MAG Silver Corp. (TSX / NYSE American: MAG)

(“MAG”, or the

“Company”) announces the

Company’s unaudited consolidated financial results for the three

months ended March 31, 2024 (“Q1 2024”). For details of the

unaudited condensed interim consolidated financial statements of

the Company for the three months ended March 31, 2024 (“Q1 2024

Financial Statements”) and management’s discussion and analysis for

the three months ended March 31, 2024 (“Q1 2024 MD&A”), please

see the Company’s filings on the System for Electronic Document

Analysis and Retrieval Plus (“SEDAR+”) at (www.sedarplus.ca) or on

the Electronic Data Gathering, Analysis, and Retrieval (“EDGAR”) at

(www.sec.gov).

All amounts herein are reported in $000s

of United States dollars (“US$”) unless otherwise specified (C$

refers to Canadian dollars).

KEY HIGHLIGHTS (on a 100% basis unless

otherwise noted)

- MAG reported net income of $14,895

($0.14 per share) driven by income from Juanicipio (equity

accounted) of $19,244, and adjusted EBITDA1 of $32,447 for the

three months ended March 31, 2024.

- A total of 325,683 tonnes of ore at

a silver head grade of 476 grams per tonne (“g/t”) (equivalent

silver head grade2 713 g/t), was processed at Juanicipio during Q1

2024.

- Juanicipio achieved silver

production and equivalent silver production2 of 4.5 and 6.4 million

ounces, respectively, during Q1 2024.

- Juanicipio delivered robust cost

performance with cash cost1 of $2.50 per silver ounce sold ($8.66

per equivalent silver ounce sold3), and all-in sustaining cost1 of

$6.11 per silver ounce sold ($11.22 per equivalent silver ounce

sold3) in Q1 2024.

- Juanicipio generated strong

operating cash flow of $42,521 and free cash flow1 of $27,820 in

the first quarter of 2024 after tax payments of $25,772.

- Juanicipio returned a total of

$17,459 in interest and loan principal repayments to MAG during Q1

2024.

- MAG published its updated technical

report on Juanicipio on March 27, 2024 outlining robust economics

with an after tax NPV of $1.2 billion over an initial 13-year life

of mine, generating annual average free cashflow exceeding $130

million. Mineral Resources increased by 33% from the 2017 PEA, with

substantial growth in Measured and Indicated categories. Inferred

resources also expanded, highlighting significant near-term,

high-grade upside potential. An inaugural 15.4 million tonnes

Mineral Reserve Estimate at 628 g/t silver equivalent grade was

declared enhancing economic confidence. Extensive exploration

upside remains, with only 5% of the property explored, indicating

high potential for further discoveries.

- MAG announced 2024 production and

cost guidance with Juanicipio expected to produce between 14.3

million and 15.8 million silver ounces yielding between 13.2

million and 14.6 million payable silver ounces at all-in sustaining

costs of between $9.50 and $10.50 per silver ounce sold. Juanicipio

remains on track to achieve 2024 guidance.

- On March 22, 2024 the Company,

through its Gatling Exploration Inc. subsidiary, acquired 100%

ownership of the Goldstake property (contiguous to its current land

holdings) from Goldstake Explorations Inc. and Transpacific

Resources Inc., for consideration of C$5,000.

________________________1 Adjusted EBITDA, total cash costs,

cash cost per ounce, all-in sustaining costs, all-in sustaining

cost per ounce and free cash flow are non-IFRS measures, please see

below ‘Non-IFRS Measures’ section and section 12 of the Q1 2024

MD&A for a detailed reconciliation of these measures to the Q1

2024 Financial Statements.2 Equivalent silver head grade and

equivalent silver production have been calculated using the

following price assumptions to translate gold, lead and zinc to

“equivalent” silver head grade and “equivalent” silver production:

$23/oz silver, $1,950/oz gold, $0.95/lb lead and $1.15/lb zinc. 3

Equivalent silver ounces sold have been calculated using realized

price assumptions to translate gold, lead and zinc to “equivalent”

silver ounces sold (metal quantity, multiplied by metal price,

divided by silver price). Q1 2024 realized prices of $23.73/oz

silver, $2,112.27/oz gold, $0.92/lb lead and $1.08/lb zinc.

