MiniLuxe Holding Corp. (TSXV: MNLX) today announced its financial

results for the 13 weeks ended March 31, 2024 (“Q1 2024”). The

fiscal year of MiniLuxe is a 52-week reporting cycle ending on the

Sunday closest to December 31, which periodically necessitates a

fiscal year of 53 weeks; fiscal years referred to in this release

consist of 52-week periods. Unless otherwise specified, all amounts

are reported in U.S. dollars.

MiniLuxe continued its consistent, organic,

year-over-year growth as Q1 2024 revenue increased 8% over Q1 2023

at $5.6M with gross profit of $2.3M, a 2% increase from Q1 2023.

The Company views gross profit dollar growth as a key indicator of

MiniLuxe’s positive trajectory towards long-term profitability and,

in conjunction with the reduced cost base, moved materially to a

narrowing loss rate. Miniluxe used its lightest volume quarter (Q1

is historically the lowest revenue volume due to seasonality) as an

opportunity to test new service initiatives focused primarily on

premium nails and waxing services. These initiatives have the

impact of temporarily reducing topline revenue and gross margins,

but are designed to accelerate adoption of MiniLuxe’s premium

service offerings. Management plans to continue to experiment with

service offering enhancements and other tests in order to continue

to provide the most relevant self-care experience on the market

while remaining committed to our mission of clean and empowerment

of the designer. Q1 2024 operating loss was ($1.8M), representing

$1.2M (or 40%) lower than Q1 2023, which was driven by reduced

general and administrative expenses.

As in past periods, the majority of the

Company’s growth came organically from the MiniLuxe Core Studios.

The Core Studio base continued its consistent, multi-year trend of

growth in Q1 2024 as revenue increased $0.2M to $5.1M, or 5% over

Q1 2023. MiniLuxe also saw good trends on the demand and supply

side of its business: (a) positive momentum on the demand side (new

client and loyal client growth) and (b) growth and development of

supply side (talent ecosystem growth). The Company focuses on

growth in loyal client base, growth in designer talent base, and

increasing studio AUV (average unit volume by revenue) as three

pillars that demonstrate the strengthening brand resiliency and

high demand for MiniLuxe in-studio service offerings.

Subsequent Events and Remaining 2024

Outlook

As was discussed in the Company’s FY2023

MD&A, the following material fundraising actions were completed

subsequent to Q1 2024:

- On March 12,

2024 MiniLuxe filed with the TSXV a new application to raise

capital on the same terms as an initial convertible debenture

offering completed on November 28, 2023 and January 22, 2024 (the

“Initial Offering”).

On April 26, 2024, the Company announced that it has completed the

closing of the non-brokered convertible debenture unit offering,

with an immediate closing of gross proceeds of approximately $0.475

million (the "Second Offering") that came as a

“top-up” round from value-add advisors and individuals. Along with

the Initial Offering, a total of approximately US$4.3 million was

raised in the convertible note offerings with all associated

warrants issued at a strike price of US$0.52/C$0.72.

- On April 9,

2024, MiniLuxe announced that it had completed a re-financing of

its Senior Term Loan, extending maturity for 24 months for the base

US$2.5 million and adding an additional US$2.0 million of new

capital, all of which will now mature in May 2027. The Senior Term

Loans are held by Flow Capital (TSXV: FW), a leading provider of

flexible growth capital and alternative debt solutions. The Senior

Term Loans shall pay 15.0% cash-pay interest along with 2.0%

simple, paid-in-kind interest that accrues until maturity. As part

of the transaction, the Company issued to Flow Capital

warrants to purchase 1,692,308 Subordinate Voting Shares of the

Company at a strike price of US$0.52 (~C$0.71) per share for a

period of three years from the date of issuance. The warrants are

subject to a hold period of four months and one day from the

issuance date in accordance with applicable securities laws.

In total, the Company has been successful in

raising a total of US$6.2 million in gross proceeds since we kicked

off the process last Fall. The Company intends to use the gross

proceeds to bridge to profitability, while focusing on a narrower

set of growth investments in the areas of fleet expansion (via

M&A and franchising) and recent product innovation of its

Paintbox press-on nails.

Also subsequent to Q1 2024, and as noted

earlier, on May 3, 2024, MiniLuxe entered into a

majority-controlled joint venture agreement with an Atlanta-based

firm Sugarcoat. The Company plans to enter into the US Southeast

via the Atlanta market through this joint venture with intentions

to convert an existing Sugarcoat nail services salon

location.

