Arch Biopartners Inc. (“Arch” or the “Company”) (TSX Venture: ARCH

and OTCQB: ACHFF) announced today that the Company has arranged a

transaction to settle an aggregate total of $2,600,000 of principal

plus accrued interest owing on four deferred convertible notes

maturing on Sept 30, 2024 (the “Notes”).

The original terms of the four Notes included

settlement of the principal owing with 3,220,147 common shares

priced at a weighted average of $0.81. In order to settle the

principal plus accrued interest owing on the Notes and be fully

compliant with TSX Venture Polices, the Company and the holder of

the Notes have agreed to settle the principal amount with the

issuance of 1,934,524 units (the “Units”) priced at $1.344 per

unit, with each unit composed of one (1) pre-paid warrant

exercisable into one common share of the Company at a date five (5)

years from the closing date of the settlement of the Notes, and 1

(one) share purchase warrant exercisable into one common share of

the Company at $1.68 per common share, at a date 5 (five) years

from the closing date of the settlement of the Notes . The accrued

interest on the Notes, totaling $130,000 up to September 30, 2024,

will be settled with an additional issuance of 96,726 Units.

The final conversion terms of the Units will be

finalized prior to the planned closing date of the Units for debt

transaction of September 30, 2024 (the “Closing Date”)

The Units for debt settlement is subject to TSXV

acceptance and pursuant to TSXV Policies, including Policy 4.3 -

Shares for Debt. The holder of the Notes is an arms-length party to

the Company. The Units will be issued subject to prospectus

exemptions available pursuant to Canadian securities law.

Original Details of the

Notes

The original details of the Notes can be found

in note 7 of the Company’s 2024 third quarter interim financial

statements and the audited 2023 annual financial statements.

The Company previously issued the Notes pursuant

to a non-brokered, unsecured convertible note financing for which

it received gross proceeds of $500,000 ("Note A"), $600,000 ("Note

B"), $500,000 ("Note C"), $1,000,000 ("Note D"), and $500,000

("Note E"), respectively. The Notes to be settled with Units

include Notes A, B, C and D.

Note A ($500,000) was scheduled to mature on

March 31, 2023, but the term of the Note was extended to September

30, 2024. The Note was convertible, at the option of the holder,

into common shares of the Company at a price per share of $0.50, in

the thirty-day period prior to maturity of the Note. The Note bears

interest of 5% per annum, which was payable in kind by the Company

with common shares to be issued at the then market price for the

common shares and subject to TSX Venture Exchange approval in each

instance.

Note B ($600,000) was scheduled to mature on

February 28, 2023, but the term of the Note was extended to

September 30, 2024. The Note was convertible, at the option of the

holder, into common shares of the Company at a price per share of

$0.60, in the thirty-day period prior to maturity of the Note. The

Note bears interest of 5% per annum, which was payable in-kind by

the Company with common shares to be issued at the then market

price for the common shares and subject to TSX Venture Exchange

approval in each instance.

Note C ($500,000) was scheduled to mature on

January 24, 2024, but the term of the Note was extended to

September 30, 2024, The Note was convertible, at the option of the

holder, into common shares of the Company at a price per common

share of $1.27, in the thirty- day period prior to the maturity of

the Note. The Note bears interest at 5% per annum, which was

payable in-kind by the Company with common shares to be issued at

then market prices for the common shares and subject to TSX Venture

Exchange approval in each instance.

Note D ($1,000,000) was scheduled to mature on

March 31, 2023, but the term of the Note was extended to September

30, 2024. The Note was convertible at the option of the holder,

into common shares in the Company at a price per share of $1.21, in

the thirty-day period prior to maturity of the Note. The note bears

simple interest at a rate of 5% per annum, which was payable in

kind by the Company with common shares to be issued at then market

price for the common shares, subject to TSX Venture Exchange

approval.

Note E ($500,000) matures on February 1, 2025

and will be convertible, at the option of the holder, into common

shares of the Company at a price per common share of $0.89, in the

thirty-day period prior to the maturity of the Note. The Note bears

interest at 8.5% per annum, which is payable in-kind by the Company

with common shares to be issued at then market prices for the

common shares and subject to TSX Venture Exchange approval in each

instance. Note E will not be part of the Units for debt transaction

described above.

Compliance with TSXV Policy 4.1 –

Convertible Debt

The extensions of Note A, B, C and D (the

“Extensions”) did not comply with the requirements under TSXV

Policy 4.1 – Private Placements. In particular, the Extensions

exceeded the allowable 5-year period of a Convertible Security (as

defined under Policy 4.1). Thus, the original conversion prices

were no longer permissible under TSXV Policies.

In order to re-establish compliance of the Notes

with TSXV Policies, the Company and the holder of the Notes have

accepted the TSXV’s recommendation to amend and settle Note A, B, C

and D with Units as described above.

The Units for debt transaction was approved by

the Company’s Board of Directors and did not require a formal

valuation nor minority shareholder approval pursuant to

Multilateral Instrument 61-101.

About Arch Biopartners

Arch Biopartners Inc. is a clinical stage

company focused on the development of innovative technologies that

have the potential to make a significant medical or commercial

impact. Arch is developing a pipeline of new drug

candidates that inhibit inflammation in the lungs, liver and

kidneys via the dipeptidase-1 (DPEP-1) pathway, relevant for

multiple medical indications.

For more information on Arch Biopartners, its

technologies and other public documents Arch has filed on SEDAR,

please visit www.archbiopartners.com

The Company has 64,650,633 common shares

outstanding.

For more information, please contact:

Richard MuruveChief Executive OfficerArch Biopartners Inc1 647

428 7031

Please send a message or subscribe for email alerts at the

company website using the link here

www.archbiopartners.com/contact-us

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of applicable Canadian securities

laws regarding expectations of our future performance, liquidity

and capital resources, as well as the ongoing clinical development

of our drug candidates targeting the dipeptidase-1 (DPEP-1)

pathway, including the outcome of our clinical trials relating to

LSALT peptide (Metablok), the successful commercialization and

marketing of our drug candidates, whether we will receive, and the

timing and costs of obtaining, regulatory approvals in Canada, the

United States, Europe and other countries, our ability to raise

capital to fund our business plans, the efficacy of our drug

candidates compared to the drug candidates developed by our

competitors, our ability to retain and attract key management

personnel, and the breadth of, and our ability to protect, our

intellectual property portfolio. These statements are based on

management’s current expectations and beliefs, including certain

factors and assumptions, as described in our most recent annual

audited financial statements and related management discussion and

analysis under the heading “Business Risks and Uncertainties”. As a

result of these risks and uncertainties, or other unknown risks and

uncertainties, our actual results may differ materially from those

contained in any forward-looking statements. The words “believe”,

“may”, “plan”, “will”, “estimate”, “continue”, “anticipate”,

“intend”, “expect” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. We undertake no

obligation to update forward-looking statements, except as required

by law. Additional information relating to Arch Biopartners Inc.,

including our most recent annual audited financial statements, is

available by accessing the Canadian Securities Administrators’

System for Electronic Document Analysis and Retrieval (“SEDAR”)

website at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release

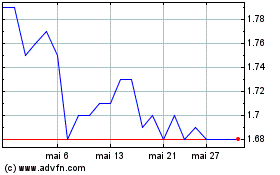

Arch Biopartners (TSXV:ARCH)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

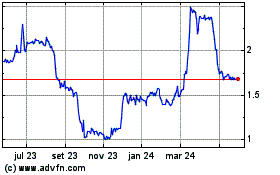

Arch Biopartners (TSXV:ARCH)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025