Coca-Cola Consolidated, Inc. (NASDAQ: COKE) (the “Company”)

announced today the preliminary results of its modified “Dutch

auction” tender offer, which expired at 5:00 p.m., New York City

time, on June 18, 2024.

Based on the preliminary count by Equiniti Trust Company, LLC,

the depositary for the tender offer (the “Depositary”), a total of

14,392.5 shares (none of which were tendered by notice of

guaranteed delivery) of the Company’s Common Stock were validly

tendered and not validly withdrawn at or below the purchase price

of $925 per share.

In accordance with the terms and conditions of the tender offer,

and based on the preliminary count by the Depositary, the Company

expects to accept for payment a total of 14,392.5 shares of its

Common Stock at a price of $925 per share, for an aggregate cost of

approximately $13.3 million, excluding fees and expenses relating

to the tender offer. The Company expects to accept for purchase all

of the shares that were validly tendered and not validly withdrawn

at or below the purchase price of $925 per share, without the need

for proration. The shares expected to be accepted for payment

represent approximately 0.2% of the shares of Common Stock that

were issued and outstanding as of June 18, 2024.

As previously announced, the Company has agreed, following the

completion of the tender offer, to purchase from Carolina Coca-Cola

Bottling Investments, Inc. (“CCCBI”), an indirect wholly-owned

subsidiary of The Coca-Cola Company, at the purchase

price equal to the price paid by the Company in the tender offer, a

number of shares of Common Stock such that CCCBI would beneficially

own 21.5% of the Company’s outstanding shares of Common Stock

immediately following the closing of the repurchase (calculated

assuming all issued and outstanding shares of the Company’s Class B

Common Stock are converted into Common Stock and taking into

account the shares of Common Stock purchased in the tender offer)

(the “Share Repurchase”). Based on the shares of Common Stock the

Company expects to accept for payment in the tender offer, the

Company expects to purchase 598,619 shares of Common Stock from

CCCBI in the Share Repurchase, for an aggregate purchase price of

approximately $553.7 million.

“When we announced our tender offer, we were optimistic it would

provide the opportunity to purchase a significant amount of our

outstanding shares,” said J. Frank Harrison, III, Chairman and

Chief Executive Officer. “While the number of shares tendered fell

short of our maximum offer, we are pleased we will purchase

approximately $567 million of value when considering both the

tender offer and shares purchased from The Coca-Cola Company.”

“We view the undersubscribed tender offer as a clear indication

that stockholders believe our shares were undervalued at the time

of the announcement,” Mr. Harrison continued. “We appreciate the

confidence our stockholders continue to express in our business. We

remain committed to our strategy of investing in our teammates,

investing in our business and taking actions to build long-term

value for our stockholders. We will continue to discuss with our

Board prudent uses of capital to create stockholder value and look

forward to communicating our plans with you in the coming

months.”

The number of shares expected to be purchased in the tender

offer and the Share Repurchase and the purchase price per share are

preliminary and subject to change. The preliminary information

contained in this press release is subject to confirmation by the

Depositary. The final number of shares to be purchased in the

tender offer and the Share Repurchase and the final purchase price

per share will be announced following the completion by the

Depositary of the confirmation process. Payment for the shares

accepted for purchase pursuant to the tender offer will occur

promptly thereafter. The closing of the Share Repurchase is

expected to occur on the 11th business day after the expiration of

the tender offer, subject to the satisfaction or waiver of the

conditions to the closing.

Certain Information Regarding the Tender

Offer

The information in this press release describing the tender

offer is for informational purposes only and does not constitute an

offer to buy or the solicitation of an offer to sell shares in the

tender offer. The tender offer was made only pursuant to the Offer

to Purchase and the related materials that Coca-Cola Consolidated

filed with the U.S. Securities and Exchange Commission, as amended

or supplemented, and distributed to its stockholders.

