Enerflex Ltd. (TSX: EFX) (NYSE: EFXT) (“Enerflex” or the “Company”)

today announced the extension and consolidation of its credit

facilities and outlined a new target leverage framework.

All amounts presented in this release are in

U.S. Dollar (“USD”) unless otherwise stated.

Extension and Consolidation of Credit

Facilities

Enerflex has entered into an agreement to extend

the maturity date of its secured revolving credit facility (the

“RCF”) by one year to October 13, 2026. Availability under the RCF

has been increased to $800 million from $700 million. Enerflex has

received renewed lending commitments from all current syndicate

members and has also introduced HSBC Bank USA, N.A. as a

lender.

In conjunction with the extension, Enerflex will

be repaying all outstanding amounts under its secured term loan

(the “TLA”) using cash on hand and availability under the expanded

RCF. As at March 31, 2024, the TLA had drawings of $120

million.

The Company also continues to maintain a $70

million unsecured credit facility (the “LC Facility”) with one of

the lenders in its RCF syndicate. The LC Facility is supported by

performance security guarantees provided by Export Development

Canada. As at March 31, 2024, the Company had utilized $36 million

of the $70 million LC Facility limit.

Target Leverage Framework and Capital

Allocation

Enerflex is introducing a new leverage

framework, targeting a bank-adjusted net debt-to-EBITDA ratio of

1.5x to 2.0x. The new leverage framework is underpinned by the

highly utilized U.S. contract compression fleet, contracted

international Energy Infrastructure product line and the recurring

nature of our After-market Services business. Enerflex’s Energy

Infrastructure product line is supported by customer contracts,

which are expected to generate approximately $1.6 billion of

revenue during their current remaining terms.

Providing meaningful returns to shareholders is

a priority for Enerflex. Once the Company is operating within its

target leverage range, Enerflex expects to re-evaluate capital

allocation priorities, which could include increased dividends,

share repurchases, additional growth capital spending, and/or

further repayment of debt. Allocation decisions will be based on

providing the most attractive shareholder returns and measured

against Enerflex’s ability to maintain balance sheet strength.

Management Commentary

Preet Dhindsa, Enerflex’s Senior Vice President

and Chief Financial Officer, stated, “We are pleased with the

extension and expansion of our RCF, appreciate the support of our

syndicate members, and welcome HSBC Bank USA, N.A. as a new member.

Repayment of the TLA reduces Enerflex’s finance costs and reflects

on-going efforts to optimize our debt stack.”

Mr. Dhindsa continued, “From a financial

flexibility perspective, we remain well positioned, with our

bank-adjusted net debt-to-EBITDA leverage ratio exiting Q1/24 at

2.2x and the extension and expansion of the RCF providing ample

liquidity to support our global business. We are pleased to

introduce a new target leverage framework and believe it provides a

visible path for the Company to increase shareholder returns over

time. In 2024, Enerflex will continue to focus on generating free

cash flow, repaying debt, and lowering finance costs.”

Second Quarter Results

Enerflex plans to release its financial results

and operating highlights for the three and six months ended June

30, 2024, after markets close on Wednesday, August 7, 2024. Results

will be communicated by news release and will be available on the

Company's website at www.enerflex.com and under the electronic

profile of the Company on SEDAR+ and EDGAR at www.sedarplus.ca and

www.sec.gov/edgar, respectively.

Investors, analysts, members of the media, and

other interested parties, are invited to participate in a

conference call and audio webcast on Thursday, August 8, 2024 at

8:00 a.m. (MDT), where members of senior management will discuss

the Company's results. A question-and-answer period will

follow.

To participate, register at

https://register.vevent.com/register/BIf11ae800bdbc49e3ae8271e165e1e310.

Once registered, participants will receive the dial-in numbers and

a unique PIN to enter the call. The audio webcast of the conference

call will be available on the Enerflex website at www.enerflex.com

under the Investors section or can be accessed directly at

https://edge.media-server.com/mmc/p/j3n23f36.

