Antelope Enterprise Holdings Limited (NASDAQ Capital Market: AEHL)

(“Antelope Enterprise”, “AEHL” or the “Company”), is the majority

owner of Hainan Kylin Cloud Services Technology Co., Ltd (“Kylin

Cloud”), the operator of a livestreaming ecommerce business in

China, and the Company expects to shortly enter the

energy field through the production of electricity in Texas using

natural gas generators, today announced its financial results for

the six months ended June 30, 2024.

First Half 2024 Summary

- Revenue

generated from the livestreaming ecommerce business was $43.4

million, a 2.6% decrease as compared to $44.6 million for the same

period of 2023.

- Gross profit

generated from the livestreaming ecommerce business was $3.5

million, a 48.7% decrease as compared to $6.8 million for the same

period of 2023.

- Loss from

operations from the livestreaming ecommerce business was $6.5

million, as compared to loss from operations of $5.5 million for

the same period of 2023.

Will Zhang, Chairman and CEO of Antelope

Enterprise, commented, “The revenue for the livestreaming ecommerce

business segment came in at $43.4 million for the first six months

of 2024, modestly lower than the $44.6 million in revenue recorded

for the six months of 2023. This slight decline was due to loss of

a few major clients and a change in business strategy to secure a

larger number of mid-tier clients to help to mitigate the risk of

retaining major clients. Our majority-owned Kylin Cloud subsidiary

had engagements with more than 70 clients in the first half of 2024

represents an increase of nearly 20 clients compared to the same

period in 2023.”

“Kylin Cloud provides turnkey livestreaming

marketing and broadcasting services to consumer brand companies by

matching consumer brand products with the appropriate hosts and

influencers. We believe that there is a tremendous market

opportunity ahead for livestreaming ecommerce and believe that

Kylin Cloud has the resources, infrastructure and team culture to

achieve sustained growth in this B2C ecosystem,” CEO Will Zhang

continued.

“In an important strategic development for the

Company, we recently announced that we are planning to enter the

energy field in the third quarter of 2024, and that we are going to

launch this business in Texas to meet the rapidly growing needs of

the computing power industry. We believe that our new positioning

in the energy supply sector is extremely timely to meet the high

expected demand for energy due to the growth of these sectors,”

concluded Chairman and CEO Will Zhang.

Six Months Results Ended June 30,

2024

Revenue for the six months

ended June 30, 2024 was $43.5 million, a decrease of $1.1 million

or 2.6% from $44.6 million for the same period of 2023. The

decrease in revenue was due to the loss of a few of the

livestreaming businesses’ major clients in the current period. This

propelled a change in business strategy to focus on securing a

larger number of mid-tier clients to mitigate the risk associated

with an over-concentration of major clients. In the first half of

2024, we had business engagements with more than 70 clients which

represented an increase of nearly 20 clients compared to the same

period in 2023.

Gross profit for the six months

ended June 30, 2024 was $3.5 million, a decrease of $3.3 million or

48.7% as compared to $6.8 million for the same period of 2023. The

decrease in gross profit was due to the decrease in revenue and an

increase in the cost of goods sold of $2.1 million or 5.7% in the

current period. The increase in cost of goods sold was due to

increased training, management and support costs attributable to

the livestreaming businesses’ focus on mid-tier clients. For the

first half of 2024, the gross profit margin was 8.0% for the

livestreaming ecommerce business as compared to a gross profit

margin of 15.3% for the first half of 2023.

Other income for the six months

ended June 30, 2024 was $0.7 million, an increase of $0.2 million

or 59.2% as compared to $0.4 million for the same period of 2023.

Other income primarily consists of interest income of $0.2 million

and other income of $0.4 million.

Selling and distribution

expenses for the six months ended June 30, 2024 were $3.1

million, a decrease of $4.0 million or 55.9% as compared to $7.1

million for the same period of 2023. The decrease in selling and

distribution expenses was due to decreased advertising and

promotion expenses of $3.5 million and decreased commission

expenses of $0.5 million.

