Occidental (NYSE: OXY) today announced the launch of an

underwritten secondary public offering of 29,560,619 shares of its

common stock by CrownRock Holdings, L.P. (the “Selling

Stockholder”).

Occidental is not offering any shares of common stock in the

offering. The Selling Stockholder will receive all of the proceeds

from the proposed offering. The offering is subject to market and

other conditions, and there can be no assurance as to whether or

when the offering may be completed.

J.P. Morgan, Morgan Stanley and RBC Capital Markets are acting

as the underwriters for the offering. The underwriters may offer

the shares of common stock from time to time for sale in one or

more transactions on the New York Stock Exchange, in the

over-the-counter market, through negotiated transactions or

otherwise, at market prices prevailing at the time of sale, at

prices related to prevailing market prices or at negotiated

prices.

The proposed offering will be made only by means of a prospectus

supplement and the accompanying base prospectus related to the

offering, copies of which may be obtained, when available, from

J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions,

1155 Long Island Avenue, Edgewood, NY 11717, via email at

prospectus-eq_fi@jpmchase.com; Morgan Stanley & Co. LLC, Attn:

Prospectus Department, 180 Varick Street, 2nd Floor, New York, NY

10014; or RBC Capital Markets, LLC, Attention: Equity Capital

Markets, 200 Vesey Street, New York, NY 10281, by telephone at

877-822-4089 or by email at equityprospectus@rbccm.com.

A shelf registration statement (including a prospectus) relating

to these securities has been filed with the Securities and Exchange

Commission (the “SEC”) and is effective. Before investing,

interested parties should read the shelf registration statement and

other documents filed with the SEC for information about Occidental

and this offering. You may get these documents for free by visiting

EDGAR on the SEC website at sec.gov.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction. Any offers, solicitations or offers to buy,

or any sales of securities will be made in accordance with the

registration requirements of the Securities Act of 1933, as

amended.

About Occidental

Occidental is an international energy company with assets

primarily in the United States, the Middle East and North Africa.

We are one of the largest oil and gas producers in the U.S.,

including a leading producer in the Permian and DJ basins, and

offshore Gulf of Mexico. Our midstream and marketing segment

provides flow assurance and maximizes the value of our oil and gas.

Our chemical subsidiary OxyChem manufactures the building blocks

for life-enhancing products. Our Oxy Low Carbon Ventures subsidiary

is advancing leading-edge technologies and business solutions that

economically grow our business while reducing emissions. We are

committed to using our global leadership in carbon management to

advance a lower-carbon world.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including, but not

limited to, statements about Occidental’s expectations, beliefs,

plans or forecasts. All statements other than statements of

historical fact are “forward-looking statements” for purposes of

federal and state securities laws, including, but not limited to:

any projections of earnings, revenue or other financial items or

future financial position or sources of financing; any statements

of the plans, strategies and objectives of management for future

operations or business strategy; any statements regarding future

economic conditions or performance; any statements of belief; and

any statements of assumptions underlying any of the foregoing.

Words such as “estimate,” “project,” “predict,” “will,” “would,”

“should,” “could,” “may,” “might,” “anticipate,” “plan,” “intend,”

“believe,” “expect,” “aim,” “goal,” “target,” “objective,”

"commit," "advance," “likely” or similar expressions that convey

the prospective nature of events or outcomes are generally

indicative of forward-looking statements. You should not place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release unless an earlier date is

specified. Unless legally required, Occidental does not undertake

any obligation to update, modify or withdraw any forward-looking

statements as a result of new information, future events or

otherwise.

