Cassava Sciences Announces Over $125 Million Raised from Warrant Distribution

08 Maio 2024 - 12:00PM

Cassava Sciences, Inc. (Nasdaq: SAVA) (the “Company”), a

biotechnology company focused on Alzheimer’s disease, today

announced total gross proceeds of over $125 million from

cash-exercises of warrants that were previously distributed to its

shareholders (the “Warrants”). Gross proceeds from the Warrants

represents the issuance of approximately 5.7 million common shares

at an effective price of $22.00 per share.

B. Dyson Capital Advisors served as exclusive

financial advisor on the Warrant distribution.

“We are grateful to so many shareholders who

continue to show support for Cassava Sciences and its mission to

develop a novel drug candidate for Alzheimer’s disease,” said Remi

Barbier, President and CEO. “Given the outcome of our first Warrant

distribution, it could be interesting to do it again at some point

in the future.”

Warrant holders had the option to cash-exercise

their Warrants or to sell their Warrants on the open market.

Warrant holders who opted to exercise their Warrants paid cash to

the Company under the terms and conditions of a warrant agreement

previously filed with the U.S. Securities and Exchange Commission

(“SEC”).

“My impression is that most shareholders

appreciated receiving Warrants,” said Eric Schoen, Chief Financial

Officer. “Shareholders had the choice to sell their Warrants and

receive cash, or to exercise their Warrants and increase their

equity stake in the Company.”

Total net proceeds to Cassava Sciences from

Warrants are estimated at over $123 million after deducting

advisory fees and certain other expenses. The Company intends to

use the net proceeds for working capital and general corporate

purposes, including continued development of simufilam, the

Company’s lead drug candidate for the proposed treatment of

Alzheimer’s disease.

The last and final deadline to cash-exercise

Warrants was May 6th, 5pm New York City time. There is no further

opportunity to exercise Warrants. Any Warrants outstanding that

were not validly exercised by 5:00 p.m. New York City time on May

6, 2024, were being redeemed by the Company starting on or around

May 7, 2024 (the “Redemption Date”) for a nominal payment of $0.001

per warrant (the “Redemption Price”). The Redemption Price will

become due and payable with respect to each outstanding warrant on

the Redemption Date. All Warrants shall terminate and expire on the

Redemption Date, subject to payment of the Redemption Price.

The shares of common stock were issued by

Cassava Sciences pursuant to an automatic "shelf" registration

statement on Form S-3, which was filed with the SEC on May 1, 2023,

and became effective immediately upon filing, and the prospectus

contained therein.

This press release shall not constitute an offer to sell, or the

solicitation of an offer to buy any of the securities described

herein, nor shall there be any sale of these securities in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful, prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Cassava Sciences,

Inc.Cassava Sciences is a clinical-stage biotechnology

company based in Austin, Texas. Our mission is to detect and treat

neurodegenerative diseases, such as Alzheimer’s disease. Our novel

science is based on stabilizing—but not removing—a critical protein

in the brain.

For more information, please visit:

https://www.CassavaSciences.com

For More Information Contact: Eric Schoen,

Chief Financial Officer(512) 501-2450 or

ESchoen@CassavaSciences.com

Cautionary Note Regarding

Forward-Looking Statements and Other Notices: This news

release contains forward-looking statements, including statements

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. These statements may be

identified by words such as “anticipate,” “believe,” “could,”

“expect,” “forecast,” “intend,” “may,” “plan,” “possible,”

“potential,” “will,” and other words and terms of similar

meaning.

Such statements are based largely on our current

expectations and projections about future events. Such statements

speak only as of the date of this news release and are subject to a

number of risks, uncertainties and assumptions, including, but not

limited to: the intended use of proceeds from the Warrants; the

potential for us to do additional warrant distributions in the

future on similar or materially different terms and conditions;

comments made by our employees regarding the Warrants; and the

potential treatment of Alzheimer’s disease with simufilam, the

Company’s lead drug candidate.

The foregoing sets forth many, but not all, of

the factors that could cause actual results to differ from

expectations in any forward-looking statement. In light of these

risks, uncertainties and assumptions, the forward-looking

statements and events discussed in this news release are inherently

uncertain and may not occur, and actual results could differ

materially and adversely from those anticipated or implied in the

forward-looking statements. Accordingly, you should not rely upon

forward-looking statements as predictions of future events. Except

as required by law, we disclaim any intention or responsibility for

updating or revising any forward-looking statements contained in

this news release. For further information regarding these and

other risks related to our business, investors should consult our

filings with the SEC, which are available on the SEC's website at

www.sec.gov.

We are in the business of new drug discovery and development.

Our research and development activities are long, complex, costly

and involve a high degree of risk. Holders of our common stock

should carefully read our current Annual Report on Form 10-K for

the year ended December 31, 2023, and future reports to be filed

with the SEC, including the risk factors therein. Because risk is

fundamental to the process of drug discovery and development, you

are cautioned to not invest in our publicly traded securities

unless you are prepared to sustain a total loss of the money you

have invested.

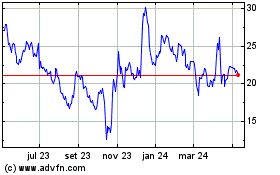

Cassava Sciences (NASDAQ:SAVA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Cassava Sciences (NASDAQ:SAVA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024