Administrative expenses for the

six months ended June 30, 2024 were $6.9 million, an increase of

$1.3 million or 22.8% as compared to $5.6 million for the same

period of 2023. The increase in administrative expenses was due to

an increase in stock compensation expense of $0.8 million and the

$0.5 million increase in professional service expenses.

Loss from continuing operations before

taxation for the six months ended June 30, 2024 was $6.5

million, an increase of $1.1 million or 19.3% as compared to a loss

from continuing operations before taxation of $5.5 million for the

same period of 2023. The increase was due to the decrease in gross

profit in the current period as compared to the same period of

2023, as described above, as well as an increase in administrative

expenses which was partly offset by a decrease in selling and

distribution expenses.

Loss per basic share and fully diluted

share from continuing operations for the six months ended

June 30, 2024 were $0.96, as compared to loss per basic and fully

diluted share of $3.38 for the same period of 2023.

Financial Condition

As of June 30, 2024, the Company had $2.3

million in cash and cash equivalents, an increase of $1.7 million

or 333.2% as compared to $0.6 million as of December 31, 2023. As

of June 30, 2024, working capital (current assets minus current

liabilities) was $5.8 million and the current ratio (current assets

divided by current liabilities) was 2.6 times, as compared to

working capital of $4.2 million and a current ratio of 8.0 times as

of December 31, 2023. Stockholders’ equity as of June 30, 2024 was

$18.0 million, an increase of $3.6 million or 25.2% as compared to

$14.4 million as of December 31, 2023.

Liquidity and Capital

Resources

Our cash flow analysis for each of the accounts

includes the cash flow transactions of discontinued operations.

Cash flow used in operating

activities was $7.2 million for the six months ended June

30, 2024, an increase of $1.6 million as compared to $5.6 million

for the same period of 2023. The increase of cash outflow was

mainly due to an increase in cash outflow on loan receivables of

$0.9 million, an increase in cash outflow on other receivables and

prepayments of $0.9 million, and increased cash outflow on trade

receivables of $1.5 million. This was partly offset by a decrease

in operating cash outflow before working capital changes of $0.6

million, a decrease in cash outflow from trade payable of $0.7

million, a decrease in cash outflow on accrued liabilities and

other payables of $0.8 million, a decrease in cash outflow on taxes

payable of $0.6 million and increased cash inflow on unearned

revenue of $0.9 million. Also, there was cash inflow from operating

activities of $2.0 million from our discontinued operations for the

six months ended June 30, 2023.

Cash flow used in investing

activities was $0.3 million, compared to a cash inflow of

$0.3 million for the same period of 2023. The increase in cash

outflow was mainly due to the acquisition of fixed assets of $1.8

million, which was partly offset by collection of note receivable

of $1.5 million and decrease in restricted cash of $0.1

million.

Cash flow generated from financing

activities was $10.1 million for the six months ended June

30, 2024, compared to $5.7 million for the same period of 2023,

primarily due to an increase in the proceeds from warrants

exercised of $1.2 million and an increase in proceeds from a

promissory note of $4.6 million. This was partly offset by a

decrease in equity financing of $3.4 million for the six months

ended June 30, 2024 compared with the six months ended June 30,

2023. For the six months ended June 30, 2023, net cash used in

financing activities includes a cash outflow of $2.1 million from

our discontinued operations.

Business Outlook

We own a majority position of a livestreaming

ecommerce business, Hainan Kylin Cloud Services Technology Co., Ltd

(“Kylin Cloud”), and aim to launch an energy supply business in the

third quarter of 2024. Kylin Cloud’s SaaS+ systems platform

strategically matches hosts and influencers to consumer brand

products which results in increased sales for these companies.

In the last few years, livestreaming ecommerce

has comprised an ever-increasing percentage

of China's ecommerce sales which we expect to continue in

the years ahead, spurred by a consumer ecosystem that includes a

young demographic and their high usage rate of mobile devices. We

believe that Kylin Cloud is unique in the livestreaming space since

it utilizes advanced analytics that matches hosts and influencers

to consumer brand products which facilitates unique content for

higher conversion rates as compared to traditional ecommerce.

