

1,384 |

1,343 |

1,323 |

3.1 % |

4.6 % |

|

o/w Telecom activities |

|

1,383 |

1,335 |

1,315 |

3.6 % |

5.2 % |

|

As % of revenues |

|

14.0 % |

13.8 % |

13.8 % |

0.2 pt |

0.2 pt |

|

o/w Mobile Financial Services |

|

1 |

8 |

8 |

(91.4)% |

(92.3)% |

|

o/w Discontinued operations |

|

166 |

169 |

169 |

(2.1)% |

(2.1)% |

|

EBITDAaL - eCAPEX of continuing operations |

|

1,022 |

1,008 |

982 |

1.4 % |

4.0 % |

|

(1) EBITDAaL presentation adjustments are described in Appendix

2. |

|

|

|

|

|

|

Appendix 2: adjusted data to

income statement items

Quarterly data

|

|

|

1Q 2024 |

|

1Q 2023historical basis |

|

In millions of euros |

|

Adjusted data |

Presentation adjustments |

Income statement |

|

Adjusted data |

Presentation adjustments |

Income statement |

|

Revenues |

|

9,850 |

- |

9,850 |

|

9,517 |

- |

9,517 |

|

External purchases |

|

(4,056) |

0 |

(4,056) |

|

(3,998) |

- |

(3,998) |

|

Other operating income |

|

229 |

- |

229 |

|

186 |

- |

186 |

|

Other operating expenses |

|

(117) |

(4) |

(121) |

|

(73) |

91 |

18 |

|

Labour expenses |

|

(2,184) |

(8) |

(2,192) |

|

(2,062) |

(28) |

(2,090) |

|

Operating taxes and levies |

|

(875) |

(1) |

(876) |

|

(863) |

(1) |

(864) |

|

Gains (losses) on disposal of fixed assets, investments and

activities |

|

na |

(152) |

(152) |

|

na |

36 |

36 |

|

Restructuring costs |

|

na |

(44) |

(44) |

|

na |

(10) |

(10) |

|

Depreciation and amortization of financed assets |

|

(38) |

- |

(38) |

|

(27) |

- |

(27) |

|

Depreciation and amortization of right-of-use assets |

|

(338) |

(2) |

(340) |

|

(330) |

- |

(330) |

|

Impairment of right-of-use assets |

|

(0) |

- |

(0) |

|

- |

- |

- |

|

Interest expense on liabilities related to financed assets |

|

(4) |

4 |

na |

|

(2) |

2 |

na |

|

Interest expense on lease liabilities |

|

(61) |

61 |

na |

|

(40) |

40 |

na |

|

EBITDAaL |

|

2,406 |

(146) |

na |

|

2,306 |

130 |

na |

|

Significant litigation |

|

(1) |

1 |

na |

|

96 |

(96) |

na |

|

Specific labour expenses |

|

(7) |

7 |

na |

|

(28) |

28 |

na |

|

Fixed assets, investments and business portfolio review |

|

(152) |

152 |

na |

|

36 |

(36) |

na |

|

Restructuring program costs |

|

(47) |

47 |

na |

|

(10) |

10 |

na |

|

Acquisition and integration costs |

|

(4) |

4 |

na |

|

(6) |

6 |

na |

|

Interest expense on liabilities related to financed assets |

|

na |

(4) |

(4) |

|

na |

(2) |

(2) |

|

Interest expense on lease liabilities |

|

na |

(61) |

(61) |

|

na |

(40) |

(40) |

Appendix 3: economic CAPEX to

investments in property, plant and intangible

investment

|

|

|

1Q 2024 |

|

1Q 2023historicalbasis |

|

In millions of euros |

|

Continuing operations |

Discontinued operations |

Group total |

|

Continuing operations |

Discontinued operations |

Group total |

|

Investments in property, plant and equipment and intangible

assets |

|

1,473 |

168 |

1,641 |

|

1,789 |

180 |

1,969 |

|

Financed assets |

|

(21) |

- |

(21) |

|

(71) |

- |

(71) |

|

Proceeds from sales of property, plant and equipment and intangible

assets |

|

(67) |

- |

(67) |

|

(91) |

- |

(91) |

|

Telecommunication licenses |

|

(2) |

(2) |

(4) |

|

(303) |

(11) |

(314) |

|

eCAPEX |

|

1,384 |

166 |

1,550 |

|

1,323 |

169 |

1,493 |

Appendix 4: key performance

indicators

|

In thousands, at the end of the period |

|

March 312024 |

|

March 312023 |

|

Number of convergent customers |

|

9,072 |

|

8,906 |

|

Number of mobile accesses (excluding MVNOs)

