Ascot Announces Closing of C$34 Million Bought Deal Financing

25 Julho 2024 - 10:05AM

Ascot Resources Ltd. (

TSX: AOT; OTCQX:

AOTVF) (“

Ascot” or the

“

Company”) is pleased to announce that it has

closed the previously announced bought deal financing, including

the full exercise of the over-allotment option, for gross proceeds

of approximately C$34 million (the “

Offering”).

The Offering consisted of 30,242,000 flow-through units (the

“

Flow-Through Units”) at a price of C$0.496 per

Flow-Through Unit and 44,188,000 hard dollar units (the “

HD

Units”) at a price of C$0.43 per HD Unit (together, the

“

Offered Securities”) for gross proceeds of

approximately C$34 million. The Offering was conducted by a

syndicate of underwriters co-led by BMO Capital Markets and

Desjardins Capital Markets (together, the “

Joint

Bookrunners”), and including Raymond James Ltd., CIBC

World Markets Inc., and Velocity Trade Capital Ltd. (collectively,

with the Joint Bookrunners, the “

Underwriters”).

Each Offered Security is comprised of one common share of the

Company (each, a “

Share") and one common share

purchase warrant of the Company (each, a

“

Warrant”). Each Warrant will entitle the holder

to acquire one Share (each, a “

Warrant Share”) at

a price of C$0.52 per Warrant Share for a period of 24 months

following Closing. The Shares and Warrants comprising the

Flow-Through Units will qualify as “flow-through shares” within the

meaning of subsection 66(15) of the Income Tax Act (Canada).

The gross proceeds raised from the Shares and

Warrants comprising Flow-Through Units will be used by the Company

to incur eligible “accelerated Canadian development expenses"

(within the meaning of the Income Tax Act (Canada)) (the

“Qualifying Expenditures”). The Qualifying

Expenditures will be incurred or deemed to be incurred and

renounced to the purchasers of the Flow-Through Units with an

effective date no later than December 31, 2024. The net proceeds

raised pursuant to the issuance of the HD Units will be used for

the ongoing commissioning and ramp-up of the Premier Gold Mine, for

additional working capital, and for general corporate purposes.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of the securities in

any State in which such offer, solicitation or sale would be

unlawful.

On behalf of the Board of Directors of

Ascot Resources Ltd.

“Derek C. White”President & CEO,

Director

For further information

contact: David Stewart, P.Eng.VP, Corporate Development

& Shareholder Communicationsdstewart@ascotgold.com778-725-1060

ext. 1024

About Ascot Resources Ltd.

Ascot is a Canadian mining company focused on

commissioning its 100%-owned Premier Gold Mine

(“Premier”), which poured first gold in April 2024

and is located on Nisga’a Nation Treaty Lands, in the prolific

Golden Triangle of northwestern British Columbia. Concurrent with

commissioning Premier towards commercial production anticipated in

the second half of 2024, the Company continues to explore its

properties for additional high-grade gold mineralization. Ascot’s

corporate office is in Vancouver, and its shares trade on the TSX

under the ticker AOT and on the OTCQX under the ticker AOTVF. Ascot

is committed to the safe and responsible operation of the Premier

Gold Mine in collaboration with Nisga’a Nation and the local

communities of Stewart, BC and Hyder, Alaska.

For more information about the Company, please

refer to the Company’s profile on SEDAR+ at www.sedarplus.ca or

visit the Company’s web site at www.ascotgold.com.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements and other information contained

in this press release about anticipated future events may

constitute forward-looking information under Canadian securities

laws ("forward-looking statements"). Forward-looking statements are

often, but not always, identified by the use of words such as

"seek", "anticipate", "believe", "plan", "estimate", "expect",

"targeted", "outlook", "on track" and "intend" and statements that

an event or result "may", "will", "should", "could", “would” or

"might" occur or be achieved and other similar expressions. All

statements, other than statements of historical fact, included

herein are forward-looking statements, including statements in

respect of the use of proceeds of the Offering, advancement and

development of the Premier Gold Mine and the timing related

thereto, the completion of the Premier Gold Mine, the production of

gold and management’s outlook for the remainder of 2024 and beyond.

These statements involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements, including risks related to the business of Ascot;

exploration and potential development of Ascot's projects; business

and economic conditions in the mining industry generally;

fluctuations in commodity prices and currency exchange rates;

interpretation of drill results and the geology, continuity and

grade of mineral deposits; the need for cooperation of government

agencies and indigenous groups in the exploration and development

of Ascot’s properties and the issuance of required permits; the

need to obtain additional financing to develop properties and

uncertainty as to the availability and terms of future financing;

the possibility of delay in exploration or development programs and

uncertainty of meeting anticipated program milestones; uncertainty

as to timely availability of permits and other governmental

approvals; receipt of necessary stock exchange approval for the

Offering; and the risks, uncertainties and other factors identified

in Ascot's periodic filings with Canadian securities regulators,

available on Ascot's SEDAR+ profile at www.sedarplus.ca including

the Annual Information Form dated March 25, 2024 under the heading

"Risk Factors". Forward-looking statements are based on assumptions

made with regard to: the estimated costs associated with

construction of the project; the ability to maintain throughput and

production levels at the Premier Gold Mine; the tax rate applicable

to the Company; future commodity prices; the grade of mineral

resources and mineral reserves; the ability of the Company to

convert inferred mineral resources to other categories; the ability

of the Company to reduce mining dilution; the ability to reduce

capital costs; and exploration plans. Forward-looking statements

are based on estimates and opinions of management at the date the

statements are made. Although Ascot believes that the expectations

reflected in such forward-looking statements and/or information are

reasonable, undue reliance should not be placed on forward-looking

statements since Ascot can give no assurance that such expectations

will prove to be correct. Ascot does not undertake any obligation

to update forward-looking statements, other than as required by

applicable laws. The forward-looking information contained in this

news release is expressly qualified by this cautionary

statement.

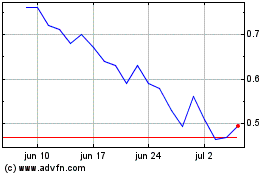

Ascot Resources (TSX:AOT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Ascot Resources (TSX:AOT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024