Stella-Jones Inc. (TSX: SJ) (“Stella-Jones” or the “Company”) today

announced financial results for its third quarter ended September

30, 2024.

“Stella-Jones' strategy is, as always, rooted in

the long-term growth of our resilient infrastructure business. In

the third quarter, despite strong long-term demand tailwinds, we

witnessed a slower pace of purchases by our utility customers.

Though total sales were lower than anticipated, we delivered a

solid quarter EBITDA margin of 17.7% and strong operating

cashflows,” said Eric Vachon, President and Chief Executive Officer

of Stella-Jones. “Year-to-date, sales were higher and our profit

margins remained above target levels. Based on utilities' current

purchasing behaviour and the Company's solid margin performance, we

are updating our three-year financial objectives to sales of

approximately $3.6 billion by 2025 and an EBITDA margin of more

than 17%.”

“Utilities continue to forecast meaningful

increases in infrastructure investments, evidenced by the

longer-term sales contracts secured from new and existing

customers. These commitments support our confidence in the solid

and sustained growth in demand for utility poles. With our

compelling infrastructure offering, robust available capacity and

strong balance sheet, we are enthusiastic about the opportunities

for continued growth and enhanced profitability,” concluded Mr.

Vachon.

|

Financial Highlights (in millions of Canadian

dollars, except ratios and per share data) |

Three-month periods ended September

30, |

Nine-month periods ended

September 30, |

|

2024 |

2023 |

2024 |

2023 |

|

Sales |

915 |

949 |

2,739 |

2,631 |

|

Gross profit(1) |

188 |

215 |

586 |

551 |

|

Gross profit margin(1) |

20.5% |

22.7% |

21.4% |

20.9% |

|

Operating income |

130 |

166 |

422 |

410 |

|

Operating income margin(1) |

14.2% |

17.5% |

15.4% |

15.6% |

|

EBITDA(1) |

162 |

193 |

518 |

488 |

|

EBITDA margin(1) |

17.7% |

20.3% |

18.9% |

18.5% |

|

Net income |

80 |

110 |

267 |

270 |

|

Earnings per share (“EPS”) - basic and diluted |

1.42 |

1.91 |

4.72 |

4.63 |

|

Weighted average shares outstanding (basic, in ‘000s) |

56,293 |

57,690 |

56,554 |

58,258 |

|

|

|

As at |

September 30, 2024 |

December 31, 2023 |

|

Net debt-to-EBITDA(1) |

2.5x |

2.6x |

|

(1) These indicated terms have no standardized meaning under GAAP

and are not likely to be comparable to similar measures presented

by other issuers. For more information, please refer to the section

entitled “Non-GAAP and Other Financial Measures” of this press

release for an explanation of the non-GAAP and other financial

measures used and presented by the Company and a reconciliation of

non-GAAP financial measures to the most directly comparable GAAP

measures. |

THIRD QUARTER RESULTS

Sales in the third quarter of 2024 were $915

million, compared to sales of $949 million for the corresponding

period last year. Excluding the positive effect of currency

conversion, sales were down $44 million, or 5%. The decrease was

driven by lower volumes across all product categories, partially

offset by higher pricing to cover increased costs. Volumes for

infrastructure product categories, namely utility poles, railway

ties and industrial products, were impacted by the slower pace of

purchases and a deferral in the execution of projects by utilities,

and a reduction in the maintenance program of certain railroads,

while residential lumber volumes were lower due to softer consumer

demand.

Pressure-treated wood

products:

- Utility

poles (49% of Q3-24 sales): Utility poles sales increased

to $448 million in the third quarter of 2024, compared to sales of

$438 million in the corresponding period last year. Excluding the

currency conversion effect, utility poles sales increased by four

million dollars, or 1%. Higher pricing to cover increased costs

more than offset the decrease in volumes when compared to the same

period last year. The lower sales volumes in the third quarter were

largely explained by the slower pace of purchases and a deferral in

the execution of projects by utilities, largely influenced by

economic factors, including inflation and utilities’ supply chain

constraints, as well as timing of utilities’ rate-based

funding.

