Ascot Resources Ltd. (

TSX: AOT; OTCQX:

AOTVF) (“

Ascot” or the

“

Company”) is pleased to announce the Company’s

unaudited financial results for the three months ended March 31,

2024 (“

Q1 2024”), and also to provide a

construction update on the Company’s Premier Gold Project

(“

PGP” or the “

project”), located

on Nisga’a Nation Treaty Lands in the prolific Golden Triangle of

northwestern British Columbia. For details of the unaudited

condensed interim consolidated financial statements and

Management's Discussion and Analysis for the three months ended

March 31, 2024, please see the Company’s filings on SEDAR+

(www.sedarplus.ca).

All amounts herein are reported in $000s of

Canadian dollars (“C$”) unless otherwise

specified.

Q1 2024 AND RECENT HIGHLIGHTS

- On May 7, 2024,

the Company announced a $5,000 non-brokered flow through private

placement (the “Offering”), the proceeds of which will be used to

fund the 2024 exploration program at the PGP. The Offering will

consist of 6,024,096 common shares of the Company, which qualify as

"flow-through shares" within the meaning of the Income Tax Act

(Canada) (the “FT Shares”), at a price of $0.83 per FT Share. The

closing of the Offering is expected to occur in one or more

tranches in or around late-May to mid-June 2024, and is subject to

certain conditions including, but not limited to, the receipt of

all necessary regulatory approvals, including the acceptance of the

Toronto Stock Exchange.

- Rock was

introduced into the grinding circuit of the mill on March 31, 2024,

and first gold-bearing ore was introduced to the mills on April 5,

2024. On April 20, 2024, first gold was poured as a part of the

commissioning process. Commissioning of the processing plant at PGP

is ongoing, with commercial production anticipated in Q3 2024. Two

gold pours have been completed using gold recovered from the

gravity circuit. Another pour from gold recovered from the

carbon-in-leach (“CIL”) circuit is anticipated imminently.

- On February 20,

2024, the Company closed its previously announced financing package

for a total of US$50 million from Sprott Resource Streaming and

Royalty Corp. and its affiliates (“SRSR”) and Nebari Credit Fund

II, LP (“Nebari Credit Fund II”), as described in the Company’s

news release dated January 22, 2024. $13,700 of the above proceeds

were used to buy back two existing 5% NSR royalties on various PGP

property claims on March 15, 2024.

- On February 20,

2024, concurrently with the above-noted financing package, the

Company closed its previously announced bought deal private

placement financing, under which the Company issued a total of

65,343,000 common shares of the Company (the “Common Shares”) at a

price of $0.44 per Common Share, for gross proceeds of

$28,751.

- At the end of Q1

2024, overall construction excluding mine development was 98%

complete compared with 86% complete at the end of 2023. A few

remaining commissioning activities in the mill are underway. The

tailing storage facility was completed and signed off by the

engineer of record at the end of March 2024.

- The new water

treatment plant began operations in February 2024. The high-density

sludge plant has been successfully commissioned and water is being

treated and discharged into the environment. The moving bed

bio-reactor (“MBBR”) is complete and media have been loaded into

the tanks.

- As of April 30,

2024, underground development totaled approximately 2,710 metres at

Big Missouri and 150 metres at Premier.

DEVELOPMENT OF THE PROJECT

Project financingOn February

20, 2024, the Company closed a bought deal private placement for

gross proceeds of $28,751 and a financing package of US$50 million

for the completion and ramp-up of PGP. The financing package

consisted of a royalty restructuring and a cost overrun

facility.

Construction progress key performance

indicatorsAt the end of Q1 2024, overall construction was

98% complete, compared with 86% complete at the end of Q4 2023.

With first gold having been poured on April 20, 2024 via gold

recovered through the gravity circuit, the project construction is

100% complete on schedule and on the most recently provided budget

of approximately C$339 million. Commissioning and ramp-up

activities in the processing plant and in the mine continue towards

achieving commercial production in Q3 of 2024.

