Pulse Seismic Inc. (TSX:PSD) (OTCQX:PLSDF) (“Pulse” or the

“Company”) is pleased to report its financial and operating results

for the three months ended March 31, 2024. The unaudited condensed

consolidated interim financial statements, accompanying notes and

MD&A are being filed on SEDAR (www.sedar.com) and will be

available on Pulse’s website at www.pulseseismic.com.

Pulse’s Board of Directors today approved a 9%

increase to the regular dividend and declared a regular quarterly

dividend of $0.015 per share. This increase results in an

annualized regular dividend of $0.06 per share. The total of the

dividend will be approximately $780,000 based on Pulse’s 51,994,563

common shares outstanding as of April 24, 2024, and will be

paid on May 23, 2024, to shareholders of record on May 14, 2024.

These dividends are designated as an eligible dividend for Canadian

income tax purposes. For non-resident shareholders, Pulse’s

dividends are subject to Canadian withholding tax.

The annual general meeting of the shareholders of

Pulse Seismic Inc. will be held at 11:00 a.m. (MDT) on April 25,

2024 at the offices of McCarthy Tetrault LLP, Suite 4000,

421-7th Avenue SW, Calgary, Alberta.

HIGHLIGHTS FOR THE THREE MONTHS ENDED

MARCH 31, 2024

- A regular quarterly dividend of $0.01375 per share was declared

and paid in the first quarter;

- The special dividend of $0.20 per share totalling $10.5

million, declared in December 2023, was paid in the first quarter;

- Shareholder free cash flow(a) was $5.0 million ($0.10 per share

basic and diluted) compared to $5.3 million ($0.10 per share basic

and diluted) in the first quarter of 2023;

- EBITDA(a) was $6.2 million ($0.12 per share basic and diluted)

compared to $6.6 million ($0.12 per share basic and diluted) in the

first quarter of 2023;

- Net earnings were $2.7 million ($0.05 per share basic and

diluted) compared to net earnings of $2.9 million ($0.05 per share

basic and diluted) in the first quarter of 2023;

- Total revenue was $8.8 million compared to $8.4 million for the

three months ended March 31, 2023;

- In the three-month period ended March 31, 2024, Pulse purchased

and cancelled, through its normal course issuer bid, a total of

627,300 common shares at a total cost of approximately $1.2 million

(at an average cost of $1.89 per common share including

commissions); and

- At March 31, 2024, Pulse was debt-free and held cash of $13.8

million.

|

|

|

|

|

|

|

SELECTED FINANCIAL AND OPERATING INFORMATION |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| (Thousands