- Railway ties (22% of Q3-24

sales): Railway ties sales decreased by $25 million to

$205 million in the third quarter of 2024, compared to sales of

$230 million in the same period last year. Excluding the currency

conversion effect, sales of railway ties decreased by $28 million,

or 12%, largely attributable to lower sales volumes explained by

the reduction in the maintenance program of certain Class 1

customers and timing of shipments.

-

Residential lumber (21% of Q3-24

sales): Sales in residential lumber decreased by $11

million to $191 million in the third quarter of 2024, compared to

sales of $202 million in the corresponding period last year. This

decrease was mainly driven by lower sales volumes due to softer

consumer demand.

- Industrial

products (4% of Q3-24 sales): Industrial

product sales were $41 million, compared to $42 million in the

corresponding period last year.

Logs and lumber:

- Logs and lumber (4% of

Q3-24 sales): Logs and lumber sales totaled $30 million,

compared to $37 million in the corresponding period last year. The

decrease in sales compared to the third quarter last year was

largely attributable to less lumber trading activity. Logs sales

remained stable as lower log sales activity was offset by the

higher market price of logs.

Gross profit was $188 million in the third

quarter of 2024 compared to $215 million in the corresponding

period last year, representing a margin of 20.5% and 22.7%,

respectively. The decrease in gross profit was largely driven by

lower sales volumes across all product categories.

Similarly, operating income totaled $130 million

in the third quarter of 2024 versus operating income of $166

million in the corresponding period of 2023. EBITDA totaled $162

million, representing a margin of 17.7%, compared to $193 million,

or a margin of 20.3% reported in the corresponding period last

year.

Net income for the third quarter of 2024 was $80

million, or $1.42 per share, compared to net income of $110

million, or $1.91 per share, in the corresponding period of

2023.

NINE-MONTH RESULTS

For the first nine months of 2024, sales

amounted to $2,739 million, versus $2,631 million for the

corresponding period last year. Excluding the contribution from the

acquisition of Baldwin Pole and Piling Company, Inc., Baldwin Pole

Mississippi, LLC and Baldwin Pole & Piling, Iowa Corporation of

$25 million and the currency conversion of $22 million,

pressure-treated wood sales rose by $79 million, or 3%, while logs

and lumber sales decreased by $18 million, or 19%. The

pressure-treated wood sales growth was driven by the increase in

infrastructure sales. Favourable pricing for utility poles and

pricing and volumes gains for railway ties were only partially

offset by lower utility poles volumes. The increase in

infrastructure sales was largely offset by the softer demand for

residential lumber and less logs sales and lumber trading activity

compared to the same period last year.

Gross profit increased to $586 million, or 21.4%

of sales in the first nine months of 2024, from $551 million or

20.9% of sales, in the corresponding period last year. Similarly,

operating income amounted to $422 million, versus $410 million a

year ago, while EBITDA was $518 million, compared to $488 million

in the prior year and EBITDA margin expanded from 18.5% in 2023 to

18.9% in 2024.

Net income in the first nine months of 2024 was

$267 million, or $4.72 per share, versus net income of $270

million, or $4.63 per share, in the corresponding period last

year.

LIQUIDITY AND CAPITAL

RESOURCES

During the third quarter ended September 30,

2024, Stella-Jones used the cash generated from operations of $186

million to maintain its assets and pursue its growth capital

expenditure, as well as reduce long-term debt and return capital to

shareholders.

During the first nine months of the year, the

Company returned $112 million to its shareholders, through

dividends of $47 million and share repurchases of $65 million.

Since the beginning of the Normal Course Issuer Bid (“NCIB”) on

November 14, 2023, the Company repurchased a total of 1,015,670

common shares for cancellation in consideration of

$85 million.

As at September 30, 2024, the Company had a

total of $342 million available under its credit facilities and

maintained a solid financial position with a net debt-to-EBITDA of

2.5x.

Subsequent to quarter-end, the Company issued

$400 million aggregate principal amount of 4.312% senior unsecured

notes, due October 1st, 2031. The Company used the net proceeds of

this offering to repay existing indebtedness under its revolving

credit facilities.