CORPORATE

- The Company is well underway with

the preparation of its 2023 sustainability report underscoring its

continued commitment to transparency with its stakeholders while

providing a comprehensive overview of the Company’s environmental,

social and governance (“ESG”) commitments, practices and

performance for 2023. A copy of MAG’s 2022 sustainability report

and MAG Silver 2022 ESG Data Table are available on the Company’s

website at https://magsilver.com/esg/reports/4.

________________________4 Information contained in or otherwise

accessible through the Company’s website, including the 2022

sustainability report and MAG Silver 2022 ESG Data Table, do not

form part of this News Release and are not incorporated into this

News Release by reference.

EXPLORATION

- Juanicipio:

- Infill drilling at Juanicipio

continued in Q1 2024 from underground aimed at upgrading

mineralization in areas expected to be mined in the near to

mid-term. During Q1 2024, 11,271 metres were drilled from

underground.

- Surface drilling focused on

expanding and upgrading the deeper zones and broader regional

exploration started in April 2024.

- During 2024, Juanicipio plans to

drill a total of 50,000 metres, with 33,000 metres from underground

and 17,000 metres from surface.

-

Deer Trail Project, Utah:

- On May 29, 2023 MAG started a Phase

3 drilling program focused on up to three porphyry “hub” target

areas thought to be the source of the manto, skarn, epithermal

mineralization and extensive alteration throughout the project area

including that at the Deer Trail and Carissa zones. In late 2023 an

early onset of winter snowfall impacted the commencement of the

third porphyry “hub” target, which is now expected to be drilled in

2024. The two completed “hub” holes to date total 2,738 metres.

Both holes intercepted alteration and mineralization in line with

what is expected on the edges of porphyry systems. Follow-up drill

targets are planned for summer 2024.

- With the early onset of snowfall,

Phase 4 drilling focussed on lower elevations commenced in the last

quarter of 2023 and continued through Q1 2024, aimed at offsetting

the Carissa discovery and testing other high-potential targets in

the Deer Trail mine area. During Q1 2024, 1,208 metres were drilled

at Carissa with results pending.

-

Larder Project, Ontario:

- Drilling targeting Cheminis and

Bear totalled 5,391 metres in Q1 2024. Targets tested include down

plunge extension of the high-grade double knuckle at the Bear East

zone and extending the Cheminis south mine sequence down

plunge.

- Cheminis Update:

Follow-up drilling of the Cheminis South Cadillac-Larder Break

(“CLD”) mine sequence down plunge is planned to test below the most

recent intercepts. Hole GAT-24-026 intersected a new zone on the

north side of the CLB within a fuchsite-silica-albite altered

komatiite grading 3.9 g/t gold over 16 metres with 2 higher grade

shoots associated with albite dykes (see Table 1 below).

- Bear Update:

Utilizing the updated model and incorporating the updated data from

recent drilling, the Bear East zone was successfully extended down

plunge by up to 1,100 metres depth. Hole GAT-24-024NB intersected

gold mineralization on both sides of the CLB which confirms the

presence of either another structural trap at depth or the

continuation of the “double knuckle” zone at surface. Gold

mineralization intersected on the north zone included 9.4 g/t gold

over 2.2 metres within a strongly altered komatiite with syenite

intrusions and 1.6 g/t gold over 4.2 metres on the south zone

within the south iron-rich volcanics (see Table 1 below). Bear East

remains open in all directions.

Table 1: 2024 Larder Drillholes Highlights

|

Hole ID |

From(m) |

To(m) |

Length(m)1 |

Gold(g/t) |

Lithology |

Target/Zone |

|

GAT-24-024NB |

1233.7 |

1244.0 |

10.3 |

2.3 |

Komatiites with Syenite Intrusions |

North Bear Zone |

|

Including |

1234.1 |

1236.3 |

2.2 |

9.4 |

Syenite |

North Bear Zone |

|

|

|

|

|

|

|

|

|

and |

1415.5 |

1419.7 |

4.2 |

1.6 |

South Volcanics |

South Bear Zone |

|

|

|

|

|

|

|

|

|

GAT-24-026 |

1127.0 |

1143.0 |

16.0 |

3.9 |

Green Komatiites with Albite dykes |

North Cheminis Zone |

|

|

|

|

|

|

|

|

|

Including |

1134.3 |

1135.5 |

1.2 |

9.1 |

Green Komatiite with Albite dykes |

North Cheminis Zone |

|

Including |

1137.4 |

1139.0 |

1.6 |

8.1 |

Green Komatiite with Albite dykes |

North Cheminis Zone |

JUANICIPIO RESULTS

All results of Juanicipio in this section are on

a 100% basis, unless otherwise noted.

