Advent Technologies Holdings, Inc. (NASDAQ: ADN) (“Advent” or the

“Company”), an innovation-driven leader in the fuel cell and

hydrogen technology space, today announced consolidated financial

results for the three months ended June 30, 2024. All amounts are

in U.S. dollars unless otherwise noted and have been prepared in

accordance with U.S. generally accepted accounting principles

(“GAAP”).

Q2 2024

Financial Highlights

(All comparisons are to Q2 2023, unless otherwise stated)

- Revenue of $0.8 million and income from grants of $0.7 million,

for a total of $1.5 million.

- Operating expenses of $10.0 million, a year-over-year decrease

of $1.2 million, primarily related to the streamlining of

operations.

- Net loss in Q2 of $(11.3) million or $(4.28) per share.

- Unrestricted cash reserves were $0.7 million as of June 30,

2024, a decrease of $0.1 million from March 31, 2024.

“We are on the road to becoming a much leaner and focused

company with the goal to substantially reduce our cash burn. We aim

to soon rely mostly on customer revenue and R&D grants for our

operations rather than on fundraising. Towards that goal, we are

focusing our activities on our Livermore and Patras offices that

are leading the US Army, Airbus, and R&D product development

efforts. Technology-wise, we have made great progress with the

Advent MEA and expect to announce strong performance improvements

to the market by year-end. I am thankful to our employees in the

USA and Greece for performing excellent work during these hard

financial times and meeting all customer milestones and

requirements,” said Dr. Vasilis Gregoriou, Chairman and CEO of

Advent Technologies.

Business Updates

Airbus: The second quarter milestones were completed

successfully, and the cooperation between the two companies

continues to be strong. Aviation has by far the most challenging

requirements compared to any other market. Advent believes that the

benchmark performance achieved through this project will also be

instrumental in achieving the performance requirements of other

markets, especially stationary power, marine, and automotive.

The project aims to accelerate the development of Advent’s MEA

and benchmark the Ion Pair MEA against aviation requirements and

current/expected technological limits. HT-PEM MEAs operating at

temperatures higher than 180°C (360°F) aim to solve one of the

largest challenges in aviation fuel cell use: thermal management.

High-temperature fuel cells allow increased performance, increased

passenger carrying capability, and increased range compared to

low-temperature fuel cell stack technology.

US Army: Work continued at a good pace in the two new contracts

with the U.S. Department of Defense (“DoD”) ($2.2m and $2.8m

awarded in 2023). Advent has successfully met all program

milestones so far (on time or with minor delays) and the demanding

mission requirements of the U.S. Army. These contracts are the

continuation of a series of past contracts with the U.S. DoD, and

their primary objective is to further optimize Advent’s proprietary

Honey Badger 50™ (“HB50”) portable fuel cell system by integrating

the Company’s innovative Ion Pair MEA technology. Upon the

completion of these contracts, Advent and the U.S. DoD aim to

reinforce their long-term collaboration by focusing on the further

optimization of the HB50 and also on low-volume production

manufacturing capacity.

Advent continued work for the ten EU-received R&D grants

that are already ongoing and met milestones in multi-partner

projects focused on further developing its technology and

accelerating its product development roadmap.

Advent continued work on developing the Advent MEA with the goal

to eventually achieve three times (3x) the power density

performance and the 3x the lifetime performance of the legacy MEA

that has been used for the last years across the line of Serene

products. Advent believes that the development of the MEA is

essential to continue and precede mass market efforts. The

experience with the Serene systems is that despite their design and

system maturity they remain too expensive for the markets intended

(especially telecom power backup in Asia and Africa). The expected

introduction of the Advent MEA into new fuel cell systems

codeveloped with OEMs can bring the cost three times down

effectively creating an inflection point for mass adoption.

Other Updates

Reverse Stock Split: On May 1, 2024, Advent announced that it

would move forward with a 1-for-30 reverse stock split of its

issued and outstanding common stock. The reverse stock split was

approved on April 30, 2024 by Advent’s Board of Directors,

following approval by the Company's stockholders at a special

meeting held on April 29, 2024. The reverse stock split brought

Advent back into compliance with Nasdaq's $1.00 per share minimum

bid price requirement for continued listing and to make the

Company's stock more attractive to a broader range of institutional

and other investors. On May 9, 2024 Advent announced that it would

file a Certificate of Amendment to its Second Amended and Restated

Certificate of Incorporation with the Secretary of State of

Delaware after the close of business on Monday, May 13, 2024 to

effectuate its previously announced 1-for-30 reverse stock split of

its issued and outstanding common stock (the “Reverse Split”).

