Immutep Limited ACN 009 237 889 (ASX: IMM, NASDAQ: IMMP)

(

Immutep or the

Company) is

pleased to announce the successful completion of its institutional

placement (

Placement) and the institutional

component (

Institutional Entitlement Offer) of its

1 for 16 pro rata accelerated non-renounceable entitlement offer

(

Entitlement Offer and, together with the

Placement, the

Offer) of new fully paid ordinary

shares in Immutep (

New Shares).

The Placement and Institutional Entitlement

Offer (together, the Institutional

Offer) closed on 4 June 2024. The Institutional

Offer had strong support from institutional investors, with a

take-up rate from eligible institutional investors of approximately

100%.

The Institutional Offer raised gross proceeds of

approximately A$89.6 million at an offer price of A$0.38 per New

Share, consisting of approximately A$72.0 million under the

Placement and approximately A$17.6 million under the Institutional

Entitlement Offer.

Dr Russell Howard, Chairman of Immutep,

said:

“Immutep has gone from strength to strength with

the team working tirelessly to deliver our late-stage clinical

program in three cancer areas: lung, breast, and head and neck

cancer. As we traverse our path towards marketing authorisation in

the US for efti, we’ve continued to report outstanding efficacy and

safety data which has strengthened our belief that it has an

exciting future, changing patient outcomes as part of a combination

with other cancer therapeutics.

“We’re delighted to have such strong and

unwavering support from our shareholders who share our belief in

efti and have continued to invest in Immutep through this

financing. I would also like to welcome our new institutional

investors to our share register. There are many milestones ahead

for Immutep and we will keep you updated as we progress.”

No shareholder approval is required in

connection with the issue of New Shares under the Institutional

Offer.

New Shares subscribed for under the

Institutional Offer are expected to be settled on Tuesday, 11 June

2024 and to be issued on Wednesday, 12 June 2024. New Shares issued

under the Institutional Offer will rank equally with existing fully

paid ordinary shares in Immutep as at their date of issue.

The Offer is expected to raise approximately

A$100.2 million, comprising the Institutional Offer of

approximately A$89.6 million and Retail Entitlement Offer of

approximately A$10.6 million.

Immutep expects ASX to lift its trading halt and

for Immutep’s ordinary shares to recommence trading on ASX

on an ex-entitlements basis from market open today.

Retail Entitlement

Offer

The retail component of the fully underwritten

Entitlement Offer (Retail

Entitlement Offer) is expected to

open at 9.00am on Friday, 7 June 2024 and close at 5.00pm (Sydney,

Australia time) on Thursday, 20 June 2024. The despatch of the

retail entitlement offer booklet for the Retail Entitlement Offer

(Booklet) with personalised entitlement and

acceptance forms for eligible retail shareholders is scheduled to

occur on Friday, 7 June 2024.

Eligible retail shareholders will be able to

subscribe for 1 New Share for every 16 existing ordinary shares

held in Immutep as at 7.00pm (Sydney, Australia time) on the record

date of Wednesday, 5 June 2024, at the offer price of A$0.38 per

New Share, being the same as the price paid per New Share by

investors in the Institutional Offer. Only retain shareholders in

Australia and New Zealand are eligible to participate in the Retail

Entitlement Offer. Persons in the United States may not participate

in the Retail Entitlement Offer.

Under the Retail Entitlement Offer, eligible

retail shareholders who subscribe for their full entitlement to New

Shares may also apply for additional New Shares (Additional

New Shares) in excess of their entitlement up to a maximum

of 100% of their entitlement or $50,000 worth of Additional New

Shares, whichever is lower, under a ‘top up’ facility. Allocations

for Additional New Shares will be determined by Immutep in its

absolute discretion and any allotment of Additional New Shares is

not guaranteed.

