Sunlands Technology Group (NYSE: STG) (“Sunlands”

or the “Company”), a leader in China’s adult online education

market and China’s adult personal interest learning market, today

announced its unaudited financial results for the first quarter

ended March 31, 2024.

First Quarter

2024 Financial and Operational

Snapshots

- Net revenues were RMB523.2 million (US$72.5 million), compared

to RMB566.9 million in the first quarter of 2023.

- Gross billings (non-GAAP) were RMB398.8 million (US$55.2

million), compared to RMB345.1 million in the first quarter of

2023.

- Gross profit was RMB446.1 million (US$61.8 million), compared

to RMB498.7 million in the first quarter of 2023.

- Net income was RMB112.7 million (US$15.6 million), compared to

RMB180.1 million in the first quarter of 2023.

- Net income margin1 was 21.5% in the first quarter of 2024,

compared to 31.8% in the first quarter of 2023.

- New student enrollments2 were 175,758, compared to 143,179 in

the first quarter of 2023.

- As of March 31, 2024, the Company’s deferred revenue balance

was RMB1,044.9 million (US$144.7 million), compared to RMB1,113.9

million as of December 31, 2023.

“Reflecting on the first quarter of 2024, we've maintained

stability amidst challenging conditions. Despite year-over-year

decrease, our net revenues and net income for the quarter stood at

RMB523.2 million and RMB112.7 million respectively. This marks our

sustained profitability, underscoring our operational efficiency

and commitment to shareholder value. Additionally, our enrollment

figures surged by 22.8%, attributable to our enhanced proficiency

in acquiring students. This improvement reflects our dedicated

initiatives to attract new users and enhance user retention and

engagement by refining our course offerings to meet diverse

learning needs.

Looking ahead, we remain optimistic about our

long-term profitability. We endeavor to closely monitor and enhance

student experience across all phases of teaching, learning,

assessment, and practice. Moving forward, we're dedicated to

delivering exceptional services and products while exploring

avenues for further business growth and operational efficiency

improvements.” said Mr. Tongbo Liu, Chief Executive Officer of

Sunlands.

Mr. Hangyu Li, finance director of Sunlands,

commented, “Throughout the first quarter, we continued our efforts

to improve operational efficiency and optimize our cost structure.

Since the fourth quarter of 2021, the net income margin has

remained consistently above 20%. We also achieved our third

consecutive quarter of net cash inflow from operations, providing a

solid financial foundation for the long-term growth of our

business. This demonstrates the resilience and adaptability of our

business model. Going forward, we will continue to optimize our

product mix while maintaining efficient operations. These strategic

initiatives will enable us to capitalize on emerging opportunities,

strengthen our leadership position in the industry and continue to

create value for our shareholders.”

Financial Results for

the First Quarter of 2024

Net Revenues

In the first quarter of 2024, net revenues

decreased by 7.7% to RMB523.2 million (US$72.5 million) from

RMB566.9 million in the first quarter of 2023. The decrease was

primarily driven by the decline in gross billings from

post-secondary courses over the recent quarters, partially offset

by the growth in revenues from sales of goods such as books and

learning materials.

Cost of Revenues

Cost of revenues increased by 13.2% to RMB77.2

million (US$10.7 million) in the first quarter of 2024 from RMB68.2

million in the first quarter of 2023. The increase was primarily

due to an increase in the cost of revenues from sales of goods such

as books and learning materials.

Gross Profit

Gross profit decreased by 10.6% to RMB446.1

million (US$61.8 million) in the first quarter of 2024 from

RMB498.7 million in the first quarter of 2023.

Operating Expenses

In the first quarter of 2024, operating expenses

were RMB341.1 million (US$47.2 million), representing a 6.4%

increase from RMB320.7 million in the first quarter of 2023.

Sales and marketing expenses increased by 11.1%

to RMB301.6 million (US$41.8 million) in the first quarter of 2024

from RMB271.4 million in the first quarter of 2023. The increase

was mainly due to a growth in spending on sales activities,

including enhanced compensation for sales personnel as well as

increased spending on branding and marketing activities focusing on

interest courses offerings.