SafetyThe Project had no lost

time injuries in Q1 2024. There was an increase in recordable

injuries at the end of the quarter which in part, can be

attributable to seasonal changes and the transition from

construction to operations. As the Project continues its transition

from construction into operations, focus has been placed on the

ongoing development of standard operating procedures, in field job

hazard analysis and worker training. There was a small increase in

property damage reported in the quarter due in part to weather

conditions and the onboarding of a significant number of new

workers to the site. The re-enforcement of reporting to the

operating team remains a key focus to ensure that all learnings are

identified and applied to prevent re-occurrence and reflect in the

future training plans. In Q2 2024, significant work will be placed

to support the operational teams to begin to operate the newly

constructed plant through the final stages of C4 and C5

commissioning.

Processing plant and site

infrastructure Mechanical and electrical work in the mill

was substantially completed in Q1 2024 with minor associated

systems and punch list items to complete. Focus has shifted to

commissioning the process plant and ramp up as well as completing

minor deficiencies.

Stage one of the tailings storage facility

(“TSF”) raise was completed and accepted by the Engineer of Record

for use. Earthworks activities in 2024 will focus on raising the

spillway dam by three metres, producing material for the 2025 raise

and advanced work on the Cascade Creek Diversion in preparation for

the 2025 works and final completion of the diversion.

The new water treatment plant was substantially

mechanically and electrically completed in Q4 2023 with some minor

areas remaining. The high-density sludge circuit was commissioned

in Q1 2024 and is advancing towards full ramp up. The MBBR circuit

was substantially complete in Q1 2024 and will begin full

commissioning as the process plant continues to deposit tailings

into the TSF and feed nitrogen species into the MBBR circuit.

The site power reticulation was completed in Q1

2024. Sustaining capital works in 2024 will focus on reticulation

to the Premier portal as well as the Big Missouri portal.

Mine developmentProcon Mining

& Tunnelling (“Procon”) a mine contractor with extensive

experience in BC and the Golden Triangle continued to advance mine

development at two portal areas: S1 about 9 kilometres north of the

mill which accesses the Big Missouri and Silver Coin deposits, and

the mill adjacent Premier Northern Light (“PNL”) portal which

accesses the Premier and Northern Light orebodies. As of the end of

Q1 2024, Procon had about 57 people on site, 40 of whom were miners

and 10 were maintenance personnel.

At Big Missouri, Procon advanced development

into several ore headings in the A zone, as well as reactivating

the S1 ramp heading that goes to Silver Coin deposit. In Q1 Procon

developed 936 metres at Big Missouri (258 metres in ore and 678

metres in waste, and by April 29, 2024, development advanced to 905

metres in waste and 507 metres in ore total in 2024. Including the

development completed in late 2022 and late 2023, the total

development to date is approximately 2,710 metres in both ore and

waste. Productivities at Big Missouri have continued to improve,

with availability of key equipment such as Maclean bolters being

made a priority.

During Q1 2024, the geological team continued to

encounter high grade material occurrences in both face sampling and

probe hole drilling in multiple areas of the A zone. As previously

reported, these occurrences are in or very near existing wireframes

or logical extensions of wireframes. At the end of March 31, 2024,

a total of approximately 30,000 tonnes of ore was mined from Big

Missouri and stockpiled at Diego pit.

At PNL, Procon dealt with issues related to near

surface structure and weak ground. These issues seem to have abated

at the end of April, and Procon has started to make better progress

as they move into the better ground conditions expected at Premier

given what was seen historically. In Q1 2024 approximately 85

metres were advanced at PNL, and at the end of April this increased

to approximately 150 metres as ground conditions improved.

Mining development is being advanced down into

the Premier deposit for initial mining in the Prew Zone, with ore

development now anticipated to begin in early Q3 2024, and initial

longhole stope production following later in Q3 2024. The ramp has

been strategically laid out to allow for underground drilling on

the Sebakwe Zone in 2024 and will eventually connect a footwall

ramp over to the 602 area at the southern end of the Premier

deposit. Although progress has been slow, the quality of the

resultant work with ground control and shotcrete arches has been

excellent, allowing for a secure and stable ramp for the

life-of-mine production to come from this area approximately 350

metres from the Premier Mill.