Offer Timetable

|

Event |

Date |

|

Announcement of results of Placement and Institutional Entitlement

Offer |

Wednesday, 5 June 2024 |

|

Trading in Immutep shares resumed on an ex-entitlement basis |

Wednesday, 5 June 2024 |

|

Record Date for determining entitlement for the Entitlement

Offer |

7.00pm Wednesday, 5 June 2024 |

|

Retail Offer Booklet made available and Retail Entitlement Offer

opens |

Friday, 7 June 2024 |

|

Settlement of Placement and Institutional Entitlement Offer |

Tuesday, 11 June 2024 |

|

Allotment of New Shares issued under the Placement and

Institutional Entitlement Offer |

Wednesday, 12 June 2024 |

|

Normal trading of New Shares issued under the Placement and

Institutional Entitlement Offer |

Thursday, 13 June 2024 |

|

Retail Entitlement Offer closing date |

Thursday, 20 June 2024 |

|

Settlement of Retail Entitlement Offer |

Tuesday, 25 June 2024 |

|

Allotment of New Shares issued under the Retail Entitlement

Offer |

Wednesday, 26 June 2024 |

|

Normal trading of New Shares issued under the Retail Entitlement

Offer |

Thursday, 27 June 2024 |

|

Despatch of holding statements |

Friday, 28 June 2024 |

About ImmutepImmutep is a

clinical-stage biotechnology company developing novel LAG-3

immunotherapy for cancer and autoimmune disease. We are pioneers in

the understanding and advancement of therapeutics related to

Lymphocyte Activation Gene-3 (LAG-3), and our diversified product

portfolio harnesses its unique ability to stimulate or suppress the

immune response. Immutep is dedicated to leveraging its expertise

to bring innovative treatment options to patients in need and to

maximise value for shareholders. For more information, please visit

www.immutep.com.

U.S. Media:Chris Basta, VP,

Investor Relations and Corporate Communications+1 (631) 318

4000; chris.basta@immutep.com

Not an offer of securities in the United

States

This announcement does not constitute an offer

to sell, or a solicitation of an offer to buy, securities in the

United States. The New Shares have not been registered under the US

Securities Act of 1933 (the US Securities Act) or

the securities laws of any state or other jurisdiction of the

United States, The New Shares may not be offered or sold in the

United States except in a transaction registered under the US

Securities Act or pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the US

Securities Act and applicable US state securities laws. No person

in the United States is not eligible to participate in the Retail

Entitlement Offer.

This announcement contains certain "forward-looking statements"

including but not limited to projections, that are based on

management's beliefs, assumptions and expectations and on

information currently available to management. Forward-looking

statements can generally be identified by the use of

forward-looking words such as, “expect”, “anticipate”, “likely”,

“intend”, “should”, “could”, “may”, “predict”, “plan”, “propose”,

“will”, “believe”, “forecast”, “estimate”, “target” “outlook”,

“guidance” and other similar expressions within the meaning of

securities laws of applicable jurisdictions.

You are strongly cautioned not to place undue reliance on

forward-looking statements, particularly in light of the current

economic climate and the significant volatility, uncertainty and

disruption to equity and capital markets. Any such statements,

opinions and estimates in this announcement speak only as of the

date hereof and are based on assumptions and contingencies subject

to change without notice, as are statements about market and

industry trends, projections, guidance and estimates.

Forward-looking statements are provided as a general guide only.

The forward-looking statements contained in this announcement are

not indications, guarantees or predictions of future performance

and involve known and unknown risks and uncertainties and other

factors, many of which are beyond the control of Immutep and its

subsidiaries, and may involve significant elements of subjective

judgement and assumptions as to future events which may or may not

be correct.

All dates and times are indicative and Immutep reserves the

right to amend any or all of these events, dates and times subject

to the Corporations Act 2001 (Cth), the ASX Listing Rules and other

applicable laws, at any time, including extending the period for

the Entitlement Offer or accepting late applications, either

generally or in particular cases, without notice. The commencement

of trading and quotation of New Shares issued under the Offer is

subject to confirmation from ASX. All times and dates are in

reference to Sydney, Australia time.

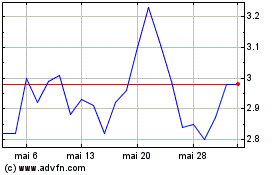

Immutep (NASDAQ:IMMP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Immutep (NASDAQ:IMMP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024