Barrick Gold Corporation (NYSE:GOLD)(TSX:ABX) (“Barrick” or the

“Company”) today reported preliminary Q3 production of 943 thousand

ounces of gold and 48 thousand tonnes of copper, as well as

preliminary Q3 sales of 967 thousand ounces of gold and 42 thousand

tonnes of copper. The Company continues to expect a materially

stronger Q4 to deliver 2024 production within the range of its full

year gold and copper guidance.

The average market price for gold in Q3 was

$2,474 per ounce while the average market price for copper in Q3

was $4.18 per pound.

Preliminary Q3 gold production was in line with

Q2. Pueblo Viejo delivered a 23% sequential improvement on

continued plant optimization, whilst North Mara had a stronger

quarter driven by higher grades. At Carlin, the Gold Quarry roaster

expansion, completed during a Q3 shutdown, is expected to underpin

higher throughput and recoveries in Q4. Turquoise Ridge improved

versus Q2, with a stronger underground mining performance more than

offsetting a planned shutdown of the Sage autoclave in Q3. At

Kibali, underground development during Q3 opened up access to more

high-grade underground headings, which are expected to be further

supplemented by higher open pit grades and volumes to drive a

stronger performance in Q4. Compared to Q2, Q3 gold cost of sales

per ounce1 is expected to be 1% to 3% higher, total cash costs per

ounce2 is expected to be 3% to 5% higher and all-in sustaining

costs per ounce2 are expected to be 0% to 2% higher, in part

reflecting higher royalties from the higher gold price

received.

As expected, preliminary Q3 copper production

was higher than Q2, driven primarily by higher grades and

recoveries at Lumwana following improved ore access driven by the

ramp up in stripping activities in Q2, with further improvements

expected in Q4. Compared to Q2, Q3 copper cost of sales per pound1

is expected to be 5% to 7% higher, C1 cash costs per pound2 are

expected to be 13% to 15% higher, while all-in sustaining costs per

pound2 are expected to be 2% to 4% lower, primarily due to a

decrease in capitalized waste stripping at Lumwana.

Barrick will provide additional discussion and

analysis regarding its third quarter 2024 production and sales when

the Company reports its quarterly results before North American

markets open on November 7, 2024.

The following table includes preliminary gold

and copper production and sales results from Barrick's

operations:

|

|

Three months endedSeptember 30, 2024 |

Nine months endedSeptember 30, 2024 |

|

|

Production |

Sales |

Production |

Sales |

|

Gold (attributable ounces (000)) |

|

|

|

Carlin (61.5%) |

182 |

183 |

589 |

592 |

|

Cortez (61.5%) |

98 |

99 |

319 |

321 |

|

Turquoise Ridge (61.5%) |

76 |

77 |

210 |

209 |

|

Phoenix (61.5%) |

29 |

28 |

88 |

89 |

|

Nevada Gold Mines (61.5%) |

385 |

387 |

1,206 |

1,211 |

| Loulo-Gounkoto (80%) |

144 |

135 |

422 |

412 |

| Pueblo Viejo (60%) |

98 |

96 |

259 |

257 |

| North Mara (84%) |

75 |

78 |

175 |

174 |

| Kibali (45%) |

71 |

77 |

229 |

230 |

| Veladero (50%) |

57 |

78 |

170 |

179 |

| Bulyanhulu (84%) |

37 |

37 |

124 |

121 |

| Hemlo |

30 |

28 |

104 |

105 |

| Tongon (89.7%) |

28 |

32 |

109 |

113 |

| Porgera

(24.5%) |

18 |

19 |

33 |

31 |

|

Total Gold |

943 |

967 |

2,831 |

2,833 |

|

|

|

|

|

|

| |

|

|

|

|

| Copper

(attributable tonnes (000)) |

|

|

| Lumwana |

30 |

26 |

77 |

73 |

| Zaldívar (50%) |

10 |

10 |

29 |

28 |

| Jabal

Sayid (50%) |

8 |

6 |

25 |

22 |

|

Total Copper |

48 |

42 |

131 |

123 |

Third Quarter 2024 Results

Barrick will release its Q3 2024 results before

market open on November 7, 2024. President and CEO Mark Bristow

will host a live presentation of the results that day in London, UK

at 11:00 EST/16:00 UTC, with an interactive webinar linked to a

conference call. Participants will be able to ask questions.

Go to the webinarUS and Canada

(toll-free), 1 844 763 8274UK (toll), +44 20 3795 9972International

(toll), +1 647 484 8814

The Q3 2024 presentation materials will be

available on Barrick’s website at www.barrick.com.

The webinar will remain on the website for later

viewing, and the conference call will be available for replay by

telephone at 1 855 669 9658 (US and Canada toll-free) and +1 412

317 0088 (international toll), replay access code 8607451.