Dr. Gregoriou concluded, “We have continued our work on

important projects with Airbus, US Army, Hyundai, and other

automotive manufacturers. We are happy to report that despite

financial difficulties, we have put our full focus and effort into

these projects, and we have done our best work to date, meeting all

the milestones. On the contrary, the Advent Denmark subsidiary has

had poor financial and technology delivery performance, leading us

to implement more cuts there. We intend to continue to reduce costs

and focus our operations and people on what is truly world-changing

and a competitive advantage for the company, and that is our Advent

MEA technology. Furthermore, we are currently in talks with OEMs

with the intention to enter into technology transfer

agreements.”

About Advent

Technologies Holdings,

Inc.

Advent Technologies Holdings, Inc. (a U.S. corporation) is an

advanced materials and technology development company operating in

the fuel cell, methanol, and hydrogen technology space. Advent is a

world-leading company in the development of the HT-PEM technology

(with more than 100 patents issued, pending, or licensed

worldwide). The HT-PEM fuel cell technology developed by Advent

enables off-grid power systems to produce clean power from various

green fuels (hydrogen, methanol, bio and eMethanol, and renewable

natural gas) and to function with higher efficiency at extreme

ambient temperatures and in general extreme environmental

conditions (humidity, air pollution). Advent’s main operations

focus on developing and manufacturing the Membrane Electrode

Assembly (MEA), which is the core electrochemical element and the

most critical component of the fuel cell. The MEA largely

determines lifetime, power density, efficiency, and overall cost of

installation and operation for all applications. Advent is working

with world-leading market-leading OEMs with the goal of bringing to

the market complete fuel cell systems for a range of applications

in the stationary power markets (backup, off-grid, and portable

power) and the heavy-duty mobility markets (automotive, aviation,

marine).For more information, please visit www.advent.energy.

Cautionary Note

Regarding Forward-Looking

Statements

This press release includes forward-looking statements. These

forward-looking statements generally can be identified by the use

of words such as “anticipate,” “expect,” “plan,” “could,” “may,”

“will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and

other words of similar meaning. Each forward-looking statement

contained in this press release is subject to risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statement. Applicable risks

and uncertainties include, among others, the Company’s ability to

maintain the listing of the Company’s common stock on Nasdaq;

future financial performance; public securities’ potential

liquidity and trading; impact from the outcome of any known and

unknown litigation; ability to forecast and maintain an adequate

rate of revenue growth and appropriately plan its expenses;

expectations regarding future expenditures; future mix of revenue

and effect on gross margins; attraction and retention of qualified

directors, officers, employees, and key personnel; ability to

compete effectively in a competitive industry; ability to protect

and enhance our corporate reputation and brand; expectations

concerning our relationships and actions with our technology

partners and other third parties; impact from future regulatory,

judicial and legislative changes to the industry; ability to locate

and acquire complementary technologies or services and integrate

those into the Company’s business; future arrangements with, or

investments in, other entities or associations; and intense

competition and competitive pressure from other companies worldwide

in the industries in which the Company will operate; and the risks

identified under the heading “Risk Factors” in our Annual Report on

Form 10-K filed with the Securities and Exchange Commission on

August 13, 2024, as well as the other information we file with the

SEC. We caution investors not to place considerable reliance on the

forward-looking statements contained in this press release. You are

encouraged to read our filings with the SEC, available at

www.sec.gov, for a discussion of these and other risks and

uncertainties. The forward-looking statements in this press release

speak only as of the date of this document, and we undertake no

obligation to update or revise any of these statements. Our

business is subject to substantial risks and uncertainties,

including those referenced above. Investors, potential investors,

and others should give careful consideration to these risks and

uncertainties.