Operating Performance

The following table and subsequent discussion provide a summary of

the operating performance of

Juanicipio for the three months ended March 31, 2024

and 2023, unless otherwise noted.

|

|

Three months ended |

|

|

March 31, |

|

March 31, |

|

|

Key mine performance data of Juanicipio (100%

basis) |

2024 |

|

2023 |

|

|

|

|

|

|

Metres developed (m) |

4,069 |

|

3,450 |

|

|

|

|

|

|

Material mined (t) |

325,081 |

|

223,632 |

|

|

Material processed (t) |

325,683 |

|

222,023 |

|

|

|

|

|

|

Silver head grade (g/t) |

476 |

|

363 |

|

|

Gold head grade (g/t) |

1.33 |

|

1.07 |

|

|

Lead head grade (%) |

1.35 |

% |

0.74 |

% |

|

Zinc head grade (%) |

2.50 |

% |

1.45 |

% |

|

|

|

|

|

Equivalent silver head grade (g/t) (1) |

713 |

|

530 |

|

|

|

|

|

|

Silver payable ounces (koz) |

3,995 |

|

2,001 |

|

|

Gold payable ounces (koz) |

8.90 |

|

5.29 |

|

|

Lead payable pounds (klb) |

7,747 |

|

2,825 |

|

|

Zinc payable pounds (klb) |

11,846 |

|

3,650 |

|

|

|

|

|

|

Equivalent silver payable ounces (koz) (2) |

5,627 |

|

2,796 |

|

|

|

|

|

(1) Equivalent silver head grades have been

calculated using the following price assumptions to translate gold,

lead and zinc to “equivalent” silver head grade: $23/oz silver,

$1,950/oz gold, $0.95/lb lead and $1.15/lb zinc (Q1 2023: $21.85/oz

silver, $1,775/oz gold, $0.915/lb lead and $1.30/lb

zinc).(2) Equivalent silver payable ounces have

been calculated using realized price assumptions to translate gold,

lead and zinc to “equivalent” silver payable ounces (metal

quantity, multiplied by metal price, divided by silver price). Q1

2024 realized prices of $23.73/oz silver, $2,112.27/oz gold,

$0.92/lb lead and $1.08/lb zinc (Q1 2023 realized prices of

$22.93/oz silver, $1,959.50/oz gold, $0.94/lb lead and $1.43/lb

zinc).

During the three months ended March 31, 2024 a

total of 325,081 tonnes of ore were mined. This represents an

increase of 45% over Q1 2023. Increases in mined tonnages at

Juanicipio have been driven by the operational ramp up of the mine

towards steady state targets.

During the three months ended March 31, 2024 a

total of 325,683 tonnes of ore were processed through the

Juanicipio plant; no ore was processed at the nearby Fresnillo and

Saucito processing plants (100% owned by Fresnillo). This

represents an increase of 47% over Q1 2023. The increase in milled

tonnage has been driven by the Juanicipio mill commissioning and

operational ramp up to nameplate capacity over the course of

2023.

The silver head grade and equivalent silver head

grade for the ore processed in the three months ended March 31,

2024 was 476 g/t and 713 g/t, respectively (three months ended

March 31, 2023: 363 g/t and 530 g/t, respectively). Head grades in

Q1 2023 were lower as low-grade commissioning stockpiles were

processed through the Juanicipio plant. Silver metallurgical

recovery during Q1 2024 was 89.1% (Q1 2023: 87.0%) reflecting

ongoing optimizations in the processing plant.