(1) |

|

242,579 |

|

226,685 |

|

o/w |

Convergent customers mobile accesses |

|

15,547 |

|

15,237 |

|

|

Mobile only accesses |

|

227,031 |

|

211,448 |

|

o/w |

Contract customers mobile accesses |

|

90,698 |

|

80,729 |

|

|

Prepaid customers mobile accesses |

|

151,881 |

|

145,956 |

|

Number of fixed accesses (2) |

|

39,238 |

|

40,540 |

|

|

Fixed Retail accesses |

|

26,798 |

|

27,221 |

|

|

|

Fixed Broadband accesses |

|

21,335 |

|

20,928 |

|

|

|

o/w |

Very high‑speed broadband fixed accesses |

|

13,270 |

|

11,599 |

|

|

|

|

Convergent customers fixed accesses |

|

9,072 |

|

8,906 |

|

|

|

|

Fixed accesses only |

|

12,263 |

|

12,021 |

|

|

|

Fixed Narrowband accesses |

|

5,463 |

|

6,294 |

|

|

Fixed Wholesale accesses |

|

12,440 |

|

13,319 |

|

Group total accesses (1+2) |

|

281,817 |

|

267,225 |

|

2023 data is on a comparable basis and includes accesses to the

telecom operator VOO acquired in June 2023 by Orange Belgium. |

Key performance indicators (KPI) by country are

presented in the “Orange investors data book Q1 2024” available on

www.orange.com, under Finance/Results:

www.orange.com/en/latest-consolidated-results

Appendix 5:

glossary

Key figures

Data on a comparable basis: data based on

comparable accounting principles, scope of consolidation and

exchange rates are presented for previous periods. The transition

from data on an historical basis to data on a comparable basis

consists of keeping the results for the period ended and then

restating the results for the corresponding period of the preceding

year for the purpose of presenting, over comparable periods,

financial data with comparable accounting principles, scope of

consolidation and exchange rate. The method used is to apply to the

data of the corresponding period of the preceding year, the

accounting principles and scope of consolidation for the period

just ended as well as the average exchange rate used for the income

statement for the period ended. Changes in data on a comparable

basis reflect organic business changes. Data on a comparable basis

is not a financial aggregate as defined by IFRS and may not be

comparable to similarly named indicators used by other

companies.

Retail services (B2C + B2B): aggregation of

revenues from (i) Convergent services, (ii) Mobile-only services,

(iii) Fixed-only services and (iv) IT and Integration services (see

definitions). Retail Services (B2C+B2B) revenues include all

revenues of a given scope excluding revenues from wholesale

services, equipment sales and other revenues (see definitions).

EBITDAaL or “EBITDA after Leases”: operating

income (i) before depreciation and amortization of fixed assets,

effects resulting from business combinations, impairment of

goodwill and fixed assets, share of profits (losses) of associates

and joint ventures, (ii) after interest on debts related to

financed assets and on lease liabilities, and (iii) adjusted for

significant litigation, specific labor expenses, fixed assets,

investments and businesses portfolio review, restructuring programs

costs, acquisition and integration costs and, where appropriate,

other specific elements. EBITDAaL is not a financial aggregate as

defined by IFRS standards and may not be directly comparable to

similarly named indicators in other companies.

eCAPEX or “economic CAPEX”: (i) acquisitions of

property, plant and equipment and intangible assets, excluding

telecommunications licenses and financed assets, (ii) less the

price of disposal of property, plant and equipment and intangible

assets. eCAPEX is not a financial performance indicator as defined

by IFRS standards and may not be directly comparable to indicators

referenced by similarly named indicators in other companies.

Organic Cash Flow (telecoms activities): for the

perimeter of the telecoms activities, net cash provided by

operating activities, minus (i) lease liabilities repayments and

debts related to financed assets repayments, and (ii) purchases and

sales of property, plant and equipment and intangible assets, net

of the change in the fixed assets payables, (iii) excluding

telecommunication licenses paid and significant litigations paid or

received. Organic Cash Flow (telecoms activities) is not a

financial aggregate defined by IFRS and may not be comparable to

similarly named indicators used by other companies.

Free cash flow all-in (telecoms activities):

Free cash flow all-in from telecom activities corresponds to net

cash provided by operating activities, minus (i) purchases and

sales of property, plant and equipment and intangible assets, net

of the change in the fixed assets payables, (ii) repayments of

lease liabilities and on debts related to financed assets, and

(iii) payments of coupons on subordinated notes. Free cash flow

all-in from telecom activities is not a financial aggregate defined

by IFRS and may not be comparable to similarly named indicators

used by other companies.

Earnings per share (EPS) – Group share Net

income – Basic: Basic earnings per share are calculated by dividing

(a) net income for the year attributable to the shareholders of the

Group, after deduction of the remuneration net of the tax to

holders of subordinated notes, by (b) the weighted average number

of ordinary shares outstanding during the period.

Return On Capital Employed or ROCE: ROCE from

telecoms activities corresponds to Net Operating Profit After Tax

(NOPAT) for the year ended (N) divided by Net Operating Assets

(NOA) for the previous year (N-1).

Net Operating Profit After Tax (NOPAT) for the

year ended (N) corresponds to operating profit (i) after interest

on lease liabilities and on debts related to financed assets, and

(ii) after income tax adjusted for the tax impact of financial

income excluding interest on lease liabilities and on debts related

to financed assets (tax charge calculated on the basis of the

statutory tax rate applicable in France, the tax jurisdiction of

the parent company Orange SA).