Advisory Regarding Forward-looking

Information

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

laws and “forward-looking statements” (and together with

“forward-looking information”, “forward-looking information and

statements”) within the meaning of the safe harbor provisions of

the US Private Securities Litigation Reform Act of 1995. All

statements other than statements of historical fact are

forward-looking information and statements. The use of any of the

words "future", "continue", "estimate", "expect", "may", "will",

"could", "believe", "predict", "potential", "objective", and

similar expressions, are intended to identify forward-looking

information and statements. In particular, this news release

includes (without limitation) forward-looking information and

statements pertaining to: expectations that the Company will repay

the TLA and the timing associated therewith; expectations that the

Energy Infrastructure product line, supported by customer

contracts, will generate approximately $1.6 billion of revenue

during their current remaining terms; the new target leverage

framework being introduced by the Company and the expectation that

it provides a visible path for the Company to increase shareholder

returns overtime; expectations for the Company to reach and operate

within its target leverage range and the timing associated

therewith, if at all; expectations that, once operating within the

target leverage range, the Company will re-evaluate capital

allocation priorities and such priorities may include increasing

dividends, share repurchases, additional growth capital spending

and/or further repayment of debt; and the ability of the Company to

continue to provide meaningful returns to shareholders.

All forward-looking information and statements

in this news release are subject to important risks, uncertainties,

and assumptions, which may affect Enerflex's operations, including,

without limitation: the impact of economic conditions; the markets

in which Enerflex's products and services are used; general

industry conditions; changes to, and introduction of new,

governmental regulations, laws, and income taxes; increased

competition; insufficient funds to support capital investments;

availability of qualified personnel or management; political unrest

and geopolitical conditions; and other factors, many of which are

beyond the control of Enerflex. As a result of the foregoing,

actual results, performance, or achievements of Enerflex could

differ and such differences could be material from those expressed

in, or implied by, these statements, including but not limited to:

the ability of Enerflex to fully realize the anticipated benefits

of, and synergies from, the acquisition of Exterran Corporation and

the timing thereof; the interpretation and treatment of the

transaction to acquire Exterran Corporation by applicable tax

authorities; the ability to maintain desirable financial ratios;

the ability to access various sources of debt and equity capital,

generally, and on acceptable terms, if at all; the ability to

utilize tax losses in the future; the ability to maintain

relationships with partners and to successfully manage and operate

the integrated business; risks associated with technology and

equipment, including potential cyberattacks; the occurrence and

continuation of unexpected events such as pandemics, severe weather

events, war, terrorist threats, and the instability resulting

therefrom; risks associated with existing and potential future

lawsuits, shareholder proposals, and regulatory actions; and those

factors referred to under the heading "Risk Factors" in Enerflex’s:

(i) Annual Information Form for the year ended December 31, 2023,

(ii) management’s discussion and analysis for the year ended

December 31, 2023, and (iii) Management Information Circular dated

March 15, 2024, each of the foregoing documents being accessible

under the electronic profile of the Company on SEDAR+ and EDGAR at

www.sedarplus.ca and www.sec.gov/edgar, respectively.

Readers are cautioned that the foregoing list of

assumptions and risk factors should not be construed as exhaustive.

The forward-looking information and statements included in this

news release are made as of the date of this news release and are

based on the information available to the Company at such time and,

other than as required by law, Enerflex disclaims any intention or

obligation to update or revise any forward-looking information and

statements, whether as a result of new information, future events,

or otherwise. This news release and its contents should not be

construed, under any circumstances, as investment, tax, or legal

advice.

ABOUT ENERFLEXEnerflex is a premier integrated

global provider of energy infrastructure and energy transition

solutions, deploying natural gas, low-carbon, and treated water

solutions – from individual, modularized products and services to

integrated custom solutions. With over 4,500 engineers,

manufacturers, technicians, and innovators, Enerflex is bound

together by a shared vision: Transforming Energy for a

Sustainable Future. The Company remains committed to the

future of natural gas and the critical role it plays, while focused

on sustainability offerings to support the energy transition and

growing decarbonization efforts.

Enerflex's common shares trade on the Toronto

Stock Exchange under the symbol "EFX" and on the New York Stock

Exchange under the symbol "EFXT". For more information about

Enerflex, visit www.enerflex.com.

For investor and media enquiries, contact:

Marc RossiterPresident and Chief Executive OfficerE-mail:

MRossiter@enerflex.com

Preet S. DhindsaSenior Vice President and Chief Financial

Officer E-mail: PDhindsa@enerflex.com

Jeff Fetterly Vice President, Corporate Development and Investor

Relations E-mail: JFetterly@enerflex.com

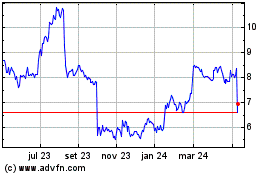

Enerflex (TSX:EFX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

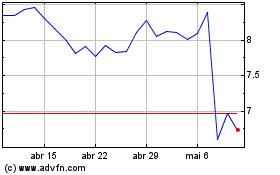

Enerflex (TSX:EFX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024