COPENHAGEN, Denmark, October 31, 2024 - Evaxion Biotech A/S

(NASDAQ: EVAX) (“Evaxion”), a clinical-stage TechBio company

specializing in developing AI-Immunology™ powered vaccines,

provides business update and announces third quarter 2024 financial

results.

Business highlights (since last quarterly update)

Since the second quarter 2024 business update, we have continued

to execute strongly on our strategy and plans with several major

milestones achieved. Key highlights include:

- Significant expansion of the infectious disease vaccine

development collaboration with MSD (tradename of Merck & co.,

Inc., Rahway, NJ, USA) in a transformative deal for Evaxion

- Continuously increasing external interest and several ongoing

partnerships discussions covering both our platform and

pipeline

- Strong progress in clinical and preclinical development with

convincing phase 2 data presented for personalized cancer vaccine

EVX-01 and preclinical Proof-of-Concept obtained for EVX-B2 mRNA

Gonorrhea vaccine candidate

- Launch of improved AI-Immunology™ platform for vaccine antigen

prediction

- Thomas Schmidt appointed as interim Chief Financial

Officer

“We continued to make solid progress on our strategy execution

in a busy third quarter and are very pleased to have achieved

several important milestones across our company. The MSD agreement,

which holds the potential to transform Evaxion over the coming

years, and the groundbreaking EVX-01 phase 2 efficacy data, stand

out among our many achievements. We continue to demonstrate our

strong capabilities as a truly AI-based TechBio company and remain

focused on advancing on-going partnerships as well as new

partnership discussions, progressing the EVX-01 trial and carrying

through preclinical studies as a basis for expanding our R&D

pipeline,” says Christian Kanstrup, CEO of Evaxion.

2024 Milestones

|

|

Milestones |

Target |

|

EVX-B1 |

Conclusion of final MTA study with potential partner |

Q1 2024 ✓ |

|

AI-Immunology™ |

Launch of EDEN™ model version 5.0 |

Mid 2024 (ECCB, September) ✓ |

|

EVX-B2-mRNA |

EVX-B2-mRNA preclinical Proof-of-Concept obtained |

Q3 2024 (18th Vaccine Congress, September) ✓ |

|

EVX-01 |

Phase 2 one-year readout |

Q3 2024 (ESMO Congress, September) ✓ |

|

EVX-B3 |

Conclusion of target discovery and validation work in collaboration

with MSD (tradename of Merck & Co., Inc., Rahway, NJ,

USA)* |

H2 2024 (✓) |

|

Precision ERV cancer vaccines |

Preclinical Proof-of-Concept obtained |

H2 2024 |

|

Funding |

Ambition for full year 2024 is to generate business development

income or cash in equal to 2024 cash burn (excluding financing

activities) of $14 million** |

|

* MSD option and license agreement on EVX-B2 and EVX-B3

supersedes this milestone** See update on the business development

income ambition below

Research & Development update

We maintain a high activity level in Research & Development

(R&D) from both a preclinical and clinical perspective. This

work yielded outstanding results in the third quarter, first and

foremost with the presentation of encouraging one-year data from

the ongoing phase 2 trial with our lead asset EVX-01, an

AI-Immunology™ designed personalized cancer vaccine, in patients

with advanced melanoma (skin cancer).

The data demonstrates 69% Overall Response Rate, reduction in

tumor target lesions in 15 out of 16 patients, an immunogenicity

rate of 79%, and a positive correlation between our AI-Immunology™

platform predictions and immune responses induced by the individual

neoantigens in the EVX-01 vaccine (p=0.00013). The observed

immunogenicity rate means that 79% of EVX-01’s vaccine targets

triggered a targeted immune response, which compares very favorably

to what is seen with other approaches.

These clinical findings underscore the significant therapeutic

potential of EVX-01 and are yet another validation of the

AI-Immunology™ platform as a leading AI technology for fast and

effective vaccine target discovery and design.

We were also successful in our preclinical research, obtaining

Proof-of-Concept for novel mRNA Gonorrhea vaccine candidate EVX-B2.

This was based on new data documenting that EVX-B2 mRNA triggers a

targeted immune response that leads to the elimination of the

gonorrhea bacteria. The same had earlier been shown for the

protein-based version of EVX-B2, which is now part of our

partnership with MSD. The mRNA data has been generated as part of

our partnership with Afrigen Biologics.

Further to our pipeline, our R&D investments are also

allocated to the continued improvement of our AI-Immunology™

platform. During the third quarter, we updated the platform with

the launch of a new version of its EDEN™ AI prediction model. Among

other improvements, the model can now predict toxin antigens,

allowing for the development of improved bacterial vaccines. We

expect this update to further solidify the strong interest seen in

AI-Immunology™ from potential partners.