Cautionary Note Regarding Forward-Looking

Statements

Certain statements contained in this news release are

“forward-looking statements” that involve risks and uncertainties

which we expect will or may occur in the future and may impact our

business, financial condition and results of operations. The words

“anticipate,” “believe,” “expect,” “intend,” “project,” “may,”

“will,” “should,” “could” and similar expressions are intended to

identify those forward-looking statements. These forward-looking

statements reflect the Company’s best judgment based on current

information, and, although we base these statements on

circumstances that we believe to be reasonable when made, there can

be no assurance that future events will not affect the accuracy of

such forward-looking information. As such, the forward-looking

statements are not guarantees of future performance, and actual

results may vary materially from the projected results and

expectations discussed in this news release. Factors that might

cause the Company’s actual results to differ materially from those

anticipated in forward-looking statements include, but are not

limited to: increased costs (including due to inflation),

disruption of supply or unavailability or shortages of raw

materials, fuel and other supplies; the reliance on purchased

finished products from external sources; changes in public and

consumer perception and preferences, including concerns related to

product safety and sustainability, artificial ingredients, brand

reputation and obesity; changes in government regulations related

to nonalcoholic beverages, including regulations related to

obesity, public health, artificial ingredients and product safety

and sustainability; decreases from historic levels of marketing

funding support provided to us by The Coca-Cola Company

and other beverage companies; material changes in the performance

requirements for marketing funding support or our inability to meet

such requirements; decreases from historic levels of advertising,

marketing and product innovation spending by

The Coca-Cola Company and other beverage companies,

or advertising campaigns that are negatively perceived by the

public; any failure of the several Coca-Cola system governance

entities of which we are a participant to function efficiently or

on our best behalf and any failure or delay of ours to receive

anticipated benefits from these governance entities; provisions in

our beverage distribution and manufacturing agreements with

The Coca-Cola Company that could delay or prevent a

change in control of us or a sale of our Coca-Cola distribution or

manufacturing businesses; the concentration of our capital stock

ownership; our inability to meet requirements under our beverage

distribution and manufacturing agreements; changes in the inputs

used to calculate our acquisition related contingent consideration

liability; technology failures or cyberattacks on our information

technology systems or our effective response to technology failures

or cyberattacks on our customers’, suppliers’ or other third

parties’ information technology systems; unfavorable changes in the

general economy; the concentration risks among our customers and

suppliers; lower than expected net pricing of our products

resulting from continued and increased customer and competitor

consolidations and marketplace competition; the effect of changes

in our level of debt, borrowing costs and credit ratings on our

access to capital and credit markets, operating flexibility and

ability to obtain additional financing to fund future needs; the

failure to attract, train and retain qualified employees while

controlling labor costs, and other labor issues; the failure to

maintain productive relationships with our employees covered by

collective bargaining agreements, including failing to renegotiate

collective bargaining agreements; changes in accounting standards;

our use of estimates and assumptions; changes in tax laws,

disagreements with tax authorities or additional tax liabilities;

changes in legal contingencies; natural disasters, changing weather

patterns and unfavorable weather; climate change or legislative or

regulatory responses to such change; and the impact of any pandemic

or public health situation. These and other factors are discussed

in the Company’s regulatory filings with the United States

Securities and Exchange Commission, including those in “Item 1A.

Risk Factors” of the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023. The forward-looking

statements contained in this news release speak only as of this

date, and the Company does not assume any obligation to update

them, except as may be required by applicable law.

About Coca-Cola Consolidated, Inc.

Coca-Cola Consolidated is the largest Coca-Cola bottler in the

United States. Our Purpose is to honor God in all we do, to serve

others, to pursue excellence and to grow profitably. For over

122 years, we have been deeply committed to the consumers,

customers and communities we serve and passionate about the broad

portfolio of beverages and services we offer. We make, sell and

distribute beverages of The Coca-Cola Company and other

partner companies in more than 300 brands and flavors across

14 states and the District of Columbia, to approximately

60 million consumers.

Headquartered in Charlotte, N.C., Coca-Cola Consolidated is

traded on The Nasdaq Global Select Market under the symbol “COKE”.

More information about the Company is available at

www.cokeconsolidated.com. Follow Coca-Cola Consolidated on

Facebook, X, Instagram and LinkedIn.

| CONTACTS: |

|

| Ashley Brown

(Media) |

Scott Anthony

(Investors) |

| Director, External

Communications |

Executive Vice President &

Chief Financial Officer |

| (803) 979-2849 |

(704) 557-4633 |

|

Ashley.Brown@cokeconsolidated.com |

Scott.Anthony@cokeconsolidated.com |

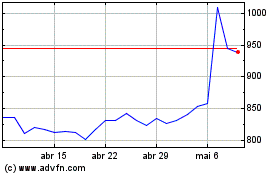

Coca Cola Consolidated (NASDAQ:COKE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Coca Cola Consolidated (NASDAQ:COKE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024