General and administrative expenses decreased by

17.9% to RMB32.6 million (US$4.5 million) in the first quarter of

2024 from RMB39.6 million in the first quarter of 2023. The

decrease was mainly due to the decline in rental expenses as

certain leases for office space were partially terminated in 2023

before the expiration of the lease term for cost saving.

Product development expenses decreased by 27.6%

to RMB7.0 million (US$1.0 million) in the first quarter of 2024

from RMB9.7 million in the first quarter of 2023. The decrease was

mainly due to declined compensation expenses related to headcount

reduction of our product development personnel.

Net Income

Net income for the first quarter of 2024 was

RMB112.7 million (US$15.6 million), as compared to RMB180.1 million

in the first quarter of 2023.

Basic and Diluted Net Income

Per Share

Basic and diluted net income per share was

RMB16.44 (US$2.28) in the first quarter of 2024.

Cash, Cash Equivalents, Restricted Cash

and Short-term Investments

As of March 31, 2024, the Company had RMB803.5

million (US$111.3 million) of cash, cash equivalents and restricted

cash and RMB179.7 million (US$24.9 million) of short-term

investments, as compared to RMB766.4 million of cash, cash

equivalents and restricted cash and RMB142.1 million of short-term

investments as of December 31, 2023.

Deferred Revenue

As of March 31, 2024, the Company had a deferred

revenue balance of RMB1,044.9 million (US$144.7 million), as

compared to RMB1,113.9 million as of December 31, 2023.

Share Repurchase

On December 6, 2021, the Company’s board of

directors authorized a share repurchase program, under which the

Company may repurchase up to US$15.0 million of Class A ordinary

shares in the form of ADSs over the next 24 months. On December 1,

2023, the Company’s board of directors authorized to extend its

share repurchase program over the next twenty-four months. As of

May 21, 2024, the Company had repurchased an aggregate of 502,139

ADSs for approximately US$2.5 million under the share repurchase

program.

Outlook

For the second quarter of 2024, Sunlands

currently expects net revenues to be between RMB480 million to

RMB500 million, which would represent a decrease of 5.0% to 8.8%

year-over-year. The above outlook is based on the current market

conditions and reflects the Company’s current and preliminary

estimates of market and operating conditions and customer demand,

which are all subject to substantial uncertainty.

Exchange Rate

The Company’s business is primarily conducted in

China and all revenues are denominated in Renminbi (“RMB”). This

announcement contains currency conversions of RMB amounts into U.S.

dollars (“US$”) solely for the convenience of the reader. Unless

otherwise noted, all translations from RMB to US$ are made at a

rate of RMB7.2203 to US$1.00, the effective noon buying rate for

March 29, 2024 as set forth in the H.10 statistical release of the

Federal Reserve Board. No representation is made that the RMB

amounts could have been, or could be, converted, realized or

settled into US$ at that rate on March 29, 2024, or at any other

rate.

Conference Call and Webcast

Sunlands’ management team will host a conference

call at 7:00 AM U.S. Eastern Time, (7:00 PM Beijing/Hong

Kong time) on May 24, 2024, following the quarterly results

announcement.

For participants who wish to join the call,

please access the link provided below to complete online

registration 15 minutes prior to the scheduled call start time.

Upon registration, participants will receive details for the

conference call, including dial-in numbers, a personal PIN and an

e-mail with detailed instructions to join the conference call.

Registration

Link:https://register.vevent.com/register/BI3a767e6d591c4806943f7c8f6a578811

Additionally, a live webcast and archive of the

conference call will be available on the Investor Relations section

of Sunlands' website at https://ir.sunlands.com/.

About Sunlands

Sunlands Technology Group (NYSE: STG)

(“Sunlands” or the “Company”), formerly known as Sunlands Online

Education Group, is a leader in China’s adult online education

market and China’s adult personal interest learning market. With a

one to many live streaming platform, Sunlands offers various

degree- or diploma-oriented post-secondary courses as well as

professional certification preparation, professional skills and

interest courses. Students can access the Company's services either

through PC or mobile applications. The Company's online platform

cultivates a personalized, interactive learning environment by

featuring a virtual learning community and a vast library of

educational content offerings that adapt to the learning habits of

its students. Sunlands offers a unique approach to education

research and development that organizes subject content into

Learning Outcome Trees, the Company's proprietary knowledge

management system. Sunlands has a deep understanding of the

educational needs of its prospective students and offers solutions

that help them achieve their goals.