The following table provides a summary of the total

cash costs5 and all-in sustaining costs5 (“AISC”)

of Juanicipio for the three months ended March

31, 2024, and 2023.

|

|

Three months ended |

|

|

March 31, |

|

March 31, |

|

|

Key mine performance data of Juanicipio (100%

basis) |

2024 |

|

2023 |

|

|

|

|

|

|

Total cash costs (5) |

9,973 |

|

22,439 |

|

|

Cash cost per silver ounce sold ($/oz) (5) |

2.50 |

|

11.21 |

|

|

Cash cost per equivalent silver ounce sold ($/oz) (5) |

8.66 |

|

14.55 |

|

|

|

|

|

|

All-in sustaining costs (5) |

24,393 |

|

32,902 |

|

|

All-in sustaining cost per silver ounce sold ($/oz) (5) |

6.11 |

|

16.44 |

|

|

All-in sustaining cost per equivalent silver ounce sold ($/oz)

(5) |

11.22 |

|

18.29 |

|

|

|

|

|

________________________5 Total cash costs, cash

cost per ounce, cash cost per equivalent ounce, all-in sustaining

costs, all-in sustaining cost per ounce, and all-in sustaining cost

per equivalent ounce are non-IFRS measures, please see the

“Non-IFRS Measures” section below and section 12 of the Q1 2024

MD&A for a detailed reconciliation of these measures to the Q1

2024 Financial Statements. Equivalent silver ounces sold have been

calculated using realized price assumptions to translate gold, lead

and zinc to “equivalent” silver ounces sold (metal quantity,

multiplied by metal price, divided by silver price). Q1 2024

realized prices of $23.73/oz silver, $2,112.27/oz gold, $0.92/lb

lead and $1.08/lb zinc (Q1 2023: $22.93/oz silver, $1,959.50/oz

gold, $0.94/lb lead and $1.43/lb zinc).

Financial Results

The following table presents excerpts of the financial results of

Juanicipio for the three months ended March 31, 2024 and 2023.

|

|

Three months ended |

|

|

March 31, |

|

March 31, |

|

|

|

2024 |

|

2023 |

|

|

|

$ |

|

$ |

|

|

Sales |

123,689 |

|

51,482 |

|

|

Cost of sales: |

|

|

|

Production cost |

(36,787 |

) |

(27,378 |

) |

|

Depreciation and amortization |

(22,038 |

) |

(7,955 |

) |

|

Gross profit |

64,864 |

|

16,149 |

|

|

Consulting and administrative expenses |

(4,189 |

) |

(1,499 |

) |

|

Extraordinary mining and other duties |

(1,392 |

) |

(520 |

) |

|

Interest expense |

(3,979 |

) |

(3,816 |

) |

|

Exchange losses and other |

(1,297 |

) |

(2,864 |

) |

|

Net income before tax |

54,007 |

|

7,451 |

|

|

Income tax expense |

(14,249 |

) |

6,731 |

|

|

Net income (100% basis) |

39,758 |

|

14,182 |

|

|

MAG’s 44% portion of net income |

17,494 |

|

6,240 |

|

|

Interest on Juanicipio loans - MAG's 44% |

1,751 |

|

1,679 |

|

|

MAG’s 44% equity income |

19,244 |

|

7,919 |

|

Sales increased by $72,207 during the three

months ended March 31, 2024, mainly due to 179% higher metal

volumes and 2% higher realized metal prices.

Offsetting higher sales was higher production

cost ($9,409) which was driven by higher sales and operational

ramp-up in mining and processing, including $3,545 in inventory

movements, and higher depreciation ($14,083) as the Juanicipio mill

achieved commercial production and commenced depreciating the

processing facility and associated equipment in June 2023.

Operating margin increased by 21% to 52%, mainly due to operational

leverage and the lower reliance on the nearby Fresnillo and Saucito

processing facilities.

Other expenses increased by $2,159 mainly as a

result of higher extraordinary mining and other duties ($872) in

relation to higher precious metal revenues from the sale of

concentrates and higher consulting and administrative expenses

($2,690) as an operator services agreement became effective upon

initiation of commercial production (the “Operator Services

Agreement”), offset by lower exchange losses and other costs

($1,566).

Taxes increased by $20,980 impacted by higher

taxable profits generated during Q1 2024, and non-cash deferred tax

credits related to the commencement of use of plant and equipment

in Q1 2023.

