Altus Group Compares Commercial Real Property Tax Rates Across 10 Major U.S. Cities in Inaugural Report

20 Junho 2024 - 10:00AM

Altus Group Limited (“Altus Group” or “the Company”) (TSX: AIF), a

leading provider of asset and fund intelligence for commercial real

estate (“CRE”), today released its inaugural US Real Property Tax

Benchmark Report comprising a comparative analysis of real property

tax rates for commercial real estate across 10 major cities in the

United States.

Real property tax represents one of the largest

operating expenses for most commercial real estate owners and

operators. In the United States, there are over 17,000 property tax

districts, each with its own assessment authority, legislation, and

tax policy, which together determine annual property tax

liabilities. Understanding how the tax amount is calculated, when

changes may occur, and how to compare costs for properties in

multi-jurisdictional portfolios can be challenging. This report

simplifies these complexities by providing a comparison of property

taxes paid in the 2023 calendar year for office, multi-family,

industrial, and retail properties in ten major U.S. cities,

supported by Altus Group’s data, analytics, and expertise.

“This report not only identifies cities with

property tax assessments that do not align with local sales data,

but also highlights where commercial property owners might consider

filing appeals to secure property tax reductions and where they

should prepare for higher taxes in the future,” said Sandi

Prendergast, Director of Tax Research, Altus Group. “Proactively

managing property taxes offers significant opportunities to reduce

an asset's operating expenses and ultimately enhance its

value.”

Effective Property Tax Rates

Since the methodology for calculating property

taxes differs by city, the report standardizes the comparison using

an effective property tax rate as a common denominator to compare

the cities. The effective property tax rate is calculated by

dividing the total tax bill (the tax amount per $1,000 of property

by the city, school district, and other taxing entities) by the

assessor’s determination of value (the “assessed fair market

value”).

The standardized 2023 effective property tax

rates by city for commercial assets were:

|

Chicago |

5.37% |

|

New York City |

4.79% |

|

Dallas |

2.29% |

|

Houston |

2.15% |

|

Miami |

2.06% |

|

Washington DC |

1.65 – 1.89% |

|

Atlanta |

1.63% |

|

Nashville |

1.30% |

|

Los Angeles |

1.20% |

|

San Francisco |

1.18% |

|

AVERAGE |

2.36 – 2.39% |

Property Taxes and Sale Prices

The report also compares property tax rates and

sale prices leveraging Altus Group’s Reonomy data to illustrate

where property tax assessments are out of sync with market values.

The tax/sale ratio (property tax paid as a percentage of sale

price) helps evaluate property tax equity and future tax

changes.

If a sales ratio is higher than the effective

tax rate, it might indicate that values in that sector are not

keeping pace with the overall market, implying there may be more

opportunities to challenge assessments in that sector. Conversely,

if the sales ratio is lower than the effective tax rate, it might

suggest that the market segment may be underassessed, and signal

that property taxes for that sector could increase with the next

revaluation.

Altus Group’s analysis in the report shows that

the actual level of taxation, based on current selling prices, is

in many cases quite different than the expected level of taxation

based on the effective tax rate. The office sector is paying the

highest taxes in proportion to current values, while the industrial

and multi-family sectors are paying the lowest. Despite value

declines in 2023, assessments in these sectors are likely to

increase (as has already happened in Dallas in 2024).

Given the limited transactions available for

analysis in 2023, Altus Group also examines how market value

changes in 2023 may impact property tax rates in 2024. The analysis

indicates a disconnect between assessments for property tax and

market trends could be grounds for challenging assessments through

the appeal process.

“In most regions, we find that assessors are

about 18 months behind on market trends, whereas our clients are 18

months ahead,” added Prendergast. “We work closely with our clients

to bridge that gap and look at the reality as of the date of

valuation to make sure that our clients’ properties are fairly

assessed.”

For a full analysis of regional trends and to

download a copy of the report, please visit:

https://www.altusgroup.com/featured-insights/united-states-property-tax-benchmark-report/

About Altus Group

Altus Group is a leading provider of asset and

fund intelligence for commercial real estate. We deliver

intelligence as a service to our global client base through a

connected platform of industry-leading technology, advanced

analytics, and advisory services. Trusted by the largest CRE

leaders, our capabilities help commercial real estate investors,

developers, proprietors, lenders, and advisors manage risks and

improve performance returns throughout the asset and fund

lifecycle. Altus Group is a global company headquartered in Toronto

with approximately 3,000 employees across North America, EMEA and

Asia Pacific. For more information about Altus Group (TSX: AIF)

please visit altusgroup.com.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Elizabeth LambeDirector, Global Communications,

Altus Group(416) 641-9787elizabeth.lambe@altusgroup.com

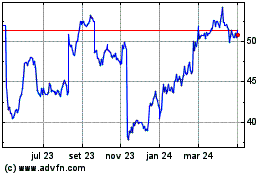

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

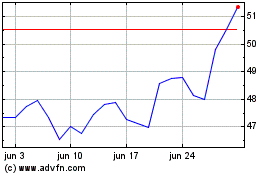

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025