Hut 8 Corp. (Nasdaq | TSX: HUT) (“Hut 8” or the “Company”), a

leading, vertically integrated operator of large-scale energy

infrastructure and one of North America’s largest Bitcoin miners,

today announced the purchase of approximately 990 Bitcoin. The

aggregate purchase price of the acquired Bitcoin was approximately

$100 million, or an average of approximately $101,710 per Bitcoin.

Combined with the Bitcoin held prior to this

purchase, Hut 8’s strategic Bitcoin reserve now totals 10,096

Bitcoin with a market value of more than $1 billion as of December

18, 2024. Based on publicly available information, the Company

believes this positions it as one of the ten largest corporate

owners of Bitcoin in the world. The 10,096 Bitcoin held in reserve

were acquired through low-cost production and the strategic

at-market purchase announced today for a realized average cost of

$24,484 per Bitcoin. The purchased Bitcoin will play a central role

in an innovative financing model for the Company’s previously

announced fleet upgrade.

Figure 1. Fundamentals-driven operating strategy

focused on driving significant and scalable cost advantage in

building a strategic Bitcoin reserve

|

|

Produced As of 9/30/2024 |

Purchased As of 12/18/2024 |

Total |

|

BTC held in reserve |

|

9,106 |

|

990 |

|

10,096 |

|

Realized average cost per BTC held in reserve1 |

$ |

16,088 |

$ |

101,710 |

$ |

24,484 |

|

lllustrative cost to mine a BTC with fleet upgrade2 |

$ |

21,180 |

|

|

| |

| Note: (1) Reflects

Hut 8’s cost to mine for produced Bitcoin and cost to purchase for

purchased Bitcoin; (2) Reflects Hut 8’s cost to mine a Bitcoin for

the three months ended September 30, 2024 of $31,482 adjusted for

the impact of increased nameplate hashrate of the new miners

expected to go online in Q1 2025 as part of our previously

announced fleet upgrade. Hut 8’s cost to mine a Bitcoin is

equivalent to the all-in electricity cost, net of credits from

participation in ancillary demand response programs, to mine a

Bitcoin at owned or leased sites and includes our net share of the

King Mountain JV. |

Hut 8’s strategic Bitcoin reserve bolsters the

Company’s capital strategy by serving as a flexible asset that can

optimize balance sheet performance and fund capital-intensive

growth initiatives, including power and digital infrastructure

development. Bitcoin held in reserve may be leveraged through

option strategies, pledges, sales, or other strategies as

appropriate. Decisions to utilize Bitcoin held in reserve will be

made on a case-by-case basis, optimizing for return on invested

capital and guided by rigorous cost-benefit analysis.

“A key component of our treasury strategy, the

strategic Bitcoin reserve supports a flywheel effect that aligns

our capital and operating strategies to accelerate value creation

across the business,” said Asher Genoot, CEO of Hut 8. “We believe

deeply in our operating business and that building a strategic

Bitcoin reserve will fortify our financial position as we pursue

large-scale growth initiatives across power and digital

infrastructure. Additionally, as we scale operations and extend our

cost advantage in Bitcoin production, we anticipate that the

flywheel effect will enable us to grow our holdings organically at

a significant discount to market prices, strengthening the yield of

our reserve strategy.”

“Our decision to establish a strategic Bitcoin

reserve is rooted in our drive to deliver superior returns to our

shareholders,” said Sean Glennan, CFO of Hut 8. “With a significant

war chest for growth, we are leveraging Bitcoin as part of a

treasury management strategy designed to generate risk-adjusted

returns that outperform idle cash. Beyond building our reserve with

a focus on low-cost production and strategic at-market purchases,

we will continue to actively manage and trade around our holdings

with the goal of unlocking additional value. Our flexible

approach is designed to ensure that, if compelling opportunities

arise within our operating business, we are prepared to

strategically deploy our reserve to drive platform expansion and

create long-term value.”

