Canoe Financial Funds win five Alternative IQ Canadian Hedge Fund Awards

07 Novembro 2024 - 6:15PM

Two Canoe Financial LP (“Canoe Financial”) Funds were recognized

with a total of five awards for absolute and risk-adjusted returns

at the Alternative IQ 2024 Canadian Hedge Fund Awards in Toronto.

Canoe Energy Alpha Fund LP

- 1st place 3-year return Equity Focused Fund

- 1st place 5-year return Equity Focused Fund

- 3rd place 3-year Sharpe Ratio Equity Focused Fund

Canoe Global Private Equity Fund

- 3rd place 1-year return Private Equity Fund

- 3rd place 3-year return Private Equity Fund

About Canoe Financial

Canoe Financial is one of Canada’s fastest growing independent

mutual fund companies managing over $18 billion in assets across a

diversified range of award-winning investment solutions. Founded in

2008, Canoe Financial is an employee-owned investment management

firm focused on building financial wealth for Canadians. Canoe

Financial has a significant presence across Canada, including

offices in Calgary, Toronto and

Montreal.

About Alternative IQ

Alternative IQ produces the annual Canadian Hedge Fund Awards

program and its presentation events held in Toronto each autumn

(performance as at June 30th), the annual CHFA Winners Showcase

Investor Conferences which present managers of award-winning hedge

funds to investors, and various other programs and publications

serving the hedge fund industry in Canada. Alternative IQ is

dedicated to celebrating, supporting and expanding Canada's Hedge

Fund Industry. AIQ is a division of Alliance Sales and Marketing,

Inc.

The Canadian Hedge Fund Awards are based on performance up to

June 30. The Canadian Hedge Fund Awards measurements for each

category are: Best 3-year and 5-year returns; Best 3-year Sharpe

Ratio. The Canadian Hedge Fund Awards are quantitative, based on

performance data, collected and tabulated by Fundata. Eligibility

requirements for hedge funds to be considered for a Canadian Hedge

Fund Award are that the fund: must be domiciled in Canada; must

have a track record of at least 1 year to June 30; must have a

minimum $10 million in AUM; and must be in Canadian dollars. For

more information, see alternativeiq.com.

Contact Investor

Relations 1–877–434–2796 info@canoefinancial.com

Canoe Energy Alpha Fund LP is offered pursuant to an offering

memorandum and are only available to investors who meet certain

eligibility or minimum purchase amount requirements under

applicable securities legislation. The offering memorandum contains

important information about the Fund, including their investment

objective and strategies, purchase options, applicable management

fees, performance fees, other charges and expenses, and should be

read carefully before investing in the Fund. No person is

authorized to give away any information or to make any

representation not contained in the Offering Memorandum and any

information or representation, other than that contained in the

Offering Memorandum, must not be relied upon. The content herein is

a summary only and should be read in conjunction with the Canoe

Energy Alpha LP offering memorandum. Only the contents of the

Offering Memorandum can be relied upon. The Canoe Energy Alpha Fund

LP is only available for sale to investors who meet the definition

of “accredited investor” or non-individuals who will be investing a

minimum of $150,000 as set forth in National Instrument 45-106

Prospectus and Registration Exemptions. Investors also must be a

resident of British Columbia, Alberta, Saskatchewan, Manitoba,

Ontario, New Brunswick, Nova Scotia, Newfoundland or Quebec. There

is a minimum subscription requirement of $25,000.

Canoe Global Private Equity Fund is a fund established as a unit

trust under the laws of the Province of Alberta, formed to make

private equity investments. The investment objective of the Fund is

to invest in private equity funds and private companies that are

diversified across geographies and industries. To this end, the

Fund intends to invest substantially all its assets in Fiera Comox

Global Private Equity Fund (Canada I) L.P., an Ontario limited

partnership (the “Fiera Comox LP”), which holds a diversified

portfolio of global corporate private equity investments, focusing

on generating attractive absolute returns over the long-term while

preserving capital. Although it is expected that that the Fund will

invest directly in the Fiera Comox LP, some or all of the

investment may be made through Fiera Global Private Equity Fund, a

unit trust under the laws of the Province of Québec with the same

investment objective as the Fund and which currently invests all or

substantially all its assets in Fiera Comox LP. The Fund may also

invest in other private equity funds, and other private securities,

but is not expected to do so in the first 5 years. As a result, the

Fund is intended for investors who are prepared to make a long-term

commitment. The Fund is offered pursuant to an offering memorandum

and is only available to investors who meet certain eligibility or

minimum purchase amount requirements under applicable securities

legislation. The offering memorandum contains important information

about the Fund, including its investment objective and strategies,

purchase options, applicable management fees, performance fees,

other charges and expenses, and should be read carefully before

investing in the Fund. No person is authorized to give away any

information or to make any representation not contained in the

Offering Memorandum and any information or representation, other

than that contained in the Offering Memorandum, must not be relied

upon. This presentation is a summary only and should be read in

conjunction with the Canoe Global Private Equity Fund Offering

Memorandum. Only the contents of the Offering Memorandum can be

relied upon. Canoe Global Private Equity Fund is only available for

sale to investors who meet the definition of “accredited investor”

or non-individuals who will be investing a minimum of $150,000 as

set forth in National Instrument 45-106 Prospectus and Registration

Exemptions. There is a minimum subscription requirement of $25,000.

Please contact us or consult the offering documents to determine

your qualification status. Investment Advisors should consult their

company’s internal policies.

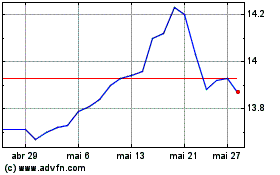

Canoe EIT Income (TSX:EIT.UN)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Canoe EIT Income (TSX:EIT.UN)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025