Business development income

Our strategy is based upon a multi-partner approach, making

effective execution upon our business development plans crucial to

our success. We were thrilled to sign the significantly expanded

vaccine development collaboration with MSD during the third

quarter. Further, we continue to see an increasing interest from

potential partners and are excited by the current partnership

opportunities both around existing pipeline assets as well as our

AI-Immunology™ platform.

The agreement with MSD carries potential business development

income of up to $10 million for 2025 on top of the $3.2 million

upfront payment received in 2024. Based upon the current business

development opportunities, we remain confident in our ability to

execute upon our multi-partner strategy and bring in significant

business development income.

Given that certain partnership discussions will be moving into

2025, we will - despite the strong interest - not be able to meet

our 2024 ambition of generating business development income or cash

in of $14 million. The discussions, having moved into 2025, will

however support the generation of business development income for

next year in addition to the potential up to $10 million from

MSD.

Nasdaq dialogue

As communicated earlier, on May 7, 2024, we received a

deficiency letter from Nasdaq Stock Market LLC (“Nasdaq”) for

failure to maintain stockholders’ equity of at least $2.5 million,

following which we presented a plan to Nasdaq to regain compliance.

Nasdaq provided us until November 4, 2024, to evidence compliance

based upon the plan submitted.

We remain committed to ensuring compliance with the Nasdaq

minimum stockholder’s equity requirement and maintain our Nasdaq

listing. This is to be pursued through increasing shareholder’s

equity via a combination of business development income and capital

markets activities. However, current equity market environment, the

geopolitical uncertainties and timing of business development

activities have to date impacted timing for the full required

increase in shareholder’s equity.

We do not expect to have regained compliance by November 4,

2024, and therefore expect Nasdaq to send us a delisting

notification after such date. We then plan to appeal the delisting

determination and request a hearing on the matter, following which

a new 180-day extension could be granted based on our plan to

regain compliance.

We are in constructive dialogue with Nasdaq around this process,

though we will not receive any guarantee that another 180-day

extension will be granted before the anticipated hearing.

Third quarter 2024 financial results

Cash position as of September 30, 2024, was $4.6 million, as

compared to $5.6 million as of December 31, 2023. The cash position

as of September 30, excludes the $3.2 million upfront from the MSD

agreement which was received in October. The Company expects that

its existing cash and cash equivalents will be sufficient to fund

its operating expenses and capital expenditure requirements into

March 2025.

Revenue of $3.0 million was recognized for the quarter ending

September 30, 2024, as compared to nil for the quarter ending

September 30, 2023. A minor proportion of this revenue derives from

the existing EVX-B3 collaboration with MSD, while the majority

relates to the newly signed option and license agreement with

MSD.

Research and Development expenses were $2.6 million for the

quarter ending September 30, 2024, as compared to $2.8 million for

the quarter ending September 30, 2023. The decrease is primarily

related to a reduced headcount.

General and Administrative expenses were $2.1 million for the

quarter ending September 30, 2024, as compared to $2.9 million for

the quarter ending September 30, 2023. The decrease was primarily

due to a decrease in expenses to management remuneration following

changes to executive management in 2023 and expenses related to

this. In addition, various minor cost reductions related to

overhead and professional fees are realized.

We generated a net loss of $1.9 million for the quarter ending

September 30, 2024, or $(0.04) per basic and diluted share, as

compared to a net loss of $5.7 million, or $(0.21) per basic and

diluted share for the quarter ending September 30, 2023. The

decreased loss was primarily driven by the recognized revenue and

reduced general & administrative expenses.

Total equity amounts to $0.1 million as of September 30, 2024.

Proceeds from the exercise of prefunded warrants amounted to $0.2

million for the quarter.

Evaxion Biotech A/SConsolidated Statement of

Financial Position Data (Unaudited)(USD in thousands)

|

|

|

Sep 30,2024 |

Dec 31,2023 |

|

Cash and cash equivalents |

|

4,576 |

5,583 |

|

Total assets |

|

15,185 |

12,889 |

|

Total liabilities |

|

15,111 |

17,618 |

|

Share capital |

|

8,732 |

5,899 |

|

Other reserves |

|

106,245 |

99,946 |

|

Accumulated deficit |

|

(114,903) |

(107,860) |

|

Total equity before derivative warrant liability |

|

74 |

(2,015) |

|

Effect from derivative liabilities from investor warrants |

|

- |

(2,714) |

|

Total equity |

|

74 |

(4,729) |

|

Total liabilities and equity |

|

15,185 |

12,889 |

Based on the Company’s current cash position with an expected

cash runway into March 2025, income from Business Development deals

and/or further funding is required to mitigate the conclusion that

there is significant doubt about the Company’s ability to continue

as a going concern. Please refer to the Form 20-F, filed March 27,

2024, for additional background on the Company.