Enquiries:

Kathy du PlessisInvestor and Media Relations+44

20 7557 7738barrick@dpapr.com

Website: www.barrick.com

Technical Information

The scientific and technical information

contained in this news release has been reviewed and approved by:

Craig Fiddes, SME-RM, Lead, Resource Modeling, Nevada Gold Mines;

Simon Bottoms, CGeol, MGeol, FGS, FAusIMM, Mineral Resource

Management and Evaluation Executive (in this capacity, Mr. Bottoms

is responsible on an interim basis for scientific and technical

information relating to the Latin America and Asia Pacific region);

and Richard Peattie, MPhil, FAusIMM, Mineral Resources Manager:

Africa and Middle East—each a “Qualified Person” as defined in

National Instrument 43-101 - Standards of Disclosure for Mineral

Projects.

Endnote 1

Gold cost of sales per ounce is calculated as

cost of sales across our gold operations (excluding sites in care

and maintenance) divided by ounces sold (both on an attributable

basis, based on Barrick’s ownership share). Copper cost of sales

per pound is calculated as cost of sales across our copper

operations divided by pounds sold (both on an attributable basis,

based on Barrick’s ownership share).

References to attributable basis means our 100%

share of Hemlo and Lumwana, our 89.7% share of Tongon, our 84%

share of North Mara and Bulyanhulu, our 80% share of

Loulo-Gounkoto, our 61.5% share of Nevada Gold Mines, our 60% share

of Pueblo Viejo, our 50% share of Veladero, Zaldívar and Jabal

Sayid, our 24.5% share of Porgera and our 45% share of Kibali.

Endnote 2

"Total cash costs per ounce" and "all-in

sustaining costs per ounce" are non-GAAP financial measures which

are calculated based on the definition published by the World Gold

Council ("WGC") (a market development organization for the gold

industry comprised of and funded by gold mining companies from

around the world, including Barrick). The WGC is not a regulatory

organization. Management uses these measures to monitor the

performance of our gold mining operations and its ability to

generate positive cash flow, both on an individual site basis and

an overall company basis.

Total cash costs start with our cost of sales

related to gold production and removes depreciation, the

non-controlling interest of cost of sales and includes by-product

credits. All-in sustaining costs start with total cash costs and

include sustaining capital expenditures, sustaining leases,

general and administrative costs, minesite exploration and

evaluation costs and reclamation cost accretion and amortization.

These additional costs reflect the expenditures made to maintain

current production levels.

We believe that our use of total cash costs and

all-in sustaining costs will assist analysts, investors and other

stakeholders of Barrick in understanding the costs associated with

producing gold, understanding the economics of gold mining,

assessing our operating performance and also our ability to

generate free cash flow from current operations and to generate

free cash flow on an overall company basis. Due to the

capital-intensive nature of the industry and the long useful lives

over which these items are depreciated, there can be a significant

timing difference between net earnings calculated in accordance

with IFRS and the amount of free cash flow that is being generated

by a mine and therefore we believe these measures are useful

non-GAAP operating metrics and supplement our IFRS disclosures.

These measures are not representative of all of our cash

expenditures as they do not include income tax payments, interest

costs or dividend payments. These measures do not include

depreciation or amortization.

Total cash costs per ounce and all-in sustaining

costs per ounce are intended to provide additional information only

and do not have standardized definitions under IFRS and should not

be considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. These measures are

not equivalent to net income or cash flow from operations as

determined under IFRS. Although the WGC has published a

standardized definition, other companies may calculate these

measures differently.

"C1 cash costs per pound" and "all-in sustaining

costs per pound" are non-GAAP financial measures related to our

copper mine operations. We believe that C1 cash costs per pound

enables investors to better understand the performance of our

copper operations in comparison to other copper producers who

present results on a similar basis. C1 cash costs per pound

excludes royalties and production taxes and non-routine charges as

they are not direct production costs. All-in sustaining costs per

pound is similar to the gold all-in sustaining costs metric and

management uses this to better evaluate the costs of copper

production. We believe this measure enables investors to better

understand the operating performance of our copper mines as this

measure reflects all of the sustaining expenditures incurred in

order to produce copper. All-in sustaining costs per pound includes

C1 cash costs, sustaining capital expenditures, sustaining leases,

general and administrative costs, minesite exploration and

evaluation costs, royalties and production taxes, reclamation cost

accretion and amortization and write-downs taken on inventory to

net realizable value.

Barrick will provide a full reconciliation of

these non-GAAP financial measures when the Company reports its

quarterly results on November 7, 2024.

Cautionary Statements Regarding Preliminary

Third Quarter Production, Sales and Costs for

2024, and Forward-Looking Information

Barrick cautions that, whether or not expressly

stated, all third quarter figures contained in this press release

including, without limitation, production levels, sales and

associated costs are preliminary, and reflect our expected third

quarter results as of the date of this press release. Actual

reported third quarter production levels, sales and associated

costs are subject to management’s final review, as well as review

by the Company’s independent accounting firm, and may vary

significantly from those expectations because of a number of

factors, including, without limitation, additional or revised

information, and changes in accounting standards or policies, or in

how those standards are applied. Barrick will provide additional

discussion and analysis and other important information about its

third quarter production levels, sales and associated costs when it

reports actual results on November 7, 2024. For a complete

picture of the Company’s financial performance, it will be

necessary to review all of the information in the Company’s third

quarter financial report and related MD&A. Accordingly, readers

are cautioned not to rely solely on the information contained

herein.