In the current period, the business strategy of

the livestreaming business was modified to focus on securing a

larger number of mid-tier clients to mitigate the risk associated

with an over-concentration of major clients. Since some of these

new clients are still in the beginning stages of collaboration and

their business volume has just started to grow, it will take time

for the new mid-tier clients to develop and increase their sales

volume. In the first half of 2024, the livestreaming business had

business engagements with more than 70 clients, which represented

an increase of nearly 20 clients compared to the same period in

2023.

In an important strategic development for the

Company, we recently announced plans to enter the energy field

through the production of electricity using natural gas generators

in Texas. This electricity would then be transmitted directly to

rapidly growing computing power sectors who require high amounts of

energy. Compared to conventional methods, this model eliminates

intermediary steps like transmission to the power grid and

processing by public utilities, which could result in lower energy

losses and higher efficiency. Given the strong market demand of

computing power industries, the Company believes it has a runway

for significant growth in the near future.

This business outlook reflects the Company's

current and preliminary views and is based on the information

currently available to us, which are subject to change, and is

subject to risks and uncertainties, as well as risks and

uncertainties identified in the Company’s public filings.

Conference Call Information

We will host a conference call at 8:00 am ET on

September 30, 2024. Listeners may access the call by dialing

1-844-695-5522 five to ten minutes prior to the scheduled

conference call time, and international callers should dial

1-412-317-0698; all callers should ask to join the Antelope

Enterprise Holdings Ltd. earnings conference call. A replay of the

conference call will be available for 14 days starting from 11:00

am ET on September 30, 2024. To access the replay, dial

1-877-344-7529 and international callers should dial

1-412-317-0088. The replay access code is 7480379.

About Antelope Enterprise Holdings

Limited

Antelope Enterprise Holdings Limited Limited

(“Antelope Enterprise”, “AEHL” or the “Company”), is the 51% owner

of Hainan Kylin Cloud Services Technology Co., Ltd (“Kylin Cloud”),

the operator of a growing livestreaming ecommerce business in China

with access to 800,000+ hosts and influencers. Through its wholly

owned US subsidiary, AEHL US LLC, the Company expects to begin

generating electricity for the rapidly growing needs of

Company expects to begin generating electricity for the

rapidly growing needs of computing power industries in the fourth

quarter of 2024. For more information, please visit our website at

https://aehltd.com/.

Safe Harbor Statement

Certain of the statements made in this press

release are "forward-looking statements" within the meaning and

protections of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements include statements with respect

to our beliefs, plans, objectives, goals, expectations,

anticipations, assumptions, estimates, intentions, and future

performance, and involve known and unknown risks, uncertainties and

other factors, which may be beyond our control, and which may cause

the actual results, performance, capital, ownership or achievements

of the Company to be materially different from future results,

performance or achievements expressed or implied by such

forward-looking statements. Forward-looking statements in this

press release include, without limitation, the continued stable

macroeconomic environment in the PRC, the PRC technology sectors

continuing to exhibit sound long-term fundamentals, and our ability

to continue to grow our energy, livestreaming ecommerce, business

management and information system consulting businesses. All

statements other than statements of historical fact are statements

that could be forward-looking statements. You can identify these

forward-looking statements through our use of words such as “may,”

“will,” “anticipate,” “assume,” “should,” “indicate,” “would,”

“believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,”

“point to,” “project,” “could,” “intend,” “target” and other

similar words and expressions of the future. Although the Company

believes that the expectations expressed in these forward-looking

statements are reasonable, it cannot assure you that such

expectations will turn out to be correct, and the Company cautions

investors that actual results may differ materially from the

anticipated results and encourages investors to review other

factors that may affect its future results in the Company's

registration statement and other filings with the U.S. Securities

and Exchange Commission.

