Enterprise Products Partners L.P. (NYSE: EPD) Co-CEO Jim Teague Interviewed by Advisor Access

10 Setembro 2024 - 9:30AM

Enterprise Products Partners L.P. (NYSE: EPD) is one

of the largest publicly traded partnerships and a leading North

American provider of midstream energy services to producers and

consumers of natural gas, natural gas liquids, crude oil, refined

products and petrochemicals.

Click Here to View

the EPD

Investor

Presentation

Advisor Access spoke with Jim

Teague, Enterprise Products Partners’ co-CEO, about

the company’s business environment and outlook, plans for future

growth and the company’s financial strength.

Advisor

Access: Would you introduce Enterprise

Products Partners to our readers?

Jim Teague: EPD is one of the

largest publicly traded partnerships and a leading provider of

midstream energy infrastructure services. Our roots date back to

1968 when Dan Duncan and two partners formed Enterprise Products

Company, a wholesale marketer of natural gas liquids. Since our IPO

in 1998, Enterprise has delivered over two decades of strategic

growth, responsible operations, and attractive returns to

unitholders.

With an A-rated balance sheet, 26 consecutive

years of distribution growth, and over 7% yield, Enterprise stands

apart as a consistent and compelling investment throughout economic

and business cycles.

AA: What are

midstream energy services and how do characterize your business

model?

JT: We operate energy

infrastructure – pipelines, terminals, and processing assets – that

provide critical, must-run energy services. We handle natural gas,

natural gas liquids (NGLs), crude oil, refined products and primary

petrochemicals…

AA: Enterprise has

$6.7 billion in major capital projects under construction. What are

these projects and how do these support future cash flow growth and

capital returns to unitholders?

JT: The majority of our

growth capital projects fall under our NGL segment, our largest

business segment…

AA: 2024 marks

Enterprise’s 26th consecutive year of distribution increases. How

are you able to accomplish this remarkable run?

JT: Our management owns

approximately 33% of our limited partner units. In other words, “we

eat our own cooking.” We think in decades, not quarters. This

long-term mindset has enabled us to build a reliable business with

essential services that our customers can count on…

AA: Many view the

U.S. energy market as in transition – how do you think about the

future and where do you see opportunities and challenges for

Enterprise?

JT: We think globally.

Energy security, reliability and affordability continue to be the

preeminent themes in energy markets…

…AA: Thank you for

your insights, Jim.

Click Here to

Read

additional

Questions, complete Answers, and the Entire Article

Online

Click HERE to

view the

EPD Disclosures

About Advisor Access

Advisor-Access LLC was designed to bring compelling

investment ideas to investors in the form of in-depth interviews

with company management and the latest fact sheets and corporate

presentations, in a concise format: the critical pieces of

information an investor needs to make an informed investment

decision. Read the Advisor-Access

Full

Disclosure Online.

Advisor Access

Rick Baggelaar

Rick@advisor-access.com

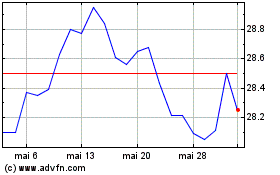

Enterprise Products Part... (NYSE:EPD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Enterprise Products Part... (NYSE:EPD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024