Presentation of

Non-GAAP Financial

Measures

In addition to the results provided in accordance with U.S. GAAP

throughout this press release, the Company has provided non-GAAP

financial measures - Adjusted Net Income / (Loss) and Adjusted

EBITDA - which present results on a basis adjusted for certain

items. The Company uses these non-GAAP financial measures for

business planning purposes and in measuring its performance

relative to that of its competitors. The Company believes that

these non-GAAP financial measures are useful financial metrics to

assess its operating performance from period-to- period by

excluding certain items that the Company believes are not

representative of its core business. These non- GAAP financial

measures are not intended to replace, and should not be considered

superior to, the presentation of the Company’s financial results in

accordance with GAAP. The use of the terms Adjusted Net Income /

(Loss) and Adjusted EBITDA may differ from similar measures

reported by other companies and may not be comparable to other

similarly titled measures. These measures are reconciled from the

respective measures under GAAP in the appendix below.

|

ADVENT TECHNOLOGIES HOLDINGS,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(Amounts in USD thousands, except share and

per share amounts) |

|

|

|

|

|

As of |

|

|

|

|

June 30,2024 |

|

|

December 31,2023 |

|

|

|

|

(Unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

682 |

|

|

$ |

3,562 |

|

|

Restricted cash, current |

|

|

- |

|

|

|

100 |

|

|

Accounts receivable, net |

|

|

922 |

|

|

|

191 |

|

|

Contract assets |

|

|

11 |

|

|

|

21 |

|

|

Inventories |

|

|

1,986 |

|

|

|

2,707 |

|

|

Prepaid expenses and Other current assets |

|

|

3,314 |

|

|

|

2,254 |

|

|

Total current assets |

|

|

6,915 |

|

|

|

8,835 |

|

|

Non-current assets: |

|

|

|

|

|

|

|

|

|

Intangibles, net |

|

|

76 |

|

|

|

79 |

|

|

Property and equipment, net |

|

|

6,734 |

|

|

|

21,549 |

|

|

Right-of-use assets |

|

|

341 |

|

|

|

3,216 |

|

|

Restricted cash, non-current |

|

|

- |

|

|

|

750 |

|

|

Other non-current assets |

|

|

303 |

|

|

|

308 |

|

|

Available for sale financial asset |

|

|

- |

|

|

|

- |

|

|

Total non-current assets |

|

|

7,454 |

|

|

|

25,902 |

|

|

Total assets |

|

$ |

14,369 |

|

|

$ |

34,737 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Trade and other payables |

|

$ |

6,283 |

|

|

$ |

5,087 |

|

|

Deferred income from grants, current |

|

|

7 |

|

|

|

530 |

|

|

Contract liabilities |

|

|

2,221 |

|

|

|

2,015 |

|

|

Loss contingency liabilities |

|

|

5,162 |

|

|

|

- |

|

|

Other current liabilities |

|

|

1,768 |

|

|

|

1,916 |

|

|

Operating lease liabilities |

|

|

162 |

|

|

|

2,186 |

|

|

Income tax payable |

|

|

176 |

|

|

|

179 |

|

|

Total current liabilities |

|

|

15,779 |

|

|

|

11,913 |

|

|

Non-current liabilities: |

|

|

|

|

|

|

|

|

|

Bonds and other long-term debt, net |

|

|

537 |

|

|

|

- |

|

|

Warrant liability |

|

|

- |

|

|

|

59 |

|

|

Long-term operating lease liabilities |

|

|

170 |

|

|

|

8,230 |

|

|

Defined benefit obligation |

|

|

91 |

|

|

|

83 |

|

|

Deferred income from grants, non-current |

|

|

- |

|

|

|

320 |

|

|

Other long-term liabilities |

|

|

671 |

|

|

|

684 |

|

|

Total non-current liabilities |

|

|

1,469 |

|

|

|

9,376 |

|

|

Total liabilities |

|

|

17,248 |

|

|

|

21,289 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingent liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

|

Common stock ($0.0001 par value per share; Shares authorized:

500,000,000 at June 30, 2024 and December 31, 2023;

Issued and outstanding: 2,636,508 and 2,580,159 at June 30,

2024 and December 31, 2023, respectively) |

|

|

- |

|

|

|

- |

|

|

Preferred stock ($0.0001 par value per share; Shares authorized:

1,000,000 at June 30, 2024 and December 31, 2023; nil

issued and outstanding at June 30, 2024 and December 31,

2023) |

|

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

|

199,265 |

|

|

|

194,941 |

|

|

Accumulated other comprehensive loss |

|

|

(2,356 |

) |

|

|

(2,334 |

) |

|

Accumulated deficit |

|

|

(199,788 |

) |

|

|

(179,159 |

) |

|

Total stockholders’ equity / (deficit) |

|

|

(2,879 |

) |

|

|

13,448 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

14,369 |

|

|

$ |

34,737 |

|

|

ADVENT TECHNOLOGIES HOLDINGS,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(Amounts in USD thousands, except share

and per share amounts) |

|

|

|

|

|

Three months

endedJune 30,(Unaudited) |

|

|

Six months

endedJune 30,(Unaudited) |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue, net |