Ore Processed at Juanicipio Plant (100%

basis)

|

Three Months Ended March 31, 2024 (325,683 tonnes

processed) |

Three Months EndedMarch 31,

2023Amount$ |

|

|

Payable Metals |

Quantity |

Average Price$ |

|

Amount$ |

|

|

Silver |

3,994,614 ounces |

|

23.73 per oz |

|

94,810 |

|

45,875 |

|

|

Gold |

8,904 ounces |

|

2,112 per oz |

|

18,807 |

|

10,367 |

|

|

Lead |

3,514 tonnes |

|

0.92 per lb. |

|

7,100 |

|

2,661 |

|

|

Zinc |

5,373 tonnes |

|

1.08 per lb. |

|

12,836 |

|

5,208 |

|

|

Treatment, refining, and other processing costs (2) |

(9,864 |

) |

(12,629 |

) |

|

Sales |

123,689 |

|

51,482 |

|

|

Production cost |

(36,787 |

) |

(27,378 |

) |

|

Depreciation and amortization (1) |

(22,038 |

) |

(7,955 |

) |

|

Gross Profit |

64,864 |

|

16,149 |

|

(1) The underground mine was considered readied

for its intended use on January 1, 2022, whereas the Juanicipio

processing facility started commissioning and ramp-up activities in

January 2023, achieving commercial production status on June 1,

2023. (2) Includes toll milling costs from processing mineralized

material at the Saucito and Fresnillo plants for Q1 2023.

Sales and treatment charges are recorded on a

provisional basis and are adjusted based on final assay and pricing

adjustments in accordance with the offtake contracts.

MAG FINANCIAL RESULTS – THREE MONTHS

ENDED MARCH 31, 2024

As at March 31, 2024, MAG had working capital of

$72,833 (December 31, 2023: $67,262) including cash of $74,683

(December 31, 2023: $68,707) and no long-term debt. As well, as at

March 31, 2024, Juanicipio had working capital of $107,088

including cash of $30,991 (MAG’s attributable share is 44%).

The Company’s net income for the three months

ended March 31, 2024 amounted to $14,895 (March 31, 2023: $4,713)

or $0.14/share (March 31, 2023: $0.05/share). MAG recorded its 44%

income from equity accounted investment in Juanicipio of $19,244

(March 31, 2023: $7,919) which included MAG’s 44% share of net

income from operations as well as loan interest earned on loans

advanced to Juanicipio (see above for MAG’s share of income from

its equity accounted investment in Juanicipio).

|

|

For the three months ended |

|

|

|

March 31,2024 |

|

March 31,2023 |

|

|

|

$ |

|

$ |

|

|

|

|

|

|

Income from equity accounted investment in Juanicipio |

19,244 |

|

7,919 |

|

|

General and administrative expenses |

(4,109 |

) |

(3,272 |

) |

|

General exploration and business development |

(357 |

) |

(102 |

) |

|

Operating income |

14,778 |

|

4,545 |

|

|

|

|

|

|

Interest income |

827 |

|

564 |

|

|

Other income |

537 |

|

127 |

|

|

Foreign exchange loss |

(163 |

) |

(180 |

) |

|

Income before income tax |

15,979 |

|

5,056 |

|

|

|

|

|

|

Deferred income tax expense |

(1,084 |

) |

(343 |

) |

|

|

|

|

|

|

|

Net income |

14,895 |

|

4,713 |

|

NON-IFRS MEASURES

The following table provides a reconciliation of

cash cost per silver ounce of Juanicipio to production cost of

Juanicipio on a 100% basis (the nearest IFRS measure) as presented

in the notes to the Q1 2024 Financial Statements.

|

|

Three months ended March 31, |

|

(in thousands of US$, except per ounce

amounts) |

2024 |

|

2023 |

|

|

Production cost as reported |

36,787 |

|

27,378 |

|

|

Depreciation on inventory movements |

673 |

|

149 |

|

|

Adjusted production cost |

37,460 |

|

27,527 |

|

|

Treatment, refining, and other processing costs |

9,864 |

|

12,629 |

|

|

By-product revenues (2) |

(38,743 |

) |

(18,236 |

) |

|

Extraordinary mining and other duties |

1,392 |

|

520 |

|

|

Total cash costs (1) |

9,973 |

|

22,439 |

|

|

Silver ounces sold |

3,994,614 |

|

2,000,974 |

|

|

Equivalent silver ounces sold (3) |

5,626,959 |

|

2,796,391 |

|

|

Cash cost per silver ounce sold ($/ounce) |

2.50 |

|

11.21 |

|

|

Cash cost per equivalent silver ounce sold

($/ounce) |

8.66 |

|

14.55 |

|

(1) As Q3 2023 represented the first

full quarter of commercial production, information presented for

total cash costs together with their associated per unit values are

not directly comparable.(2) By-product revenues

relates to the sale of other metals namely gold, lead, and zinc.