About Non-GAAP Financial

Measures

We use gross billings, EBITDA,

non-GAAP operating cost and expenses, non-GAAP income

from operations and Non-GAAP net income per share, each a non-GAAP

financial measure, in evaluating our operating results and for

financial and operational decision-making purposes.

We define gross billings for a specific period

as the total amount of cash received for the sale of course

packages, net of the total amount of refunds paid in such period.

Our management uses gross billings as a performance measurement

because we generally bill our students for the entire course

tuition at the time of sale of our course packages and recognize

revenue proportionally over a period. EBITDA is defined as net

income excluding depreciation and amortization, interest expense,

interest income, and income tax expenses. We believe that gross

billings and EBITDA provide valuable insight into the sales of our

course packages and the performance of our business.

These non-GAAP financial measures should not be

considered in isolation from, or as a substitute for, their most

directly comparable financial measure prepared in accordance with

GAAP. A reconciliation of the historical non-GAAP financial

measures to their respective most directly comparable GAAP measure

has been provided in the tables included below. Investors are

encouraged to review the reconciliation of the historical non-GAAP

financial measures to their respective most directly comparable

GAAP financial measures. As gross billings, EBITDA, operating cost

and expenses excluding share-based compensation expenses, general

and administrative expenses excluding share-based compensation

expenses, sales and marketing expenses excluding share-based

compensation expenses, product development expenses excluding

share-based compensation expenses, non-GAAP net income exclude

share-based compensation expenses, and basic and diluted net income

per share excluding share-based compensation expenses have

material limitations as an analytical metric and may not be

calculated in the same manner by all companies, it may not be

comparable to other similarly titled measures used by other

companies. In light of the foregoing limitations, you should not

consider gross billings and EBITDA as a substitute for, or superior

to, their respective most directly comparable financial measures

prepared in accordance with GAAP. We encourage investors and others

to review our financial information in its entirety and not rely on

a single financial measure.

Safe Harbor Statement

This press release contains forward-looking

statements made under the “safe harbor” provisions of Section 21E

of the Securities Exchange Act of 1934, as amended, and the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” “confident” and similar statements.

Sunlands may also make written or oral forward-looking statements

in its reports filed with or furnished to the U.S. Securities and

Exchange Commission, in its annual report to shareholders, in press

releases and other written materials and in oral statements made by

its officers, directors or employees to third parties. Any

statements that are not historical facts, including statements

about Sunlands' beliefs and expectations, are forward-looking

statements that involve factors, risks and uncertainties that could

cause actual results to differ materially from those in the

forward-looking statements. Such factors and risks include, but not

limited to the following: Sunlands' goals and strategies; its

expectations regarding demand for and market acceptance of its

brand and services; its ability to retain and increase student

enrollments; its ability to offer new courses and educational

content; its ability to improve teaching quality and students’

learning results; its ability to improve sales and marketing

efficiency and effectiveness; its ability to engage, train and

retain new faculty members; its future business development,

results of operations and financial condition; its ability to

maintain and improve technology infrastructure necessary to operate

its business; competition in the online education industry in

China; relevant government policies and regulations relating to

Sunlands’ corporate structure, business and industry; and general

economic and business condition in China Further information

regarding these and other risks, uncertainties or factors is

included in the Sunlands' filings with the U.S. Securities and

Exchange Commission. All information provided in this press release

is current as of the date of the press release, and Sunlands does

not undertake any obligation to update such information, except as

required under applicable law.

