Gatos Silver, Inc. (NYSE/TSX: GATO) (“Gatos Silver” or the

“Company”) today announced production results for the quarter and

nine months ended September 30, 2024 at its 70%-owned Cerro Los

Gatos (“CLG”) mine in Mexico, including an 11% increase in silver

equivalent production in the third quarter of 2024 compared with a

year earlier. Gatos Silver also announced improved annual

production and cost guidance for 2024.

Dale Andres, CEO of Gatos Silver, commented:

“The CLG mine continues to produce consistent results, with another

quarter of strong production and another new record for mill

throughput. As a result of continued good operational performance,

we are increasing our 2024 full year silver and silver equivalent

production guidance by 7% and 6%, respectively, and lowering our

by-product AISC by 12%, based on the midpoint of each guidance

range. We are also further ramping up exploration efforts on both

near mine and greenfield targets in the Los Gatos district, with

three additional surface drill rigs being added in November to

focus on the Lince area, bringing the total number of active drill

rigs on the property to twelve.”

Production Results (CLG 100%

basis)

CLG comparative production highlights are

summarized below:

|

|

Three Months Ended September

30, |

Nine Months EndedSeptember

30, |

|

CLG Production (100% Basis) |

2024 |

2023 |

2024 |

2023 |

|

Tonnes milled (dmt) |

298,586 |

268,312 |

885,570 |

794,082 |

|

Tonnes milled per day (dmt) |

3,246 |

2,916 |

3,232 |

2,909 |

|

Feed Grades |

|

|

|

|

|

Silver (g/t) |

285 |

285 |

281 |

293 |

|

Zinc (%) |

4.04 |

3.82 |

4.19 |

3.92 |

|

Lead (%) |

1.97 |

1.84 |

1.93 |

1.85 |

|

Gold (g/t) |

0.30 |

0.30 |

0.29 |

0.29 |

|

Contained Metal |

|

|

|

|

|

Silver ounces (millions) |

2.42 |

2.22 |

7.10 |

6.65 |

|

Zinc pounds - in zinc conc. (millions) |

16.5 |

13.8 |

51.5 |

42.7 |

|

Lead pounds - in lead conc. (millions) |

11.4 |

9.5 |

33.5 |

28.7 |

|

Gold ounces - in lead conc. (thousands) |

1.45 |

1.28 |

4.20 |

3.86 |

|

Silver Equivalent ounces (millions)1 |

3.84 |

3.46 |

11.42 |

10.45 |

|

Recoveries |

|

|

|

|

|

Silver - in both lead and zinc concentrates |

88.4% |

90.3% |

88.7% |

89.1% |

|

Zinc - in zinc concentrate |

62.2% |

61.1% |

62.8% |

62.3% |

|

Lead - in lead concentrate |

87.8% |

87.4% |

88.8% |

88.4% |

|

Gold - in lead concentrate |

49.9% |

49.2% |

50.2% |

52.7% |

1 For 2024, silver equivalent production is

calculated using prices of $23/oz silver, $1.20/lb zinc, $0.90/lb

lead and $1,800/oz gold to “convert” zinc, lead and gold production

contained in concentrate to “equivalent” silver ounces (contained

metal, multiplied by price, divided by silver price). For 2023,

silver equivalent production was calculated using prices of $22/oz

silver, $1.20/lb zinc, $0.90/lb lead and $1,700/oz gold. For

comparative purposes, the calculated silver equivalent production

for the three and nine months ended September 30, 2023 would be

3.41 million ounces and 10.30 million ounces, respectively, using

price assumptions for 2024.

Mill throughput rate averaged 3,246 tonnes per

day during the third quarter of 2024, slightly higher than the

previous record achieved in the second quarter of 2024 and up 11%

from the third quarter of 2023.

Silver and silver equivalent production was 2.42

million and 3.84 million ounces in the third quarter of 2024, 9%

and 11% above the 2.22 million and 3.46 million ounces,

respectively, in the third quarter of 2023. The increase is

primarily attributable to higher mill throughput with silver feed

grades consistent between these periods. Zinc, lead and gold

production increased by 20%, 20% and 13%, respectively, compared

with the third quarter of 2023, primarily due to higher mill

throughput and higher feed grades for zinc and lead.

As of September 30, 2024, the Company and the

Los Gatos Joint Venture (“LGJV”) reported cash and cash equivalents

of $116.7 million and $33.9 million, respectively.

2024 Guidance Update (CLG 100%

basis)

As a result of continued strong production

performance, Gatos Silver is increasing its full year 2024 guidance

for silver production and silver equivalent production.

Silver production is now expected to be between

9.2 million and 9.7 million ounces compared with original guidance

of 8.4 million to 9.2 million ounces. This represents an increase

of 10% at the low end of the range and 5% at the high end. Silver

equivalent production is now expected to be between 14.7 million

and 15.5 million ounces, compared with original guidance of 13.5

million to 15.0 million silver equivalent ounces. This represents

an increase of 9% at the low end of the range and 3% at the high

end.

Based on current mine plan sequencing at CLG,

the Company expects full year zinc, lead and gold production to be

near the high end of the original guidance range of 61 to 69

million pounds, 40 to 46 million pounds and 4.5 to 5.5 thousand

ounces, respectively.