All written or oral forward-looking statements

attributable to us are expressly qualified in their entirety by

this cautionary notice, including, without limitation, those risks

and uncertainties described in our annual report on Form 20-F for

the year ended December 31, 2023 and otherwise in our SEC

reports and filings. Such reports are available upon request from

the Company, or from the Securities and Exchange Commission,

including through the SEC's Internet website

at http://www.sec.gov. We have no obligation and do not

undertake to update, revise or correct any of the forward-looking

statements after the date hereof, or after the respective dates on

which any such statements otherwise are made.

FINANCIAL TABLES FOLLOW

ANTELOPE ENTERPRISE HOLDINGS., LTD AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

FINANCIAL POSITION

|

|

|

As of June 30, 2024 |

|

|

As of December 31, 2023 |

|

|

|

|

USD’000 |

|

|

USD’000 |

|

|

|

|

(Unaudited) |

|

|

(Audited) |

|

|

|

|

|

|

|

|

|

|

ASSETS AND LIABILITIES |

|

|

|

|

|

|

|

|

|

NONCURRENT ASSETS |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

1,946 |

|

|

|

161 |

|

|

Intangible assets, net |

|

|

1 |

|

|

|

1 |

|

|

Right-of-use assets, net |

|

|

310 |

|

|

|

- |

|

|

Security deposit |

|

|

166 |

|

|

|

- |

|

|

Loan receivable |

|

|

10,768 |

|

|

|

5,181 |

|

|

Note Receivable |

|

|

5,490 |

|

|

|

6,949 |

|

|

Total noncurrent assets |

|

|

18,681 |

|

|

|

12,292 |

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

Trade receivable |

|

|

1,508 |

|

|

|

- |

|

|

Other receivables and prepayments |

|

|

4,367 |

|

|

|

2,871 |

|

|

Available-for-sale financial assets |

|

|

- |

|

|

|

99 |

|

|

Due from related parties |

|

|

1,286 |

|

|

|

1,316 |

|

|

Cash and bank balances |

|

|

2,322 |

|

|

|

536 |

|

|

Total current assets |

|

|

9,483 |

|

|

|

4,822 |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

|

28,164 |

|

|

|

17,114 |

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Trade payables |

|

|

639 |

|

|

|

- |

|

|

Accrued liabilities and other payables |

|

|

1,077 |

|

|

|

216 |

|

|

Unearned revenue |

|

|

1,009 |

|

|

|

27 |

|

|

Amounts owed to related parties |

|

|

53 |

|

|

|

78 |

|

|

Lease liabilities |

|

|

117 |

|

|

|

- |

|

|

Taxes payable |

|

|

763 |

|

|

|

281 |

|

|

Total current liabilities |

|

|

3,658 |

|

|

|

602 |

|

|

|

|

|

|

|

|

|

|

|

|

NET CURRENT ASSETS |

|

|

5,825 |

|

|

|

4,220 |

|

|

|

|

|

|

|

|

|

|

|

|

NONCURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Lease liabilities |

|

|

227 |

|

|

|

- |

|

|

Note payable |

|

|

6,245 |

|

|

|

2,111 |

|

|

Total noncurrent liabilities |

|

|

6,472 |

|

|

|

2,111 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

10,130 |

|

|

|

2,713 |

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS |

|

|

18,034 |

|

|

|

14,401 |

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

|

|

|

Reserves |

|

|

17,145 |

|

|

|

13,985 |

|

|

Noncontrolling interest |

|

|

889 |

|

|

|

416 |

|

|

|

|

|

|

|

|

|

|

|

|

Total equity |

|

|

18,034 |

|

|

|

14,401 |

|

ANTELOPE ENTERPRISE HOLDINGS LIMITED AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME (LOSS)(UNAUDITED)