RecruitmentAt the end of Q1

2024, total site recruitment has reached approximately 90% of the

planned operational team. A key achievement was the successful

recruitment for some challenging roles pertaining particularly to

some of the maintenance roles, health and safety (specifically,

mine rescue), and technical roles for the mine and processing area.

Policies and procedures development have been ongoing throughout Q1

2024 and key documents will be rolled out in Q2 2024.

Permitting and Environmental

ComplianceA Joint Permit Amendment Application (“JPAA”)

was required to be re-aligned with the project completion dates and

was submitted in October 2023. The JPAA underwent first round

comments through February 2024 and second round comments were

received in late April 2024, with our responses anticipated to be

submitted in May 2024.

The air permit was received on March 25, 2024.

The updated environmental permit PE-8044, including the sewage

treatment facility discharge permit is anticipated to be received

in late May 2024.

2024 EXPLORATION PROGRAM

Planning for the 2024 exploration program is in

full swing with an anticipated start date in late June. There are

several areas on the properties that will be targeted by new

drilling. Near the Premier mill, several drill holes have been

planned around the Prew and Sebakwe zones of the Premier deposit.

The new holes will complement the existing drill pattern at Prew

and test induced polarization geophysical anomalies from last

year’s survey.

Additional drill holes have been planned for the

Big Missouri deposit where underground development is rapidly

providing access to different parts of the deposit. The new holes

will be designed for resource conversion and mine plan addition at

this deposit. Specific new drill targets have been identified at

the Day Zone on the western edge of the deposit, where geophysical

anomalies seem to outline previously untested mineralization along

strike of known ore zones.

Additional exploration drill holes are targeting

a large geophysical anomaly to the west of the Dilworth deposit

that extends surface showings to the north onto Ascot’s PGP

property. This target has a large strike extent and may require

drilling over more than one exploration season.

The Company anticipates a drill program of

between 15,000 and 20,000 metres distributed over the areas

described above. The program will require utilization of two drill

rigs into late September or early October 2024.

FINANCIAL RESULTS FOR THE THREE MONTHS

ENDED MARCH 31, 2024

The Company reported a net loss of $6,208 for Q1

2024 compared to $7,589 for Q1 2023. The lower net loss for the

current period is primarily attributable to a $2,170 decrease in

the loss on extinguishment of debt and a $1,196 decrease in

financing costs, partially offset by increases in other expense

categories.

LIQUIDITY AND CAPITAL

RESOURCES

As at March 31, 2024, the Company had cash &

cash equivalents of $47,028 and working capital deficiency of

$33,030. The working capital deficiency is caused by an estimated

$23,024 as the current portion of the deferred revenue only to be

settled with future production from the Project and the $25,180

value of the Convertible facility, which is classified as current

due to the lender’s right to exercise the conversion option at any

time at a variable exercise price. Excluding these non-cash current

liabilities, working capital was $15,174. In Q1 2024, the Company

issued 67,807,135 common shares, 10,164,528 warrants, and granted

110,000 stock options and 28,667 Deferred Share Units. Also,

100,766 stock options expired or were forfeited, 24,427 Restricted

Share Units were forfeited, and 99,039 stock options, 137,533

Deferred Share Units and 158,726 Restricted Share Units were

exercised in Q1 2024.

MANAGEMENT’S OUTLOOK FOR

2024

In 2024, the Company will transition from the

construction of the mine and related infrastructure to the

operation of the entire site and becoming a gold producer. Despite

the challenges associated with this transition, there are many

opportunities for the Company to grow and create value.

The key activities and priorities for 2024

include:

- Making health

and safety a priority in the commencement of operations

- Completing the

commissioning of the process plant

- Completing the

access ramp and starting the mine production at the Premier

deposit

- Continuing to

expand the mine production and development at the Big Missouri

deposit

- Shipping and

selling of gold doré

- Advancing the

exploration and infill drilling program on the numerous

opportunities to increase resources

- Compliance with

the environmental requirements of the site and making sure water

treatment and the tailings management facility operate as

designed

- Successfully

transition from a mine developer to a mine operator

Qualified Person

John Kiernan, P.Eng., Chief Operating Officer of

the Company is the Company’s Qualified Person (QP) as defined by

National Instrument 43-101 and has reviewed and approved the

technical contents of this news release.

