Hut 8 Operations Update for August 2024

06 Setembro 2024 - 7:30AM

Hut 8 Corp. (Nasdaq | TSX: HUT) (“Hut 8” or the “Company”), a

leading, vertically integrated operator of large-scale energy

infrastructure and one of North America’s largest Bitcoin miners,

today released its operations update for August 2024.

“During August, we maintained our focus on low-cost operations

and unit economics,” said Asher Genoot, CEO of Hut 8. “Maximizing

returns from our current fleet remains a priority while we continue

to plan a thoughtfully structured fleet upgrade to next-generation

ASICs. Reactor, our curtailment software, enabled us to mine when

profitable and keep energy costs low during what is typically the

hottest month of the year.”

“We also advanced commercialization efforts for our 205-megawatt

site in the Texas Panhandle, as well as large-scale opportunities

in our development pipeline that are suitable for Bitcoin mining

and AI. We look forward to sharing further updates on each of these

growth vectors as they materialize.”

Highlights:

- Advanced commercialization

discussions for the Texas Panhandle site in parallel with ongoing

engineering and procurement efforts, targeting energization in H1

2025

- Energized Building 1 at Cedarvale

during August and remain on track to bring the remaining three

buildings online by December

Operating Metrics

|

Average during the period unless otherwise noted |

August 2024 |

July 2024 |

|

| Total

energy capacity under management1,2,3 |

762 MW |

762 MW |

|

| Total

deployed miners under management4 |

179.5K |

174.2K |

|

| Total

hashrate under management5 |

18.5 EH/s |

18.0 EH/s |

|

|

|

|

|

|

|

Self-Mining6 |

|

|

|

| Deployed

miners7 |

58.5K |

58.2K |

|

| Deployed

hashrate8 |

5.6 EH/s |

5.5 EH/s |

|

| Bitcoin

produced1,9 |

87 BTC |

105 BTC |

|

| Bitcoin

on balance sheet1 |

9,105 BTC |

9,102 BTC |

|

|

|

|

|

|

|

Managed Services2,10 |

|

|

|

| Energy

capacity under management1 |

582 MW |

582 MW |

|

| Deployed

miners under management |

130.5K |

125.4K |

|

| Hashrate

under management |

13.9 EH/s |

13.4 EH/s |

|

|

|

|

|

|

|

Hosting |

|

|

|

| Deployed

miners under management11,12 |

76.7K |

76.7K |

|

| Hashrate

under management13 |

8.5 EH/s |

8.5 EH/s |

|

|

|

|

|

|

Energy Infrastructure

Platform1

|

|

|

|

|

Current Revenue Stream(s)14 |

|

|

Site |

Location |

Owner |

Power Capacity |

Self-Mining |

Managed Services |

Hosting |

HPC |

Power Sales |

|

|

Expansion Site

115 |

Texas

Panhandle |

Hut 8 |

205 MW |

|

|

|

|

|

|

|

Medicine Hat |

Medicine

Hat, AB |

Hut 8 |

67 MW |

Yes |

|

|

|

|

|

|

Salt Creek |

Orla,

TX |

Hut 8 |

63 MW |

Yes |

|

|

|

|

|

|

Alpha |

Niagara

Falls, NY |

Hut 8 |

50 MW |

Yes |

|

Yes |

|

|

|

|

Drumheller16 |

Drumheller, AB |

Hut 8 |

42 MW |

|

|

|

|

|

|

|

Kelowna |

Kelowna,

BC |

Hut 8 |

1.1 MW |

|

|

|

Yes |

|

|

|

Mississauga |

Mississauga, ON |

Hut 8 |

0.9 MW |

|

|

|

Yes |

|

|

|

Vaughan |

Vaughan,

ON |

Hut 8 |

0.6 MW |

|

|

|

Yes |

|

|

|

Vancouver II |

Vancouver, BC |

Hut 8 |

0.5 MW |

|

|

|

Yes |

|

|

|

Vancouver I |

Vancouver, BC |

Hut 8 |

0.3 MW |

|

|

|

Yes |

|

|

|

King

Mountain17 |

McCamey,

TX |

Hut 8 (JV) |

280 MW |

Yes |

Yes |

Yes |

|

Yes |

|

|

Iroquois

Falls18 |

Iroquois

Falls, ON |

Hut 8 (JV) |

120 MW |

|

|

|

|

Yes |

|

|

Kingston18 |

Kingston, ON |

Hut 8 (JV) |

110 MW |

|

|

|

|

Yes |

|

|

North Bay18 |

North

Bay, ON |

Hut 8 (JV) |

40 MW |

|

|

|

|

Yes |

|

|

Kapuskasing18 |

Kapuskasing, ON |

Hut 8 (JV) |

40 MW |

|

|

|

|

