SL Green Office Leasing Volume Exceeds 1.4 Million Square Feet in 2024

17 Julho 2024 - 5:05PM

SL Green Realty Corp. (NYSE:SLG), Manhattan’s largest office

landlord, today announced that it signed leases totaling 420,513

square feet during the second quarter of 2024 and leases totaling

an additional 367,401 square feet in July to date. This increases

the total office leases signed year-to-date to 1,421,574 square

feet, while maintaining a pipeline of approximately 1.2 million

square feet.

Notable leases signed since the first quarter include:

- Ares Management, a leading global investment manager, signed a

15-year, 307,336 square foot lease covering floors 37-44 at 245

Park Avenue, which included a 175,587 square foot renewal and

131,749 square feet of expansion space. Chris Corrinet, Lewis

Miller, Michael Geohegan, Munish Viralam and Cara Chayet of CBRE

represented the tenant. Patrick Murphy, Bruce Mosler, Tara Stacom,

Harry Blair, Ron LoRusso, Justin Royce, Pierce Hance and Will

Yeatman of Cushman & Wakefield represented the landlord.

- Elliot Management Corp, one of the oldest fund managers with

over $65 billion in assets, signed a new 12-year, 149,437 square

foot lease at 280 Park Avenue. Neil Goldmacher, Chris Mongeluzzo

and Eric Zemachson of Newmark represented Elliot. Mary Ann Tighe,

Peter Turchin, Gregg Rothkin, Jason Pollen and Hannah Gerard of

CBRE represented the landlord.

- Tradeweb Markets LLC, a leading global operator of electronic

marketplaces for rates, credit, equities and money markets, signed

a new 15-year, 75,825 square foot lease covering floors 29 and 30

at 245 Park Avenue. David Kleiner, Michael Berg, Will McGarry and

Finley Burger of Jones Lang LaSalle represented Tradeweb. Patrick

Murphy, Bruce Mosler, Tara Stacom, Harry Blair, Ron LoRusso, Justin

Royce, Pierce Hance and Will Yeatman of Cushman Wakefield

represented the landlord.

- Golenbock Eiseman Assor Bell & Peskoe, a multi-practice law

firm, signed an 8-year, 38,050 square foot renewal lease covering

floors 16 and 17 at 711 Third Avenue. Rob Silver and Scott Brown of

Newmark represented the tenant.

- Brightwood Capital Advisors, a private-credit lender to small

and midsize businesses, signed a 10-year, 17,320 square foot

renewal lease covering the 26th floor at 810 Seventh Avenue. Jared

Horowitz of Newmark represented Brightwood.

“Leasing momentum has maintained a healthy pace throughout the

first half of the year with tenant demand focused on buildings that

have been upgraded, amenitized and are located near mass transit,

which is the hallmark of the SL Green portfolio,” said

Steven Durels, Executive Vice President and Director of

Leasing and Real Property at SL Green.

About SL Green Realty Corp.SL Green Realty

Corp., Manhattan's largest office landlord, is a fully integrated

real estate investment trust, or REIT, that is focused primarily on

acquiring, managing and maximizing the value of Manhattan

commercial properties. As of June 30, 2024, SL Green held interests

in 55 buildings totaling 31.8 million square feet. This included

ownership interests in 28.1 million square feet of Manhattan

buildings and 2.8 million square feet securing debt and preferred

equity investments.

Forward Looking Statement

This press release includes certain statements

that may be deemed to be "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995 and

are intended to be covered by the safe harbor provisions thereof.

All statements, other than statements of historical facts, included

in this press release that address activities, events or

developments that we expect, believe or anticipate will or may

occur in the future, including such matters as future capital

expenditures, dividends and acquisitions (including the amount and

nature thereof), development trends of the real estate industry and

the New York metropolitan area markets, business strategies,

expansion and growth of our operations and other similar matters,

are forward-looking statements. These forward-looking statements

are based on certain assumptions and analyses made by us in light

of our experience and our perception of historical trends, current

conditions, expected future developments and other factors we

believe are appropriate. Forward-looking statements are not

guarantees of future performance and actual results or developments

may differ materially, and we caution you not to place undue

reliance on such statements. Forward-looking statements are

generally identifiable by the use of the words "may," "will,"

"should," "expect," "anticipate," "estimate," "believe," "intend,"

"project," "continue," or the negative of these words, or other

similar words or terms.

Forward-looking statements contained in this

press release are subject to a number of risks and uncertainties,

many of which are beyond our control, that may cause our actual

results, performance or achievements to be materially different

from future results, performance or achievements expressed or

implied by forward-looking statements made by us. Factors and risks

to our business that could cause actual results to differ from

those contained in the forward-looking statements include risks and

uncertainties described in our filings with the Securities and

Exchange Commission. Except to the extent required by law, we

undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of future events,

new information or otherwise.

PRESS

CONTACTslgreen@berlinrosen.com

SLG – LEAS

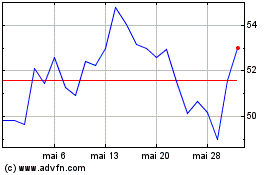

SL Green Realty (NYSE:SLG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

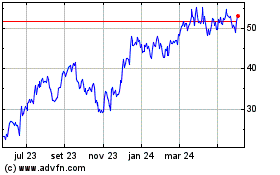

SL Green Realty (NYSE:SLG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024