|

|

|

SIX MONTHS ENDED JUNE 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

USD’000 |

|

|

USD’000 |

|

|

|

|

|

|

|

|

|

|

Net sales |

|

|

43,462 |

|

|

|

44,636 |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

|

39,969 |

|

|

|

37,824 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

3,493 |

|

|

|

6,812 |

|

|

|

|

|

|

|

|

|

|

|

|

Other income |

|

|

651 |

|

|

|

409 |

|

|

Selling and distribution expenses |

|

|

(3,130 |

) |

|

|

(7,100 |

) |

|

Administrative expenses |

|

|

(6,863 |

) |

|

|

(5,588 |

) |

|

Finance costs |

|

|

(537 |

) |

|

|

- |

|

|

Other expenses |

|

|

(139 |

) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Loss before taxation |

|

|

(6,525 |

) |

|

|

(5,467 |

) |

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

|

2 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the period from continuing operations |

|

|

(6,527 |

) |

|

|

(5,467 |

) |

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations |

|

|

|

|

|

|

|

|

|

Gain on disposal of discontinued operations |

|

|

- |

|

|

|

10,659 |

|

|

Loss from discontinued operations |

|

|

- |

|

|

|

(200 |

) |

|

Net income (loss) |

|

|

(6,527 |

) |

|

|

4,992 |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to : |

|

|

|

|

|

|

|

|

|

Equity holders of the Company |

|

|

(6,635 |

) |

|

|

4,997 |

|

|

Non-controlling interest |

|

|

108 |

|

|

|

(5 |

) |

|

Net income (loss) |

|

|

(6,527 |

) |

|

|

4,992 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to the equity holders of the Company arising

from: |

|

|

|

|

|

|

|

|

|

Continuing operations |

|

|

(6,635 |

) |

|

|

(5,462 |

) |

|

Discontinued operations |

|

|

- |

|

|

|

10,459 |

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss |

|

|

|

|

|

|

|

|

|

Exchange differences on translation of financial statements of

foreign operations |

|

|

(913 |

) |

|

|

(598 |

) |

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) |

|

|

(7,440 |

) |

|

|

4,394 |

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) attributable to: |

|

|

|

|

|

|

|

|

|

Equity holders of the Company |

|

|

(7,548 |

) |

|

|

4,399 |

|

|

Non-controlling interest |

|

|

108 |

|

|

|

(5 |

) |

|

Total comprehensive income (loss) |

|

|

(7,440 |

) |

|

|

4,394 |

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) arising from: |

|

|

|

|

|

|

|

|

|

Continuing operations |

|

|

(7,440 |

) |

|

|

(6,065 |

) |

|

Discontinued operations |

|

|

- |

|

|

|

10,459 |

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) per share attributable to the equity holders of the

Company |

|

|

|

|

|

|

|

|

|

Basic (USD) |

|

|

|

|

|

|

|

|

|

— from continuing operations |

|

|

(0.96 |

) |

|

|

(3.38 |

) |

|

— from discontinued operations |

|

|

- |

|

|

|

6.48 |

|

|

Diluted (USD) |

|

|

|

|

|

|

|

|

|

— from continuing operations |

|

|

(0.96 |

) |

|

|

(3.38 |

) |

|

— from discontinued operations |

|

|

- |

|

|

|

5.27 |

|

ANTELOPE ENTERPRISE HOLDINGS LIMITED AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH

FLOWS(UNAUDITED)

|

|

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

USD’000 |

|

|

USD’000 |

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Income (loss) before taxation |

