31 October 2024

RECOMMENDED AND FINAL CASH AND SHARE

ACQUISITION

for

i3 Energy plc ("i3 Energy")

by

Gran Tierra Energy Inc. ("Gran

Tierra")

to be implemented by way of a scheme of

arrangement under Part 26 of the Companies Act 2006

SCHEME OF ARRANGEMENT BECOMES

EFFECTIVE

On 19 August 2024, the boards of directors of i3

Energy and Gran Tierra announced that they had reached agreement on

the terms of a recommended and final cash and share acquisition of

the entire issued, and to be issued, share capital of i3 Energy

(the "Acquisition"). The Acquisition is being

implemented by means of a Court-sanctioned scheme of arrangement

under Part 26 of the Companies Act 2006.

i3 Energy published a circular in relation to

the Scheme dated 29 August 2024 (the "Scheme

Document").

On 29 October 2024, i3 Energy announced that the

Court had sanctioned the Scheme at the Sanction Hearing held on 29

October 2024.

i3 Energy and Gran Tierra are pleased to

announce that, following delivery of the Court Order to the

Registrar of Companies and satisfaction or waiver of all of the

conditions set out in the Scheme Document, the Scheme has now

become Effective in accordance with its terms and, pursuant to the

Scheme, the entire issued and to be issued share capital of i3

Energy is now owned by Gran Tierra.

Consideration

A Scheme Shareholder on the register of members

of i3 Energy at the Scheme Record Time, being 6.00 p.m. on 30

October 2024, will be entitled to receive one New Gran Tierra Share

per every 207 i3 Energy Shares held and 10.43 pence cash per i3

Energy Share subject to any adjustments to such consideration

resulting from valid Elections made under the Mix and Match

Facility. For Scheme Shareholders holding Scheme Shares in

certificated form, settlement of the consideration will be effected

by electronic payment or (for those Scheme Shareholders who have

not set up an electronic payment mandate) by the despatch of

cheques. For Scheme Shareholders holding Scheme Shares in

uncertificated form, settlement of consideration will be effected

by the crediting of CREST or CDS accounts, as applicable. In each

case settlement of consideration will occur as soon as practicable

and in any event not later than 14 days after the date of this

announcement, being 14 November 2024.

Further to the announcement on 7 October 2024,

i3 Energy confirms that, the Scheme having become Effective, the

Acquisition Dividend totalling £3,084,278 will be paid as

follows:

| |

Dividend: |

0.2565 pence /

i3 Energy Share |

| |

|

|

| |

Record Date: |

6.00 p.m. on 30 October 2024 |

| |

|

|

| |

Payment date: |

by 13 November 2024 |

| |

|

|

i3 Energy admission to listing on

AIM

An application was made for the suspension of

admission to trading in i3 Energy Shares on the London Stock

Exchange's AIM Market ("AIM") and such suspension

has taken effect from 7.30 a.m. today. The cancellation of the

admission to trading of the i3 Energy Shares on AIM has been

applied for and is expected to take place by 8.00 a.m. on 1

November 2024. The delisting of the i3 Energy Shares on the Toronto

Stock Exchange has been applied for and is expected to take place

at the close of markets on 1 November 2024.

Gran Tierra admission of shares to

listing

An application has been made for the admission

of 5,808,925 new shares (the "Consideration

Shares") of common stock of par value USD0.001 per share

in Gran Tierra. Gran Tierra has applied for the Consideration

Shares to be admitted to the Equity Shares (International

Commercial Companies Secondary Listing) Category of the Official

List of the Financial Conduct Authority and to trading on the main

market of the London Stock Exchange PLC (together,

"Admission").

Gran Tierra expects Admission of the

Consideration Shares to occur at 8.00 a.m. on 1 November 2024. The

Consideration Shares will rank pari passu in all respects with Gran

Tierra's existing shares of common stock of par value USD0.001 per

share.

Total Voting Rights

Following Admission, Gran Tierra will have total

issued share capital of 36,460,141 common shares, and holds no

common shares in treasury. Gran Tierra Shareholders may use the

figure of 36,460,141 as the denominator in calculations to

determine if they are required to notify Gran Tierra of their

interest in, or a change to their interest in Gran Tierra under the

Financial Conduct Authority's Disclosure Guidance and Transparency

Rules.