(3) Equivalent silver payable ounces have been

calculated using realized prices to translate gold, lead and zinc

to “equivalent” silver payable ounces (metal quantity, multiplied

by metal price, divided by silver price). Q1 2024 realized prices:

$23.73/oz silver, $2,112.27/oz gold, $0.92/lb lead and $1.08/lb

zinc (Q1 2023: $22.93/oz silver, $1,959.50/oz gold, $0.94/lb lead

and $1.43/lb zinc).

The following table provides a reconciliation of

AISC of Juanicipio to production cost and various operating

expenses of Juanicipio on a 100% basis (the nearest IFRS measure),

as presented in the notes to the Q1 2024 Financial

Statements.

|

|

Three months ended March 31, |

|

(in thousands of US$, except per ounce

amounts) |

2024 |

|

2023 |

|

|

Total cash costs |

9,973 |

|

22,439 |

|

|

General and administrative expenses |

4,189 |

|

1,499 |

|

|

Exploration |

1,368 |

|

2,133 |

|

|

Sustaining capital expenditures |

8,598 |

|

6,598 |

|

|

Sustaining lease payments |

208 |

|

179 |

|

|

Interest on lease liabilities |

(16 |

) |

(6 |

) |

|

Accretion on closure and reclamation costs |

72 |

|

59 |

|

|

All-in sustaining costs (1) |

24,393 |

|

32,902 |

|

|

Silver ounces sold |

3,994,614 |

|

2,000,974 |

|

|

Equivalent silver ounces sold (2) |

5,626,959 |

|

2,796,391 |

|

|

All-in sustaining cost per silver ounce sold

($/ounce) |

6.11 |

|

16.44 |

|

|

All-in sustaining cost per equivalent silver ounce sold

($/ounce) |

11.22 |

|

18.29 |

|

|

Average realized price per silver ounce sold

($/ounce) |

23.73 |

|

22.93 |

|

|

All-in sustaining margin ($/ounce) |

17.63 |

|

6.48 |

|

|

All-in sustaining margin ($/equivalent ounce) |

12.51 |

|

4.64 |

|

|

All-in sustaining margin |

70,417 |

|

12,973 |

|

(1) As Q3 2023 represented the first

full quarter of commercial production, information presented for

all-in sustaining costs and all-in sustaining margin together with

their associated per unit values are not directly

comparable.(2) Equivalent silver payable ounces

have been calculated using realized prices to translate gold, lead

and zinc to “equivalent” silver payable ounces (metal quantity,

multiplied by metal price, divided by silver price). Q1 2024

realized prices: $23.73/oz silver, $2,112.27/oz gold, $0.92/lb lead

and $1.08/lb zinc, (Q1 2023 realized prices: $22.93/oz silver,

$1,959.50/oz gold, $0.94/lb lead and $1.43/lb zinc).

For the three months ended March 31, 2024 the

Company incurred corporate G&A expenses of $3,964 (three months

ended March 31, 2023: $3,262), which exclude depreciation

expense.

The Company’s attributable silver ounces sold

and equivalent silver ounces sold for the three months ended March

31, 2024 were 1,757,630 and 2,475,862 respectively (three months

ended March 31, 2023: 880,429 and 1,230,412 respectively),

resulting in additional all‐in sustaining cost for the Company of

$2.26/oz and $1.60/oz respectively (three months ended March 31,

2023: $3.71/oz and $2.65/oz respectively), in addition to

Juanicipio’s all-in-sustaining costs presented in the above

table.