Yes |

|

|

Cedarvale3 |

Barstow,

TX |

Managed |

215 MW |

|

Yes |

|

|

|

|

|

East Stiles |

Midland,

TX |

Managed |

30 MW |

|

Yes |

|

|

|

|

|

Rebel |

Midland,

TX |

Managed |

25 MW |

|

Yes |

|

|

|

|

|

Stiles |

Midland,

TX |

Managed |

20 MW |

|

Yes |

|

|

|

|

|

Garden City |

Midland,

TX |

Managed |

12 MW |

|

Yes |

|

|

|

|

|

Total |

|

|

1,322 MW |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Upcoming Conferences & Events:

- September 9-11, 2024: H.C. Wainwright 26th Annual Global

Investment Conference

- September 25-26, 2024: TMT M&A Forum USA 2024

- September 25-26, 2024: infra/STRUCTURE 2024

- September 26, 2024: ArcStone-Kingswood Growth Summit 2024

Notes:

- As of the end of the period

- Includes all Self-Mining, Managed Services, and Hosting

infrastructure, including 100% of the energy capacity at the King

Mountain site, which is owned by the King Mountain JV in which the

Company has a 50% membership interest and a Fortune 200 renewable

energy producer has the remaining 50% membership interest (the

“King Mountain JV”).

- Includes 215 megawatts assuming full capacity at Cedarvale,

which was first energized in April and is currently under

construction.

- Includes all miners that are racked with power and networking,

rounded to the nearest 100, in Self-Mining, Managed Services, and

Hosting infrastructure with power and networking, including all

miners at the King Mountain site.

- Includes all Self-Mining, Managed Services, and Hosting

hashrate, including 100% of the hashrate at the King Mountain

site.

- Self-Mining operations for Hut 8 include 100% of operations at

the King Mountain site.

- Deployed miners are defined as those physically racked with

power and networking, rounded to the nearest 100; deployed

self-mining miners net of the 50% share of the King Mountain JV

held by Hut 8’s joint venture partner was 49.5K during August and

49.2K during July.

- Indicates the target hashrate of all deployed miners; deployed

self-mining hashrate net of the 50% share of the King Mountain JV

held by Hut 8’s joint venture partner was 4.7 EH/s during both

August and July.

- Bitcoin produced net of the 50% share of the King Mountain JV

held by Hut 8’s joint venture partner was 74 BTC during August and

88 during July.

- The Managed Services figures reflected in this table include

the Self-Mining and Hosting metrics from the sites where Hut 8’s

Managed Services business is an additional service layer in the

operation of the site (at King Mountain, Rebel, Stiles, East

Stiles, and Garden City). As a result, the sum of the Self-Mining,

Managed Services, and Hosting numbers will not add up to the “Total

energy capacity under management”, “Total deployed miners under

management”, and “Total hashrate under management” figures that are

also reflected in the table.

- Miners are rounded to the nearest 100.

- 42.6K deployed miners under management net of the 50% share of

the King Mountain JV held by Hut 8’s joint venture partner during

both August and July.

- 4.7 EH/s under management net of Hut 8’s joint venture

partner’s 50% share of the King Mountain JV during both August and

July, respectively.

- Reflects revenue sources to Hut 8, its subsidiaries, and/or

joint ventures in which they participate.

- Site is currently under development.

- Site currently shut down; Hut 8 maintaining lease with option

value of re-energizing site.

- Owned by a JV between Hut 8 and a Fortune 200 renewable energy

producer in which Hut 8 has an approximately 50% membership

interest.

- Owned by a JV between Hut 8 and Macquarie in which Hut 8 has an

approximately 80% membership interest.