of dollars except per share data, |

Three months ended

March 31, |

Year

ended |

|

| numbers of

shares and kilometres of seismic data) |

2024 |

2023 |

December

31, |

|

|

|

(Unaudited) |

2023 |

|

| Revenue |

|

|

|

|

|

Data library sales |

8,777 |

8,407 |

39,127 |

|

| |

|

|

|

|

| Amortization

of seismic data library |

2,270 |

2,286 |

9,103 |

|

| Net

earnings |

2,681 |

2,908 |

15,007 |

|

|

Per share basic and diluted |

0.05 |

0.05 |

0.28 |

|

| Cash

provided by operating activities |

10,464 |

5,413 |

23,524 |

|

|

Per share basic and diluted |

0.20 |

0.10 |

0.44 |

|

|

EBITDA(a) |

6,229 |

6,615 |

30,431 |

|

|

Per share basic and diluted(a) |

0.12 |

0.12 |

0.57 |

|

| Shareholder

free cash flow(a) |

5,038 |

5,261 |

24,829 |

|

|

Per share basic and diluted(a) |

0.10 |

0.10 |

0.47 |

|

| |

|

|

|

|

| Capital

expenditures |

|

|

|

|

|

Seismic data |

225 |

- |

- |

|

|

Property and equipment |

- |

4 |

28 |

|

| Total

capital expenditures |

225 |

4 |

28 |

|

| |

|

|

|

|

|

Dividends |

|

|

|

|

|

Regular dividends |

715 |

670 |

2,862 |

|

|

Special dividends |

- |

- |

18,519 |

|

|

Total dividends |

715 |

670 |

21,381 |

|

| |

|

|

|

|

| Weighted

average shares outstanding |

|

|

|

|

|

Basic and diluted |

52,122,006 |

53,614,717 |

53,237,569 |

|

| Shares

outstanding at period-end |

51,994,563 |

53,596,769 |

52,621,863 |

|

| |

|

|

|

|

| Seismic

library |

|

|

|

|

|

2D in kilometres |

829,207 |

829,207 |

829,207 |

|

|

3D in square kilometres |

65,310 |

65,310 |

65,310 |

|

| |

|

|

|

|

|

FINANCIAL POSITION AND RATIO |

|

|

|

|

| |

March 31, |

March

31, |

December

31, |

|

|

(thousands of dollars except ratio) |

2024 |

2023 |

2023 |

|

| Working

capital |

10,579 |

11,136 |

7,468 |

|

| Working

capital ratio |

3.8:1 |

13.3:1 |

1.5:1 |

|

| Cash and

cash equivalents |

13,765 |

10,455 |

15,948 |

|

| Total

assets |

31,122 |

37,220 |

41,249 |

|

| Trailing

12-month (TTM) EBITDA(b) |

30,045 |

8,641 |

30,431 |

|

|

Shareholders’ equity |

26,543 |

35,679 |

25,655 |

|

| |

|

|

|

|

(a) The Company’s continuous disclosure

documents provide discussion and analysis of “EBITDA”, “EBITDA per

share”, “shareholder free cash flow” and “shareholder free cash

flow per share”. These financial measures do not have standard

definitions prescribed by IFRS and, therefore, may not be

comparable to similar measures disclosed by other companies. The

Company has included these non-GAAP financial measures because

management, investors, analysts and others use them as measures of

the Company’s financial performance. The Company’s definition of

EBITDA is cash available to invest in growing the Company’s seismic

data library, pay interest and principal on long-term debt when

applicable, purchase its common shares, pay taxes and the payment

of dividends. EBITDA is calculated as earnings (loss) from

operations before interest, taxes, depreciation and amortization.

EBITDA per share is defined as EBITDA divided by the weighted

average number of shares outstanding for the period. The Company

believes EBITDA assists investors in comparing Pulse’s results on a

consistent basis without regard to non-cash items, such as

depreciation and amortization, which can vary significantly

depending on accounting methods or non-operating factors such as

historical cost. Shareholder free cash flow further refines the

calculation by adding back non-cash expenses and deducting net

financing costs and current income tax expense from EBITDA.

Shareholder free cash flow per share is defined as shareholder free

cash flow divided by the weighted average number of shares

outstanding for the period. (b) TTM EBITDA is defined as the sum of

EBITDA generated over the previous 12 months and is used to provide

a comparable annualized measure. These non-GAAP financial measures

are defined, calculated and reconciled to the nearest GAAP

financial measures in the Management's Discussion and Analysis.

OUTLOOK

Following the high level of data licensing and

financial performance achieved in 2023, the Company has also

experienced a solid start to 2024, generating $8.8 million of

revenue in the first quarter. While the outlook for economic and

commodity markets is mixed, several factors are expected to have a

positive impact on the year ahead in the energy industry. The

continued strength in crude oil prices and expectations that global

demand for fossil fuels will continue to trend upward is key. The

completion of the Trans Mountain Pipeline Expansion project is

imminent and the LNG Canada facility is expected to be operational

in 2025. These critical energy projects will provide increased

export capacity for delivering both oil and natural gas to global

markets.

After two high-volume years of industry Merger

& Acquisition activity, Sayer Energy Advisors reported that

they anticipate a year-over-year reduction to approximately $12

billion in 2024. This forecast reflects the stronger balance sheets

and profitability in the industry and, accordingly, fewer assets

and companies for sale. An initial 2024 forecast by Enserva

anticipates industry capital spending growth of a further 10

percent this year. Land sales are also forecast to remain robust.

In November 2023, the Canadian Association of Energy Contractors

issued an initial 2024 drilling forecast of 6,229 wells, up from

5,748 in 2023.

The Company cautions, as always, that industry

conditions do not provide visibility regarding Pulse’s seismic data

library sales levels and remains focused on the business practices

that have served it throughout the full range of conditions. Pulse

maintains a strong balance sheet, has zero debt, no capital

spending commitments, and a disciplined and rigorous approach to

evaluating growth opportunities. This 15-person company, led by an

experienced and capable management team, operates with a low-cost

structure and focuses on developing excellent client relations and

providing exceptional customer service. Pulse’s strong financial

position, high leverage to increased revenue in its EBITDA margin

and careful management of its cash resources have resulted in the

return of capital to shareholders through regular and special

dividends and the repurchase of its shares.

CORPORATE PROFILE

Pulse is a market leader in the acquisition,

marketing and licensing of 2D and 3D seismic data to the western

Canadian energy sector. Pulse owns the largest licensable seismic

data library in Canada, currently consisting of approximately

65,310 square kilometres of 3D seismic and 829,207 kilometres of 2D

seismic. The library extensively covers the Western Canada

Sedimentary Basin, where most of Canada’s oil and natural gas

exploration and development occur.