ANNOUNCEMENT OF NORMAL COURSE ISSUER

BID

Given the highly cash generative nature of the

Company's business, in November 2024, the Company's Board of

Directors authorized a new NCIB for share repurchases. On November

6, 2024, the Company announced that the Toronto Stock Exchange has

accepted its Notice of Intention to Make a NCIB. Please refer to

the press release issued by the Company, a copy of which is located

in the Investor relations section of its website.

UPDATED 2023-2025 FINANCIAL

OBJECTIVES

The Company has updated its 2023-2025 financial

objectives to reflect lower than expected organic sales growth and

a higher EBITDA margin, compared with the financial objectives set

in May 2023. The projections do not include the impact of potential

future acquisitions and assume that foreign currency exchange rates

remain generally consistent with current levels.

- Sales are now expected to be

approximately $3.6 billion by 2025, compared to organic sales

greater than $3.6 billion, previously set out in the three-year

financial objectives. This update was driven by the

lower-than-anticipated organic sales growth for utility poles,

largely influenced by customers' current purchasing behaviour.

- EBITDA margin is expected to exceed

17% and compares with the prior projection of 16%. This reflects an

11% EBITDA compound annual growth rate for the 2023 to 2025 period,

compared to the prior growth expectation of 9%.

QUARTERLY DIVIDEND

On November 5, 2024, the Board of Directors

declared a quarterly dividend of $0.28 per common share payable on

December 20, 2024 to shareholders of record at the close of

business on December 2, 2024. This dividend is designated to

be an eligible dividend.

CONFERENCE CALL

Stella-Jones will hold a conference call to

discuss these results on November 6, 2024, at 10:00 a.m.

Eastern Standard Time (“EST”). Interested parties can join the call

by dialing 1-866-518-4114. A live audio webcast of the conference

call will be available on the Company’s website, on the Investor

relations section’s home page or here:

https://meetings.lumiconnect.com/400-522-443-288. This recording

will be available on Wednesday, November 6, 2024, as of 1:00 p.m.

EST until 11:59 p.m. EST on Wednesday, November 13, 2024.

ABOUT STELLA-JONES

Stella-Jones Inc. (TSX: SJ) is a leading North

American manufacturer of pressure-treated wood products, focused on

supporting infrastructure that is essential to the delivery of

electrical distribution and transmission, and the operation and

maintenance of railway transportation systems. It supplies the

continent’s major electrical utilities and telecommunication

companies with wood utility poles and North America’s Class 1,

short line and commercial railroad operators with railway ties and

timbers. It also supports infrastructure with industrial products,

namely wood for railway bridges and crossings, marine and

foundation pilings, construction timbers and coal tar-based

products. Additionally, the Company manufactures and distributes

premium treated residential lumber and accessories to Canadian and

American retailers for outdoor applications, with a significant

portion of the business devoted to servicing Canadian customers

through its national manufacturing and distribution network.

CAUTION REGARDING FORWARD-LOOKING

INFORMATION

Except for historical information provided

herein, this press release may contain information and statements

of a forward-looking nature concerning the future performance of

the Company. These statements are based on suppositions and

uncertainties as well as on management's best possible evaluation

of future events. Such items include, among others: general

political, economic and business conditions, evolution in customer

demand for the Company's products and services, product selling

prices, availability and cost of raw materials, operational

disruption, climate change, failure to recruit and retain qualified

workforce, information security breaches or other cyber-security

threats, changes in foreign currency rates, the ability of the

Company to raise capital and factors and assumptions referenced

herein and in the Company’s continuous disclosure filings. As a

result, readers are advised that actual results may differ from

expected results. Unless required to do so under applicable

securities legislation, the Company does not assume any obligation

to update or revise forward-looking statements to reflect new

information, future events or other changes after the date

hereof.