The Company now expects full year by-product

all-in sustaining costs (“AISC”)1 to be between $8.50 and $10.00

per ounce of payable silver compared to the original guidance range

of $9.50 to $11.50 per ounce of payable silver. This represents a

decrease of 11% at the low end of the range and 13% at the high

end. Full year co-product AISC1 is expected to remain within our

original guidance ranges of $14.00 to $16.00 per ounce of payable

silver equivalent.

The Company remains on track to meet sustaining

capital expenditure guidance1 at CLG of $45 million and total

exploration and resource development drilling expenditures of $18

million in 2024.

About Gatos Silver

Gatos Silver is a silver dominant exploration,

development and production company that discovered a new silver and

zinc-rich mineral district in southern Chihuahua State, Mexico. As

a 70% owner of the Los Gatos Joint Venture (“LGJV”), the Company is

primarily focused on operating the Cerro Los Gatos mine and on

growth and development of the Los Gatos district. The LGJV consists

of approximately 103,000 hectares of mineral rights, representing a

highly prospective and under-explored district with numerous

silver-zinc-lead epithermal mineralized zones identified as

priority targets.

On September 5, 2024, Gatos Silver and First

Majestic Silver Corp. (“First Majestic”) announced that they

entered into a definitive merger agreement pursuant to which First

Majestic will acquire all of the issued and outstanding common

shares of Gatos Silver. The proposed transaction would consolidate

three world-class, producing silver mining districts in Mexico to

create a leading intermediate primary silver producer. Information

relating to the proposed transaction can be found at the Company’s

website at www.gatossilver.com.

Qualified Person

Scientific and technical disclosure in this

press release was approved by Anthony (Tony) Scott, P.Geo., Senior

Vice President of Corporate Development and Technical Services of

Gatos Silver who is a “Qualified Person” as defined in S-K 1300 and

NI 43-101.

Non-GAAP Financial Performance

Measures

We use certain measures that are not defined by

GAAP to evaluate various aspects of our business. These non-GAAP

financial measures are intended to provide additional information

only and do not have any standardized meaning prescribed by GAAP

and should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with GAAP. The

measures are not necessarily indicative of operating profit or cash

flow from operations as determined under GAAP.

AISC includes total production cash costs

incurred at the LGJV’s mining operations (including all direct and

indirect operating cash costs related to the physical activities of

producing metals, including mining, processing and other plant

costs, treatment and refining costs, freight and handling, general

and administrative costs, corporate cost allocations, mining taxes,

and royalties) plus sustaining capital expenditures and excluding

exploration, resource development drilling and reclamation

expenses. AISC on a co-product basis is the AISC costs per ounce of

payable silver equivalent, where payable silver equivalent is

calculated by “converting” payable zinc, lead, copper and gold in

concentrate to “equivalent” payable silver ounces (payable metal,

multiplied by price, divided by silver price). AISC on a by-product

basis is the AISC per ounce of payable silver less revenues from

payable zinc, lead, copper and gold per ounce of payable silver.

Commodity price assumptions used in both of the foregoing metrics

are based on actual realized prices for the first nine months and

forward curves for the remaining months of 2024. The Company

believes AISC represents the total sustainable costs of producing

silver from current operations and provides additional information

on the LGJV’s operational performance and ability to generate cash

flows. This non-GAAP financial measure is intended to provide

additional information only and does not have any standardized

meaning prescribed by GAAP and should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with GAAP. The Company does not provide a

reconciliation of forward-looking AISC to the GAAP measure of the

LGJV expenses due to the inherent difficulty in forecasting and

quantifying certain amounts that are necessary for such

reconciliation, and as a result, is not able to provide a

reconciliation of AISC without unreasonable effort. The amount of

the non-GAAP adjustments may be material and, therefore, could

result in projected AISC being materially different than projected

LGJV GAAP expenses.

Forward-Looking Statements

This press release contains statements that

constitute “forward looking information” and “forward-looking

statements” within the meaning of U.S. and Canadian securities

laws. All statements other than statements of historical facts

contained in this press release, including statements regarding

guidance for production, AISC, sustaining capital expenditure and

total exploration and resource development drilling expenditures,

and future exploration efforts are forward-looking statements.

Forward-looking statements are based on management’s beliefs and

assumptions and on information currently available to management.

Such statements are subject to risks and uncertainties, and actual

results may differ materially from those expressed or implied in

the forward-looking statements, and such other risks and

uncertainties described in our filings with the U.S. Securities and

Exchange Commission and Canadian securities commissions. Gatos

Silver expressly disclaims any obligation or undertaking to update

the forward-looking statements contained in this press release to

reflect any change in its expectations or any change in events,

conditions, or circumstances on which such statements are based

unless required to do so by applicable law. No assurance can be

given that such future results will be achieved. Forward-looking

statements speak only as of the date of this press release.

Investors and Media

ContactAndré van NiekerkChief Financial

Officerinvestors@gatossilver.com(604) 424-0984

____________________1 See Non-GAAP Financial

Measures below.

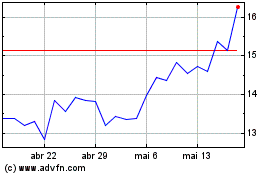

Gatos Silver (TSX:GATO)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Gatos Silver (TSX:GATO)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025