For further information, please contact:

Neal Coleman, President and CEO Or Pamela

Wicks, Vice President Finance and CFO Tel.: 403-237-5559

Toll-free: 1-877-460-5559 E-mail: info@pulseseismic.com. Please

visit our website at www.pulseseismic.com

This document contains information that

constitutes “forward-looking information” or “forward-looking

statements” (collectively, “forward-looking information”) within

the meaning of applicable securities legislation. Forward-looking

information is often, but not always, identified by the use of

words such as “anticipate”, “believe”, “expect”, “plan”, “intend”,

“forecast”, “target”, “project”, “guidance”, “may”, “will”,

“should”, “could”, “estimate”, “predict” or similar words

suggesting future outcomes or language suggesting an outlook.

The Outlook section herein contain forward-looking information

which includes, but is not limited to, statements regarding:

|

> |

The outlook of the Company for the year ahead, including future

operating costs and expected revenues; |

|

> |

Recent events on the political,

economic, regulatory, public health and legal fronts affecting the

industry’s medium- to longer-term prospects, including progression

and completion of contemplated pipeline projects; |

|

> |

The Company’s capital resources

and sufficiency thereof to finance future operations, meet its

obligations associated with financial liabilities and carry out the

necessary capital expenditures through 2024; |

|

> |

Pulse’s capital allocation

strategy; |

|

> |

Pulse’s dividend policy; |

|

> |

Oil and natural gas prices and

forecast trends; |

|

> |

Oil and natural gas drilling

activity and land sales activity; |

|

> |

Oil and natural gas company

capital budgets; |

|

> |

Future demand for seismic

data; |

|

> |

Future seismic data sales; |

|

> |

Pulse’s business and growth

strategy; and |

|

> |

Other expectations, beliefs, plans, goals, objectives, assumptions,

information and statements about possible future events,

conditions, results and performance, as they relate to the Company

or to the oil and natural gas industry as a whole. |

By its very nature, forward-looking information

involves inherent risks and uncertainties, both general and

specific, and risks that predictions, forecasts, projections and

other forward-looking statements will not be achieved. Pulse does

not publish specific financial goals or otherwise provide guidance,

due to the inherently poor visibility of seismic revenue. The

Company cautions readers not to place undue reliance on these

statements as a number of important factors could cause the actual

results to differ materially from the beliefs, plans, objectives,

expectations and anticipations, estimates and intentions expressed

in such forward-looking information. These factors include, but are

not limited to:

|

> |

Uncertainty of the timing and volume of data sales; |

|

> |

Volatility of oil and natural gas

prices; |

|

> |

Risks associated with the oil and

natural gas industry in general; |

|

> |

The Company’s ability to access

external sources of debt and equity capital; |

|

> |

Credit, liquidity and commodity

price risks; |

|

> |

The demand for seismic data

and; |

|

> |

The pricing of data library

licence sales; |

|

> |

Cybersecurity; |

|

> |

Relicensing (change-of-control)

fees and partner copy sales; |

|

> |

Environmental, health and safety risks; |

|

> |

Federal and provincial government laws and regulations, including

those pertaining to taxation, royalty rates, environmental

protection, public health and safety; |

|

> |

Competition; |

|

> |

Dependence on key management, operations and marketing

personnel; |

|

> |

The loss of seismic data; |

|

> |

Protection of intellectual

property rights; |

|

> |

The introduction of new products;

and |

|

> |

Climate change. |

Pulse cautions that the foregoing list of

factors that may affect future results is not exhaustive.

Additional information on these risks and other factors which could

affect the Company’s operations and financial results is included

under “Risk Factors” in the Company’s most recent annual

information form, and in the Company’s most recent audited annual

financial statements, most recent MD&A, management information

circular, quarterly reports, material change reports and news

releases. Copies of the Company’s public filings are available on

SEDAR at www.sedar.com.

When relying on forward-looking information to

make decisions with respect to Pulse, investors and others should

carefully consider the foregoing factors and other uncertainties

and potential events. Furthermore, the forward-looking information

contained in this document is provided as of the date of this

document and the Company does not undertake any obligation to

update publicly or to revise any of the included forward-looking

information, except as required by law. The forward-looking

information in this document is provided for the limited purpose of

enabling current and potential investors to evaluate an investment

in Pulse. Readers are cautioned that such forward-looking

information may not be appropriate, and should not be used, for

other purposes.

PDF

available: http://ml.globenewswire.com/Resource/Download/3cc6514a-57ae-41a9-a186-49fe4fe40991

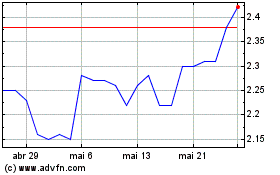

Pulse Seismic (TSX:PSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Pulse Seismic (TSX:PSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025