On behalf of the Board of Directors of

Ascot Resources Ltd.“Derek C. White”President & CEO,

and Director

For further information

contact:

David Stewart, P.Eng.VP, Corporate Development

& Shareholder Communications dstewart@ascotgold.com

778-725-1060 ext. 1024

About Ascot Resources Ltd.

Ascot is a Canadian mining company focused on

commissioning its 100%-owned Premier Gold Mine, which poured first

gold in April 2024 and is located on Nisga’a Nation Treaty Lands,

in the prolific Golden Triangle of northwestern British Columbia.

Concurrent with commissioning Premier towards commercial production

anticipated in Q3 of 2024, the Company continues to explore its

properties for additional high-grade gold mineralization. Ascot’s

corporate office is in Vancouver, and its shares trade on the TSX

under the ticker AOT and on the OTCQX under the ticker AOTVF. Ascot

is committed to the safe and responsible operation of the Premier

Gold Mine in collaboration with Nisga’a Nation and the local

communities of Stewart, BC and Hyder, Alaska.

For more information about the Company, please

refer to the Company’s profile on SEDAR+ at www.sedarplus.ca or

visit the Company’s web site at www.ascotgold.com.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements and other information contained

in this press release about anticipated future events may

constitute forward-looking information under Canadian securities

laws ("forward-looking statements").

Forward-looking statements are often, but not always, identified by

the use of words such as "seek", "anticipate", "believe", "plan",

"estimate", "expect", "targeted", "outlook", "on track" and

"intend" and statements that an event or result "may", "will",

"should", "could", “would” or "might" occur or be achieved and

other similar expressions. All statements, other than statements of

historical fact, included herein are forward-looking statements,

including statements in respect of the terms of the Offering, the

closing of the Offering, the advancement and development of the PGP

and the timing related thereto, the completion of the PGP mine, the

production of gold and management’s outlook for the remainder of

2024 and beyond. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements, including risks associated with

entering into definitive agreements for the transactions described

herein; fulfilling the conditions to closing of the transactions

described herein, including the receipt of TSX approvals; the

business of Ascot; risks related to exploration and potential

development of Ascot's projects; business and economic conditions

in the mining industry generally; fluctuations in commodity prices

and currency exchange rates; uncertainties relating to

interpretation of drill results and the geology, continuity and

grade of mineral deposits; the need for cooperation of government

agencies and indigenous groups in the exploration and development

of Ascot’s properties and the issuance of required permits; the

need to obtain additional financing to develop properties and

uncertainty as to the availability and terms of future financing;

the possibility of delay in exploration or development programs and

uncertainty of meeting anticipated program milestones; uncertainty

as to timely availability of permits and other governmental

approvals; and other risk factors as detailed from time to time in

Ascot's filings with Canadian securities regulators, available on

Ascot's profile on SEDAR+ at www.sedarplus.ca including the Annual

Information Form of the Company dated March 25, 2024 in the section

entitled "Risk Factors". Forward-looking statements are based on

assumptions made with regard to: the estimated costs associated

with construction of the Project; the timing of the anticipated

start of production at the Project; the ability to maintain

throughput and production levels at the PGP mill; the tax rate

applicable to the Company; future commodity prices; the grade of

mineral resources and mineral reserves; the ability of the Company

to convert inferred mineral resources to other categories; the

ability of the Company to reduce mining dilution; the ability to

reduce capital costs; and exploration plans. Forward-looking

statements are based on estimates and opinions of management at the

date the statements are made. Although Ascot believes that the

expectations reflected in such forward-looking statements and/or

information are reasonable, undue reliance should not be placed on

forward-looking statements since Ascot can give no assurance that

such expectations will prove to be correct. Ascot does not

undertake any obligation to update forward-looking statements,

other than as required by applicable laws. The forward-looking

information contained in this news release is expressly qualified

by this cautionary statement.

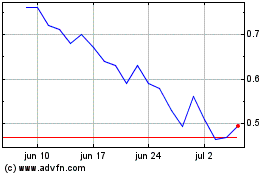

Ascot Resources (TSX:AOT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Ascot Resources (TSX:AOT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025