Evaxion Biotech A/SConsolidated Statement of

Comprehensive Loss Data (Unaudited)(USD in thousands, except per

share data)

| |

Three Months Ended September

30, |

Nine Months Ended September

30, |

|

|

2024 |

2023 |

2024 |

2023 |

|

Revenue |

3,017 |

— |

3,222 |

— |

|

Research and development |

(2,614) |

(2,830) |

(8,202) |

(9,618) |

|

General and administrative |

(2,134) |

(2,932) |

(5,728) |

(8,215) |

|

Operating loss |

(1,731) |

(5,762) |

(10,708) |

(17,833) |

|

Finance income |

84 |

72 |

5,922 |

404 |

|

Finance expenses |

(384) |

(182) |

(2,665) |

(786) |

|

Net loss before tax |

(2,031) |

(5,872) |

(7,451) |

(18,215) |

|

Income tax benefit |

96 |

194 |

513 |

613 |

|

Net loss for the period |

(1,935) |

(5,678) |

(6,938) |

(18,215) |

|

Net loss attributable to shareholders of Evaxion Biotech

A/S |

(1,935) |

(5,678) |

(6,938) |

(18,215) |

|

Loss per share – basic and diluted |

(0.04) |

(0.21) |

(0.13) |

(0.66) |

|

Number of shares used for calculation (basic and diluted) |

55,255,329 |

27,659,878 |

51,905,948 |

26,754,440 |

Contact information

Evaxion Biotech A/SMads KronborgVice President, Investor

Relations & Communication+45 53 54 82

96mak@evaxion-biotech.com

About EVAXION

Evaxion Biotech A/S is a pioneering TechBio company based upon

its AI platform, AI-Immunology™. Evaxion’s proprietary and scalable

AI prediction models harness the power of artificial intelligence

to decode the human immune system and develop novel immunotherapies

for cancer, bacterial diseases, and viral infections. Based upon

AI-Immunology™, Evaxion has developed a clinical-stage oncology

pipeline of novel personalized vaccines and a preclinical

infectious disease pipeline in bacterial and viral diseases with

high unmet medical needs. Evaxion is committed to transforming

patients’ lives by providing innovative and targeted treatment

options. For more information about Evaxion and its groundbreaking

AI-Immunology™ platform and vaccine pipeline, please visit our

website.

Forward-looking statement

This announcement contains forward-looking

statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. The words “target,” “believe,”

“expect,” “hope,” “aim,” “intend,” “may,” “might,” “anticipate,”

“contemplate,” “continue,” “estimate,” “plan,” “potential,”

“predict,” “project,” “will,” “can have,” “likely,” “should,”

“would,” “could,” and other words and terms of similar

meaning identify forward-looking statements. Actual

results may differ materially from those indicated by such

forward-looking statements as a result of various factors,

including, but not limited to, risks related to: our financial

condition and need for additional capital; our development work;

cost and success of our product development activities and

preclinical and clinical trials; commercializing any approved

pharmaceutical product developed using our AI platform technology,

including the rate and degree of market acceptance of our product

candidates; our dependence on third parties including for conduct

of clinical testing and product manufacture; our inability to enter

into partnerships; government regulation; protection of our

intellectual property rights; employee matters and managing growth;

our ADSs and ordinary shares, the impact of international

economic, political, legal, compliance, social and business

factors, including inflation, and the effects on our business

from the worldwide ongoing COVID-19 pandemic and the ongoing

conflict in the region

surrounding Ukraine and Russia and the Middle

East; and other uncertainties affecting our business

operations and financial condition. For a further discussion

of these risks, please refer to the risk factors included in our

most recent Annual Report on Form 20-F and other

filings with the U.S. Securities and Exchange Commission

(SEC), which are available at www.sec.gov. We do

not assume any obligation to update any forward-looking statements

except as required by law.

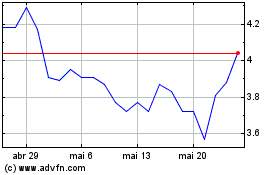

Evaxion Biotech AS (NASDAQ:EVAX)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Evaxion Biotech AS (NASDAQ:EVAX)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024