About Hut 8

Hut 8 Corp. is an energy infrastructure operator and Bitcoin

miner with self-mining, hosting, managed services, and traditional

data center operations across North America. Headquartered in

Miami, Florida, Hut 8 Corp. has a portfolio comprising twenty

sites: ten Bitcoin mining, hosting, and Managed Services sites in

Alberta, New York, and Texas, five high performance computing data

centers in British Columbia and Ontario, four power generation

assets in Ontario, and one newly announced site in the Texas

Panhandle. For more information, visit www.hut8.com and follow us

on X (formerly known as Twitter) at @Hut8Corp.

Cautionary Note Regarding Forward–Looking

Information

This press release includes “forward-looking information” and

“forward-looking statements” within the meaning of Canadian

securities laws and United States securities laws, respectively

(collectively, “forward-looking information”). All information,

other than statements of historical facts, included in this press

release that address activities, events or developments that Hut 8

expects or anticipates will or may occur in the future, including

such things as future business strategy, competitive strengths,

goals, expansion and growth of the business, operations, plans and

other such matters is forward-looking information. Forward-looking

information is often identified by the words “may”, “would”,

“could”, “should”, “will”, “intend”, “plan”, “anticipate”, “allow”,

“believe”, “estimate”, “expect”, “predict”, “can”, “might”,

“potential”, “predict”, “is designed to”, “likely” or similar

expressions. Specifically, such forward-looking information

included in this press release includes statements relating to

maximizing returns from the Company’s current fleet, planning a

thoughtfully structured fleet upgrade to next-generation ASICs, and

energizing the remaining three buildings at Cedarvale by December

2024.

Statements containing forward-looking information are not

historical facts, but instead represent management's expectations,

estimates and projections regarding future events based on certain

material factors and assumptions at the time the statement was

made. While considered reasonable by Hut 8 as of the date of this

press release, such statements are subject to known and unknown

risks, uncertainties, assumptions and other factors that may cause

the actual results, level of activity, performance or achievements

to be materially different from those expressed or implied by such

forward-looking information, including but not limited to, security

and cybersecurity threats and hacks; malicious actors or botnet

obtaining control of processing power on the Bitcoin network;

further development and acceptance of the Bitcoin network; changes

to Bitcoin mining difficulty; loss or destruction of private keys;

increases in fees for recording transactions in the Blockchain;

erroneous transactions; reliance on a limited number of key

employees; reliance on third party mining pool service providers;

regulatory changes; classification and tax changes; momentum

pricing risk; fraud and failure related to digital asset exchanges;

difficulty in obtaining banking services and financing; difficulty

in obtaining insurance, permits and licenses; internet and power

disruptions; geopolitical events; uncertainty in the development of

cryptographic and algorithmic protocols; uncertainty about the

acceptance or widespread use of digital assets; failure to

anticipate technology innovations; the COVID19 pandemic, climate

change; currency risk; lending risk and recovery of potential

losses; litigation risk; business integration risk; changes in

market demand; changes in network and infrastructure; system

interruption; changes in leasing arrangements; failure to achieve

intended benefits of power purchase agreements; potential for

interrupted delivery, or suspension of the delivery, of energy to

mining sites and other risks related to the digital asset mining

and data center business. For a complete list of the factors that

could affect Hut 8, please see the “Risk Factors” section of Hut

8’s Transition Report on Form 10-K, available under the Company’s

EDGAR profile at www.sec.gov, and Hut 8’s other continuous

disclosure documents which are available under the Company’s SEDAR+

profile at www.sedarplus.ca and EDGAR profile

at www.sec.gov.

Hut 8 Corp. Investor Relations

Sue Ennis

ir@hut8.com

Hut 8 Corp. Media Relations

media@hut8.com

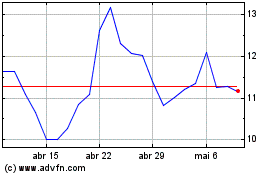

Hut 8 (TSX:HUT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

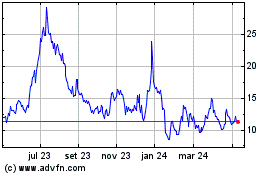

Hut 8 (TSX:HUT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024