The following table provides a reconciliation of

EBITDA and Adjusted EBITDA attributable to the Company based on its

economic interest in Juanicipio to net income (the nearest IFRS

measure) of the Company per the Q1 2024 Financial Statements. All

adjustments are shown net of estimated income tax.

|

|

Three months ended March 31, |

|

(in thousands of US$) |

2024 |

|

2023 |

|

|

Net income after tax |

14,895 |

|

4,713 |

|

|

Add back (deduct): |

|

|

|

Taxes |

1,084 |

|

343 |

|

|

Depreciation and depletion |

145 |

|

10 |

|

|

Finance costs (income and expenses) |

(1,201 |

) |

(511 |

) |

|

EBITDA (1) |

14,923 |

|

4,555 |

|

|

Add back (deduct): |

|

|

|

Adjustment for non-cash share-based compensation |

966 |

|

763 |

|

|

Share of net earnings related to Juanicipio |

(19,244 |

) |

(7,919 |

) |

|

MAG attributable interest in Junicipio Adjusted EBITDA |

35,802 |

|

9,718 |

|

|

Adjusted EBITDA (1) |

32,447 |

|

7,117 |

|

(1) As Q3 2023 represents the first full

quarter of commercial production, information presented for EBITDA

and Adjusted EBITDA is not directly comparable.

The following table provides a reconciliation of

free cash flow of Juanicipio to its cash flow from operating

activities on a 100% basis (the nearest IFRS measure), as presented

in the notes to the Q1 2024 Financial Statements.

|

|

Three months ended March 31, |

|

(in thousands of US$) |

2024 |

|

2023 |

|

|

Cash flow from operating activities |

42,521 |

|

(29,910 |

) |

|

Less: |

|

|

|

Cash flow used in investing activities |

(14,492 |

) |

(19,004 |

) |

|

Sustaining lease payments |

(208 |

) |

(179 |

) |

|

Juanicipio free cash flow

(1) |

27,820 |

|

(49,093 |

) |

(1) As Q3 2023 represents the

first full quarter of commercial production, comparative

information presented for free cash flow of Juanicipio is not

directly comparable.

Qualified Persons: All

scientific or technical information in this press release including

assay results referred to, and mineral resource estimates, if

applicable, is based upon information prepared by or under the

supervision of, or has been approved by Gary Methven, P.Eng., Vice

President, Technical Services and Lyle Hansen, P.Geo, Geotechnical

Director; both are “Qualified Persons” for purposes of National

Instrument 43-101, Standards of Disclosure for Mineral

Projects.

About MAG Silver Corp.

MAG Silver Corp. is a growth-oriented Canadian

exploration company focused on advancing high-grade, district scale

precious metals projects in the Americas. MAG is emerging as a

top-tier primary silver mining company through its (44%) joint

venture interest in the 4,000 tonnes per day Juanicipio Mine,

operated by Fresnillo plc (56%). The mine is located in the

Fresnillo Silver Trend in Mexico, the world's premier silver mining

camp, where in addition to underground mine production and

processing of high-grade mineralised material, an expanded

exploration program is in place targeting multiple highly

prospective targets. MAG is also executing multi-phase exploration

programs at the 100% earn-in Deer Trail Project in Utah and the

100% owned Larder Project, located in the historically prolific

Abitibi region of Canada.

Neither the Toronto Stock Exchange nor the NYSE

American has reviewed or accepted responsibility for the accuracy

or adequacy of this press release, which has been prepared by

management.

Certain information contained in this release,

including any information relating to MAG’s future oriented

financial information, are “forward-looking information” and

“forward-looking statements” within the meaning of applicable

Canadian and United States securities legislation (collectively

herein referred as “forward-looking statements”), including the

“safe harbour” provisions of provincial securities legislation, the

U.S. Private Securities Litigation Reform Act of 1995, Section 21E

of the U.S. Securities Exchange Act of 1934, as amended and Section

27A of the U.S. Securities Act. Such forward-looking statements

include, but are not limited to:

- statements that address maintaining

the nameplate 4,000 tpd milling rate at Juanicipio;

- statements that address our

expectations regarding exploration and drilling;

- statements regarding production

expectations and nameplate;

- statements regarding the additional

information from future drill programs;

- estimated future exploration and

development operations and corresponding expenditures and other

expenses for specific operations;

- the expected capital, sustaining

capital and working capital requirements at Juanicipio, including

the potential for additional cash calls;

- expected upside from additional

exploration;

- expected results from Deer Trail

Project drilling;

- expected results from the Larder

Project at the Fernland, Cheminis, and Bear zones;

- expected capital requirements and

sources of funding; and

- other future events or

developments.

