Clairvest Group Inc. (TSX: CVG) today reported results for the

fourth quarter and year ended March 31, 2024 and events which

occurred subsequent to year end. (All figures are in Canadian

dollars unless otherwise stated)

Highlights

- March 31, 2024 book value was

$1,176.3 million or $80.16 per share compared with $1,150.3 million

or $78.38 per share as at December 31, 2023 and $1,217.7 million or

$81.05 per share as at March 31, 2023

- Net income for the fourth quarter

was $26.1 million or $1.78 per share as the fair value of certain

investments increased

- Net loss for fiscal 2024 was $3.4

million or $0.23 per share. During fiscal 2024, Clairvest had $38

million of net realized gains and $84 million of net unrealized

losses on its private equity portfolio

- Clairvest commenced the investment

program for Clairvest Equity Partners VII, a US$1.2 billion fund

which includes a US$300 million commitment from Clairvest

- Subsequent to year end, Clairvest

and Clairvest Equity Partners VI (“CEP VI”) invested in a south

eastern United States, residential-focused, municipal solid waste

collection company, our ninth investment in the waste management

domain

- Subsequent to year end, Clairvest

and CEP VI together with ECL Entertainment, LLC (“ECL”), an

experienced gaming operator, acquired Wyoming Downs, a licensed

live horse racing and off-track betting operator in Wyoming

- Subsequent to year end, Clairvest

and Clairvest Equity Partners V (“CEP V”) sold their interest in

Durante Rentals, realizing a 0.7x multiple on invested capital at

closing

- Clairvest won the 2024 Private

Equity Global Dealmaker Award for its investment in Arrowhead

Environmental Partners (“Arrowhead”) where it earned a 12.3x

multiple on invested capital

- [Subsequent to year end, Clairvest

declared an annual dividend of $1.5 million, or $0.10 per share,

and a special dividend of $10.3 million, or $0.7016 per share, both

payable on July 26, 2024]

Clairvest’s book value was $1,176.3 million or

$80.16 per share as at March 31, 2024, compared with $1,150.3

million or $78.38 per share as at December 31, 2023 and $1,217.7

million or $81.05 per share as at March 31 2023. Total cash, cash

equivalents and temporary investments excluding marketable

securities, as reported under IFRS, was $253 million. In addition,

our acquisition entities held $91 million in cash, cash equivalents

and temporary investments as at March 31, 2024 bringing total

available cash to $344 million. In aggregate, this represented 29%

of our book value as at March 31, 2024, or approximately $23 per

share.

Net income for the fourth quarter was $26.1

million, or $1.78 per share. The net income for the fourth quarter

of fiscal 2024 reflects a net increase in the fair value of

Clairvest’s investee companies and a corresponding increase in

carried interest from the CEP Funds.

Net loss for the fiscal year was $3.4 million or

$0.23 per share. During the fiscal year, Clairvest divested its

investment in Arrowhead for net realized gains of $38 million,

while the rest of the portfolio experienced net unrealized losses

of $84 million, inclusive of foreign exchange losses. The largest

reduction in value resulted from a change in foreign tax regulation

on an overseas investment.

Also during the fiscal year, 350,300 shares were

purchased and cancelled for a total purchase price of $25.9

million, or at an average price of $73.94 per share.

On April 1, 2024, Clairvest commenced its new

investment program with Clairvest Equity Partners VII, a US$1.2

billion fund pool comprised of a US$300 million commitment from

Clairvest and US$902 million in commitments from third-party

investors. As at the date of this press release, Clairvest Equity

Partners VII had not made any investments.

Subsequent to year end, Clairvest together with

CEP VI made a US$30 million equity investment in a regional,

residential-focused, municipal solid waste collection company

located in the southeastern United States. Clairvest’s portion of

the investment was US$8.1 million (C$11.1 million).

Also subsequent to year end, Clairvest, CEP VI

and ECL acquired Wyoming Downs, a licensed live horse racing and

off-track betting operator in Wyoming for US$191 million, with

Clairvest and CEP VI’s portion of the equity being US$62 million.

Prior to the acquisition, Clairvest and CEP VI had funded a US$15

million deposit during fiscal 2024, and funded a further US$47.2

million at closing to complete the investment. Clairvest’s portion

of the deposit made during the quarter and funding at closing

subsequent to year end was US$4.0 million and US$12.8 million,

respectively.

Also subsequent to year end, Clairvest and CEP V

sold their interest in Durante Rentals. Total proceeds received at

closing on the transaction was US$25 million, Clairvest’s portion

of which was US$8 million, compared to a carrying value of US$5

million as at March 31, 2024. The position was sold at a loss which

generated a 0.7x multiple on invested capital.

"Clairvest capped off the year on a high note,

receiving the 2024 CVCA Private Equity Global Dealmaker of the Year

Award for our investment in Arrowhead Environmental Partners, which

marks our eighth such success. Clairvest and CEP VI achieved a

12.3x MOIC and a 123% internal rate of return on this investment.

