Firm Capital Mortgage Investment Corporation Announces Exercise, in Full, of Over-Allotment Option

12 Agosto 2024 - 9:38AM

Firm Capital Mortgage Investment Corporation (the “Corporation”)

(TSX: FC) is pleased to announce that the underwriters of its

previously completed public offering of common shares exercised, in

full, their over-allotment option, resulting in the issue of an

additional 292,500 common shares at a price of $11.30 per share.

The exercise of the over-allotment option brings the total gross

proceeds of the public offering to $25,340,250. The underwriting

syndicate for the offering of shares was bookrun by TD Securities

Inc. and CIBC Capital Markets, and included Canaccord Genuity

Corp., National Bank Financial Inc., RBC Dominion Securities Inc.,

Scotia Capital Inc., Raymond James Ltd., Desjardins Securities

Inc., iA Private Wealth Inc. and Ventum Financial Corp.

The net proceeds from the exercise of the

over-allotment option will be used by the Corporation to repay

indebtedness.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. The

securities offered have not been, and will not be, registered under

the United States Securities Act of 1933, as amended, or any state

securities laws, and may not be offered, sold or delivered,

directly or indirectly, in the United States, its possessions and

other areas subject to its jurisdiction or to, or for the account

or for the benefit of a U.S. person, unless an exemption from

registration is available. This news release is for information

purposes only and does not constitute an offer to sell or a

solicitation of an offer to buy any securities of the Corporation

in any jurisdiction.

About The Corporation

Where Mortgage Deals Get Done®

The Corporation, through its mortgage banker,

Firm Capital Corporation, is a non-bank lender providing

residential and commercial short-term bridge and conventional real

estate financing, including construction, mezzanine, and equity

investments. The Corporation’s investment objective is the

preservation of shareholders’ equity, while providing shareholders

with a stable stream of monthly dividends from investments. The

Corporation achieves its investment objectives through investments

in selected niche markets that are under-serviced by large lending

institutions. Lending activities to date continue to develop a

diversified mortgage portfolio, producing a stable return to

shareholders. Full reports of the financial results of the

Corporation for the year are outlined in the audited consolidated

financial statements and the related management’s discussion and

analysis of the Corporation, available on the SEDAR+ website at

www.sedarplus.ca. In addition, supplemental information is

available on the Corporation’s website at www.firmcapital.com.

Forward-Looking Statements

This news release contains forward-looking

statements within the meaning of applicable securities laws

including, among others, statements associated with the expected

use of proceeds from the exercise of the over-allotment option and

the statements related to the Corporation’s business, including

those contained or incorporated in the Corporation’s prospectus

supplement dated August 2, 2024 supplementing the Corporation’s

short form base shelf prospectus dated July 29, 2024, as well as

statements with respect to management’s beliefs, estimates, and

intentions, and similar statements concerning anticipated future

events, results, circumstances, performance or expectations that

are not historical facts. Forward-looking statements generally can

be identified by the use of forward-looking terminology such as

“outlook”, “objective”, “may”, “will”, “expect”, “intent”,

“estimate”, “anticipate”, “believe”, “should”, “plans” or

“continue” or similar expressions suggesting future outcomes or

events. Such forward-looking statements reflect management’s

current beliefs and are based on information currently available to

management.

These statements are not guarantees of future

performance and are based on our estimates and assumptions that are

subject to risks and uncertainties, including those described in

the Corporation’s prospectus supplement dated August 2, 2024

supplementing the Corporation’s short form base shelf prospectus

dated July 29, 2024 under “Risk Factors” (a copy of which can be

obtained at www.sedarplus.ca), which could cause our actual results

and performance to differ materially from the forward-looking

statements contained in this news release.

Those risks and uncertainties include, among

others, risks associated with public health crises, mortgage

lending, dependence on the Corporation’s manager and mortgage

banker, competition for mortgage lending, real estate values,

interest rate fluctuations, environmental matters, shareholder

liability and the introduction of new tax rules. Material factors

or assumptions that were applied in drawing a conclusion or making

an estimate set out in the forward-looking information include,

among others, that the Corporation is able to invest in mortgages

at rates consistent with rates historically achieved; adequate

mortgage investment opportunities are presented to the Corporation;

and adequate bank indebtedness and bank loans are available to the

Corporation. Although the forward-looking information contained in

this news release is based upon what management believes are

reasonable assumptions, there can be no assurance that actual

results and performance will be consistent with these

forward-looking statements.

All forward-looking statements in this news

release are qualified by these cautionary statements. Except as

required by applicable law, the Corporation undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events,

or otherwise.

For further information, please contact:Firm

Capital Mortgage Investment CorporationEli DadouchPresident &

Chief Executive Officer(416) 635-0221

Boutique Mortgage Lenders®

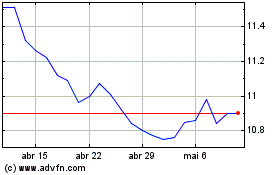

Firm Capital Mortgage In... (TSX:FC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

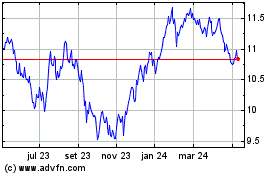

Firm Capital Mortgage In... (TSX:FC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025