Xali Gold Announces a Modification to Deal Terms for SDA Plant in Mexico

25 Abril 2024 - 8:00AM

Xali Gold Corp. (TSXV:XGC) ("Xali Gold” or the “Company”) is

pleased to announce that it has granted a temporary modification to

the deal terms with Mexican company, Grupo Minero WIYA

(“

WIYA”) regarding the San Dieguito de Arriba

(“

SDA”) Plant in Nayarit, Western Mexico. While

the original Rent to Purchase Agreement as per the Xali Gold News

Release dated December 18, 2023 remains in place, WIYA and the

Company have agreed to a three month modification of terms so that

WIYA has time to better develop their mining

operations.

“We are pleased that WIYA was able to put our

SDA Plant into operation and demonstrate that it functions well,”

says Joanne Freeze, President and CEO of Xali Gold. “We remain

encouraged that our business relationship with WIYA could develop

into a long-term mutually beneficial partnership for developing

various small mines in Nayarit using our exploration skills and

their financial strength.”

Operation of the plant was temporarily put on

hold in March 2024 as WIYA was unable to supply sufficient

mineralized material to the plant to sell concentrates, receive a

steady income and make payments to the Company.

Terms of the Temporary Modification to

Rent to Purchase Agreement

WIYA Agrees to:

- Pay US$45,000 to Xali Gold within

15 days from the plant restarting, which will be credited against

the final payment due as part of the Rent to Purchase agreement

dated December 8, 2023.

- Pay Xali Gold US$30.00/ton for each

ton processed with bi-weekly minimum payments of US$30,000.

Processing is expected to be between 2,700 and 3,000 tons per month

and monthly adjustments of the overall tonnage processed will also

be paid. For example, if 3,000 tons are processed during one month,

then payments to Xali Gold would total US$90,000.

- Maintain a minimum of 1,500 tons of

mineral at the plant with a guaranteed value, based on

metallurgical tests, to initially operate for at least 15 days with

reasonable profits.

The rest of the general terms of the December 8,

2023 Rent to Purchase Agreement between WIYA and Xali Gold not

temporarily modified in this 3 month agreement, remain in force.

The profits from the partnership will be shared equally with

Magellan Acquisitions Corp. (“Magellan”), as the

Company and Magellan each own 50% of the SDA plant, as per the earn

in agreement with Magellan.

During the lease period, Xali Gold will provide

adequate supervision and will authorize the personnel who will

operate in the SDA Plant. Xali Gold also has the right to

coordinate all technical and administrative activities, in order to

assist WIYA in the operation.

About Xali Gold

Xali Gold has gold and silver projects in Peru

and Mexico. The Company’s flagship project El Oro is a district

scale gold project encompassing a well-known prolific high-grade

gold dominant gold-silver epithermal vein system in Mexico. The

project covers 20 veins with past production and more than 57 veins

in total, from which approximately 6.4 million ounces of gold and

74 million ounces of silver were reported to have been produced

from just two of these veins (Ref. Mexico Geological Service

Bulletin Nr. 37, Mining of the El Oro and Tlapujahua Districts.

1920, T. Flores).

Modern understanding of epithermal vein systems

indicates that several of the El Oro district’s veins hold

excellent discovery potential, particularly below and adjacent to

the historic workings of the San Rafael Vein, which was mined to an

average depth of only 200m.

Xali Gold is dedicated to being a responsible

Community partner.

Joanne C. Freeze, P.Geo., President and CEO is

the Qualified Person as defined by National Instrument 43-101 for

the projects discussed above. Ms. Freeze has reviewed and approved

the contents of this release.

Neither the TSX Venture Exchange nor its

Regulation Services Provider accepts responsibility for the

adequacy or accuracy of this release.

Forward-looking InformationThis

news release may contain forward-looking information (as such term

is defined under Canadian securities laws) including but not

limited to historical production records. While such

forward-looking information is expressed by Xali Gold in good faith

and believed by Xali Gold to have a reasonable basis, they may

address future events and conditions and are therefore subject to

inherent risks and uncertainties including those set out in Xali

Gold’s MD&A. Factors that cause the actual results to differ

materially from those in forward-looking information include,

without limitation, gold prices, results of exploration and

development activities, regulatory changes, defects in title,

availability of materials and equipment, timeliness of government

approvals, potential environmental issues, availability of capital

and financing and general economic, market or business conditions.

Xali Gold expressly disclaims any intention or obligation to update

or revise any forward-looking information, whether as a result of

new information, future events or otherwise, except in accordance

with applicable securities laws.

On behalf of the Board of Xali Gold

Corp.

“Joanne Freeze” P.Geo.President, CEO and

Director

For further information please contact:Joanne

Freeze, President & CEOTel: + 1 (604)

689-1957info@xaligold.com

NR 129

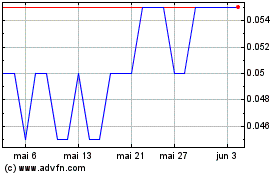

Xali Gold (TSXV:XGC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

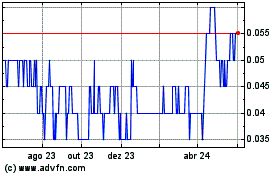

Xali Gold (TSXV:XGC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024