Finnovate Acquisition Corp. (“Finnovate” or the “Company”) (Nasdaq:

“FNVT”, “FNVTU”, “FNVTW”) announced today that, in connection with

the Company’s upcoming extraordinary general meeting of

shareholders (the “Special Meeting”) to consider and approve an

extension of time for the Company to consummate an initial business

combination from November 8, 2024 to May 8, 2025 (the “Extension”),

Finnovate Sponsor, L.P. (the “Sponsor”) or its designees have

agreed to revise their intended contribution to support the

Extension, such that they will contribute to the Company as a loan

an aggregate of $0.05 for each Class A ordinary share that is not

redeemed, for each calendar month (commencing on November 8, 2024

and on the 8th day of each subsequent month) until May 8, 2025

(each, an “Extension Period”), or portion thereof, that is needed

to complete an initial business combination (the “Contribution”).

For example, if the Company takes until May 8, 2025 to complete its

initial business combination, which would represent six calendar

months, the Sponsor or its designees would make aggregate

Contributions resulting in a redemption amount of approximately

$11.91 per unredeemed share, in comparison to the current

redemption amount of $ approximately 11.61 per share.

Each Contribution will be deposited in the trust

account within seven calendar days from the beginning of each

Extension Period (or portion thereof), and any Contribution is

conditioned upon the implementation of the Extension. No

Contribution will occur if the Extension is not approved or is not

completed. The amount of each Contribution will not bear interest

and will be repayable by the Company to the Sponsor or its

designees upon consummation of its initial business combination.

The Company will have the sole discretion whether to continue

extending for additional calendar months until May 8, 2025. If the

Company opts not to utilize any remaining portion of the Extension

Period, then the Company will liquidate and dissolve promptly in

accordance with its Articles, and its Sponsor’s obligation to make

additional contributions will terminate.

In connection with the above announcement of the

Contribution to be made by the Sponsor or its designees if the

Extension is approved, the Company is also postponing the Special

Meeting from the originally scheduled 10:00 a.m. Eastern time on

Friday, November 1, 2024, to 10:00 a.m. Eastern time on Wednesday,

November 6, 2024. At the Special Meeting, shareholders will be

asked to vote on the proposal to extend the date by which the

Company must consummate an initial business combination from

November 8, 2024 to May 8, 2025, or such earlier date as determined

by the Company’s board of directors.

As a result of this change, the Special Meeting

will now be held at 10:00 a.m., Eastern time, on November 6, 2024,

via a live webcast at

https://www.cstproxy.com/finnovateacquisition/egm2024. Also as a

result of this change, the deadline for holders of the Company’s

Class A ordinary shares issued in the Company’s initial public

offering to submit their shares for redemption in connection with

the Extension, is being extended to 5:00 p.m., Eastern time, on

Monday, November 4, 2024.

The Company plans to continue to solicit proxies

from shareholders during the period prior to the Special Meeting.

Only the holders of the Company’s ordinary shares as of the close

of business on October 2, 2024, the record date for the Special

Meeting, are entitled to vote at the Special Meeting.

About Finnovate Acquisition

Corp.

Finnovate Acquisition Corp. (Nasdaq: FNVT) is a

blank check company incorporated in the Cayman Islands with the

purpose of acquiring one and more businesses and assets, via a

merger, capital stock exchange, asset acquisition, stock purchase,

and reorganization.

Forward-Looking Statements

This press release includes forward-looking

statements that involve risks and uncertainties. Forward-looking

statements are statements that are not historical facts. Such

forward-looking statements are subject to risks and uncertainties,

which could cause actual results to differ from the forward-looking

statements. These forward-looking statements and factors that may

cause such differences include, without limitation, uncertainties

relating to the Company’s shareholder approval of the Extension,

its inability to complete an initial business combination within

the required time period or, and other risks and uncertainties

indicated from time to time in filings with the Securities and

Exchange Commission (the “SEC”), including the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2023

under the heading “Risk Factors” and in other reports the Company

has filed, or to be filed, with the SEC. Readers are cautioned not

to place undue reliance upon any forward-looking statements, which

speak only as of the date made. The Company expressly disclaims any

obligations or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the Company’s expectations with respect

thereto or any change in events, conditions or circumstances on

which any statement is based.

Participants in the Solicitation

Finnovate and its directors, executive officers,

other members of management and employees, under SEC rules, may be

deemed to be participants in the solicitation of proxies from the

securityholders of the Company in favor of the approval of the

Extension Proposal. Investors and security holders may obtain more

detailed information regarding the names, affiliations and

interests of the Company’s directors and officers in the Company’s

definitive proxy statement filed with the SEC on October 15, 2024

(as may be amended, the “Proxy Statement”), which may be obtained

free of charge from the sources indicated above.

No Offer or Solicitation

This press release s shall not constitute a

solicitation of a proxy, consent or authorization with respect to

any securities or in respect of the Extension. This communication

shall also not constitute an offer to sell or the solicitation of

an offer to buy any securities, nor shall there be any sale of

securities in any states or jurisdictions in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act or an exemption therefrom.

Additional Information and Where to Find It

Finnovate urges investors, shareholders and

other interested persons to read the Proxy Statement as well as

other documents filed by the Company with the SEC, because these

documents will contain important information about the Company and

the Extension. Shareholders may obtain copies of the Proxy

Statement, without charge, at the SEC’s website at www.sec.gov or

by directing a request to: Advantage Proxy, Inc., P.O. Box 10904,

Yakima, WA 98909, Attn: Karen Smith.

INVESTOR RELATIONS CONTACT

Finnovate Acquisition Corp.Calvin Kung265

Franklin StreetSuite 1702Boston, MA 02110+1 (424) 253-0908

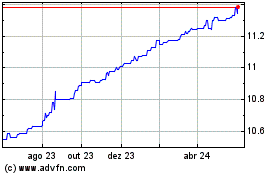

Finnovate Acquisition (NASDAQ:FNVT)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

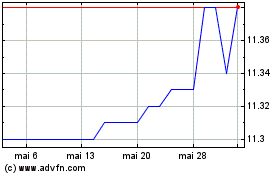

Finnovate Acquisition (NASDAQ:FNVT)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024