This outstanding result is a testament to our partnership approach

and extensive experience in the waste management industry," says

Ken Rotman, CEO of Clairvest. "Fiscal 2024 and the months post year

end have been active at Clairvest. We have witnessed some terrific

accomplishments in the portfolio but also a few setbacks, some due

to operational challenges within our portfolio companies and some

resulting from the external environment which includes, this year,

changes in foreign tax regulations which may cause a material

adverse impact to our investments. With our latest round of

investments, we completed the CEP VI investment program with 15

platform investments, 14 of which are still active. As we launch

CEP VII, we are optimistic given the opportunities we are seeing

compared with the past few years, but also realistic about the

future and the amount of work required to maintain our track

record."

Also subsequent to year end, Clairvest declared

an annual ordinary dividend of $0.10 per share and a special

dividend of $0.7016 per share, such that in aggregate, the

dividends represent 1% of the March 31, 2024 book value. Both

dividends will be payable on July 26, 2024 to common shareholders

of record as of July 5, 2024 and are eligible dividends for

Canadian income tax purposes.

| Summary of

Financial Results – Unaudited |

|

|

|

|

|

|

|

Financial Results(1) |

Quarter ended |

Year ended |

|

March 31 |

March 31 |

|

2024 |

2023 |

2024 |

2023 |

|

($000’s, except per share amounts) |

$ |

$ |

$ |

$ |

|

Net investment gain (loss) |

22,024 |

(12,137) |

(19,385) |

(62,150) |

|

Net carried interest from Clairvest Equity Partners III and IV |

1,005 |

6,716 |

3,700 |

14,258 |

|

Distributions, interest income, dividends and fees |

11,897 |

11,704 |

52,336 |

178,075 |

|

Total expenses (recovery), excluding income taxes |

1,592 |

19,066 |

39,824 |

66,499 |

|

Net income (loss) and comprehensive income (loss) |

26,103 |

(13,838) |

(3,353) |

52,369 |

|

Basic and fully diluted net income (loss) per share |

1.78 |

(0.92) |

(0.23) |

3.48 |

|

Financial Position |

March 31 |

March 31, |

|

2024 |

2023 |

|

($000’s, except share information and per share amounts) |

$ |

$ |

|

Total assets |

1,342,139 |

1,429,651 |

|

Total cash, cash equivalents and temporary investments |

330,193 |

390,832 |

|

Carried interest from Clairvest Equity Partners III and IV |

52,188 |

49,314 |

|

Corporate investments(1) |

870,660 |

891,709 |

|

Total liabilities |

165,842 |

211,924 |

|

Management participation from Clairvest Equity Partners III and

IV |

41,506 |

38,365 |

|

Book value(2) |

1,176,297 |

1,217,727 |

|

Common shares outstanding |

14,673,701 |

15,024,001 |

|

Book value per share(2) |

80.16 |

81.05 |

(1) Includes carried interest of $143,617 (March

31: $151,161) and management participation of $103,740 (March 31:

$112,280) from Clairvest Equity Partners V, VI and VII, and $90,973

(March 31: $102,256) in cash, cash equivalents and temporary

investments held by Clairvest’s acquisition entities.(2) Book value

is a non-IFRS measure calculated as the value of total assets less

the value of total liabilities.

Clairvest’s annual fiscal 2024 financial

statements and MD&A are available on the SEDAR website at

www.sedar.com and the Clairvest website at www.clairvest.com.

About Clairvest

Clairvest’s mission is to partner with

entrepreneurs to help them build strategically significant

businesses. Founded in 1987 by a group of successful Canadian

entrepreneurs, Clairvest is a top performing private equity

management firm with over CAD $4.5 billion of capital under

management. Clairvest invests its own capital and that of third

parties through the Clairvest Equity Partners limited partnerships

in owner-led businesses. Under the current management team,

Clairvest has initiated investments in 66 different platform

companies and generated top quartile performance over an extended

period.

Contact Information

Stephanie LoDirector of Investor Relations and

MarketingClairvest Group

Inc. Tel: (416)

925-9270Fax: (416) 925-5753stephaniel@clairvest.com

Forward-looking Statements

This news release contains forward-looking

statements with respect to Clairvest Group Inc., its subsidiaries,

its CEP limited partnerships and their investments. These

statements are based on current expectations and are subject to

known and unknown risks, uncertainties and other factors which may

cause the actual results, performance or achievements of Clairvest,

its subsidiaries, its CEP limited partnerships and their

investments to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Such factors include general and

economic business conditions and regulatory risks. Clairvest is

under no obligation to update any forward-looking statements

contained herein should material facts change due to new

information, future events or otherwise.

www.clairvest.com

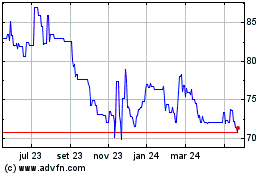

Clairvest (TSX:CVG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

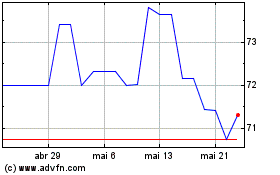

Clairvest (TSX:CVG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025