ARGAN: 2024 ESG report - CO2 emissions decreased by 33.5%

27 Junho 2024 - 12:45PM

ARGAN: 2024 ESG report - CO2 emissions decreased by 33.5%

Press release – Neuilly-sur-Seine, Thursday, June 27,

2024 – 5.45 pm

2024 ESG report:

CO2 emissions decreased

by 33.5%

ARGAN, the only listed French real

estate company specializing in the DEVELOPMENT and RENTAL of

PREMIUM WAREHOUSES, published its 2024 ESG report. Almost 8 months

after having unveiled its new ESG strategy, ARGAN recorded first

significant results and is confirming its ambitions for

2030.

- A clear

reduction in CO2 emissions linked

to energy consumption: the 26.5% decrease in

gas consumption recorded in

2023 contributed, overall, to a 14.5% reduction in

emissions coming from the part of Scope 3 that is linked to the use

of the warehouses. Note that the target set for 2030 as part of our

low carbon strategy is a decrease of –50%. Overall, ARGAN’s 2023

carbon footprint showed a 33.5% decrease from 2022. These first

encouraging results reflect the impact of policies for frugal use

of energy that have been put in place by ARGAN’s client-tenants, of

the implementation of BMS devices that help precisely monitor

energy flows and the systematic deployment of Aut0nom®, the “Net

Zero” in-use warehouse. In 2024, the effective launch of the Heat

Pumps Plan, which aims at replacing gas boilers in the existing

portfolio with electric heat pumps, will further carry the decrease

of “in-use” emissions;

- An

accelerating Social / Societal policy: Our Group also

pursued its initiatives in favour of long-term commitment from its

employees, as the first free shares for all employees were

created, while maintaining an attractive compensation

structure (collective commercial bonuses and profit

sharing) and an equity ratio of 2.4, which is

a particularity amongst companies part of the SBF 120 French

index;

- An

ongoing strengthening of the ESG

governance framework: ARGAN has also

undertaken significant work in formalizing best practices by

drafting and disseminating a set of charters

(anti-corruption, ethics, IT & personal data, and stock market

code of conduct), while specifying its organization regarding the

development and monitoring of its ESG policy (Supervisory Board,

Audit, risks and sustainability Committee, Executive Board, and

monthly ESG-Energy monitoring committee).

These efforts have already been recognized by

independent third parties. ARGAN has improved its ESG risk

rating from 'moderate' to 'low' by

Sustainalytics and has been awarded a silver medal

by Ethifinance.

Beyond presenting the initial progress

made, the 2024 report details the upcoming steps in the deployment

of the 2023-2030 roadmap and very concretely expresses ARGAN’s

ambition to build excellent, responsible, and sustainable logistics

real estate.

The 2024 ESG report published today is

available on our argan.fr website under “ESG commitments”

(in English and French).

2024 financial calendar (Publication of the

press release after closing of the stock exchange)

- July 1: Net sales of 2nd quarter 2024

- July 24: Half-year results 2024

- October 1: Net sales of 3rd quarter 2024

2025 financial calendar (Publication of the

press release after closing of the stock exchange)

- January 3: Net sales of 4th quarter 2024

- January 16: Annual results 2024

- March 20: General Assembly 2025

About ARGAN

ARGAN is the only French real

estate company specializing in the DEVELOPMENT & RENTAL OF

PREMIUM WAREHOUSES listed on EURONEXT and is the leading player of

its market. Building on a unique client-tenant-centric approach,

ARGAN builds pre-let PREMIUM warehouses for blue-chip clients and

supports them throughout all project phases from the development

milestones to the rental management.Profitability, tight control

over our debt and sustainability are at the heart of

ARGAN’s DNA. Its strongly proactive ESG policy has

very concrete results with our Aut0nom® concept, the “in-use” Net

Zero warehouse. As at December 31, 2023, our portfolio represented

3.6 million sq.m, across about a hundred warehouses, exclusively

located in the continental part of France. This portfolio was

valued €3.7 billion for a yearly rental income of about €200

million in

2024. ARGAN

is a listed real estate investment company (French SIIC), on

Compartment A of Euronext Paris (ISIN FR0010481960 - ARG) and is

included in the Euronext SBF 120, CAC All-Share, EPRA Europe and

IEIF SIIC France indices.www.argan.fr

| Francis

Albertinelli – CFO Aymar de Germay – General SecretarySamy Bensaid

– Head of Investor RelationsPhone: +33 1 47 47 47 40 E-mail:

contact@argan.frwww.argan.fr |

Marlène Brisset – Media relationsPhone: +33 6 59 42 29

35E-mail: argan@citigatedewerogerson.com |

|

|

- 20240627 - ARGAN published its 2024 ESG report

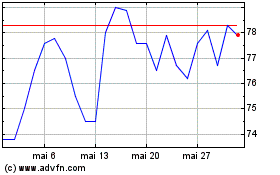

Argan (EU:ARG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Argan (EU:ARG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024