“Our team has pulled together to focus on and

accelerate a clear set of priorities driving stronger gross profit

and studio-level contribution. New growth initiatives such as

franchising, M&A and commercial brand partnerships also saw

material momentum coming in to 2024. We are also pleased with the

ability to continue to attract new primary capital from a strong

set of value-add investors.” said Tony Tjan, Chief Executive

Officer and Co-founder of MiniLuxe.

Q1 2024 Results

Selected Financial Measures

Results of Operations

The following table outlines the consolidated

statements of loss and comprehensive loss for the thirteen weeks

ended March 31, 2024 and April 2, 2023:

Cash Flows

The following table presents cash and cash

equivalents as at March 31, 2024 and April 2, 2023:

Non-IFRS Measures and Reconciliation of

Non-IFRS Measures

This press release references certain non-IFRS

measures used by management. These measures are not recognized

under International Financial Reporting Standards (“IFRS”), do not

have a standardized meaning prescribed by IFRS, and are therefore

unlikely to be comparable to similar measures presented by other

companies. Rather, these measures are provided as additional

information to complement those IFRS measures by providing further

understanding of the Company’s results of operations from

management’s perspective. Accordingly, these measures should not be

considered in isolation nor as a substitute for analysis of the

Company’s financial information reported under IFRS. The non-IFRS

measures referred to in this press release are “Adjusted EBITDA”

and “Fleet Adjusted EBITDA”.

Adjusted EBITDAManagement

believes Adjusted EBITDA most accurately reflects the commercial

reality of the Company's operations on an ongoing basis by adding

back non-cash expenses. Additionally, the rent-related adjustments

ensure that studio-related expenses align with revenue generated

over the corresponding time periods.

Adjusted EBITDA is calculated by adding back

fixed asset depreciation, right-of-use asset amortization under

IFRS 16, asset disposal, and share-based compensation expense to

IFRS operating income, then deducting straight-line rent expenses1

net of lease abatements. IFRS operating income is revenue less cost

of sales (gross profit), additionally adjusted for general and

administrative expenses, and depreciation and amortization

expense.

A reconciliation of IFRS operating income to

Adjusted EBITDA is included in Selected Consolidated Financial

Information.

The Company also uses Fleet Adjusted EBITDA to

evaluate the performance of its MiniLuxe Core Studio business (19

MiniLuxe-branded studios operating for 1+ year). This metric is

calculated in a similar manner, starting with Talent revenue and

adjusting for non-fleet Talent revenue and cost of sales, further

adjusted by fleet general and administrative expenses and finally

subtracting straight line rent expense (similar to amount used in

the full company Adjusted EBITDA, less amounts allocated to

locations outside of MiniLuxe’s core studio business, i.e.

Paintbox). The Company believes that this metric most closely

mirrors how management views the fleet portion of the business. A

reconciliation of Talent revenue to Fleet Adjusted EBITDA is

included in Selected Consolidated Financial Information.

The following table reconciles Adjusted EBITDA

to net loss for the periods indicated:

The following table reconciles Fleet Adjusted

EBITDA to net loss for the periods indicated:

About MiniLuxe

MiniLuxe, a Delaware corporation based in

Boston, Massachusetts. MiniLuxe is a lifestyle brand and talent

empowerment platform servicing the beauty and self-care industry.

The Company focuses on delivering high-quality nail care and

esthetic services and offers a suite of trusted proprietary

products that are used in the Company’s owned-and-operated studio

services. For over a decade, MiniLuxe has been elevating industry

standards through healthier, ultra-hygienic services, a modern

design esthetic, socially responsible labor practices, and

better-for-you, cleaner products. MiniLuxe’s aims to radically

transform a highly fragmented and under-regulated self-care and

nail care industry through its brand, standards, and technology

platform that collectively enable better talent and client

experiences. For its clients, MiniLuxe offers best-in-class

self-care services and better-for-you products, and for nail care

and beauty professionals, MiniLuxe seeks to become the employer of

choice. In addition to creating long-term durable economic returns

for our stakeholders, the brand seeks to positively impact and

empower one of the most diverse and largest hourly worker segments

through professional development and certification, economic

mobility, and company ownership opportunities (e.g., equity

participation and future franchise opportunities). Since its

inception, MiniLuxe has performed over 4 million services.