|

$ |

805 |

|

|

$ |

1,112 |

|

|

$ |

4,256 |

|

|

$ |

2,089 |

|

|

Cost of revenues |

|

|

(155 |

) |

|

|

(1,905 |

) |

|

|

(1,174 |

) |

|

|

(3,389 |

) |

|

Gross loss |

|

|

650 |

|

|

|

(793 |

) |

|

|

3,082 |

|

|

|

(1,300 |

) |

|

Income from grants |

|

|

677 |

|

|

|

660 |

|

|

|

2,114 |

|

|

|

1,194 |

|

|

Research and development expenses |

|

|

(3,587 |

) |

|

|

(2,883 |

) |

|

|

(5,002 |

) |

|

|

(6,024 |

) |

|

Administrative and selling expenses |

|

|

(6,372 |

) |

|

|

(8,331 |

) |

|

|

(13,275 |

) |

|

|

(16,820 |

) |

|

Sublease income |

|

|

- |

|

|

|

138 |

|

|

|

145 |

|

|

|

265 |

|

|

Amortization of intangibles |

|

|

(1 |

) |

|

|

(188 |

) |

|

|

(2 |

) |

|

|

(409 |

) |

|

Credit loss – customer contracts |

|

|

- |

|

|

|

(127 |

) |

|

|

- |

|

|

|

(127 |

) |

|

Impairment losses |

|

|

- |

|

|

|

(9,763 |

) |

|

|

- |

|

|

|

(9,763 |

) |

|

Operating loss |

|

|

(8,633 |

) |

|

|

(21,287 |

) |

|

|

(12,938 |

) |

|

|

(32,984 |

) |

|

Fair value change of warrant liability |

|

|

- |

|

|

|

99 |

|

|

|

59 |

|

|

|

489 |

|

|

Finance income / (expenses), net |

|

|

(54 |

) |

|

|

8 |

|

|

|

(286 |

) |

|

|

118 |

|

|

Foreign exchange gains / (losses), net |

|

|

(156 |

) |

|

|

159 |

|

|

|

(165 |

) |

|

|

118 |

|

|

Loss contingency |

|

|

36 |

|

|

|

|

|

|

|

(4,871 |

) |

|

|

|

|

|

Other income / (expenses), net |

|

|

(2,466 |

) |

|

|

(806 |

) |

|

|

(2,483 |

) |

|

|

(760 |

) |

|

Loss before income tax |

|

|

(11,273 |

) |

|

|

(21,827 |

) |

|

|

(20,684 |

) |

|

|

(33,019 |

) |

|

Income taxes |

|

|

- |

|

|

|

(4 |

) |

|

|

55 |

|

|

|

(800 |

) |

|

Net loss |

|

$ |

(11,273 |

) |

|

$ |

(21,831 |

) |

|

$ |

(20,629 |

) |

|

$ |

(33,819 |

) |

|

Net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic loss per share |

|

|

(4.28 |

) |

|

|

(12.26 |

) |

|

|

(7.91 |

) |

|

|

(19.25 |

) |

|

Basic weighted average number of shares |

|

|

2,634,179 |

|

|

|

1,780,574 |

|

|

|

2,609,549 |

|

|

|

1,757,137 |

|

|

Diluted loss per share |

|

|

(4.28 |

) |

|

|

(12.26 |

) |

|

|

(7.91 |

) |

|

|

(19.25 |

) |

|

Diluted weighted average number of shares |

|

|

2,634,179 |

|

|

|

1,780,574 |

|

|

|

2,609,549 |

|

|

|

1,757,137 |

|

|

ADVENT TECHNOLOGIES HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(Amounts in USD thousands, except share and

per share amounts) |

|

|

|

|

|

Six Months

EndedJune 30,(unaudited) |

|

|

|

(Amounts in thousands) |

|

2024 |

|

|

2023 |

|

|

$ change |

|

|

% change |

|

|

Net Cash used in Operating Activities |

|

$ |

(4,810 |

) |

|

$ |

(18,899 |

) |

|

$ |

14,089 |

|

|

|

(74.5 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from sale of property and equipment |