Cancellation of the Trafigura Loan

Facility

Gran Tierra also announces that the Loan

Facility entered into on 19 August 2024 with Trafigura has today

been cancelled. As announced on 18 September 2024, Gran Tierra

completed an offering of an additional US$ 150 million aggregate

principal amount of its 9.500% Senior Secured Amortizing Notes due

2029, the net proceeds of which are being applied to satisfy the

cash consideration payable to i3 Energy Shareholders in place of

the term loan facility available to Gran Tierra pursuant to the

terms of the Loan Facility.

Board and constitutional

changes

Each of the i3 Energy Directors has resigned as

a director of i3 Energy with effect from the Scheme becoming

Effective.

Pedro Zutara, Adam Hewitson and Amy Lister have

been appointed as directors of i3 Energy with effect from the

Scheme becoming Effective.

i3 Energy will in due course submit an

application to cease to be a reporting issuer in each of the

provinces of Canada under National Policy 11-206 – Process for

Cease to be a Reporting Issuer Applications. i3 Energy is expected

to be converted to a private limited company and its name changed

to Gran Tierra UK Limited. As disclosed in the Scheme Document, i3

Energy Shares are expected to be transferred to a wholly-owned

subsidiary of Gran Tierra following completion of the

re-registration.

Full details of the Acquisition are set out in

the Scheme Document. Defined terms used but not defined in

this announcement have the meanings set out in the Scheme Document.

All references to times in this announcement are to London

time.

Enquiries:

| Gran TierraGary

GuidryRyan

Ellson |

Tel: +1 (403) 265 3221 |

| |

|

| i3 EnergyMajid

Shafiq (CEO) |

c/o CamarcoTel: +44 (0) 203 757

4980 |

| |

|

|

Stifel Nicolaus Europe Limited (Joint Financial Adviser to

Gran Tierra)Callum StewartSimon Mensley |

Tel: +44 (0) 20 7710 7600 |

|

|

|

|

Eight Capital (Joint Financial Adviser to Gran

Tierra)Tony P. LoriaMatthew Halasz |

Tel: +1 (587) 893 6835 |

| |

|

| Zeus Capital Limited

(Rule 3 Financial Adviser, Nomad and Joint Broker to i3

Energy)James Joyce, Darshan Patel, Isaac

Hooper |

Tel: +44 (0) 203 829

5000 |

| |

|

| Tudor, Pickering, Holt

& Co. Securities - Canada, ULC (Financial Adviser to i3

Energy)Brendan Lines |

Tel: +1 (403) 705 7830 |

| |

|

| National Bank Financial

Inc. (Financial Adviser to i3 Energy)Tarek Brahim Arun

Chandrasekaran |

Tel: +1 (403) 410

7749 |

| |

|

| CamarcoGeorgia

Edmonds, Violet Wilson, Sam Morris |

Tel: +44 (0) 203 757 4980 |

| |

|

No increase statement

The financial terms of the Acquisition will not

be increased save that Gran Tierra reserves the right to revise the

financial terms of the Acquisition in the event: (i) a third party,

other than Gran Tierra, announces a firm intention to make an offer

for i3 Energy on more favourable terms than Gran Tierra's

Acquisition; or (ii) the Panel otherwise provides its consent.

Notices relating to financial

advisers

Stifel Nicolaus Europe Limited ("Stifel"),

which is authorised and regulated by the FCA in the UK, is acting

as financial adviser exclusively for Gran Tierra and no one else in

connection with the matters referred to in this announcement and

will not be responsible to anyone other than Gran Tierra for

providing the protections afforded to its clients or for providing

advice in relation to matters referred to in this announcement.

Neither Stifel, nor any of its affiliates, owes or accepts any

duty, liability or responsibility whatsoever (whether direct or

indirect, whether in contract, in tort, under statute or otherwise)

to any person who is not a client of Stifel in connection with this

announcement, any statement contained herein or otherwise.

Eight Capital ("Eight

Capital"), which is authorised and regulated by the

Canadian Investment Regulatory Organization in Canada, is acting

exclusively for Gran Tierra and for no one else in connection with

the subject matter of this announcement and will not be responsible

to anyone other than Gran Tierra for providing the protections

afforded to its clients or for providing advice in connection with

the subject matter of this announcement.

