FOR IMMEDIATE RELEASE

O-I Glass, Inc. (the “Company”) announced that

Owens-Brockway Glass Container Inc. (“OBGC”), an indirect wholly

owned subsidiary of the Company, intends to offer, subject to

market and other conditions, $300 million aggregate principal

amount of its senior notes due 2032 (the “Notes”) in a private

offering (the “Offering”) to eligible purchasers under

Rule 144A and Regulation S of the U.S. Securities Act of 1933,

as amended (the “Securities Act”). OBGC’s obligations under the

Notes will be guaranteed on a joint and several basis by

Owens-Illinois Group, Inc. (“OI Group”) and certain U.S. domestic

subsidiaries of OI Group that are guarantors under OI Group’s

credit agreement.

OBGC expects to use the net proceeds from the Offering, together

with cash on hand, to redeem all of OBGC’s outstanding 6.375%

Senior Notes due 2025 (the “2025 OBGC Notes”).

The Notes and the guarantees have not been registered under the

Securities Act, or applicable state securities laws, and will be

offered only to persons reasonably believed to be qualified

institutional buyers in reliance on Rule 144A under the

Securities Act and to certain non-U.S. persons in transactions

outside the United States in reliance on Regulation S under the

Securities Act. Unless so registered, the Notes and the guarantees

may not be offered or sold in the United States except pursuant to

an exemption from the registration requirements of the Securities

Act and applicable state securities laws. Prospective purchasers

that are qualified institutional buyers are hereby notified that

the seller of the Notes may be relying on the exemption from the

provisions of Section 5 of the Securities Act provided by

Rule 144A.

The information contained in this news release is for

informational purposes only and shall not constitute a notice of

redemption for the 2025 OBGC Notes or an offer to sell or the

solicitation of an offer to buy the 2025 OBGC Notes, the Notes or

the guarantees, nor shall there be any sale of the Notes and the

guarantees in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state.

About O-I Glass

At O-I Glass, Inc. (NYSE: OI), we love glass and we’re proud to

be one of the leading producers of glass bottles and jars around

the globe. Glass is not only beautiful, it’s also pure and

completely recyclable, making it the most sustainable rigid

packaging material. Headquartered in Perrysburg, Ohio (USA), O-I is

the preferred partner for many of the world’s leading food and

beverage brands. We innovate in line with customers’ needs to

create iconic packaging that builds brands around the world. Led by

our diverse team of more than 23,000 people across 68 plants in 19

countries, O-I achieved net sales of $7.1 billion in 2023.

Forward-Looking Statements

This press release contains “forward-looking” statements related

to the Company within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”) and Section

27A of the Securities Act. Forward-looking statements reflect the

Company’s current expectations and projections about future events

at the time, and thus involve uncertainty and risk. The words

“believe,” “expect,” “anticipate,” “will,” “could,” “would,”

“should,” “may,” “plan,” “estimate,” “intend,” “predict,”

“potential,” “continue,” and the negatives of these words and other

similar expressions generally identify forward-looking

statements.

It is possible that the Company’s future financial performance

may differ from expectations due to a variety of factors including,

but not limited to the following: (1) the general political,

economic and competitive conditions in markets and countries where

the Company has operations, including uncertainties related to

economic and social conditions, trade disputes, disruptions in the

supply chain, competitive pricing pressures, inflation or

deflation, changes in tax rates and laws, war, civil disturbance or

acts of terrorism, natural disasters, public health issues and

weather, (2) cost and availability of raw materials, labor, energy

and transportation (including impacts related to the current

Ukraine-Russia and Israel-Hamas conflicts and disruptions in supply

of raw materials caused by transportation delays), (3) competitive

pressures from other glass container producers and alternative

forms of packaging or consolidation among competitors and

customers, (4) changes in consumer preferences or customer

inventory management practices, (5) the continuing consolidation of

the Company’s customer base, (6) the Company’s ability to improve

its glass melting technology, known as the modular advanced glass

manufacturing asset (“MAGMA”) program, and implement it within the

timeframe expected, (7) unanticipated supply chain and operational

disruptions, including higher capital spending, (8) seasonality of

customer demand, (9) the failure of the Company’s joint venture

partners to meet their obligations or commit additional capital to

the joint venture, (10) labor shortages, labor cost increases or

strikes, (11) the Company’s ability to acquire or divest

businesses, acquire and expand plants, integrate operations of

acquired businesses and achieve expected benefits from

acquisitions, divestitures or expansions, (12) the Company’s

ability to generate sufficient future cash flows to ensure the

Company’s goodwill is not impaired, (13) any increases in the

underfunded status of the Company’s pension plans, (14) any failure

or disruption of the Company’s information technology, or those of

third parties on which the Company relies, or any cybersecurity or

data privacy incidents affecting the Company or its third-party

service providers, (15) risks related to the Company’s indebtedness

or changes in capital availability or cost, including interest rate

fluctuations and the ability of the Company to generate cash to

service indebtedness and refinance debt on favorable terms, (16)

risks associated with operating in foreign countries, (17) foreign

currency fluctuations relative to the U.S. dollar, (18) changes in

tax laws or U.S. trade policies, (19) the Company’s ability to

comply with various environmental legal requirements, (20) risks

related to recycling and recycled content laws and regulations,

(21) risks related to climate-change and air emissions, including

related laws or regulations and increased environmental, social and

governance scrutiny and changing expectations from stakeholders,

(22) risks related to the Company’s long-term succession planning

process and (23) the other risk factors discussed in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023 and

any subsequently filed Quarterly Reports on Form 10-Q or the

Company’s other filings with the Securities and Exchange

Commission.

It is not possible to foresee or identify all such factors. Any

forward-looking statements in this press release are based on

certain assumptions and analyses made by the Company in light of

its experience and perception of historical trends, current

conditions, expected future developments, and other factors it

believes are appropriate in the circumstances. Forward-looking

statements are not a guarantee of future performance and actual

results, or developments may differ materially from expectations.

While the Company continually reviews trends and uncertainties

affecting the Company’s results or operations and financial

condition, the Company does not assume any obligation to update or

supplement any particular forward-looking statements contained in

this press release.

SOURCE: O-I Glass, Inc.

- Owens-Brockway Glass Container Inc. Launches $300 Million

Senior Notes Offering

For more information, contact:

Chris Manuel

Vice President of Investor Relations

567-336-2600

Chris.Manuel@o-i.com

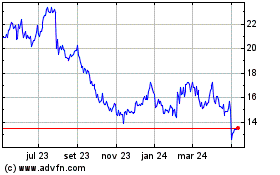

OI Glass (NYSE:OI)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

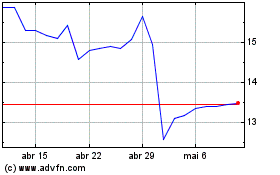

OI Glass (NYSE:OI)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024