For further information

Christine MastrangeloInvestor Relations, MiniLuxe Holding

Corp.cmastrangelo@MiniLuxe.comMiniLuxe.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward-looking statements

This press release contains "forward-looking

information" and "forward-looking statements" (collectively,

"forward-looking information") concerning the Company and its

subsidiaries within the meaning of applicable securities laws.

Forward-looking information may relate to the future financial

outlook and anticipated events or results of the Company and may

include information regarding the Company's financial position,

business strategy, growth strategies, acquisition prospects and

plans, addressable markets, budgets, operations, financial results,

taxes, dividend policy, plans and objectives. Particularly,

information regarding the Company's expectations of future results,

performance, achievements, prospects or opportunities or the

markets in which the Company operates is forward-looking

information. In some cases, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "targets", "expects", "budgets", "scheduled", "estimates",

"outlook", "forecasts", "projects", "prospects", "strategy",

"intends", "anticipates", "believes", or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might", or "will" occur. In addition, any

statements that refer to expectations, intentions, projections or

other characterizations of future events or circumstances contain

forward-looking information. Statements containing forward-looking

information are not historical facts but instead represent

management's expectations, estimates and projections regarding

future events or circumstances.

Many factors could cause the Company's actual

results, performance, or achievements to be materially different

from any future results, performance, or achievements that may be

expressed or implied by such forward-looking information,

including, without limitation, those listed in the "Risk Factors"

section of the Company's filing statement dated November 9, 2021.

Should one or more of these risks or uncertainties materialize, or

should assumptions underlying the forward-looking statements prove

incorrect, actual results, performance, or achievements could vary

materially from those expressed or implied by the forward-looking

statements contained in this press release.

Forward-looking information, by its nature, is

based on the Company's opinions, estimates and assumptions in light

of management's experience and perception of historical trends,

current conditions and expected future developments, as well as

other factors that the Company currently believes are appropriate

and reasonable in the circumstances. Those factors should not be

construed as exhaustive. Despite a careful process to prepare and

review forward-looking information, there can be no assurance that

the underlying opinions, estimates and assumptions will prove to be

correct. These factors should be considered carefully, and readers

should not place undue reliance on the forward-looking information.

Although the Company bases its forward-looking information on

assumptions that it believes were reasonable when made, which

include, but are not limited to, assumptions with respect to the

Company's future growth potential, results of operations, future

prospects and opportunities, execution of the Company's business

strategy, there being no material variations in the current tax and

regulatory environments, future levels of indebtedness and current

economic conditions remaining unchanged, the Company cautions

readers that forward-looking statements are not guarantees of

future performance and that our actual results of operations,

financial condition and liquidity, and the development of the

industry in which the Company operates may differ materially from

the forward-looking statements contained in this press release. In

addition, even if the Company's results of operations, financial

condition and liquidity, and the development of the industry in

which it operates are consistent with the forward-looking

information contained in this press release, those results or

developments may not be indicative of results or developments in

subsequent periods.

Although the Company has attempted to identify

important risk factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other risk factors not presently known to the Company

or that the Company presently believes are not material that could

also cause actual results or future events to differ materially

from those expressed in such forward-looking information. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such information. Accordingly, readers should not

place undue reliance on forward-looking information, which speaks

only as of the date made (or as of the date they are otherwise

stated to be made). Any forward-looking statement that is made in

this press release speaks only as of the date of such

statement.

1 Straight-line rent expense for a given payment period is

calculated by dividing the sum of all payments over the life of the

lease (the figure used in the present value calculation of the

right-of-use asset) by the number of payment periods (typically

months). This number is then annualized by adding the rent expenses

calculated for the payment periods that comprise each fiscal year.

For leases signed mid-year, the total straight-line rent expense

calculation applies the new lease terms only to the payment periods

after the signing of the new lease.

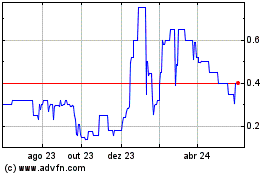

Miniluxe (TSXV:MNLX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

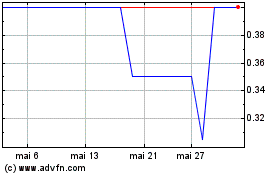

Miniluxe (TSXV:MNLX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024