Heritage Commerce Corp Announces $15 Million Share Repurchase

25 Julho 2024 - 7:38PM

Heritage Commerce Corp (NASDAQ: HTBK) (the

"Company") the holding company of Heritage Bank of Commerce (the

"Bank") today announced that its Board of Directors (the “Board”)

adopted a share repurchase program (the “Repurchase Program”) under

which the Company is authorized to repurchase up to $15 million of

the Company’s shares of its issued and outstanding common stock.

“From time to time, we believe Heritage’s shares are undervalued

and repurchases represent a value-enhancing deployment of capital,”

said Clay Jones, President and Chief Executive Officer. “We are

confident about the growth of our Company, and we believe that when

our shares are undervalued, repurchases represent a value-enhancing

deployment of capital. We believe this Repurchase Program will

enhance the return on our tangible common equity. As we look at the

broader landscape, and the strategic opportunities before us, we

will remain financially disciplined with a clear focus on executing

against our strategic plan and delivering value for our

shareholders.”

Under the Repurchase Program, the Company is authorized to

purchase up to $15 million of its common stock from time-to-time in

open market transactions, made pursuant to Rule 10b-18 of the

Securities Exchange Act of 1934, as amended. The actual timing,

price, value and amount of any repurchases under the Repurchase

Program will depend on various factors, including the market price

of the Company’s common stock, trading volume, general market

conditions and other corporate and economic considerations,

including the best interests of our shareholders. The Company has

entered into an agreement with Keefe, Bruyette & Woods to

assist in repurchasing shares of Company common stock as part of

the Repurchase Program.

The Repurchase Program may be suspended, terminated or modified

at any time for any reason, including market conditions, the cost

of repurchasing shares, the availability of alternative investment

opportunities, liquidity, and other factors deemed appropriate.

These factors may also affect the timing and amount of share

repurchases. The Repurchase Program does not obligate the Company

to purchase any particular number of shares. Unless otherwise

suspended or terminated, the Repurchase Program expires on July 31,

2025.

Heritage Commerce Corp, a bank holding company

established in October 1997, is the parent company of Heritage Bank

of Commerce, established in 1994 and headquartered in San Jose, CA

with full-service branches in Danville, Fremont, Gilroy, Hollister,

Livermore, Los Altos, Los Gatos, Morgan Hill, Oakland, Palo Alto,

Pleasanton, Redwood City, San Francisco, San Jose, San Mateo, San

Rafael, and Walnut Creek. Heritage Bank of Commerce is an SBA

Preferred Lender. Bay View Funding, a subsidiary of Heritage Bank

of Commerce, is based in San Jose, CA and provides

business-essential working capital factoring financing to various

industries throughout the United States. For more information,

please visit www.heritagecommercecorp.com. The contents of our

website are not incorporated into, and do not perform a part of,

this release or of our filings with the Securities and Exchange

Commission.

Forward-Looking Statement

Disclaimer

Certain matters discussed in this press release constitute

forward-looking statements within the meaning of Section 21E of the

Securities Exchange Act of 1934, as amended. Such forward-looking

statements may be deemed to include, among other things, statements

relating to the Company’s future financial performance, projected

cash flows of our investment securities portfolio, the performance

of our loan portfolio, estimated net interest income resulting from

a shift in interest rates, expectation of high credit quality

issuers ability to repay, as well as statements relating to the

anticipated effects on the Company’s financial condition and

results of operations from expected developments or events. Any

statements that reflect our belief about, confidence in, or

expectations for future events, performance or condition should be

considered forward-looking statements. Readers should not construe

these statements as assurances of a given level of performance, nor

as promises that we will take actions that we currently expect to

take. All statements are subject to various risks and

uncertainties, many of which are outside our control and some of

which may fall outside our ability to predict or anticipate.

Accordingly, our actual results may differ materially from our

projected results, and we may take actions or experience events

that we do not currently expect. The Bank does not undertake, and

specifically disclaims, any obligation to update or revise any

forward-looking statements, whether to reflect new information,

future events, or otherwise, except as required by law.

Member FDIC

For additional information,

contact:Debbie ReuterEVP, Corporate

SecretaryDirect: (408) 494-4542Debbie.Reuter@herbank.com

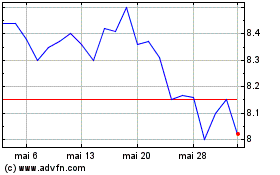

Heritage Commerce (NASDAQ:HTBK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Heritage Commerce (NASDAQ:HTBK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024