For investor and media enquiries, please

contact:

Sunlands Technology GroupInvestor Relations

Email: sl-ir@sunlands.comSOURCE: Sunlands Technology Group

|

SUNLANDS TECHNOLOGY GROUPUNAUDITED

CONDENSED CONSOLIDATED BALANCE

SHEETS(Amounts in thousands,

except for share and per share data, or otherwise

noted) |

| |

| |

|

|

As of December 31, |

|

|

As of March 31, |

| |

|

|

2023 |

|

|

2024 |

|

|

|

|

RMB |

|

|

|

RMB |

|

|

|

US$ |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

763,800 |

|

|

|

800,476 |

|

|

|

110,865 |

|

|

Restricted cash |

|

|

2,578 |

|

|

|

3,055 |

|

|

|

423 |

|

|

Short-term investments |

|

|

142,084 |

|

|

|

179,661 |

|

|

|

24,883 |

|

|

Prepaid expenses and other current assets |

|

|

109,018 |

|

|

|

106,139 |

|

|

|

14,700 |

|

|

Deferred costs, current |

|

|

14,274 |

|

|

|

10,068 |

|

|

|

1,394 |

|

| Total current assets |

|

|

1,031,754 |

|

|

|

1,099,399 |

|

|

|

152,265 |

|

| Non-current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

786,670 |

|

|

|

779,559 |

|

|

|

107,968 |

|

|

Intangible assets, net |

|

|

975 |

|

|

|

751 |

|

|

|

104 |

|

|

Right-of-use assets |

|

|

135,820 |

|

|

|

130,377 |

|

|

|

18,057 |

|

|

Deferred costs, non-current |

|

|

68,773 |

|

|

|

61,499 |

|

|

|

8,518 |

|

|

Long-term investments |

|

|

61,354 |

|

|

|

56,540 |

|

|

|

7,831 |

|

|

Other non-current assets |

|

|

33,160 |

|

|

|

34,337 |

|

|

|

4,756 |

|

| Total non-current assets |

|

|

1,086,752 |

|

|

|

1,063,063 |

|

|

|

147,234 |

|

| TOTAL ASSETS |

|

|

2,118,506 |

|

|

|

2,162,462 |

|

|

|

299,499 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrued expenses and other current liabilities |

|

|

409,691 |

|

|

|

417,455 |

|

|

|

57,820 |

|

|

Deferred revenue, current |

|

|

553,812 |

|

|

|

480,712 |

|

|

|

66,578 |

|

|

Lease liabilities, current portion |

|

|

8,019 |

|

|

|

8,587 |

|

|

|

1,189 |

|

|

Long-term debt, current portion |

|

|

38,654 |

|

|

|

38,654 |

|

|

|

5,354 |

|

| Total current liabilities |

|

|

1,010,176 |

|

|

|

945,408 |

|

|

|

130,941 |

|

|

SUNLANDS TECHNOLOGY GROUPUNAUDITED

CONDENSED CONSOLIDATED BALANCE

SHEETS-continued(Amounts in

thousands, except for share and per share data, or otherwise

noted) |

| |

| |

|

As of December 31, |

|

As of March

31, |

| |

|

|

2023 |

|

|

2024 |

|

| |

|

RMB |

|

RMB |

|

US$ |

| Non-current liabilities |

|

|

|

|

|

|

|

Deferred revenue, non-current |

|

|

560,111 |

|

|

|

564,154 |

|

|

|

78,134 |

|

|

Lease liabilities, non-current portion |

|

|

157,269 |

|

|

|

150,579 |

|

|

|

20,855 |

|

|

Deferred tax liabilities |

|

|

3,742 |

|

|

|

3,106 |

|

|

|

430 |

|

|

Other non-current liabilities |

|

|

6,994 |

|

|

|

7,067 |

|

|

|

979 |

|

|

Long-term debt, non-current portion |

|

|

104,665 |

|

|

|

95,001 |

|

|

|

13,157 |

|

| Total non-current

liabilities |

|

|

832,781 |

|

|

|

819,907 |

|

|

|

113,555 |

|

| TOTAL LIABILITIES |

|

|

1,842,957 |

|

|

|

1,765,315 |

|

|

|

244,496 |

|

|

|

| SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

Class A ordinary shares (par value of US$0.00005, 796,062,195

shares |

|

|

|

|

|

|

|

authorized; 3,131,807 and 3,131,807 shares issued as of December

31, 2023 |

|

|

|

|

|

|

|

and March 31, 2024, respectively; 2,702,523 and 2,697,294

shares |

|

|

|

|

|

|

|

outstanding as of December 31, 2023 and March 31, 2024,

respectively) |

|

|

1 |

|

|

|

1 |

|

|

|

- |

|

|

Class B ordinary shares (par value of US$0.00005, 826,389

shares |

|

|

|

|

|

|

|

authorized; 826,389 and 826,389 shares issued and outstanding |

|

|

|

|

|

|

|

as of December 31, 2023 and March 31, 2024, respectively) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Class C ordinary shares (par value of US$0.00005, 203,111,416