Finally, Barrick cautions that this press

release contains forward-looking statements with respect to: (i)

Barrick’s expected fourth quarter production and ability to deliver

within the range of its full year gold and copper guidance; and

(ii) costs per ounce for gold and per pound for copper.

Forward-looking statements are necessarily based

upon a number of estimates and assumptions including material

estimates and assumptions related to the factors set forth below

that, while considered reasonable by the Company as at the date of

this press release in light of management’s experience and

perception of current conditions and expected developments, are

inherently subject to significant business, economic, and

competitive uncertainties and contingencies. Known or unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements, and undue reliance

should not be placed on such statements and information.

Such factors include, but are not limited to:

fluctuations in the spot and forward price of gold, copper, or

certain other commodities (such as silver, diesel fuel, natural

gas, and electricity); the speculative nature of mineral

exploration and development; changes in mineral production

performance, exploitation, and exploration successes; the

resumption of operations at the Porgera mine and expected ramp up

of mining and processing in 2024; risks associated with projects in

the early stages of evaluation, and for which additional

engineering and other analysis is required; disruption of supply

routes which may cause delays in construction and mining

activities, including disruptions in the supply of key mining

inputs due to the invasion of Ukraine by Russia and conflicts in

the Middle East; whether benefits expected from recent transactions

are realized; quantities or grades of reserves will be diminished,

and that resources may not be converted to reserves; increased

costs, delays, suspensions and technical challenges associated with

the construction of capital projects; operating or technical

difficulties in connection with mining or development activities,

including geotechnical challenges, tailings dam and storage

facilities failures, and disruptions in the maintenance or

provision of required infrastructure and information technology

systems; risks that exploration data may be incomplete and

considerable additional work may be required to complete further

evaluation, including but not limited to drilling, engineering and

socioeconomic studies and investment; failure to comply with

environmental and health and safety laws and regulations; increased

costs and physical risks, including extreme weather events and

resource shortages, related to climate change; timing of, receipt

of, or failure to comply with, necessary permits and approvals;

non-renewal of key licenses by governmental authorities;

uncertainty whether some or all of targeted investments and

projects will meet the Company’s capital allocation objectives and

internal hurdle rate; the impact of inflation, including global

inflationary pressures driven by supply chain disruptions, global

energy cost increases following the invasion of Ukraine by Russia

and country-specific political and economic factors in Argentina;

the impact of global liquidity and credit availability on the

timing of cash flows and the values of assets and liabilities based

on projected future cash flows; fluctuations in the currency

markets; changes in national and local government legislation,

taxation, controls or regulations and/or changes in the

administration of laws, policies and practices; expropriation or

nationalization of property and political or economic developments

in Canada, the United States, and other jurisdictions in which the

Company or its affiliates do or may carry on business in the

future; lack of certainty with respect to foreign legal systems,

corruption and other factors that are inconsistent with the rule of

law; damage to the Company’s reputation due to the actual or

perceived occurrence of any number of events, including negative

publicity with respect to the Company’s handling of environmental

matters or dealings with community groups, whether true or not; the

possibility that future exploration results will not be consistent

with the Company’s expectations; risk of loss due to acts of war,

terrorism, sabotage and civil disturbances; risks associated with

artisanal and illegal mining; risks associated with diseases,

epidemics and pandemics; litigation and legal and administrative

proceedings; contests over title to properties, particularly title

to undeveloped properties, or over access to water, power and other

required infrastructure; business opportunities that may be

presented to, or pursued by, the Company; our ability to

successfully integrate acquisitions or complete divestitures; risks

associated with working with partners in jointly controlled assets;

employee relations including loss of key employees; and

availability and increased costs associated with mining inputs and

labor. In addition, there are risks and hazards associated with the

business of mineral exploration, development and mining, including

environmental hazards, industrial accidents, unusual or unexpected

formations, pressures, cave-ins, flooding and gold bullion, copper

cathode or gold or copper concentrate losses (and the risk of

inadequate insurance, or inability to obtain insurance, to cover

these risks).

Many of these uncertainties and contingencies

can affect our actual results and could cause actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, us. Readers

are cautioned that forward-looking statements are not guarantees of

future performance. All of the forward-looking statements made in

this press release are qualified by these cautionary statements.

Specific reference is made to the most recent Form 40-F/Annual

Information Form on file with the SEC and Canadian provincial

securities regulatory authorities for a more detailed discussion of

some of the factors underlying forward-looking statements and the

risks that may affect Barrick’s ability to achieve the expectations

set forth in the forward-looking statements contained in this press

release.

Barrick disclaims any intention or obligation to

update or revise any forward-looking statements whether as a result

of new information, future events or otherwise, except as required

by applicable law.

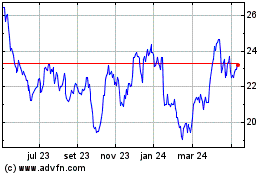

Barrick Gold (TSX:ABX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

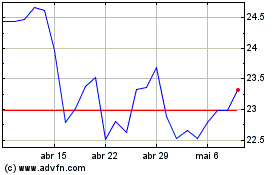

Barrick Gold (TSX:ABX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024