U.S. Index Futures Show Pre-Market Gains, Oil Prices Fall

24 Maio 2024 - 9:42AM

IH Market News

U.S. index futures are up in pre-market trading this Friday

after a drop in the three major indexes in the previous session,

during which the Dow Jones posted its worst session in over a

year.

At 06:46 AM, Dow Jones futures (DOWI:DJI) rose 69 points, or

0.18%. S&P 500 futures advanced 0.29%, and Nasdaq-100 futures

gained 0.29%. The 10-year Treasury yield stood at 4.475%.

In the commodities market, West Texas Intermediate crude oil for

July fell 0.73% to $80.77 per barrel. Brent crude oil for July fell

0.71%, near $80.79 per barrel. Iron ore traded on the Dalian

Exchange fell 0.44% to $125.38 per metric ton.

On Friday’s economic agenda, April’s durable goods orders will

be released at 8:30 AM by the Commerce Department. At 10:00 AM, the

revised reading of the consumer sentiment index for May will be

published by the University of Michigan and Thomson Reuters.

European markets are trading lower this Friday, following a

global trend due to concerns about U.S. interest rates. Destatis

confirmed that Germany’s GDP grew by 0.2% in the first quarter,

while UK retail sales fell by 2.3% in April, exceeding the expected

0.4% decline forecasted by economists surveyed by Reuters.

Asian markets ended Friday with widespread declines. Shanghai SE

fell 0.88%, Japan’s Nikkei dropped 1.17%, Hong Kong’s Hang Seng

decreased 1.38%, South Korea’s Kospi lost 1.26%, and Australia’s

ASX 200 fell 1.08%.

U.S. stocks had a promising start on Thursday, with an initial

rise led by the technology sector following strong results from

Nvidia (NASDAQ:NVDA). However, the optimism was short-lived. A

surprise with the higher-than-expected May reading of the

Purchasing Managers’ Index created uncertainties about the U.S.

rate-cut cycle. The Dow Jones fell 1.53%, the S&P 500 retreated

0.74%, and the Nasdaq depreciated 0.39%. Concerns about maintaining

high rates influenced the negative behavior of the indexes, while

the chances of rate cuts by September fell to 55.4%, according to

CME Group’s FedWatch Tool.

Scheduled to report quarterly results are Booz Allen

Hamilton Holding Corp (NYSE:BAH), Mesa

Labs (NASDAQ:MLAB), Sunlands Technology

Group (NYSE:STG), Buckle Inc (NYSE:BKE),

Hibbett Sports (NASDAQ:HIBB), Broadway

Financial Corporation (NASDAQ:BYFC), MicroCloud

Hologram (NASDAQ:HOLO), among others.

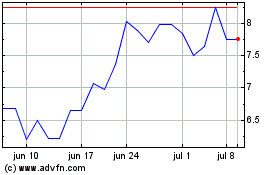

Sunlands Technology (NYSE:STG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

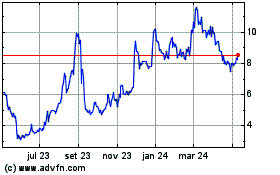

Sunlands Technology (NYSE:STG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024