Zeus Capital Limited ("Zeus"),

which is authorised and regulated by the FCA in the United Kingdom,

is acting exclusively for i3 Energy as financial adviser, nominated

adviser and joint broker and no one else in connection with the

matters referred to in this announcement and will not be

responsible to anyone other than i3 Energy for providing the

protections afforded to clients of Zeus, or for providing advice in

relation to matters referred to in this announcement. Neither Zeus

nor any of its affiliates owes or accepts any duty, liability or

responsibility whatsoever (whether direct or indirect, whether in

contract, in tort, under statute or otherwise) to any person who is

not a client of Zeus in connection with the matters referred to in

this announcement, any statement contained herein or otherwise.

Tudor, Pickering, Holt & Co. Securities -

Canada, ULC ("TPH&Co."), which is regulated by the Canadian

Investment Regulatory Organization and a member of the Canadian

Investor Protection Fund, is acting exclusively for i3 Energy by

way of its engagement with i3 Energy Canada Ltd., a wholly owned

subsidiary of i3 Energy, in connection with the matters referred to

in this announcement and for no one else, and will not be

responsible to anyone other than i3 Energy for providing the

protections afforded to its clients nor for providing advice in

relation to the matters set out in this announcement. Neither

TPH&Co. nor any of its subsidiaries, branches or affiliates and

their respective directors, officers, employees or agents, owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of TPH&Co. in

connection with this announcement, any statement contained herein

or otherwise.

National Bank Financial Inc. ("NBF"), which is

regulated by the Canadian Investment Regulatory Organization and a

member of the Canadian Investor Protection Fund, is acting as

financial adviser to i3 Energy Canada Ltd., a wholly-owned

subsidiary of i3 Energy plc, in connection with the subject matter

of this announcement. Neither NBF, nor any of its subsidiaries,

branches or affiliates and their respective directors, officers,

employees or agents, owes or accepts any duty, liability or

responsibility whatsoever (whether direct or indirect, whether in

contract, in tort, under statute or otherwise) to any person who is

not a client of NBF in connection with this announcement, any

statement contained herein or otherwise.

Additional Information

This announcement is for information purposes

only. It is not intended to, and does not, constitute or form part

of any offer, offer to acquire, invitation or the solicitation of

an offer to purchase, or an offer to acquire, subscribe for, sell

or otherwise dispose of, any securities or the solicitation of any

vote or approval in any jurisdiction, pursuant to this announcement

or otherwise nor shall there be any sale, issuance or transfer of

securities of Gran Tierra or i3 Energy pursuant to the Acquisition

in any jurisdiction in contravention of applicable laws.

This announcement is not an offer of securities

for sale in the United States or in any other jurisdiction. No

offer of securities shall be made in the United States absent

registration under the U.S. Securities Act of 1933, as amended (the

“U.S. Securities Act”), or pursuant to an exemption from, or in a

transaction not subject to, such registration requirements. Any

securities issued as part of the Acquisition are anticipated to be

issued in reliance upon available exemption from such registration

requirements pursuant to Section 3(a)(10) of the U.S.

Securities Act. Any New Gran Tierra Shares to be issued in

connection with the Acquisition are expected to be issued in

reliance upon the prospectus exemption provided by Section 2.11 or

Section 2.16, as applicable, of National Instrument 45-106 –

Prospectus Exemptions of the Canadian Securities Administrators and

in compliance with the provincial securities laws of Canada.

This announcement has been prepared in

accordance with the laws of England and Wales, the Code, the AIM

Rules for Companies and the Disclosure Guidance and Transparency

Rules and the information disclosed may not be the same as that

which would have been prepared in accordance with the laws of

jurisdictions outside England and Wales.

This announcement does not constitute a

prospectus or circular or prospectus exempted document.

Overseas Shareholders

The availability of the Acquisition to i3 Energy

Shareholders who are not resident in the United Kingdom may be

affected by the laws of the relevant jurisdictions in which they

are resident. Any person outside the United Kingdom or who are

subject to the laws and/regulations of another jurisdiction should

inform themselves of, and should observe, any applicable legal

and/or regulatory requirements. Any failure to comply with the

restrictions may constitute a violation of the securities laws of

any such jurisdiction.