Forward-looking statements involve estimates, expectations,

projections, goals, forecasts, assumptions, risks and

uncertainties. Actual outcomes or results may differ from

anticipated results, sometimes materially. Factors that could cause

results to differ from those projected or assumed in any

forward-looking statement include, but are not limited to: general

economic conditions, including slowdowns and recessions,

domestically or internationally; Occidental’s indebtedness and

other payment obligations, including the need to generate

sufficient cash flows to fund operations; Occidental’s ability to

successfully monetize select assets and repay or refinance debt and

the impact of changes in Occidental’s credit ratings or future

increases in interest rates; assumptions about energy markets;

global and local commodity and commodity-futures pricing

fluctuations and volatility; supply and demand considerations for,

and the prices of, Occidental’s products and services; actions by

the Organization of the Petroleum Exporting Countries (“OPEC”) and

non-OPEC oil producing countries; results from operations and

competitive conditions; future impairments of Occidental's proved

and unproved oil and gas properties or equity investments, or

write-downs of productive assets, causing charges to earnings;

unexpected changes in costs; inflation, its impact on markets and

economic activity and related monetary policy actions by

governments in response to inflation; availability of capital

resources, levels of capital expenditures and contractual

obligations; the regulatory approval environment, including

Occidental's ability to timely obtain or maintain permits or other

government approvals, including those necessary for drilling and/or

development projects; Occidental's ability to successfully

complete, or any material delay of, field developments, expansion

projects, capital expenditures, efficiency projects, acquisitions

or divestitures; risks associated with acquisitions, mergers and

joint ventures, such as difficulties integrating businesses,

uncertainty associated with financial projections, projected

synergies, restructuring, increased costs and adverse tax

consequences; uncertainties and liabilities associated with

acquired and divested properties and businesses; uncertainties

about the estimated quantities of oil, natural gas liquids and

natural gas reserves; lower-than-expected production from

development projects or acquisitions; Occidental’s ability to

realize the anticipated benefits from prior or future streamlining

actions to reduce fixed costs, simplify or improve processes and

improve Occidental’s competitiveness; exploration, drilling and

other operational risks; disruptions to, capacity constraints in,

or other limitations on the pipeline systems that deliver

Occidental’s oil and natural gas and other processing and

transportation considerations; volatility in the securities,

capital or credit markets, including capital market disruptions and

instability of financial institutions; government actions, war

(including the Russia-Ukraine war and conflicts in the Middle East)

and political conditions and events; health, safety and

environmental (“HSE”) risks, costs and liability under existing or

future federal, regional, state, provincial, tribal, local and

international HSE laws, regulations and litigation (including

related to climate change or remedial actions or assessments);

legislative or regulatory changes, including changes relating to

hydraulic fracturing or other oil and natural gas operations,

retroactive royalty or production tax regimes, and deep-water and

onshore drilling and permitting regulations; Occidental's ability

to recognize intended benefits from its business strategies and

initiatives, such as Occidental's low-carbon ventures businesses or

announced greenhouse gas emissions reduction targets or net-zero

goals; potential liability resulting from pending or future

litigation, government investigations and other proceedings;

disruption or interruption of production or manufacturing or

facility damage due to accidents, chemical releases, labor unrest,

weather, power outages, natural disasters, cyber-attacks, terrorist

acts or insurgent activity; the scope and duration of global or

regional health pandemics or epidemics, and actions taken by

government authorities and other third parties in connection

therewith; the creditworthiness and performance of Occidental's

counterparties, including financial institutions, operating

partners and other parties; failure of risk management;

Occidental’s ability to retain and hire key personnel; supply,

transportation and labor constraints; reorganization or

restructuring of Occidental’s operations; changes in state, federal

or international tax rates; and actions by third parties that are

beyond Occidental’s control.

Additional information concerning these and other factors that

may cause Occidental’s results of operations and financial position

to differ from expectations can be found in Occidental’s filings

with the SEC, including Occidental’s Annual Report on Form 10-K for

the year ended December 31, 2023, Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K.

Contacts

|

Media |

Investors |

| Eric Moses |

R. Jordan Tanner |

| 713-497-2017 |

713-552-8811 |

| eric_moses@oxy.com |

investors@oxy.com |

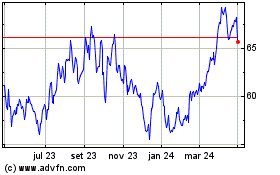

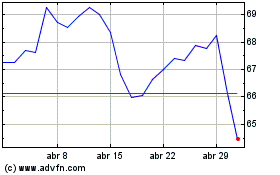

Occidental Petroleum (NYSE:OXY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Occidental Petroleum (NYSE:OXY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024