Figure 2. Flywheel effect accelerates value

creation across capital and operating strategies

About Hut 8

Hut 8 Corp. is an energy infrastructure operator

and Bitcoin miner with self-mining, hosting, managed services, and

traditional data center operations across North America.

Headquartered in Miami, Florida, Hut 8 Corp.’s portfolio comprises

fifteen sites: five Bitcoin mining, hosting, and managed services

sites in Alberta, New York, and Texas, five cloud and colocation

data centers in British Columbia and Ontario, four power generation

assets in Ontario, and one non-operational site in Alberta.

Cautionary Note Regarding

Forward-Looking Information

This press release includes “forward-looking

information” and “forward-looking statements” within the meaning of

applicable securities laws in Canada and the United States,

including the United States Private Securities Litigation Reform

Act of 1995 (collectively, “forward-looking information”). All

information, other than statements of historical facts, included in

this press release that address activities, events or developments

that Hut 8 expects or anticipates will or may occur in the future,

including such things as future business strategy, competitive

strengths, goals, expansion and growth of the business, operations,

plans and other such matters is forward-looking information.

Forward-looking information is often identified by the words “may”,

“would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”,

“allow”, “believe”, “estimate”, “expect”, “predict”, “can”,

“might”, “potential”, “is designed to”, “likely” or similar

expressions, but the absence of these words does not mean that a

statement is not forward-looking. Such forward-looking information

may include, but is not limited to, the Company’s intended use of

the purchased Bitcoin, including its intention to optimize for

return on invested capital and decision-making guided by rigorous

cost-benefit analysis, its focus on driving significant and

scalable cost advantage in building a strategic Bitcoin reserve,

its expected go-forward cost to mine a Bitcoin (excluding hosted

facilities) upon the expected fleet upgrade, its strategic Bitcoin

reserve as a flexible asset, the Company’s flywheel effect to

accelerate value creation across the business, the fortification of

the Company’s financial position as it builds its strategic Bitcoin

reserve, its ability to grow its Bitcoin holdings at a significant

discount to market prices, its treasury management strategy, the

Company’s ability to unlock additional value and its focus on

delivering superior returns.

Statements containing forward-looking

information are not historical facts, but instead represent

management's expectations, estimates and projections regarding

future events based on certain material factors and assumptions at

the time the statement was made. While considered reasonable by the

Company as of the date of this press release, such statements are

subject to known and unknown risks, uncertainties, assumptions, and

other factors that may cause the actual results, level of activity,

performance, or achievements to be materially different from those

expressed or implied by such forward-looking information. For

factors that could cause actual results to differ materially from

the forward-looking information in this press release, please see

the risks described under the “Risk Factors” section of the

Registration Statement, the Prospectus Supplement, the Company’s

Transition Report on Form 10-K for the transition period from July

1, 2023 to December 31, 2023, filed with the SEC on April 26, 2024,

and Hut 8’s other public disclosure documents, which are available

under the Company’s EDGAR profile at www.sec.gov and SEDAR+

profile at www.sedarplus.ca.

Hut 8 Corp. Investor

RelationsSue Ennisir@hut8.com

Hut 8 Corp. Media

Relationsmedia@hut8.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/057ce780-f422-45c5-bc25-dc2816841a46

An overview of Hut 8’s strategic Bitcoin reserve can be

downloaded

here: http://ml.globenewswire.com/Resource/Download/08e37d60-bc9d-45e4-ac02-8816869bfcb5

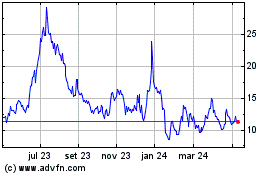

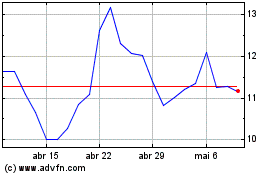

Hut 8 (TSX:HUT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Hut 8 (TSX:HUT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025