|

|

300 |

|

|

|

- |

|

|

|

300 |

|

|

|

N/A |

|

|

Purchases of property and equipment |

|

|

(28 |

) |

|

|

(2,348 |

) |

|

|

2,320 |

|

|

|

(98.8 |

)% |

|

Advances for the acquisition of property and equipment |

|

|

- |

|

|

|

(1,214 |

) |

|

|

1,214 |

|

|

|

N/A |

|

|

Acquisition of subsidiaries |

|

|

- |

|

|

|

(1,864 |

) |

|

|

1,864 |

|

|

|

N/A |

|

|

Net Cash provided by / (used in) Investing

Activities |

|

$ |

272 |

|

|

$ |

(5,426 |

) |

|

$ |

5,698 |

|

|

|

(105.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock and paid-in capital |

|

|

282 |

|

|

|

3,410 |

|

|

|

(3,128 |

) |

|

|

(91.7 |

)% |

|

Proceeds from borrowings |

|

|

540 |

|

|

|

- |

|

|

|

540 |

|

|

|

N/A |

|

|

Net cash provided by Financing Activities |

|

$ |

822 |

|

|

$ |

3,410 |

|

|

$ |

(2,588 |

) |

|

|

(75.9 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net decrease in cash, cash equivalents, restricted cash and

restricted cash equivalents |

|

$ |

(3,716 |

) |

|

$ |

(20,915 |

) |

|

$ |

17,199 |

|

|

|

(82.2 |

)% |

|

Effect of exchange rate changes on cash, cash equivalents,

restricted cash and restricted cash equivalents |

|

|

(14 |

) |

|

|

94 |

|

|

|

(108 |

) |

|

|

(114.9 |

)% |

|

Cash, cash equivalents, restricted cash and restricted cash

equivalents at the beginning of year |

|

|

4,412 |

|

|

|

33,619 |

|

|

|

(29,207 |

) |

|

|

(86.9 |

)% |

|

Cash, cash equivalents, restricted cash and restricted cash

equivalents at the end of period |

|

$ |

682 |

|

|

$ |

12,798 |

|

|

$ |

(12,116 |

) |

|

|

(94.7 |

)% |

Supplemental Non-GAAP Measures and Reconciliations

In addition to providing measures prepared in accordance with

GAAP, we present certain supplemental non-GAAP measures. These

measures are EBITDA, Adjusted EBITDA and Adjusted Net Income /

(Loss), which we use to evaluate our operating performance, for

business planning purposes and to measure our performance relative

to that of our peers. These non-GAAP measures do not have any

standardized meaning prescribed by GAAP and therefore may differ

from similar measures presented by other companies and may not be

comparable to other similarly titled measures. We believe these

measures are useful in evaluating the operating performance of

Advent’s ongoing business. These measures should be considered in

addition to, and not as a substitute for net income, operating

expense and income, cash flows and other measures of financial

performance and liquidity reported in accordance with GAAP. The

calculation of these non-GAAP measures has been made on a

consistent basis for all periods presented.

EBITDA and

Adjusted EBITDA

These supplemental non-GAAP measures are provided to assist

readers in determining our operating performance. We believe this

measure is useful in assessing performance and highlighting trends

on an overall basis. We also believe EBITDA and Adjusted EBITDA are

frequently used by securities analysts and investors when comparing

our results with those of other companies. EBITDA differs from the

most comparable GAAP measure, net income / (loss), primarily

because it does not include interest, income taxes, depreciation of

property, plant and equipment, and amortization of intangible

assets. Adjusted EBITDA adjusts EBITDA for items such as one-time

transaction costs, asset impairment charges, and fair value changes

in the warrant liability.

The following tables show a reconciliation of net loss to EBITDA

and Adjusted EBITDA for the three and six months ended June 30,

2024 and 2023.