Net Operating Assets (NOA) for the previous year

(N-1) correspond to (i) equity and (ii) financial liabilities and

derivative liabilities (non‑current and current), excluding debts

on financed assets, (iii) less financial assets and derivative

assets (non‑current and current), cash and cash equivalents,

including investments in Mobile Financial Services.

ROCE from telecoms activities is not a financial

aggregate defined by IFRS and may not be comparable to similarly

named indicators used by other companies.

Performance indicators

Fixed retail accesses: number of fixed broadband

accesses (xDSL (ADSL and VDSL), FTTx, cable, Fixed-4G (fLTE) and

other broadband accesses (satellite, Wimax and others)) and fixed

narrowband accesses (mainly PSTN) and payphones.

Fixed wholesale accesses: number of fixed

broadband and narrowband wholesale accesses operated by Orange.

Convergence

Convergent services: customer base and revenues

from B2C Convergent retail offers, excluding equipment sales (see

definition) defined as an offer combining at least a broadband

access (xDSL, FTTx, cable or Fixed-4G (fLTE) with cell-lock) and a

mobile voice contract (excluding MVNOs).

Convergent ARPO: average quarterly revenues per

convergent offer (ARPO) calculated by dividing revenues from retail

Convergent services offers invoiced to B2C customers generated over

the past three months (excluding IFRS 15 adjustments) by the

weighted average number of retail Convergent offers over the same

period. ARPO is expressed by monthly revenues per convergent

offer.

Mobile-only services

Mobile-only services: revenues from mobile

offers (mainly outgoing calls: voice, SMS and data) invoiced to

retail customers, excluding convergent services and equipment sales

(see definitions). The customer base includes customers with a

contract excluding retail convergence, machine-to-machine contracts

and prepaid cards.

Mobile-only ARPO: average quarterly revenues

from Mobile-only (ARPO) calculated by dividing revenues from

Mobile-only retail services (excluding machine-to-machine and IFRS

15 adjustments) generated over the past three months by the

weighted average of Mobile-only customers (excluding

machine-to-machine) over the same period. The ARPO is expressed as

monthly revenues per Mobile-only customer.

Fixed-only services

Fixed-only services: revenues from fixed retail

offers, excluding B2C convergent offers and equipment sales (see

definitions). It includes (i) fixed narrowband services

(conventional fixed telephony), (ii) fixed broadband services, and

(iii) business solutions and networks (with the exception of

France, for which essential business solutions and networks are

supported by Orange Business segment). For the Orange Business

segment, Fixed-only service revenues include sales of network

equipment related to the operation of voice and data services. The

customer base consists of fixed narrowband and fixed broadband

customers, excluding retail convergence customers.

Fixed-only Broadband ARPO: average quarterly

revenues from Fixed-only Broadband (ARPO) calculated by dividing

the revenue from Fixed-only Broadband retail services (excluding

IFRS 15 adjustments) generated over the past three months by the

weighted average of Fixed-only Broadband customers over the same

period. ARPO is expressed as monthly revenues per Fixed-only

Broadband customer.

IT & Integration services

IT & Integration services: revenues from

unified communication and collaboration services (Local Area

Network and telephony, advising, integration and project

management), hosting and infrastructure services (including Cloud

Computing), applications services (customer relations management

and other applications services), security services, video

conferencing offers, machine-to-machine services (excluded

connectivity) as well as sales of equipment related to the above

products and services.

Wholesale

Wholesale services: revenues from other carriers

consists of (i) mobile services to other carriers including

incoming traffic, visitor roaming, network sharing, national

roaming and Mobile Virtual Network Operators (MVNOs), (ii) fixed

services to other carriers including national networking, services

to international carriers, high-speed and very high-speed broadband

access (fibre access, unbundling of telephone lines and xDSL access

sales) and the sale of telephone lines on the wholesale market, and

(iii) equipment sales to other carriers.

Equipment sales

Equipment sales: revenues from all mobile and

fixed equipment sales, excluding (i) equipment sales associated

with the supply of IT and Integration services, (ii) sales of

network equipment related to the operation of voice and data

services in the Orange Business operating segment, (iii) equipment

sales to other carriers, and (iv) equipment sales to dealers and

brokers.

Other revenues

Other revenues: revenues including (i) equipment

sales to brokers and dealers, (ii) portal, (iii) on-line

advertising revenues, (iv) corporate transversal business line

activities, and (v) other miscellaneous revenues.

1 Excluding TOTEM Spain2 Unless otherwise stated,

percentage changes are on a year-on-year basis, calculated against

Q1 2023 on a comparable basis.3 Public Switched Telephone Network4

These targets are on a comparable basis and do not take into

account mergers and acquisitions not yet finalized. They exclude

the contribution of Orange Spain.

5 Excluding M2M and prepaid

- PR Q12024 Financial results

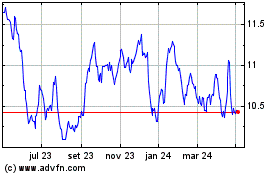

Orange (EU:ORA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

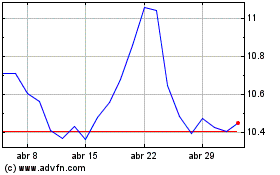

Orange (EU:ORA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024