Aecon Group Inc. (TSX: ARE) (“Aecon”) announced today receipt of

regulatory approval from the Toronto Stock Exchange (the “TSX”) of

its notice of intention to make a normal course issuer bid (the

“NCIB”).

Under the NCIB, Aecon may purchase for

cancellation, during the period commencing on August 19, 2024 and

ending on the earlier of August 18, 2025 and the date on which

Aecon reaches the maximum purchases permitted under the NCIB, up to

3,126,306 common shares of Aecon (“Common Shares”), representing 5%

of the issued and outstanding Common Shares. Aecon had a total of

62,526,130 issued and outstanding Common Shares as of August 7,

2024.

Purchases of Common Shares under the NCIB will

be made in accordance with TSX rules through the facilities of the

TSX and/or through alternative Canadian trading systems. The price

paid for any repurchased Common Shares will be the market price of

such Common Shares at the time of acquisition. Daily purchases on

the TSX under the NCIB will be limited to a maximum of 75,578

Common Shares, representing 25% of the average daily trading volume

of the Common Shares on the TSX for six months ending July 31,

2024, subject to any purchases made pursuant to the block purchase

exception.

Aecon believes that the repurchase of Common

Shares at certain market prices is an appropriate and desirable use

of Aecon’s funds that is in the best interests of Aecon and

beneficial to its shareholders. Aecon intends to make any purchases

on an opportunistic basis, taking share price and other

considerations into account. The NCIB will be funded using Aecon’s

existing cash resources or its senior credit facility.

The actual number of Common Shares which may be

purchased under the NCIB and the timing of any such purchases will

be determined by the management of Aecon, subject to applicable

securities laws and TSX rules. Aecon may elect to suspend or

discontinue repurchases of Common Shares at any time, in accordance

with applicable laws. There can be no assurances that any such

purchases of Common Shares under the NCIB will be completed.

Aecon also announced that it has entered into an

automatic securities purchase plan (the “Plan”) in respect of the

NCIB with a designated broker (the “Broker”). The Broker will be

responsible for making purchases of Common Shares pursuant to the

Plan to facilitate the purchase of Common Shares during times when

Aecon would ordinarily not be permitted to purchase Common Shares

due to regulatory restrictions or trading black-out periods

established under Aecon’s Insider Trading Policy. Under the Plan,

Aecon may, but is not required to, instruct the Broker to make

purchases under the NCIB based on parameters set by Aecon in

accordance with the Plan, TSX rules and applicable securities laws.

The Plan has been pre-cleared by the TSX and will be implemented

effective August 19, 2024.

About Aecon

Aecon Group Inc. (TSX: ARE) is a North American

construction and infrastructure development company with global

experience. Aecon delivers integrated solutions to private and

public-sector clients through its Construction segment in the

Civil, Urban Transportation, Nuclear, Utility and Industrial

sectors, and provides project development, financing, investment,

management, and operations and maintenance services through its

Concessions segment. Join our online community on X, LinkedIn,

Facebook, and Instagram @AeconGroupInc.

Statement on Forward-Looking

Information

The information in this press release includes

certain forward-looking statements which may constitute

forward-looking information under applicable securities laws. These

forward-looking statements are based on currently available

competitive, financial and economic data and operating plans but

are subject to risks and uncertainties. Forward-looking statements

may include, without limitation, statements regarding the

operations, business, financial condition, expected financial

results, performance, prospects, ongoing objectives, strategies and

outlook for Aecon, including statements regarding: Aecon’s

intention to commence the NCIB, the timing, methods and quantity of

any purchases under the NCIB, the availability of cash for

repurchases of Common Shares under the NCIB, and compliance with

applicable laws and regulations pertaining to the NCIB.

Forward-looking statements may in some cases be identified by words

such as “may,” “will,” “expects,” “target,” “future,” “plans,”

“believes,” “anticipates,” “estimates,” “projects,” “intends,”

“should” or the negative of these terms, or similar

expressions.

In addition to events beyond Aecon’s control,

there are factors which could cause actual or future results,

performance or achievements to differ materially from those

expressed or inferred herein including, but not limited to: the

risk of not being able to meet contractual schedules and other

performance requirements, the risk of not being able to meet its

labour needs and the application of critical accounting estimates

in respect of the remaining three fixed price legacy projects being

performed by joint ventures in which Aecon is a participant, and

the information in respect of such joint ventures under review and

assessment in respect of the application of such critical

accounting estimates. These forward-looking statements are based on

a variety of factors and assumptions including, but not limited to

that: none of the risks identified above materialize, there are no

unforeseen changes to economic and market conditions, no

significant events occur outside the ordinary course of business

and assumptions regarding the outcome of the outstanding claims in

respect of the remaining three fixed price legacy projects being

performed by joint ventures in which Aecon is a participant. These

assumptions are based on information currently available to Aecon,

including information obtained from third-party sources. While

Aecon believes that such third-party sources are reliable sources

of information, Aecon has not independently verified the

information. Aecon has not ascertained the validity or accuracy of

the underlying economic assumptions contained in such information

from third-party sources and hereby disclaims any responsibility or

liability whatsoever in respect of any information obtained from

third-party sources.

Risk factors are discussed in greater detail in

Section 13 - “Risk Factors” in Aecon’s 2023 Management’s Discussion

and Analysis for the fiscal year ended December 31, 2023 and

Aecon’s Management’s Discussion and Analysis for the fiscal quarter

ended June 30, 2024, each filed on SEDAR+ (www.sedarplus.ca).

Except as required by applicable securities laws, forward-looking

statements speak only as of the date on which they are made and

Aecon undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

For further information:

Adam BorgattiSVP, Corporate Development and Investor

Relations416-297-2600ir@aecon.com

Nicole CourtVice President, Corporate

Affairs416-297-2600corpaffairs@aecon.com

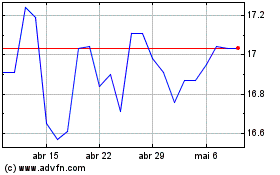

Aecon (TSX:ARE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Aecon (TSX:ARE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024