|

EBITDA and Adjusted EBITDA |

|

Three months

endedJune 30,(Unaudited) |

|

|

|

|

|

Six months

endedJune 30,(Unaudited) |

|

|

|

|

|

(in Millions of US dollars) |

|

2024 |

|

|

2023 |

|

|

$ change |

|

|

2024 |

|

|

2023 |

|

|

$ change |

|

|

Net loss |

|

$ |

(11.27 |

) |

|

$ |

(21.83 |

) |

|

|

10.56 |

|

|

$ |

(20.63 |

) |

|

$ |

(33.82 |

) |

|

|

13.19 |

|

|

Depreciation of property and equipment |

|

$ |

0.40 |

|

|

$ |

0.81 |

|

|

|

(0.41 |

) |

|

$ |

1.12 |

|

|

$ |

1.21 |

|

|

|

(0.09 |

) |

|

Amortization of intangibles |

|

$ |

- |

|

|

$ |

0.19 |

|

|

|

(0.19 |

) |

|

$ |

- |

|

|

$ |

0.41 |

|

|

|

(0.41 |

) |

|

Finance income / (expenses), net |

|

$ |

0.06 |

|

|

$ |

(0.01 |

) |

|

|

0.07 |

|

|

$ |

0.29 |

|

|

$ |

(0.12 |

) |

|

|

0.41 |

|

|

Loss contingency |

|

$ |

(0.04 |

) |

|

$ |

- |

|

|

|

(0.04 |

) |

|

$ |

4.87 |

|

|

$ |

- |

|

|

|

4.87 |

|

|

Other income / (expenses), net |

|

$ |

2.46 |

|

|

$ |

0.81 |

|

|

|

1.65 |

|

|

$ |

2.48 |

|

|

$ |

0.76 |

|

|

|

1.72 |

|

|

Foreign exchange differences, net |

|

$ |

0.16 |

|

|

$ |

(0.16 |

) |

|

|

0.32 |

|

|

$ |

0.17 |

|

|

$ |

(0.12 |

) |

|

|

0.29 |

|

|

Income taxes |

|

$ |

- |

|

|

$ |

- |

|

|

|

- |

|

|

$ |

(0.06 |

) |

|

$ |

0.80 |

|

|

|

(0.86 |

) |

|

EBITDA |

|

$ |

(8.23 |

) |

|

$ |

(20.19 |

) |

|

|

11.96 |

|

|

$ |

(11.76 |

) |

|

$ |

(30.88 |

) |

|

|

19.12 |

|

|

Net change in warrant liability |

|

$ |

- |

|

|

$ |

(0.10 |

) |

|

|

0.10 |

|

|

$ |

(0.06 |

) |

|

$ |

(0.49 |

) |

|

|

0.43 |

|

|

Impairment losses |

|

$ |

- |

|

|

$ |

9.76 |

|

|

|

(9.76 |

) |

|

$ |

- |

|

|

$ |

9.76 |

|

|

|

(9.76 |

) |

|

Adjusted EBITDA |

|

$ |

(8.23 |

) |

|

$ |

(10.53 |

) |

|

|

2.30 |

|

|

$ |

(11.82 |

) |

|

$ |

(21.61 |

) |

|

|

9.79 |

|

This supplemental non-GAAP measure is provided to assist readers

in determining our financial performance. We believe this measure

is useful in assessing performance and highlighting trends on an

overall basis. Adjusted Net Loss differs from the most comparable

GAAP measure, net loss, primarily because it does not include

one-time transaction costs, asset impairment charges and warrant

liability changes. The following table shows a reconciliation of

net loss to Adjusted Net Loss for the three and six months ended

June 30, 2024 and 2023.

|

Adjusted Net Loss |

|

Three months

endedJune 30,(Unaudited) |

|

|

|

|

|

Six months

endedJune 30,(Unaudited) |

|

|

|

|

|

(in Millions of US dollars) |

|

2024 |

|

|

2023 |

|

|

$ change |

|

|

2024 |

|

|

2023 |

|

|

$ change |

|

|

Net loss |

|

$ |

(11.27 |

) |

|

$ |

(21.83 |

) |

|

|

10.56 |

|

|

$ |

(20.63 |

) |

|

$ |

(33.82 |

) |

|

|

13.19 |

|

|

Net change in warrant liability |

|

$ |

- |

|

|

$ |

(0.10 |

) |

|

|

0.10 |

|

|

$ |

(0.06 |

) |

|

$ |

(0.49 |

) |

|

|

0.43 |

|

|

Impairment losses |

|

$ |

- |

|

|

$ |

9.76 |

|

|

|

(9.76 |

) |

|

$ |

- |

|

|

$ |

9.76 |

|

|

|

(9.76 |

) |

|

Adjusted Net Loss |

|

$ |

(11.27 |

) |

|

$ |

(12.17 |

) |

|

|

0.90 |

|

|

$ |

(20.69 |

) |

|

$ |

(24.55 |

) |

|

|

3.86 |

|

Advent Technologies Holdings, Inc.

Dr. Vasilis Gregoriou,press@advent.energy

Source: Advent Technologies Holdings, Inc.

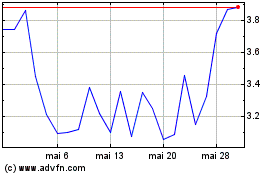

Advent Technologies (NASDAQ:ADN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Advent Technologies (NASDAQ:ADN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024