Note to readers:

Condensed interim unaudited consolidated financial

statements for the third quarter ended September 30, 2024 as well

as management’s discussion and analysis are available on

Stella-Jones’ website at

www.stella-jones.com.

|

Head Office3100 de la Côte-Vertu Blvd., Suite

300Saint-Laurent, QuébecH4R 2J8 Tel.: (514) 934-8666Fax: (514)

934-5327 |

Exchange ListingsThe Toronto Stock ExchangeStock

Symbol: SJTransfer Agent and

RegistrarComputershare Investor Services Inc. |

Investor RelationsSilvana TravagliniSenior

Vice-President and Chief Financial OfficerTel.: (514) 934-8660Fax:

(514) 934-5327stravaglini@stella-jones.com |

|

Stella-Jones Inc. |

| Condensed Interim Consolidated Statements of Income |

| (Unaudited) |

(expressed in millions of Canadian dollars,

except earnings per common share)

| |

For thethree-month

periodsended September 30, |

|

For thenine-month

periodsended September 30, |

|

|

2024 |

2023 |

|

|

2024 |

2023 |

|

| |

|

|

|

|

|

| Sales |

915 |

949 |

|

|

2,739 |

2,631 |

|

| |

|

|

|

|

|

| Expenses |

|

|

|

|

|

| |

|

|

|

|

|

|

Cost of sales (including depreciation and amortization (3 months -

$29 (2023 - $23) and 9 months - $85 (2023 - $66)) |

727 |

734 |

|

|

2,153 |

2,080 |

|

|

Selling and administrative (including depreciation and amortization

(3 months - $3 (2023 - $4) and 9 months - $11 (2023 - $12)) |

53 |

48 |

|

|

156 |

137 |

|

| Other losses, net |

5 |

1 |

|

|

8 |

4 |

|

| |

785 |

783 |

|

|

2,317 |

2,221 |

|

| Operating

income |

130 |

166 |

|

|

422 |

410 |

|

| |

|

|

|

|

|

| Financial

expenses |

23 |

17 |

|

|

65 |

47 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Income before income

taxes |

107 |

149 |

|

|

357 |

363 |

|

| |

|

|

|

|

|

| Income tax

expense |

|

|

|

|

|

| Current |

24 |

40 |

|

|

84 |

95 |

|

| Deferred |

3 |

(1 |

) |

|

6 |

(2 |

) |

| |

|

|

|

|

|

| |

27 |

39 |

|

|

90 |

93 |

|

| |

|

|

|

|

|

| Net

income |

80 |

110 |

|

|

267 |

270 |

|

| |

|

|

|

|

|

| Basic and diluted

earnings per common share |

1.42 |

1.91 |

|

|

4.72 |

4.63 |

|

|

Stella-Jones Inc. |

| Condensed Interim Consolidated Statements of Financial

Position |

| (Unaudited) |

(expressed in millions of Canadian dollars)

|

|

As at |

As at |

| |

September 30, 2024 |

December 31, 2023 |

| Assets |

|

|

| Current

assets |

|

|

| Accounts receivable |

370 |

308 |

| Inventories |

1,616 |

1,580 |

| Income taxes receivable |

1 |

11 |

| Other current assets |

55 |

48 |

| |

2,042 |

1,947 |

| Non-current

assets |

|

|

| Property, plant and

equipment |

974 |

906 |

| Right-of-use assets |

305 |

285 |

| Intangible assets |

164 |

169 |

| Goodwill |

382 |

375 |

| Derivative financial

instruments |

16 |

21 |

| Other non-current assets |

7 |

5 |

| |

3,890 |

3,708 |

| Liabilities and

Shareholders’ Equity |

|

|

| Current

liabilities |

|

|

| Accounts payable and accrued

liabilities |

192 |

204 |

| Income taxes payable |

19 |

— |

| Current portion of long-term

debt |

1 |

100 |

| Current portion of lease

liabilities |

60 |

54 |

| Current portion of provisions

and other long-term liabilities |

26 |

26 |

| |

298 |

384 |

| Non-current

liabilities |

|

|

| Long-term debt |

1,283 |

1,216 |

| Lease liabilities |

257 |

240 |

| Deferred income taxes |

183 |

175 |

| Provisions and other long-term

liabilities |

34 |

31 |

| Employee future benefits |

6 |

10 |

| |

2,061 |

2,056 |

| Shareholders’

equity |

|

|

| Capital stock |

188 |

189 |

| Retained earnings |

1,485 |

1,329 |

| Accumulated other

comprehensive income |

156 |

134 |

| |

|

|

| |

1,829 |

1,652 |

| |

3,890 |

3,708 |

|

Stella-Jones Inc. |

| Condensed Interim Consolidated Statements of Cash Flows |

| (Unaudited) |

(expressed in millions of Canadian dollars)

