SL Green Signs Retail Leases Totaling More Than 66,000 Square Feet

17 Julho 2024 - 5:20PM

SL Green Realty Corp. (NYSE: SLG), Manhattan’s largest office

landlord, today announced that it has signed retail leases totaling

66,014 square feet since the end of the first quarter of 2024 and

has reached full retail occupancy at One Madison Avenue.

“One Madison Avenue epitomizes what a new office development

should be to appeal to a new age workforce. Our goal was to curate

an array of high-quality hospitality and lifestyle tenants to

provide elevated live-work-play experiences for our tenants and the

vibrant Flatiron neighborhood,” said Brett Herschenfeld,

Executive Vice President, Retail and Opportunistic Investments at

SL Green. “Our strong retail leasing across the portfolio

is indicative of the appetite for unique, quality retail throughout

New York City, driven by high foot traffic and an increase in New

York City tourism.”

The new hospitality-focused retail tenants augment the

building’s existing lifestyle flagship retail tenant Chelsea Piers,

which will open its second Manhattan location at the tower in

August 2024.

One Madison Avenue’s retail leasing achievements includes the

following culinary offerings:

- La Tête d’Or by Daniel (11,983 square feet, 15

years): Chef Daniel Boulud will open his first steakhouse

experience later this year. With influences drawn from the comfort

of the American steakhouse blended with the classic Parisian dining

scene, the restaurant will feature a 150-person main dining area, a

cocktail bar in a dramatic lounge, private dining room, and an

exclusive private omakase steak and seafood table to enjoy a unique

dining experience. SL Green represented both the tenant and the

landlord.

- Delicious Hospitality Group (13,558 square

feet, 15 years): Owners of Pasquale Jones and Charlie Bird will be

opening a new seafood-focused restaurant concept. The firm was

represented by Ariel Schuster and Michael Cohen of Newmark and the

landlord was represented by Ariel Schuster, Ross Berkowitz and Alex

Hedaya of Newmark.

- Los Tacos No. 1 (4,032 square feet, 15 years):

The bustling taqueria serving authentic Mexican cuisine was

represented by Neal Ohm and Michael Cohen of Newmark. The landlord

was represented by Ariel Schuster, Ross Berkowitz & Alex Hedaya

of Newmark.

- Sweetgreen (3,917 square feet, 10 years): The

nationally loved restaurant brand known for its salads, plates and

bowls was represented by David Firestein and Jacqueline Klinger of

The Shopping Center Group. The landlord was represented by Ariel

Schuster, Ross Berkowitz and Alex Hedaya of Newmark.

- Alidoro (1,004 square feet, 15 years): Italian

specialty sandwich shop adds authentic New York food and beverage

to serve the building’s tenants. Alidoro was represented by Jon

Paul Pirraglia of Ripco while the landlord was represented by Ross

Berkowitz and Alex Hedaya of Newmark.

- Jōji Box (1,966 square feet, 15 years):

Michelin star chefs George Ruan, Wayne Cheng and Xiao Lin of Jōji

omakase fame will open a second Jōji Box location, which will be

expanded to include accessible and fast casual omakase sushi,

following its success at One Vanderbilt Avenue. SL Green

represented both the tenant and the landlord.

Located adjacent to Madison Square Park, the 27-story, 1.4

million-square-foot Midtown South office tower will provide the

highest standard for today’s workplace with forward-thinking

amenities and a cutting-edge healthy work environment.

Elsewhere in the Company’s portfolio, other notable retail lease

signings include:

- Brasserie Cognac signed a new 13,687 square

feet, 15-year lease at 461 Fifth Avenue, bringing the tower’s

retail space to 100% leased. The tenant was represented by Scott

Feldberg of GPG Management and the landlord was represented by

Ariel Schuster, Ross Berkowitz and Jason Wecker of Newmark.

- Chase Bank renewed its 4,718-square-foot lease

for five years at 810 Seventh Avenue. The tenant was represented by

Michael O’Neill of Cushman & Wakefield and the landlord was

represented in-house.

About SL Green Realty Corp.SL Green Realty

Corp., Manhattan's largest office landlord, is a fully integrated

real estate investment trust, or REIT, that is focused primarily on

acquiring, managing and maximizing the value of Manhattan

commercial properties. As of June 30, 2024, SL Green held interests

in 55 buildings totaling 31.8 million square feet. This included

ownership interests in 28.1 million square feet of Manhattan

buildings and 2.8 million square feet securing debt and preferred

equity investments.

Forward Looking StatementThis

press release includes certain statements that may be deemed to be

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995 and are intended to be

covered by the safe harbor provisions thereof. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that we

expect, believe or anticipate will or may occur in the future,

including such matters as future capital expenditures, dividends

and acquisitions (including the amount and nature thereof),

development trends of the real estate industry and the New York

metropolitan area markets, business strategies, expansion and

growth of our operations and other similar matters, are

forward-looking statements. These forward-looking statements are

based on certain assumptions and analyses made by us in light of

our experience and our perception of historical trends, current

conditions, expected future developments and other factors we

believe are appropriate. Forward-looking statements are not

guarantees of future performance and actual results or developments

may differ materially, and we caution you not to place undue

reliance on such statements. Forward-looking statements are

generally identifiable by the use of the words "may," "will,"

"should," "expect," "anticipate," "estimate," "believe," "intend,"

"project," "continue," or the negative of these words, or other

similar words or terms.

Forward-looking statements contained in this

press release are subject to a number of risks and uncertainties,

many of which are beyond our control, that may cause our actual

results, performance or achievements to be materially different

from future results, performance or achievements expressed or

implied by forward-looking statements made by us. Factors and risks

to our business that could cause actual results to differ from

those contained in the forward-looking statements include risks and

uncertainties described in our filings with the Securities and

Exchange Commission. Except to the extent required by law, we

undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of future events,

new information or otherwise.

PRESS CONTACTslgreen@berlinrosen.com

SLG-LEAS

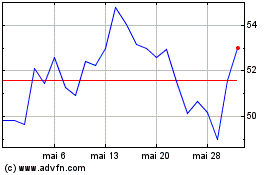

SL Green Realty (NYSE:SLG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

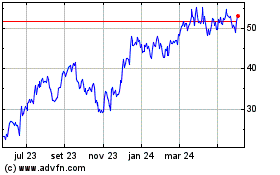

SL Green Realty (NYSE:SLG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024