The release, publication or distribution of this

announcement in or into or from jurisdictions other than the United

Kingdom may be restricted by law and therefore any persons who are

subject to the laws of any jurisdiction other than the United

Kingdom should inform themselves about, and observe, such

restrictions. Any failure to comply with the applicable

restrictions may constitute a violation of the securities laws of

such jurisdiction. To the fullest extent permitted by applicable

law, the companies and persons involved in the Acquisition disclaim

any responsibility or liability for the violation of such

restrictions by any person.

Unless otherwise determined by Gran Tierra or

required by the Code and permitted by applicable law and

regulation, the Acquisition will not be made available, directly or

indirectly, in, into or from a Restricted Jurisdiction where to do

so would violate the laws in that jurisdiction and no person may

vote in favour of the Acquisition by any such use, means,

instrumentality or form (including, without limitation, facsimile,

email or other electronic transmission, telex or telephone) within

any Restricted Jurisdiction or any other jurisdiction if to do so

would constitute a violation of the laws of that jurisdiction.

Accordingly, copies of this announcement and all documents relating

to the Acquisition are not being, and must not be, directly or

indirectly, mailed or otherwise forwarded, distributed or sent in,

into or from a Restricted Jurisdiction where to do so would violate

the laws in that jurisdiction, and persons receiving this document

and all documents relating to the Acquisition (including

custodians, nominees and trustees) must observe these restrictions

and must not mail or otherwise distribute or send them in, into or

from such jurisdictions where to do so would violate the laws in

that jurisdiction. Doing so may render invalid any purported vote

in respect of the Acquisition.

Dealing and Opening Position Disclosure

Requirements

Under Rule 8.3(a) of the Takeover Code, any

person who is interested in one per cent. or more of any class of

relevant securities of an offeree company or of any securities

exchange offeror (being any offeror other than an offeror in

respect of which it has been announced that its offer is, or is

likely to be, solely in cash) must make an Opening Position

Disclosure following the commencement of the Offer Period and, if

later, following the announcement in which any securities exchange

offeror is first identified.

An Opening Position Disclosure must contain

details of the person's interests and short positions in, and

rights to subscribe for, any relevant securities of each of (i) the

offeree company and (ii) any securities exchange offeror(s). An

Opening Position Disclosure by a person to whom Rule 8.3(a) applies

must be made by no later than 3.30 p.m. (London time) on the 10th

Business Day following the commencement of the Offer Period and, if

appropriate, by no later than 3.30 p.m. (London time) on the 10th

Business Day following the announcement in which any securities

exchange offeror is first identified. Relevant persons who deal in

the relevant securities of the offeree company or of a securities

exchange offeror prior to the deadline for making an Opening

Position Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Takeover Code, any

person who is, or becomes, interested in one per cent. or more of

any class of relevant securities of the offeree company or of any

securities exchange offeror must make a Dealing Disclosure if the

person deals in any relevant securities of the offeree company or

of any securities exchange offeror. A Dealing Disclosure must

contain details of the dealing concerned and of the person's

interests and short positions in, and rights to subscribe for, any

relevant securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s), save to the extent that these

details have previously been disclosed under Rule 8. A Dealing

Disclosure by a person to whom Rule 8.3(b) applies must be made by

no later than 3.30 p.m. (London time) on the Business Day following

the date of the relevant dealing. If two or more persons act

together pursuant to an agreement or understanding, whether formal

or informal, to acquire or control an interest in relevant

securities of an offeree company or a securities exchange offeror,

they will be deemed to be a single person for the purpose of Rule

8.3.

Opening Position Disclosures must also be made

by the offeree company and by any offeror and Dealing Disclosures

must also be made by the offeree company, by any offeror and by any

persons acting in concert with any of them (see Rules 8.1, 8.2 and

8.4). Details of the offeree and offeror companies in respect of

whose relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Panel's website at www.thetakeoverpanel.org.uk, including

details of the number of relevant securities in issue, when the

Offer Period commenced and when any offeror was first identified.

You should contact the Panel's Market Surveillance Unit on +44 20

7638 0129 if you are in any doubt as to whether you are required to

make an Opening Position Disclosure or a Dealing

Disclosure.

Publication on website and availability

of hard copies

In accordance with Rule 26.1 of the Code, a copy

of this announcement is and will be available free of charge,

subject to certain restrictions relating to persons resident in

Restricted Jurisdictions, for inspection on i3 Energy 's

website https://i3.energy/grantierra-offer-terms/ and on

Gran Tierra's website

https://www.grantierra.com/investor-relations/recommended-acquisition/

by no later than 12 noon (London time) on the Business Day

following this announcement. For the avoidance of doubt, the

contents of the website referred to in this announcement are not

incorporated into and do not form part of this announcement.