| |

For thethree-month

periodsended September 30, |

|

For thenine-month

periodsended September 30, |

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

| Cash flows from (used

in) |

|

|

|

|

|

| Operating

activities |

|

|

|

|

|

| Net income |

80 |

|

110 |

|

|

267 |

|

270 |

|

| Adjustments for |

|

|

|

|

|

| Depreciation of property,

plant and equipment |

11 |

|

9 |

|

|

34 |

|

28 |

|

| Depreciation of right-of-use

assets |

17 |

|

14 |

|

|

49 |

|

38 |

|

| Amortization of intangible

assets |

4 |

|

4 |

|

|

13 |

|

12 |

|

| Financial expenses |

23 |

|

17 |

|

|

65 |

|

47 |

|

| Income tax expense |

27 |

|

39 |

|

|

90 |

|

93 |

|

| Other |

5 |

|

(1 |

) |

|

5 |

|

4 |

|

| |

167 |

|

192 |

|

|

523 |

|

492 |

|

| |

|

|

|

|

|

| Changes in non-cash working

capital components |

|

|

|

|

|

| Accounts receivable |

70 |

|

25 |

|

|

(68 |

) |

(98 |

) |

| Inventories |

27 |

|

(48 |

) |

|

(14 |

) |

(163 |

) |

| Other current assets |

— |

|

(1 |

) |

|

(6 |

) |

(11 |

) |

| Accounts payable and accrued

liabilities |

(34 |

) |

5 |

|

|

(13 |

) |

38 |

|

| |

63 |

|

(19 |

) |

|

(101 |

) |

(234 |

) |

| Interest paid |

(25 |

) |

(21 |

) |

|

(67 |

) |

(50 |

) |

| Income taxes paid |

(19 |

) |

(22 |

) |

|

(54 |

) |

(83 |

) |

| |

186 |

|

130 |

|

|

301 |

|

125 |

|

| Financing

activities |

|

|

|

|

|

| Net change in revolving credit

facilities |

(83 |

) |

36 |

|

|

(117 |

) |

251 |

|

| Proceeds from long-term

debt |

— |

|

— |

|

|

168 |

|

— |

|

| Repayment of long-term

debt |

(1 |

) |

— |

|

|

(103 |

) |

(1 |

) |

| Repayment of lease

liabilities |

(16 |

) |

(13 |

) |

|

(46 |

) |

(36 |

) |

| Dividends on common

shares |

(15 |

) |

(13 |

) |

|

(47 |

) |

(40 |

) |

| Repurchase of common

shares |

(30 |

) |

(45 |

) |

|

(65 |

) |

(105 |

) |

| Other |

1 |

|

1 |

|

|

1 |

|

1 |

|

| |

(144 |

) |

(34 |

) |

|

(209 |

) |

70 |

|

| Investing

activities |

|

|

|

|

|

| Business combinations |

(4 |

) |

(52 |

) |

|

(4 |

) |

(85 |

) |

| Purchase of property, plant

and equipment |

(35 |

) |

(42 |

) |

|

(91 |

) |

(103 |

) |

| Property insurance

proceeds |

— |

|

— |

|

|

10 |

|

— |

|

| Additions of intangible

assets |

(3 |

) |

(2 |

) |

|

(7 |

) |

(7 |

) |

| |

(42 |

) |

(96 |

) |

|

(92 |

) |

(195 |

) |

| Net change in cash and

cash equivalents during the period |

— |

|

— |

|

|

— |

|

— |

|

| Cash and cash

equivalents – Beginning of period |

— |

|

— |

|

|

— |

|

— |

|

| Cash and cash

equivalents – End of period |

— |

|

— |

|

|

— |

|

— |

|

NON-GAAP AND OTHER FINANCIAL

MEASURES

This section includes information required by

National Instrument 52-112 – Non-GAAP and Other Financial Measures

Disclosure in respect of “specified financial measures” (as defined

therein).