|

|

(6,524 |

) |

|

|

5,192 |

|

|

Adjustments for |

|

|

|

|

|

|

|

|

|

Operating lease charge |

|

|

33 |

|

|

|

- |

|

|

Depreciation of property, plant and equipment |

|

|

40 |

|

|

|

26 |

|

|

Gain on disposal of subsidiaries |

|

|

- |

|

|

|

(10,659 |

) |

|

Loan forgiveness by related party |

|

|

- |

|

|

|

(167 |

) |

|

Loss on convertible note |

|

|

6 |

|

|

|

5 |

|

|

Standstill fee on note payable |

|

|

125 |

|

|

|

- |

|

|

Share based compensation |

|

|

5,442 |

|

|

|

4,115 |

|

|

Interest expense on lease liability |

|

|

13 |

|

|

|

- |

|

|

Amortization of OID of convertible note |

|

|

28 |

|

|

|

22 |

|

|

Operating cash flows before working capital changes |

|

|

(838 |

) |

|

|

(1,466 |

) |

|

Increase in trade receivables |

|

|

(1,508 |

) |

|

|

- |

|

|

Increase in other receivables and prepayments |

|

|

(2,189 |

) |

|

|

(1,325 |

) |

|

Increase in loan receivable |

|

|

(5,587 |

) |

|

|

(4,688 |

) |

|

Increase (Decrease) in trade payables |

|

|

639 |

|

|

|

(70 |

) |

|

Increase in unearned revenue |

|

|

982 |

|

|

|

56 |

|

|

Increase (Decrease) in taxes payable |

|

|

480 |

|

|

|

(106 |

) |

|

Increase in accrued liabilities and other payables |

|

|

861 |

|

|

|

8 |

|

|

Cash used in operations |

|

|

(7,160 |

) |

|

|

(7,591 |

) |

|

Interest paid |

|

|

- |

|

|

|

- |

|

|

Income tax paid |

|

|

- |

|

|

|

(14 |

) |

|

Net cash generated from operating activities from discontinued

operations |

|

|

- |

|

|

|

2,038 |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities |

|

|

(7,160 |

) |

|

|

(5,567 |

) |

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Acquisition of fixed assets |

|

|

(1,825 |

) |

|

|

(72 |

) |

|

Decrease in notes receivable |

|

|

1,460 |

|

|

|

- |

|

|

Decrease in available-for-sale financial asset |

|

|

99 |

|

|

|

126 |

|

|

Decrease in restricted cash |

|

|

- |

|

|

|

299 |

|

|

Cash disposed as a result of disposal of subsidiaries |

|

|

- |

|

|

|

(37 |

) |

|

Net cash used in investing activities from discontinued

operations |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash generated from (used in) investing activities |

|

|

(266 |

) |

|

|

316 |

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Payment for lease liabilities |

|

|

(13 |

) |

|

|

- |

|

|

Insurance of share capital for equity financing |

|

|

4,297 |

|

|

|

7,661 |

|

|

Warrants exercised |

|

|

1,228 |

|

|

|

- |

|

|

Proceeds from promissory note |

|

|

4,630 |

|

|

|

- |

|

|

Repayment of promissory note |

|

|

(550 |

) |

|

|

- |

|

|

Advance from related parties |

|

|

533 |

|

|

|

55 |

|

|

Net cash used in financing activities from discontinued

operations |

|

|

- |

|

|

|

(2,064 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net cash generated from financing activities |

|

|

10,125 |

|

|

|

5,652 |

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE IN CASH & EQUIVALENTS |

|

|

2,699 |

|

|

|

401 |

|

|

CASH & EQUIVALENTS, BEGINNING OF PERIOD |

|

|

536 |

|

|

|

612 |

|

|

EFFECT OF FOREIGN EXCHANGE RATE DIFFERENCES |

|

|

(913 |

) |

|

|

(560 |

) |

|

|

|

|

|

|

|

|

|

|

|

CASH & EQUIVALENTS, END OF PERIOD |

|

|

2,322 |

|

|

|

453 |

|

|

|

The accompanying notes in the Company’s Form 6-K as

filed with the SEC are an integral part of these consolidated

financial statements.

Source: Antelope Enterprise Holdings

Ltd.

|

Contact Information: |

|

| Antelope

Enterprise Holdings Limited |

Precept

Investor Relations LLC |

| Edmund

Hen, Chief Financial Officer |

David

Rudnick, Account Manager |

| Email:

info@aehltd.com |

Email:

david.rudnick@preceptir.com |

|

|

Phone: +1

646-694-8538 |

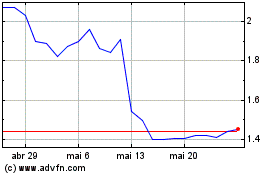

Antelope Enterprise (NASDAQ:AEHL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Antelope Enterprise (NASDAQ:AEHL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025