When used in this release, any statements that

express or involve discussions with respect to predictions,

beliefs, plans, projections, objectives, assumptions or future

events of performance (often but not always using words or phrases

such as “anticipate”, “believe”, “estimate”, “expect”, “intend”,

“plan”, “strategy”, “goals”, “objectives”, “project”, “potential”

or variations thereof or stating that certain actions, events, or

results “may”, “could”, “would”, “might” or “will” be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions), as they relate to the Company or management, are

intended to identify forward-looking statements. Such statements

reflect the Company’s current views with respect to future events

and are subject to certain known and unknown risks, uncertainties

and assumptions.

Forward-looking statements are necessarily based

upon estimates and assumptions, which are inherently subject to

significant business, economic and competitive uncertainties and

contingencies, many of which are beyond the Company’s control and

many of which, regarding future business decisions, are subject to

change. Assumptions underlying the Company’s expectations regarding

forward-looking statements contained in this release include, among

others: MAG’s ability to carry on its various exploration and

development activities including project development timelines, the

timely receipt of required approvals and permits, the price of the

minerals produced, the costs of operating, exploration and

development expenditures, the impact on operations of the Mexican

tax and legal regimes, MAG’s ability to obtain adequate financing,

outbreaks or threat of an outbreak of a virus or other contagions

or epidemic disease will be adequately responded to locally,

nationally, regionally and internationally.

Although MAG believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those in the forward-looking statements. These

forward-looking statements involve known and unknown risks,

uncertainties and many factors could cause actual results,

performance or achievements to be materially different from any

future results, performance or achievements that may be expressed

or implied by such forward-looking statements including amongst

others: commodities prices; changes in expected

mineral production performance; unexpected increases in

capital costs or cost overruns; exploitation and exploration

results; continued availability of capital and financing; general

economic, market or business conditions; risks relating to the

Company’s business operations; risks relating to the financing of

the Company’s business operations; risks related to the Company’s

ability to comply with restrictive covenants and maintain financial

covenants pursuant to the terms of the Credit Facility; the

expected use of the Credit Facility; risks relating to the

development of Juanicipio and the minority interest investment in

the same; risks relating to the Company’s property titles; risks

related to receipt of required regulatory approvals; pandemic

risks; supply chain constraints and general costs escalation in the

current inflationary environment heightened by the invasion of

Ukraine by Russia and the events relating to the Israel-Hamas war;

risks relating to the Company’s financial and other instruments;

operational risk; environmental risk; political risk; currency

risk; market risk; capital cost inflation risk; risk relating to

construction delays; the risk that data is incomplete or

inaccurate; the risks relating to the limitations and assumptions

within drilling, engineering and socio-economic studies relied upon

in preparing economic assessments and estimates, including the 2017

PEA; as well as those risks more particularly described under the

heading “Risk Factors” in the Company’s Annual Information Form

dated March 27, 2023 available under the Company’s profile on

SEDAR+ at www.sedarplus.ca.

Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

herein. This list is not exhaustive of the factors that may affect

any of the Company’s forward-looking statements. The Company’s

forward-looking statements are based on the beliefs, expectations

and opinions of management on the date the statements are made and,

other than as required by applicable securities laws, the Company

does not assume any obligation to update forward-looking statements

if circumstances or management’s beliefs, expectations or opinions

should change. For the reasons set forth above, investors should

not attribute undue certainty to or place undue reliance on

forward-looking statements.

Please Note: Investors are urged to consider

closely the disclosures in MAG's annual and

quarterly reports and other public filings, accessible through

the Internet at www.sedarplus.ca and www.sec.gov.

LEI: 254900LGL904N7F3EL14

For further information on behalf of MAG Silver Corp.

Contact Michael J. Curlook, Vice President, Investor Relations and Communications

Phone: (604) 630-1399

Toll Free: (866) 630-1399

Email:info@magsilver.com

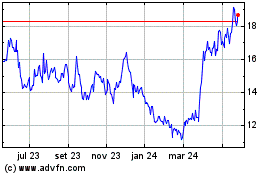

MAG Silver (TSX:MAG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

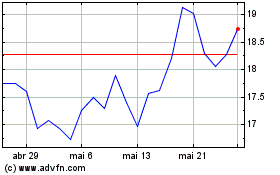

MAG Silver (TSX:MAG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024