The below-described non-GAAP financial measures,

non-GAAP ratios and other financial measures have no standardized

meaning under GAAP and are not likely to be comparable to similar

measures presented by other issuers. The Company’s method of

calculating these measures may differ from the methods used by

others, and, accordingly, the definition of these measures may not

be comparable to similar measures presented by other issuers. In

addition, non-GAAP financial measures, non-GAAP ratios and other

financial measures should not be viewed as a substitute for the

related financial information prepared in accordance with GAAP.

Non-GAAP financial measures include:

- Gross profit:

Sales less cost of sales

- EBITDA: Operating

income before depreciation of property, plant and equipment,

depreciation of right-of-use assets and amortization of intangible

assets (also referred to as earnings before interest, taxes,

depreciation and amortization)

- Net debt: Sum of

long-term debt and lease liabilities (including the current

portion)

Non-GAAP ratios include:

- Gross profit

margin: Gross profit divided by sales for the

corresponding period

- EBITDA margin:

EBITDA divided by sales for the corresponding period

- Net

debt-to-EBITDA: Net debt divided by trailing 12-month

(TTM) EBITDA

Other financial measures include:

- Operating income

margin: Operating income divided by sales for the

corresponding period

Management considers these non-GAAP and

specified financial measures to be useful information to assist

knowledgeable investors to understand the Company’s financial

position, operating results and cash flows as they provide a

supplemental measure of its performance. Management uses non-GAAP

and other financial measures in order to facilitate operating and

financial performance comparisons from period to period, to prepare

annual budgets, to assess the Company’s ability to meet future debt

service, capital expenditure and working capital requirements, and

to evaluate senior management’s performance. More specifically:

- Gross profit and gross

profit margin: The Company uses these financial measures

to evaluate its ongoing operational performance.

- EBITDA and EBITDA

margin: The Company believes these measures provide

investors with useful information because they are common industry

measures used by investors and analysts to measure a company’s

ability to service debt and to meet other payment obligations, or

as a common valuation measurement. These measures are also key

metrics of the Company's operational and financial performance and

are used to evaluate senior management’s performance.

- Net debt and net

debt-to-EBITDA: The Company believes these measures are

indicators of the financial leverage of the Company.

The following tables present the reconciliations

of non-GAAP financial measures to their most comparable GAAP

measures.

|

Reconciliation of Operating Income to EBITDA(in

millions of dollars) |

Three-month periods ended September 30, |

Nine-month periods ended September

30, |

|

|

2024 |

2023 |

2024 |

2023 |

|

Operating income |

130 |

166 |

422 |

410 |

|

Depreciation and amortization |

32 |

27 |

96 |

78 |

|

EBITDA |

162 |

193 |

518 |

488 |

|

Reconciliation of Long-Term Debt to Net Debt(in

millions of dollars) |

As atSeptember 30, 2024 |

As atDecember 31, 2023 |

|

Long-term debt, including current portion |

1,284 |

|

1,316 |

|

|

Add: |

|

|

|

|

|

Lease liabilities, including current portion |

317 |

|

294 |

|

|

Net Debt |

1,601 |

|

1,610 |

|

|

EBITDA (TTM) |

638 |

|

608 |

|

|

Net Debt-to-EBITDA |

2.5x |

2.6x |

|

|

|

|

| Source: |

Stella-Jones

Inc. |

Stella-Jones

Inc. |

| |

|

|

| Contacts: |

Silvana Travaglini,

CPA |

Stephanie

Corrente |

| |

Senior Vice-President and Chief

Financial Officer Stella-Jones |

Director, Corporate

CommunicationsStella-Jones |

| |

Tel.: (514) 934-8660 |

|

| |

stravaglini@stella-jones.com |

communications@stella-jones.com |

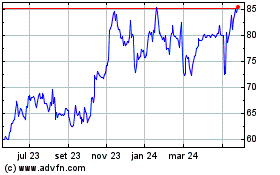

Stella Jones (TSX:SJ)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

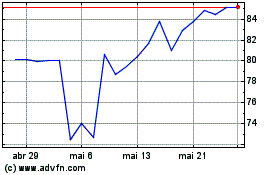

Stella Jones (TSX:SJ)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024