shares |

|

|

|

|

|

|

|

authorized; 3,332,062 and 3,332,062 shares issued and

outstanding |

|

|

|

|

|

|

|

as of December 31, 2023 and March 31, 2024, respectively) |

|

|

1 |

|

|

|

1 |

|

|

|

- |

|

|

Treasury stock |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Accumulated deficit |

|

|

(2,171,284 |

) |

|

|

(2,058,549 |

) |

|

|

(285,106 |

) |

|

Additional paid-in capital |

|

|

2,305,042 |

|

|

|

2,304,369 |

|

|

|

319,151 |

|

|

Accumulated other comprehensive income |

|

|

143,276 |

|

|

|

152,812 |

|

|

|

21,164 |

|

| Total Sunlands Technology

Group shareholders’ equity |

|

|

277,036 |

|

|

|

398,634 |

|

|

|

55,209 |

|

| Non-controlling interest |

|

|

(1,487 |

) |

|

|

(1,487 |

) |

|

|

(206 |

) |

| TOTAL SHAREHOLDERS’

EQUITY |

|

|

275,549 |

|

|

|

397,147 |

|

|

|

55,003 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

2,118,506 |

|

|

|

2,162,462 |

|

|

|

299,499 |

|

|

SUNLANDS TECHNOLOGY GROUPUNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(Amounts in thousands, except for share