Forward Looking Statements

This announcement (including information

incorporated by reference into this announcement), oral statements

regarding the Acquisition and other information published by Gran

Tierra and i3 Energy contain certain forward-looking statements

with respect to the financial condition, strategies, objectives,

results of operations and businesses of Gran Tierra and i3 Energy

and their respective groups and certain plans and objectives with

respect to the Combined Group. These forward-looking statements can

be identified by the fact that they do not relate only to

historical or current facts. Forward looking statements are

prospective in nature and are not based on historical facts, but

rather on current expectations and projections of the management of

Gran Tierra and i3 Energy about future events, and are therefore

subject to risks and uncertainties which could cause actual results

to differ materially from the future results expressed or implied

by the forward-looking statements. The forward looking statements

contained in this announcement include, without limitation,

statements relating to the expected effects of the Acquisition on

Gran Tierra and i3 Energy, the expected timing and method of

completion, and scope of the Acquisition, the expected actions of

i3 Energy and Gran Tierra upon completion of the Acquisition and

other statements other than historical facts. Forward looking

statements often use words such as "anticipate", "target",

"expect", "estimate", "intend", "plan", "strategy", "focus",

"envision", "goal", "believe", "hope", "aims", "continue", "will",

"may", "should", "would", "could", or other words of similar

meaning. These statements are based on assumptions and assessments

made by Gran Tierra, and/or i3 Energy in light of their experience

and their perception of historical trends, current conditions,

future developments and other factors they believe appropriate. By

their nature, forward looking statements involve risk and

uncertainty, because they relate to events and depend on

circumstances that will occur in the future and the factors

described in the context of such forward looking statements in this

announcement could cause actual results and developments to differ

materially from those expressed in or implied by such forward

looking statements. Although it is believed that the expectations

reflected in such forward-looking statements are reasonable, no

assurance can be given that such expectations will prove to have

been correct and readers are therefore cautioned not to place undue

reliance on these forward-looking statements. Actual results may

vary from the forward-looking statements.

There are several factors which could cause

actual results to differ materially from those expressed or implied

in forward looking statements. Among the factors that could cause

actual results to differ materially from those described in the

forward-looking statements are changes in the global, political,

economic, business, competitive, market and regulatory forces,

future exchange and interest rates, changes in tax rates and future

business acquisitions or dispositions.

Each forward-looking statement speaks only as at

the date of this announcement. Neither Gran Tierra nor i3 Energy,

nor their respective groups assume any obligation to update or

correct the information contained in this announcement (whether as

a result of new information, future events or otherwise), except as

required by applicable law or by the rules of any competent

regulatory authority.

Early Warning Reporting Provisions of Canadian

Securities Laws

Certain of the information in this announcement

is being issued under the early warning reporting provisions of

Canadian securities laws. An early warning report with additional

information in respect of the foregoing matters will be filed and

made available under the SEDAR profile of i3 Energy

at www.sedarplus.ca. The purpose of the Scheme was to enable

Gran Tierra to acquire 100% of the share capital of i3 Energy.

Immediately prior to the completion of the Scheme, Gran Tierra did

not own, directly or indirectly, any securities of i3 Energy. To

obtain a copy of the early warning report, you may also

contact Phillip Abraham, Vice President, Legal & Business

Development at 403-698-7918. Gran Tierra is an oil and

gas company subsisting under the laws of Delaware, United

States and its head office is located at 500 Centre Street

SE, Calgary, Alberta T2P 1A6 and i3 Energy's head office

is located at 500, 207 – 9 Ave SW, Calgary, Alberta T2P

1K3.

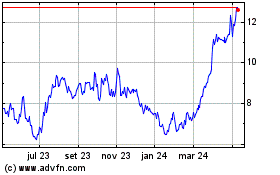

Gran Tierra Energy (TSX:GTE)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

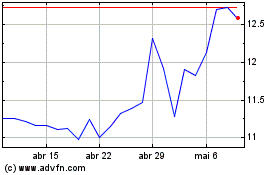

Gran Tierra Energy (TSX:GTE)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025