Presidio Property Trust Provides Update on Model Home Activity in Q3 2024

17 Outubro 2024 - 9:50AM

(NASDAQ: SQFT; SQFTP; SQFTW) Presidio Property Trust, Inc.

(“Presidio” or the “Company”), an internally managed, diversified

real estate investment trust (“REIT”) announced that in third

quarter of 2024, through subsidiary and affiliate entities, it

acquired seven newly constructed single-family model home

properties located in Texas. These seven homes were purchased for a

total of approximately $4 million, with mortgage notes payable of

approximately $2.8 million, and approximately $1.2 million in cash.

They are then leased back to the homebuilders on a triple-net

basis. Additionally, during the third quarter of 2024, through

subsidiary and affiliate entities, we sold four homes for a total

of approximately $2.4 million. These homes were purchased between

2019 and 2022 with a total acquisition price of approximately $2.1

million. Model homes account for approximately 30% of our real

estate assets.

“We continue to see brisk activity with our resale portfolio.

Durning challenging sales cycles, like we have recently seen, its

important to have solid builder relationships. We have been

fortunate to have strong business partnerships with our builder

clients, many of which have lasted decades,” said Steve Hightower,

President of the Model Homes Division.

About Presidio Property

Trust

Presidio is an internally managed real estate

investment trust with holdings in model home properties, which are

triple net leased to homebuilders, and office, industrial, and

retail properties. Presidio’s model homes are leased to

homebuilders located in Arizona, Illinois, Texas, Wisconsin, and

Florida. Presidio’s office, industrial, and retail properties are

located primarily in Colorado, with properties also located in

Maryland, North Dakota, Texas, and Southern California. Presidio

also owns approximately 6.5% of the outstanding common stock of

Conduit Pharmaceuticals Inc., a disease agnostic multi-asset

clinical-stage life science company providing an efficient model

for compound development. For more information on Presidio, please

visit Presidio’s website at https://www.PresidioPT.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains statements that are

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and other federal

securities laws. Forward-looking statements are statements that are

not historical, including statements regarding management’s

intentions, beliefs, expectations, representations, plans or

predictions of the future, and are typically identified by such

words as “believe,” “expect,” “anticipate,” “intend,” “estimate,”

“may,” “will,” “should” and “could.” Because such statements

include risks, uncertainties and contingencies, actual results may

differ materially from those expressed or implied by such

forward-looking statements. These forward-looking statements are

based upon Presidio’s present expectations, but these statements

are not guaranteed to occur. Except as required by law, Presidio

disclaims any obligation to publicly update or revise any

forward-looking statement to reflect changes in underlying

assumptions or factors, of new information, data or methods, future

events or other changes. Investors should not place undue reliance

upon forward-looking statements. For further discussion of the

factors that could affect outcomes please refer to Presidio’s

filings with the SEC, including those under “Risk Factors” therein,

copies of which are available on the SEC’s website,

www.sec.gov.

Investor Relations Contact:

Presidio Property Trust, Inc.Lowell Hartkorn, Investor

RelationsLHartkorn@presidiopt.comTelephone: (760) 471-8536

x1244

This press release was published by a CLEAR® Verified

individual.

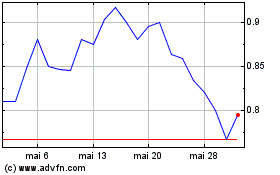

Presidio Property (NASDAQ:SQFT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Presidio Property (NASDAQ:SQFT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025