TerraVest Industries Inc. (TSX:TVK) (“TerraVest” or the “Company”)

is pleased to announce, that as a result of strong investor demand,

it has entered into a revised agreement to increase the size of its

previously announced bought deal treasury offering. Under the

revised agreement, the Company has agreed to sell, on a bought deal

basis, 1,134,000 common shares (the “Shares”) from treasury to a

syndicate of underwriters (the “Underwriters”) with National Bank

Financial Inc., Canaccord Genuity Corporation, and Desjardins

Capital Markets acting as Co-Bookrunners. The Shares will be

offered at a price of $74.25 per Share (the “Offering Price”), for

gross proceeds to the Company of approximately $84,199,500 (the

“Offering”).

As the Company continues to pursue acquisition

opportunities, it wishes to maintain flexibility to take advantage

of these opportunities should the situation warrant. The net

proceeds from the Offering will be initially allocated towards

repaying existing debt and supporting general corporate activities,

until required for future acquisitions or growth opportunities.

The Company has also granted the Underwriters an

option to purchase up to an additional 166,000 Shares, representing

approximately 15% of the size of the Offering (the “Over-Allotment

Option”), on the same terms and conditions, exercisable in whole or

in part, up to 30 days after the closing of the Offering. If the

Over-Allotment Option is exercised in full, the Company will

receive additional gross proceeds of $12,325,500, for aggregate

gross proceeds from the Offering of $96,525,000.

"The successful completion of the Offering will

further strengthen our balance sheet and position us favourably to

continue investing in and improving our current portfolio, while

also pursuing our long-term strategy for acquisitions,” said Dustin

Haw, CEO of TerraVest Industries Inc.

The Shares will be offered in each of the

provinces of Canada by way of a prospectus supplement (the

“Prospectus Supplement”) to the short form base shelf prospectus

(the “Shelf Prospectus”) of the Company dated May 8, 2024.

Closing of the Offering is expected to occur on

or about May 15, 2024. The Offering is subject to normal regulatory

approvals, including approval of the Toronto Stock Exchange of the

listing of the Shares.

Access to the Shelf Prospectus, the Prospectus

Supplement, and any amendments to the documents are provided in

accordance with securities legislation relating to procedures for

providing access to a base shelf prospectus, a prospectus

supplement and any amendment to the documents. The Shelf Prospectus

is, and the Prospectus Supplement will be (within two business days

from the date hereof), accessible on SEDAR+ at

www.sedarplus.ca.

An electronic or paper copy of the Shelf

Prospectus, the Prospectus Supplement (when filed), and any

amendment to the documents may be obtained, without charge, from

National Bank Financial Inc. by phone at (416) 869-8414 or by

e-mail at NBF-Syndication@bnc.ca. The Shelf Prospectus and

Prospectus Supplement will contain important detailed information

about the Company and the proposed Offering. Prospective investors

should read the Shelf Prospectus and Prospectus Supplement (when

filed) and the other documents the Company has filed on SEDAR+

before making an investment decision.

The Shares have not been and will not be

registered under the United States Securities Act of 1933, as

amended, and accordingly will not be offered, sold or delivered,

directly or indirectly within the United States, its possessions

and other areas subject to its jurisdiction or to, or for the

account or for the benefit of a United States person, except

pursuant to applicable exemptions from the registration

requirements.

ABOUT TERRAVEST INDUSTRIES INC.:

TerraVest is a diversified industrial company

that manufactures and sells goods and services to a variety of

end-markets. The Company is a market-leading manufacturer of home

heating products, propane, anhydrous ammonia (“NH3”) and natural

gas liquids (“NGL”) transport vehicles and storage vessels, energy

processing equipment and fiberglass storage tanks. TerraVest is

focused on acquiring and operating market-leading businesses that

will benefit from TerraVest’s financial and operational support.

For more information on the Company, please visit

https://terravestindustries.com/. Additional information relating

to the Company, including all public filings, is available on

SEDAR+ (www.sedarplus.ca).

FOR FURTHER INFORMATION, PLEASE CONTACT:

Dustin HawChief Executive OfficerTerraVest

Industries Inc.ir@terravestindustries.com

Caution Concerning Forward-Looking

Statements

This news release contains forward-looking

statements. All statements other than statements of historical fact

contained in this news release are forward-looking statements,

including, without limitation, statements regarding the Offering,

anticipated timing of the Closing of the Offering, potential for

future acquisitions by TerraVest, our strategic direction and

evaluation of the business segments and TerraVest as a whole,

TerraVest’s plans with respect to its existing portfolio businesses

and other plans and objectives of or involving TerraVest. Readers

can identify many of these statements by looking for words such as

“expects” and “will” or similar terms or variations of these words.

Although management believes that the expectations represented in

such forward-looking statements are reasonable, there can be no

assurance that such expectations will prove to be correct.

By their nature, forward-looking statements

require us to make assumptions and, accordingly, forward-looking

statements are subject to inherent risks and uncertainties. There

is significant risk that the forward-looking statements will not

prove to be accurate. We caution readers of this news release not

to place undue reliance on our forward-looking statements because a

number of factors may cause actual future circumstances, results,

conditions, actions or events to differ materially from the plans,

expectations, estimates or intentions expressed in the

forward-looking statements and the assumptions underlying the

forward-looking statements.

Assumptions and analysis about the performance

of TerraVest as a whole and its business segments, the markets in

which the business segments compete and the prospects and values of

the business segments are considered in setting the business plan

for TerraVest, plans and/or ability to pay dividends, outlook for

operations, financial position, results and cash flows, other plans

and objectives and in making related forward-looking statements.

Such assumptions include, without limitation, demand for products

and services of the business segments in respect of the Canadian

and other markets in which the businesses are active will be

stable, and that input costs to business segments do not vary

significantly from levels experienced historically. Should any of

these factors or assumptions vary, actual results may differ

materially from the forward-looking statements.

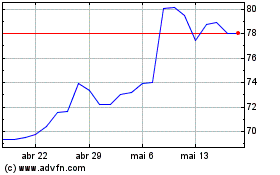

TerraVest Industries (TSX:TVK)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

TerraVest Industries (TSX:TVK)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024