and per share data, or otherwise noted) |

| |

| |

|

For the Three Months Ended March

31, |

| |

|

|

2023 |

|

|

2024 |

|

| |

|

RMB |

|

RMB |

|

US$ |

|

Net revenues |

|

|

566,876 |

|

|

|

523,240 |

|

|

|

72,468 |

|

| Cost of revenues |

|

|

(68,155 |

) |

|

|

(77,163 |

) |

|

|

(10,687 |

) |

| Gross profit |

|

|

498,721 |

|

|

|

446,077 |

|

|

|

61,781 |

|

| |

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

Sales and marketing expenses |

|

|

(271,414 |

) |

|

|

(301,575 |

) |

|

|

(41,768 |

) |

|

Product development expenses |

|

|

(9,680 |

) |

|

|

(7,010 |

) |

|

|

(971 |

) |

|

General and administrative expenses |

|

|

(39,640 |

) |

|

|

(32,552 |

) |

|

|

(4,508 |

) |

| Total operating expenses |

|

|

(320,734 |

) |

|

|

(341,137 |

) |

|

|

(47,247 |

) |

| Income from operations |

|

|

177,987 |

|

|

|

104,940 |

|

|

|

14,534 |

|

| Interest income |

|

|

6,561 |

|

|

|

9,289 |

|

|

|

1,287 |

|

| Interest expense |

|

|

(2,124 |

) |

|

|

(1,604 |

) |

|

|

(222 |

) |

| Other income, net |

|

|

8,798 |

|

|

|

5,780 |

|

|

|

801 |

|

| Income before income tax

(expenses)/benefit |

|

|

|

|

|

|

|

and loss from equity method investments |

|

|

191,222 |

|

|

|

118,405 |

|

|

|

16,400 |

|

| Income tax

(expenses)/benefit |

|

|

(7,731 |

) |

|

|

391 |

|

|

|

54 |

|

| Loss from equity method

investments |

|

|

(3,384 |

) |

|

|

(6,061 |

) |

|

|

(839 |

) |

| Net income |

|

|

180,107 |

|

|

|

112,735 |

|

|

|

15,615 |

|

| |

|

|

|

|

|

|

| Less: net income attributable

to non-controlling interest |

|

|

1 |

|

|

|

- |

|

|

|

- |

|

| Net income attributable to

Sunlands Technology Group |

|

|

180,106 |

|

|

|

112,735 |

|

|

|

15,615 |

|

| Net income per share

attributable to ordinary shareholders of |

|

|

|

|

|

|

|

Sunlands Technology Group: |

|

|

|

|

|

|

|

Basic and diluted |

|

|

26.00 |

|

|

|

16.44 |

|

|

|

2.28 |

|

| Weighted average shares used

in calculating net income |

|

|

|

|

|

|

|

per ordinary share: |

|

|

|

|

|

|

|

Basic and diluted |

|

|

6,926,440 |

|

|

|

6,857,016 |

|

|

|

6,857,016 |

|

|

SUNLANDS TECHNOLOGY GROUPUNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME(Amounts in thousands) |

| |

| |

|

For the Three Months Ended March

31, |

| |

|

|

2023 |

|

|

2024 |

| |

|

RMB |

|

|

RMB |

|

|

|

US$ |

|

|

Net income |

|

|

180,107 |

|

|

|

112,735 |

|

|

|

15,615 |

|

| Other comprehensive

(loss)/income, net of tax effect of nil: |

|

|

|

|

|

|

|

|

|

|

|

Change in cumulative foreign currency translation adjustments |

|

|

(2,327 |

) |

|

|

9,536 |

|

|

|

1,321 |

|

| Total comprehensive

income |

|

|

177,780 |

|

|

|

122,271 |

|

|

|

16,936 |

|

| Less: comprehensive income

attributable to non-controlling interest |

|

|

1 |

|

|

|

- |

|

|

|

- |

|

| Comprehensive income

attributable to Sunlands Technology Group |

|

|

177,779 |

|

|

|

122,271 |

|

|

|

16,936 |

|

|

SUNLANDS TECHNOLOGY GROUPRECONCILIATION

OF GAAP AND NON-GAAP

RESULTS(Amounts in

thousands) |

| |

| |

|

For the Three Months Ended March

31, |

|

|

|

|

2023 |

|

|

|

2024 |

|

| |

|

RMB |

|

RMB |

| Net revenues |

|

|

566,876 |

|

|

|

523,240 |

|

| Less: other revenues |

|

|

(41,847 |

) |

|

|

(58,874 |

) |

| Add: tax and surcharges |

|

|

17,995 |

|

|

|

16,369 |

|

| Add: ending deferred

revenue |

|

|

1,513,896 |

|

|

|

1,044,866 |

|

| Add: ending refund

liability |

|

|

112,188 |

|

|

|

130,840 |

|

| Less: beginning deferred

revenue |

|

|

(1,690,946 |

) |

|

|

(1,113,923 |

) |

| Less: beginning refund

liability |

|

|

(133,066 |

) |

|

|

(143,744 |

) |

| Gross billings (non-GAAP) |

|

|

345,096 |

|

|

|

398,774 |

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| Net income |

|

|

180,107 |

|

|

|

112,735 |

|

| Add: income tax

expenses/(benefit) |

|

|

7,731 |

|

|

|

(391 |

) |

|

depreciation and amortization |

|

|

7,590 |

|

|

|

7,431 |

|

|

interest expense |

|

|

2,124 |

|

|

|

1,604 |

|

| Less: interest income |

|

|

(6,561 |

) |

|

|

(9,289 |

) |

| EBITDA (non-GAAP) |

|

|

190,991 |

|

|

|

112,090 |

|

1 Net income margin is defined as net income as

a percentage of net revenues.

2 New student enrollments for a given period

refer to the total number of orders placed by students that newly

enroll in at least one course during that period, including those

students that enroll and then terminate their enrollment with us,

excluding orders of our low-price courses, such as “mini courses”

and “RMB1 courses”, which we offer in the form of recorded videos

or short live streaming, to strengthen our competitiveness and

improve customer experience.

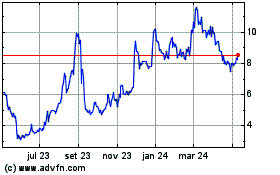

Sunlands Technology (NYSE:STG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

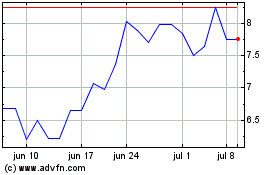

Sunlands Technology (NYSE:STG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024